Financial Betrayal: Top County Official Caught in Shocking Embezzlement Scandal

Finance

2025-04-23 21:15:57

In a dramatic turn of events, Calhoun County Sheriff Thomas Summers revealed a significant breakthrough in an ongoing financial investigation, announcing the arrest of a former county finance director on Wednesday. The arrest comes after a thorough and meticulous investigation that uncovered potential financial misconduct within the county's administrative offices. The former finance director, whose name has not yet been publicly disclosed, is now facing serious legal scrutiny. Sheriff Summers emphasized that the arrest is the result of a comprehensive probe that carefully examined financial records and administrative practices. While details remain limited at this time, the arrest signals the sheriff's department's commitment to maintaining financial integrity and accountability in county government. Residents can expect more information to be released as the investigation continues to unfold. Local officials have remained tight-lipped about the specific allegations, but the arrest suggests potential irregularities in financial management that warranted immediate legal action. MORE...

Discover Financial Soars: Earnings Surge as Credit Costs Dip and Interest Revenue Climbs

Finance

2025-04-23 21:03:49

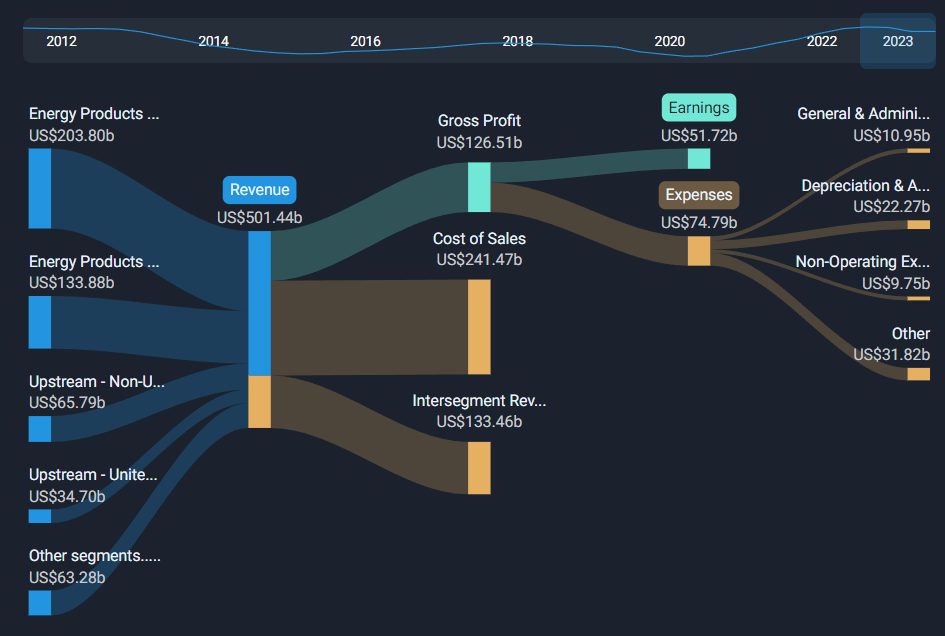

Discover Financial Soars with Impressive Q1 Performance, Boosting Investor Confidence In a promising start to the year, Discover Financial Services has unveiled a remarkable 30% surge in first-quarter profits, signaling strong financial health and strategic resilience. The impressive growth was driven by two key factors: a significant reduction in credit loss provisions and a notable increase in interest income. The financial services giant demonstrated its ability to navigate challenging economic landscapes by carefully managing potential credit risks while simultaneously capitalizing on favorable market conditions. Investors and analysts are taking note of the company's robust financial strategy, which has translated into substantial bottom-line improvements. The substantial profit increase highlights Discover's effective risk management and its capacity to generate revenue even in uncertain economic environments. By optimizing its lending practices and maintaining a prudent approach to credit provisions, the company has positioned itself as a standout performer in the competitive financial services sector. This quarterly performance not only reflects the company's operational strength but also instills confidence among shareholders and market observers about Discover Financial's future growth potential. MORE...

Trade Tensions Escalate: Bessent Dismisses Hopes of Immediate China Tariff Breakthrough

Finance

2025-04-23 20:48:03

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Trade Tensions: UK Signals Cautious Approach to Trump-Era Deal Negotiations

Finance

2025-04-23 20:30:43

In a strategic approach to international trade, the United Kingdom is carefully navigating potential economic partnerships with the United States. British Finance Minister Rachel Reeves has emphasized that while the UK will not hastily enter into tariff agreements, they are actively working to streamline trade barriers and create more opportunities for bilateral economic cooperation. Reeves' statement signals a measured and deliberate approach to trade negotiations, suggesting that the UK is prioritizing thoughtful deal-making over rushed compromises. The government's focus appears to be on developing a balanced and mutually beneficial trade relationship that protects British economic interests while fostering productive international connections. By taking a methodical stance, the UK aims to ensure that any future trade agreements with the United States are carefully crafted to support both nations' economic goals and maintain long-term strategic advantages. MORE...

Wall Street Rollercoaster: Dow Surges, Tech Stocks Spark Midday Rally Before Dramatic Pullback

Finance

2025-04-23 20:02:58

Wall Street breathed a collective sigh of relief as President Trump quelled mounting speculation about the future of Federal Reserve Chair Jerome Powell. In a decisive statement, the president emphatically declared he has "no intention" of removing Powell from his leadership role, instantly calming investor nerves and helping to stabilize financial markets. The announcement came amid growing tensions between the White House and the central bank, which had previously sparked significant uncertainty among investors. By publicly affirming Powell's position, Trump effectively dispelled fears about potential interference with the Federal Reserve's critical independence. Stocks responded positively to the news, with major indices experiencing a notable uptick. The market's swift reaction underscored the importance of maintaining institutional stability and the potential impact of leadership changes at key financial institutions. This reassurance from the president helps preserve the traditional separation between political leadership and monetary policy, a fundamental principle that investors and economic experts consider crucial for maintaining market confidence and economic predictability. MORE...

Danger Ahead: 5 Credit Card Moves That Could Sink Your Financial Future

Finance

2025-04-23 19:34:04

Red Flags: Are Your Credit Card Habits Putting Your Financial Health at Risk?

Credit cards can be powerful financial tools, but they can also become dangerous traps if not managed wisely. Recognizing warning signs in your credit card usage is the first step toward financial wellness. If you find yourself nodding along to any of these common patterns, it's time to pause and reassess your approach.

Warning Signs You Can't Ignore

- Minimum Payments Become Your Norm: If you're consistently paying only the minimum amount due, you're setting yourself up for a long-term debt cycle that can drain your financial resources.

- Credit Limits Feel Like Extra Income: Treating your credit limit as an extension of your spending money is a dangerous mindset that leads to overwhelming debt.

- Emergency Expenses Always Go on Credit: Relying on credit cards for unexpected costs instead of building an emergency fund is a recipe for financial instability.

- You've Lost Track of Your Total Balance: When you're afraid to add up your total credit card debt, it's a clear sign that your spending has spiraled out of control.

Don't panic if these patterns sound familiar. Recognizing the problem is the first crucial step toward financial recovery. Consider creating a strategic debt repayment plan, building an emergency fund, and seeking professional financial advice if needed.

Take Action Now

Your financial future is in your hands. Start by reviewing your credit card statements, creating a realistic budget, and developing healthier spending habits. Remember, it's never too late to turn your financial situation around.

MORE...Silicon Valley Shift: Intel's Q1 Earnings Reveal Tan's First Test as New CEO

Finance

2025-04-23 19:22:48

Investors and tech enthusiasts are eagerly anticipating Intel's upcoming first-quarter earnings report, scheduled for release after the market closes on Thursday. The semiconductor giant is set to provide crucial insights into its financial performance and strategic direction during a challenging period for the tech industry. Analysts will be closely watching key metrics, including revenue, profit margins, and forward-looking guidance. The report comes at a critical time for Intel, as the company continues to navigate competitive pressures and work to regain its footing in the rapidly evolving semiconductor market. Investors are particularly interested in understanding how Intel's recent restructuring efforts and investments in next-generation technologies are impacting its financial health. The earnings call promises to shed light on the company's progress in addressing manufacturing challenges and competing with rivals in the chip manufacturing landscape. As the tech world holds its breath, Intel's first-quarter results could provide a significant indicator of the company's future trajectory and its ability to adapt to the dynamic semiconductor industry. MORE...

Tariff Tensions: German Finance Chief Calls for Urgent Trade Relief

Finance

2025-04-23 18:43:26

In a critical address at the Semafor World Economy Summit in Washington, German Finance Minister Joerg Kukies emphasized the pressing need to reduce economic uncertainty, particularly regarding ongoing trade negotiations with the United States. "The prolonged absence of a clear agreement is allowing economic ambiguity to persist in both our economies," Kukies warned, highlighting the urgent need for resolution. His comments come at a particularly sensitive time for Germany, which has been grappling with significant economic challenges. The country stands as the sole G7 nation that has failed to achieve economic growth over the past two years, a stark reality that could be further exacerbated by potential U.S. trade tariffs. These proposed tariffs threaten to push Germany into an unprecedented scenario - a potential third consecutive year of economic recession in its post-war history. Kukies's statement underscores the critical importance of swift, decisive action in resolving trade tensions and providing clarity for businesses and economic stakeholders on both sides of the Atlantic. The ongoing uncertainty not only impacts immediate economic performance but also undermines long-term strategic planning and investment confidence. MORE...

Wall Street Tremors: Ken Griffin Warns of Citadel's Future Under Trump's Shadow

Finance

2025-04-23 18:32:39

Ken Griffin, the billionaire hedge fund manager behind Citadel, is sounding the alarm about the potential risks facing America's financial landscape in the current political climate. In a candid and provocative statement, Griffin suggests that the nation's financial reputation—long considered a beacon of stability and strength—now stands on precarious ground. The renowned investor has expressed deep concern about the growing political polarization and its potential to undermine the United States' global financial credibility. Griffin's warnings come at a time of significant uncertainty, with the political environment creating unprecedented challenges for financial institutions and market confidence. As a key player in the financial world, Griffin's perspective carries substantial weight. His comments highlight the delicate balance between political dynamics and economic stability, suggesting that the traditional pillars of American financial dominance may be experiencing unprecedented stress. The implications of Griffin's statement extend beyond mere speculation. They represent a critical assessment from an insider who has long been at the forefront of financial innovation and investment strategy. His concerns reflect a broader anxiety about the potential long-term consequences of current political tensions on the nation's economic standing. While Griffin doesn't mince words about the challenges ahead, his commentary serves as a wake-up call for policymakers, investors, and business leaders. It underscores the need for careful navigation through the complex intersection of politics and finance in today's volatile global environment. MORE...

Fiscal Freefall: Los Angeles Confronts Staggering $1 Billion Budget Crisis

Finance

2025-04-23 18:16:37

Los Angeles Faces Tough Financial Choices: City Considers Massive Workforce Reduction

In a stark revelation of the city's financial challenges, Mayor Karen Bass has announced a dramatic proposal to lay off over 1,600 city employees in an urgent bid to balance the municipal budget. The potential mass layoffs highlight the deep economic strain currently gripping Los Angeles.

The proposed workforce reduction underscores a critical question: How did one of America's most vibrant cities find itself in such a precarious financial position? The situation reveals a complex web of budgetary pressures, including lingering economic impacts from the pandemic, rising operational costs, and declining revenue streams.

Mayor Bass's proposal represents a painful but potentially necessary step to restore fiscal stability. City officials are grappling with tough decisions, weighing the immediate need for budget balance against the human cost of significant job losses.

As Los Angeles navigates these challenging financial waters, residents and city workers alike are watching closely, hoping for a resolution that minimizes economic disruption while maintaining essential municipal services.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421