Shriram Finance Breaks Ground: Launching Digital Payment Revolution with Innovative Wallet and UPI Strategy

Finance

2025-04-25 11:34:19

Shriram Finance is set to make a bold strategic move into the digital payments landscape, unveiling plans to launch mobile wallets and prepaid cards. This innovative expansion represents a significant step for the shadow banking institution as it seeks to broaden its financial service portfolio and create new revenue streams. The company aims to leverage its strong market presence and customer trust to enter the rapidly growing digital payments ecosystem. By introducing mobile wallets and prepaid card solutions, Shriram Finance is positioning itself to capture emerging opportunities in the fintech space and provide more convenient financial services to its existing and potential customers. This strategic diversification comes at a time when digital payment platforms are experiencing unprecedented growth, driven by increasing smartphone penetration and changing consumer preferences. Shriram Finance's entry into this sector signals the company's commitment to innovation and adaptability in a rapidly evolving financial services landscape. The new payment offerings are expected to complement the company's core lending business, potentially attracting a younger, more tech-savvy customer base and creating additional touchpoints for financial engagement. By expanding beyond traditional lending, Shriram Finance is demonstrating its forward-thinking approach to financial services. MORE...

Wall Street Beware: Deepfake Scammers Set Their Sights on Finance Leaders

Finance

2025-04-25 11:09:16

In a startling revelation, deepfake technology is rapidly becoming a powerful weapon for online fraudsters, according to a recent investigation by Fortune magazine. Social media platforms are now battlegrounds where sophisticated digital impersonation techniques are being deployed with alarming frequency. These hyper-realistic synthetic media manipulations are designed to deceive unsuspecting users, blurring the lines between authentic and fabricated content. Cybercriminals are leveraging advanced artificial intelligence to create convincing video and audio representations that can trick individuals, businesses, and even sophisticated digital systems. The growing prevalence of deepfakes poses significant risks across multiple domains, including financial scams, identity theft, and misinformation campaigns. As technology continues to evolve, users are urged to remain vigilant and develop critical skills to identify potentially manipulated digital content. Experts recommend implementing robust verification processes and maintaining a skeptical approach when encountering seemingly authentic but potentially suspicious multimedia content online. MORE...

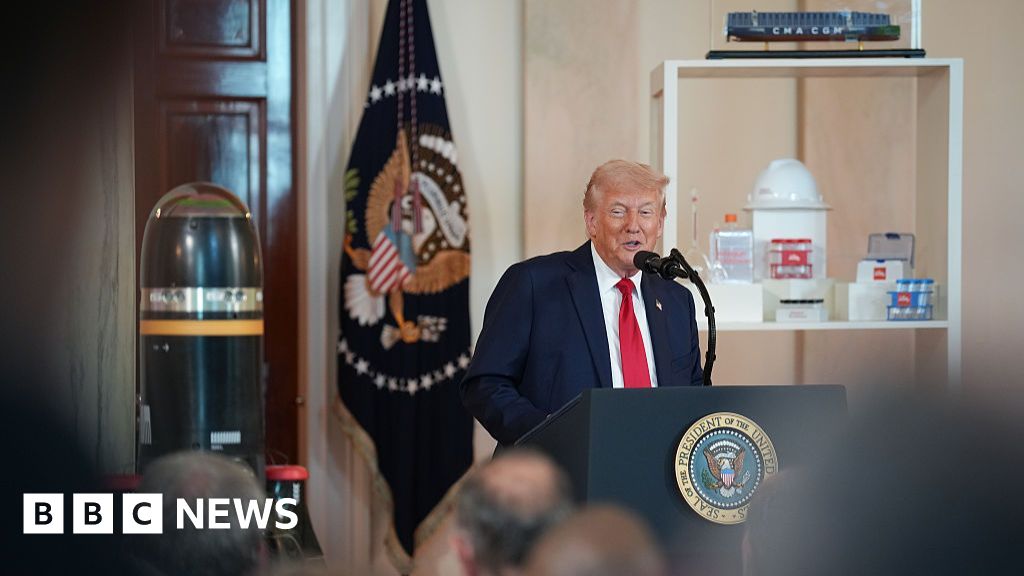

Wealth Watch: Trump's Social Security Tax Cuts Could Reshape Rich Americans' Financial Landscape

Finance

2025-04-25 11:01:34

The Ongoing Debate: Trump's Tax Cuts and Social Security's Future

As the nation holds its collective breath, the speculation surrounding President Donald Trump's tax cuts continues to captivate Americans across the political spectrum. The potential impact on Social Security has become a hot-button issue that resonates with citizens from all walks of life, sparking intense discussions and growing uncertainty.

With so much at stake, people are closely monitoring every development, wondering how these proposed changes might affect their financial security and long-term economic prospects. The will he/won't he narrative has transformed from mere political chatter into a critical conversation about the future of retirement benefits and economic policy.

Experts, policymakers, and everyday Americans are eagerly awaiting clarity on how these potential tax cut strategies could reshape the social safety net that millions of retirees and future beneficiaries depend on.

MORE...Burnout Breaking Point: Smart Money Moves to Survive Financial Exhaustion

Finance

2025-04-25 11:00:35

In today's high-pressure work environment, financial stress has emerged as a critical catalyst for professional burnout. Workplace culture expert Jennifer Moss, author of the groundbreaking book "Unlocking Happiness at Work," offers invaluable insights into a revolutionary concept: "burnout budgeting." During her recent appearance on Wealth with Brad Smith, Moss delved deep into the intricate relationship between financial wellness and mental resilience. She illuminates how strategic financial planning can serve as a powerful shield against the overwhelming exhaustion that plagues modern professionals. Burnout budgeting isn't just about managing money—it's about creating a holistic approach to financial and emotional well-being. By understanding the economic triggers of workplace stress, employees can develop proactive strategies to protect their mental health and professional sustainability. For workers seeking to combat burnout, Moss suggests a comprehensive approach that goes beyond traditional financial advice. Her insights provide a roadmap for navigating the complex intersection of personal finance and professional mental health. Want to dive deeper into expert analysis and cutting-edge market insights? Explore more compelling content on Wealth and empower yourself with knowledge that can transform your professional journey. MORE...

Financial Shakeup: Bank of England Halts Investments and Dividends Amid Fiscal Pressure

Finance

2025-04-25 10:57:10

In a significant financial shake-up, the Bank of England is taking drastic measures to manage its budget constraints, announcing the cancellation of investment projects and suspending dividend payments to the UK government. This strategic decision comes in the wake of a comprehensive review led by former Federal Reserve Chairman Ben Bernanke, which is set to transform the central bank's forecasting approach. The move highlights the mounting financial pressures facing the Bank of England, signaling a period of fiscal prudence and restructuring. By halting investment initiatives and dividend distributions, the institution aims to stabilize its financial position and adapt to the evolving economic landscape. Bernanke's review is expected to introduce more robust and dynamic forecasting methods, potentially reshaping how the Bank of England assesses and responds to economic challenges. This comprehensive overhaul reflects the central bank's commitment to maintaining financial resilience and transparency in an increasingly complex global economic environment. The decision underscores the ongoing challenges faced by financial institutions in navigating economic uncertainties, with the Bank of England taking proactive steps to ensure its long-term stability and effectiveness. MORE...

Money Maverick: How Ramit Sethi Outsmarted Wall Street Before 30 and Reveals Gen Z's Financial Superpower

Finance

2025-04-25 10:19:31

Cracking the Code to Millionaire Success in Your Twenties: Insights from Ramit Sethi Want to transform your financial future before hitting 30? Netflix star and best-selling author Ramit Sethi believes achieving millionaire status isn't as complex as most people think. In a candid conversation with Fortune, Sethi breaks down the misconceptions about wealth-building and offers a refreshingly straightforward approach to financial success. "The path to becoming a self-made millionaire is more accessible than most people realize," Sethi explains. His no-nonsense strategy combines smart financial planning, strategic career development, and a mindset shift that goes beyond traditional money advice. Drawing from his own experiences and years of financial expertise, Sethi challenges the notion that becoming wealthy requires extraordinary luck or inherited privilege. Instead, he emphasizes practical steps that young professionals can implement immediately to set themselves up for financial freedom. Key takeaways include developing multiple income streams, investing wisely, and creating a personal financial system that works uniquely for your goals. For aspiring entrepreneurs and ambitious young professionals, Sethi's approach offers a blueprint for turning financial dreams into tangible reality. Whether you're just starting your career or looking to level up your financial game, Sethi's insights provide a compelling roadmap to building wealth in your twenties – proving that financial success is within reach for those willing to learn and take strategic action. MORE...

Green Finance Revolution: How Global Banks Are Reshaping Sustainable Investment in 2025

Finance

2025-04-25 09:39:43

In a groundbreaking analysis spanning over 20 countries, a new comprehensive report delves into the strategic approaches of 51 public financial institutions, revealing critical insights into how green banks can effectively unlock private capital investment. The study offers an unprecedented look at the challenges and innovative solutions in sustainable finance, providing a roadmap for financial institutions seeking to accelerate green investment strategies. By examining the experiences of public financial institutions worldwide, the research uncovers key barriers that have traditionally hindered private capital mobilization in sustainable development projects. The report not only identifies these obstacles but also presents practical, actionable strategies for overcoming them, making it an essential resource for policymakers, financial leaders, and sustainability experts. With climate change and sustainable development becoming increasingly urgent global priorities, this research provides timely and critical guidance on how financial institutions can play a pivotal role in driving meaningful environmental and economic transformation. The insights gleaned from this extensive study promise to reshape approaches to green financing and investment across international markets. MORE...

Green Finance Shakeup: US Financial Hubs Slide in Global Rankings as Policy Winds Shift

Finance

2025-04-25 08:51:53

In a striking revelation, the latest global financial survey exposes a significant shortcoming for the United States: no American financial center has managed to break into the top 10 rankings for green financing. This finding highlights a potential gap in the nation's sustainable investment landscape and raises questions about the country's commitment to environmentally responsible financial strategies. The survey, which evaluates financial hubs based on their green financing initiatives and sustainable investment practices, delivers a wake-up call to U.S. financial centers. While major cities like New York and San Francisco have long been considered global financial powerhouses, their performance in green financing appears to be lagging behind international competitors. This development comes at a critical time when global attention is increasingly focused on sustainable economic development and climate-conscious investment strategies. The absence of U.S. cities in the top 10 suggests that American financial institutions may need to accelerate their efforts to integrate environmental, social, and governance (ESG) principles into their core business models. Investors, policymakers, and environmental advocates are likely to view this survey as a catalyst for change, potentially pushing U.S. financial centers to reassess and reinvigorate their approach to green financing and sustainable investment. MORE...

Beyond Spreadsheets: How Tech is Revolutionizing Finance's Digital Transformation

Finance

2025-04-25 08:02:21

The Modern CFO's Talent Dilemma: Scaling Teams in a Constrained Hiring Landscape Chief financial officers are navigating an unprecedented challenge in today's complex business environment: how to strategically expand their teams when traditional hiring approaches are increasingly limited. The current economic landscape presents a unique paradox that demands innovative workforce solutions. In an era marked by economic uncertainty, budget constraints, and rapid technological transformation, CFOs are being forced to rethink their talent acquisition and team development strategies. The conventional playbook of simply posting job listings and conducting standard recruitment no longer suffices. Instead, forward-thinking financial leaders are embracing alternative approaches such as: • Upskilling existing team members • Leveraging flexible and contract talent • Investing in automation and AI-driven tools • Creating cross-functional development programs • Utilizing strategic outsourcing These methods allow organizations to enhance team capabilities without the traditional overhead of full-time hiring, providing the agility and resilience needed in today's dynamic business world. The key is to view talent development as a strategic investment rather than a transactional process, transforming potential limitations into opportunities for innovation and growth. MORE...

EU Defense Spending Dilemma: Poland Seeks Flexibility, Fears Uneven Commitment

Finance

2025-04-25 06:09:40

Poland is preparing to seek a strategic financial flexibility from the European Commission, with plans to request a special exemption from standard EU borrowing limits. The move is designed to support the country's ambitious defense spending plans in the coming years while maintaining compliance with European fiscal regulations. Polish Finance Minister Andrzej Domanski revealed the government's intentions on Thursday, highlighting the nation's commitment to bolstering its military capabilities. However, the government remains cautious, expressing concerns about whether other EU member states will adopt similar approaches to defense funding. The proposed exemption would allow Poland to invest significantly in national defense without triggering penalties for exceeding traditional EU budget constraints. This approach reflects the country's heightened focus on military preparedness in light of ongoing geopolitical tensions in the region. As Poland moves forward with its request, the European Commission will carefully evaluate the proposal, balancing national security needs with broader economic stability guidelines. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421