Financial Calm: China Holds Steady on Lending Rates Amid Economic Balancing Act

Finance

2025-02-20 01:02:23

In a strategic move to stabilize China's currency, the People's Bank of China (PBOC) is taking decisive action to shield the yuan from potential depreciation pressures. Anticipating potential increases in tariff rates, the central bank is implementing robust measures to maintain the yuan's strength and economic resilience. The PBOC's proactive approach reflects a careful balancing act, demonstrating China's commitment to protecting its currency's value amid complex global economic challenges. By prioritizing defense against potential downward pressures, the central bank aims to instill confidence in international markets and provide a buffer against external economic uncertainties. This strategic intervention underscores the PBOC's sophisticated monetary policy, which seeks to navigate the intricate landscape of international trade tensions and currency fluctuations with precision and foresight. MORE...

Wall Street Braces: Market Futures Dip as Investors Await Fed's Next Move

Finance

2025-02-20 00:25:21

Wall Street's Attention Rivets on White House as Economic Tensions Escalate Investors are closely monitoring the latest developments from the White House as ongoing tariff tensions continue to send ripples through financial markets. The economic landscape is experiencing significant shifts, with recent defense spending announcements creating substantial momentum for military contracting corporations. The intricate dance of international trade policies and government spending is keeping market participants on the edge of their seats. As geopolitical strategies unfold, investors are carefully analyzing the potential impacts on various sectors, particularly those with strong ties to government contracts and international trade. Military contractors are experiencing notable volatility, with new defense budget allocations promising to reshape the competitive landscape. These strategic spending decisions are not just numbers on a spreadsheet, but potential game-changers for companies positioned at the intersection of national security and technological innovation. The current economic environment demands unprecedented attention, as each policy announcement and trade negotiation could trigger significant market movements. Savvy investors are staying alert, ready to navigate the complex and dynamic financial terrain. MORE...

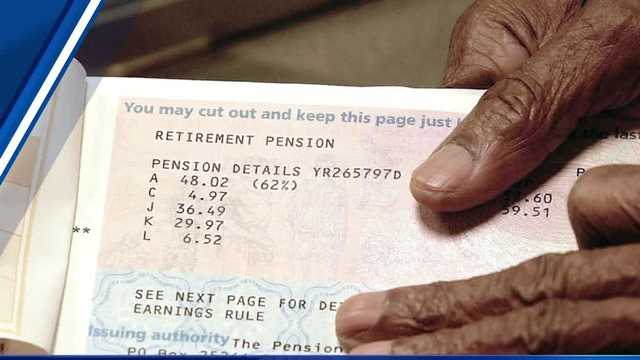

Retirement Countdown: The Insider Secrets Your Financial Advisor Doesn't Want You to Miss

Finance

2025-02-19 23:23:00

Thinking About Retiring in 2025? Hold That Resignation Letter! So, you've got 2025 circled on your calendar as your big retirement year? Before you start daydreaming about endless golf sessions and tropical vacations, pump the brakes for a moment. Retirement planning isn't as simple as walking into your manager's office and declaring your departure. Careful preparation is key to a smooth transition from full-time work to your golden years. You'll want to consider multiple factors like your financial readiness, healthcare costs, retirement savings, and lifestyle expectations. Have you thoroughly assessed your retirement nest egg? Are your investments diversified enough to support your desired standard of living? Take time to crunch the numbers, consult with financial advisors, and create a comprehensive retirement strategy. Your future self will thank you for the meticulous planning and thoughtful approach. Remember, a successful retirement isn't just about leaving work—it's about creating a fulfilling and financially secure next chapter of your life. MORE...

Wall Street's Pulse: S&P 500 Flirts with Record Peak as Investors Decode Fed's Latest Signals

Finance

2025-02-19 23:21:52

U.S. Stocks Close Modestly Higher Amid Fed Minutes and Earnings Reports

Wall Street experienced a subdued trading session on Wednesday, with the S&P 500 climbing approximately 0.25% to achieve its second consecutive closing high. The Dow and Nasdaq also saw slight gains, reflecting a cautious market sentiment.

Federal Reserve Insights

The recently released minutes from the Federal Reserve's January policy meeting revealed concerns about potential economic impacts from policy proposals, particularly regarding tariffs and their effect on inflation targeting.

Market Expert Perspective

Liz Miller, president of Summit Place Financial Advisors, offered insights into the market's current mood: "Investors are carefully evaluating the Federal Reserve's perspectives while maintaining a measured approach. The market is demonstrating a preference for visible earnings growth and awaiting clearer policy directions."

Earnings Season Highlights

The fourth-quarter earnings season is drawing to a close, with an impressive 74% of S&P 500 companies surpassing earnings expectations. Notable performances included:

- Analog Devices: Shares rose 9.7% after beating profit and revenue estimates

- Celanese: Experienced a significant 21.5% stock decline following a quarterly loss

- Shift4: Stock dropped 17.5% after announcing a $2.5 billion acquisition of Global Blue

- Nikola: Plummeted over 39% after filing for Chapter 11 bankruptcy protection

The market continues to navigate uncertain economic terrain, balancing corporate performance with potential policy changes.

MORE...Leadership Shake-Up: American Financial Group Reshapes Board in Strategic Overhaul

Finance

2025-02-19 23:11:00

Cincinnati, OH - In a strategic leadership move, American Financial Group, Inc. (NYSE: AFG) has expanded its Board of Directors by welcoming two prominent new members. The company's Board of Directors has officially elected Craig Lindner Jr. and David L. Thompson Jr. to serve as Directors, signaling a commitment to strengthening corporate governance and strategic leadership. This appointment underscores American Financial Group's ongoing dedication to bringing fresh perspectives and expertise to its top-level decision-making processes. The addition of Lindner and Thompson is expected to contribute valuable insights and strategic vision to the company's future direction. The announcement was made today, February 19, 2025, marking an important milestone in the company's leadership evolution. MORE...

Wall Street Betrayal: Ex-CNBC Analyst's $3M Investment Scam Exposed

Finance

2025-02-19 23:05:13

In a stunning fall from grace, a once-prominent financial commentator from Los Angeles County has admitted to orchestrating a massive investment fraud scheme that swindled millions from unsuspecting investors. Federal prosecutors revealed on Wednesday that James Art, a former CNBC financial pundit, pleaded guilty to orchestrating an elaborate financial deception that shocked the investment community. The Department of Justice detailed how Art systematically misled investors, exploiting his media credibility and financial expertise to convince victims to part with their hard-earned money. His carefully constructed facade of financial legitimacy crumbled as he was forced to acknowledge his criminal actions in court. This case serves as a stark reminder that even seemingly trustworthy financial experts can engage in fraudulent activities, underscoring the importance of due diligence and skepticism when making investment decisions. Art's dramatic downfall highlights the ongoing need for investor vigilance in an increasingly complex financial landscape. The guilty plea marks a significant moment of reckoning for Art, who must now face the legal consequences of his calculated financial misconduct. MORE...

Serpentine Shifts: How the Year of the Snake Slithers Through Real Estate Markets

Finance

2025-02-19 22:51:00

As the real estate and mortgage finance landscape evolves, industry experts anticipate a year of transformative potential and strategic opportunities. Marty Green from Polunsky Beitel suggests that the coming months will be marked by critical policy debates and pivotal discussions about the future of government-sponsored enterprises Fannie Mae and Freddie Mac. The sector stands at a crossroads, with emerging challenges and innovative possibilities promising to reshape the mortgage and housing markets. Stakeholders are closely watching potential policy shifts that could fundamentally alter the financial infrastructure supporting home ownership and real estate investments. Green's insights highlight the dynamic nature of the industry, where regulatory changes, market trends, and strategic repositioning are set to play crucial roles in defining the year's trajectory. The ongoing conversations about Fannie Mae and Freddie Mac's structural framework could have far-reaching implications for lenders, homebuyers, and the broader economic ecosystem. Professionals and investors alike are preparing for a period of significant adaptation, recognizing that flexibility and strategic foresight will be key to navigating the complex terrain of real estate finance in the months ahead. MORE...

Wall Street's Wild Week: Fed Signals, Tech Titans' Stumble, and the Short Sellers' Gambit

Finance

2025-02-19 22:28:00

Market Resilience: S&P 500 Hits Record High Despite Policy Uncertainties The S&P 500 demonstrated remarkable strength on Wednesday, setting a new record close even as investors navigate the complex landscape of trade policies and economic indicators. Yahoo Finance's senior markets reporter Josh Schafer delved into the day's critical market dynamics, offering insights into several key developments. The Federal Reserve's January FOMC minutes revealed underlying concerns about tariff policies, casting a shadow of uncertainty over market sentiment. Despite these potential headwinds, the market showed impressive resilience, with the major indices displaying notable performance. Of particular interest was the recent performance lag among the Magnificent Seven stocks, which have been instrumental in driving market momentum. Schafer also explored emerging short seller strategies, providing a nuanced perspective on current market trends. Investors and market watchers are closely monitoring these developments, seeking to understand the intricate interplay between policy decisions, market sentiment, and stock performance. For more in-depth analysis and expert insights into the latest market movements, be sure to check out more "Asking for a Trend" segments. MORE...

Defying Doubt: Wall Street's Surprising Resilience in Uncertain Times

Finance

2025-02-19 22:22:51

Market Insights: Navigating Uncertainty in the 2025 Investment Landscape

In a recent interview with Market Domination Overtime, Roundhill Investments CEO David Mazza offered a nuanced perspective on the current market dynamics, describing the investment environment as a "shoot first, ask questions later" scenario.

As markets enter the third year of the current bull run, Mazza highlights a growing sense of investor caution. "The challenge is the increased uncertainty," he explains. "Investors are becoming more reactive, quickly selling off positions in response to any negative news while seeking to protect their hard-earned gains."

Despite this cautious sentiment, major market indexes continue to scale new heights, a phenomenon Mazza characterizes as climbing a "classic wall of worry". He notes an interesting dichotomy: while retail investors remain optimistic and market sentiment appears positive, the underlying market structure has become increasingly fragile.

Strategic Investment Approach

For investors navigating this complex landscape, Mazza recommends a strategic approach centered on covered-call strategies. This method allows investors to:

- Maintain market exposure

- Mitigate potential risks

- Reduce overall portfolio volatility

"It's a balanced way to stay engaged with the market while taking a more measured approach to risk management," Mazza advises.

For more expert insights and in-depth market analysis, viewers are encouraged to explore additional Market Domination Overtime content.

MORE...Consumer Shield: Inside the CFPB's Mission to Guard Your Financial Future

Finance

2025-02-19 22:01:11

In a riveting conversation, NPR's Scott Detrow delves into the potential fallout of dismantling the Consumer Financial Protection Bureau (CFPB) with personal finance expert Susan Tompor. The discussion illuminates the critical role this agency plays in safeguarding everyday Americans from predatory financial practices. Tompor breaks down the real-world consequences of potentially weakening this consumer watchdog, highlighting how the CFPB has been a crucial shield for millions of consumers against unfair banking, lending, and credit practices. From protecting against hidden fees to challenging deceptive financial products, the agency has been a lifeline for many struggling with complex financial landscapes. The conversation explores the broader implications for everyday consumers, revealing how the CFPB's potential dismantling could leave vulnerable populations exposed to financial exploitation. Detrow and Tompor unpack the nuanced ways this agency has been a critical line of defense in the financial ecosystem, protecting everything from credit card practices to mortgage lending. Listeners are invited to understand the high stakes of this regulatory debate, with Tompor providing insights into how the CFPB's work directly impacts personal financial security and economic fairness for millions of Americans. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421