Real Estate Titans Apollo Commercial Finance Crush Q1 Expectations: Inside the Loan Portfolio Triumph

Finance

2025-04-26 07:06:03

Apollo Commercial Real Estate Finance (ARI) continues to demonstrate resilience in a challenging commercial real estate landscape, showcasing impressive loan originations and strategic portfolio expansion. Despite economic headwinds and market uncertainties, the company has maintained a robust financial position. The firm's ability to generate new loan opportunities highlights its strategic adaptability and deep understanding of the commercial real estate market. While facing potential challenges in dividend coverage, ARI remains committed to delivering value to its shareholders through careful portfolio management and targeted investment strategies. Investors and market analysts are closely watching the company's performance, noting its proactive approach to navigating the complex real estate financing environment. Apollo Commercial Real Estate Finance's commitment to maintaining a diversified and high-quality loan portfolio positions it favorably amid ongoing economic fluctuations. The company's leadership continues to focus on prudent risk management and identifying strategic investment opportunities that can drive long-term growth and stability. As the commercial real estate market evolves, ARI remains dedicated to creating sustainable value and maintaining its competitive edge in the industry. MORE...

Breaking: OceanFirst Financial Surges with Impressive Q1 Loan Expansion and Strategic Momentum

Finance

2025-04-26 07:06:02

OceanFirst Financial Corp Demonstrates Resilience with Strong Commercial Lending Performance OceanFirst Financial Corp (OCFC) has showcased impressive financial strength, highlighting significant growth in its commercial loan portfolio and a notable improvement in net interest margin. Despite facing headwinds in non-interest income and managing operational costs, the bank has maintained a robust financial position. The company's strategic focus on commercial lending has paid dividends, with substantial expansion in its loan book signaling confidence in the current market environment. Investors and analysts are taking note of the bank's ability to navigate challenging economic conditions while maintaining steady growth. While non-interest income presented some challenges, OceanFirst has demonstrated operational agility by carefully managing expenses and leveraging its core lending strengths. The improved net interest margin reflects the bank's effective financial management and adaptability in a complex banking landscape. As OceanFirst continues to execute its strategic initiatives, the company remains committed to delivering value to shareholders and maintaining its competitive edge in the regional banking sector. MORE...

Provident Financial Services Smashes Q1 Expectations: Profits Surge Beyond Wall Street Predictions

Finance

2025-04-26 07:05:37

Provident Financial Services Demonstrates Resilience Amid Challenging Banking Landscape In a recent financial update, Provident Financial Services Inc (PFS) has showcased its strength and adaptability in a complex banking environment. The company reported impressive net earnings that underscore its strategic positioning, while simultaneously experiencing significant growth in its commercial loan portfolio. Despite facing headwinds in the form of deposit declines and potential asset quality challenges, Provident has managed to maintain a robust financial performance. The institution's ability to navigate these market complexities highlights management's strategic acumen and the company's operational flexibility. The commercial loan segment emerged as a bright spot, reflecting the bank's targeted approach to business lending and its deep understanding of market opportunities. This growth comes at a critical time when many financial institutions are experiencing more conservative lending patterns. While deposit trends have presented some concerns, Provident's leadership appears confident in their ability to manage these fluctuations through proactive financial strategies. The company's commitment to maintaining asset quality and prudent risk management continues to be a cornerstone of its operational philosophy. Investors and market analysts will be closely monitoring Provident's ongoing performance as it continues to demonstrate resilience in an increasingly complex financial landscape. MORE...

Principal Financial Smashes Q1 Expectations: Earnings Surge Signals Robust Financial Health

Finance

2025-04-26 07:05:26

Principal Financial Group Inc (PFG) Demonstrates Resilience Amid Market Challenges, Delivers Strong Financial Performance In a testament to its strategic financial management, Principal Financial Group has successfully navigated turbulent market conditions, reporting a compelling 10% increase in earnings per share (EPS) and maintaining robust capital returns. Despite facing significant headwinds from market volatility and potential cash flow constraints, the company has showcased remarkable financial strength and operational efficiency. The impressive EPS growth reflects the organization's ability to adapt and optimize its financial strategies in an unpredictable economic landscape. By leveraging its diversified portfolio and prudent risk management approach, Principal Financial Group has not only weathered market uncertainties but also delivered value to its shareholders. Key highlights of the financial performance include strategic capital allocation, disciplined expense management, and a proactive stance in addressing potential market challenges. The company's resilience underscores its commitment to maintaining financial stability and generating sustainable long-term returns. Investors and market analysts are likely to view this performance as a positive indicator of Principal Financial Group's operational excellence and strategic positioning in the competitive financial services sector. MORE...

Oil Price Rollercoaster: Angola Braces for Economic Turbulence, IMF Deal Looms

Finance

2025-04-25 23:33:45

Angola is taking proactive steps to assess its financial resilience amid potential oil price volatility, with Finance Minister Vera Daves de Sousa revealing on Friday that comprehensive stress tests are underway to evaluate the potential impact on government finances. The strategic assessment suggests that the country may be inching closer to seeking financial support from the International Monetary Fund (IMF), as economic uncertainties continue to challenge the oil-dependent nation. The stress tests represent a critical move by Angola to understand and prepare for potential economic shocks, particularly given the country's heavy reliance on oil revenues. By conducting these comprehensive financial evaluations, the government aims to develop robust strategies to mitigate potential fiscal challenges and maintain economic stability in an increasingly unpredictable global energy market. Minister de Sousa's acknowledgment of potentially seeking an IMF loan program underscores the government's commitment to transparent financial management and proactive economic planning. This approach signals Angola's willingness to leverage international financial expertise to navigate potential economic headwinds and protect its fiscal interests. MORE...

City's Financial Pulse: Resilience Shines Through Budget Challenges

Finance

2025-04-25 22:00:00

Despite Potential Financial Challenges, South Pasadena Remains Financially Stable South Pasadena's financial outlook remains resilient, even as recent projections suggest a potential reduction in reserve funds at the start of the new fiscal year. City officials presented an updated financial assessment last week, reassuring residents that while reserve levels might be lower than initially anticipated, the city's overall fiscal health remains strong. The preliminary forecast indicates a slight dip in reserve funds, but municipal leaders are confident in the city's ability to maintain financial solvency. This transparency in financial reporting demonstrates the city's commitment to responsible fiscal management and keeping residents informed about the community's economic status. City finance experts continue to monitor the situation closely, ensuring that South Pasadena can navigate any potential economic challenges while maintaining essential services and infrastructure investments. MORE...

Financial Literacy Comes Alive: Students Dive Deep into Real-World Money Management at JA Finance Park

Finance

2025-04-25 21:21:52

Financial Literacy Comes Alive: Junior Achievement Empowers Local Students at JA Finance Park On a vibrant Friday in April, Junior Achievement transformed financial education into an immersive, real-world learning experience for local students. The JA Finance Park event, held on April 25th, provided participants with a unique opportunity to explore personal finance, budgeting, and real-life financial decision-making in a dynamic, interactive environment. During the event, students stepped into the shoes of working adults, navigating complex financial scenarios and making critical monetary choices that mirror the challenges of real-world financial management. By simulating realistic financial situations, Junior Achievement helped young learners develop essential money management skills that will serve them throughout their lives. The program demonstrates Junior Achievement's ongoing commitment to financial literacy, equipping the next generation with the knowledge and confidence needed to make informed economic decisions. Through hands-on learning and practical experiences, students gained invaluable insights into personal finance, budgeting, and financial planning. MORE...

Driving Growth: AutoNation's Finance Arm Rockets 186% in Unprecedented Surge

Finance

2025-04-25 21:10:11

AutoNation Finance is experiencing a remarkable surge in growth, with its loan originations skyrocketing in the first quarter. The Fort Lauderdale-based captive lender has demonstrated impressive financial performance, originating $460 million in loans during Q1 - a staggering 185.7% increase compared to the same period last year. This substantial growth is closely tied to the company's robust new-vehicle sales and expanding loan portfolio. The impressive financial milestone highlights AutoNation's strong market position and strategic lending approach. The surge in loan originations has propelled AutoNation Finance's auto portfolio to an impressive $1.5 million, signaling robust momentum in the automotive financing sector. The company's earnings presentation reveals a compelling narrative of financial resilience and strategic expansion, positioning AutoNation Finance as a significant player in the automotive lending landscape. MORE...

Leasing Industry Braces for Downturn: Finance Sector Signals Cautionary Forecast

Finance

2025-04-25 20:39:21

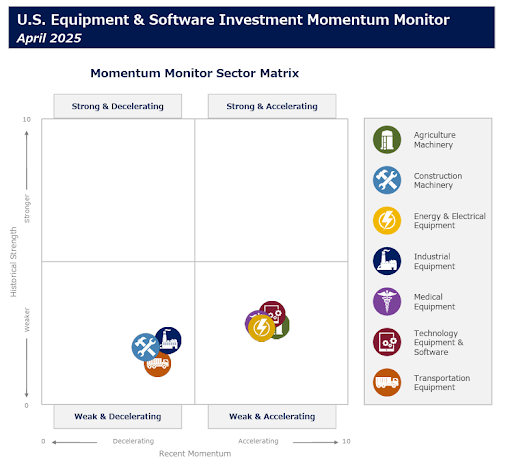

Equipment Finance Sector Faces Challenging Economic Landscape

The Equipment Leasing & Finance Foundation has released its latest quarterly update, painting a sobering picture of the economic environment. In a recent publication, the national nonprofit organization has significantly adjusted its economic projections for the second quarter of 2025, signaling growing concerns across the equipment finance industry.

The foundation's analysis reveals a deteriorating economic outlook, driven by multiple critical factors. Key challenges include:

- Plummeting consumer and business confidence

- Rapidly escalating inflation expectations

- Increasingly restrictive monetary policy

These converging economic pressures are creating a complex and uncertain landscape for businesses and investors in the equipment finance sector. The downward revision suggests that companies may need to adopt more cautious strategies and closely monitor market dynamics in the coming months.

Stakeholders are advised to stay informed and prepared for potential market volatility as these economic trends continue to unfold.

MORE...U.S. Diplomacy in Action: Deputy Secretary Landau Meets Bahrain's Finance Minister in High-Stakes Economic Dialogue

Finance

2025-04-25 20:26:00

In a significant diplomatic meeting today, Deputy Secretary of State Christopher Landau engaged in high-level discussions with Bahraini Minister of Finance and National Economy Shaikh Salman bin Khalifa Al Khalifa in Washington, D.C. The two leaders delved into the robust and longstanding relationship between the United States and Bahrain, highlighting the kingdom's strategic importance as a key partner in trade and regional infrastructure. During their conversation, they emphasized Bahrain's exceptional trade and logistics zone, which has become a model of international cooperation. The meeting underscored the mutual commitment to strengthening bilateral ties and exploring new avenues of economic and strategic collaboration between the two nations. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421