Behind the Scenes: How Lawyer Lobbyists Shape Wall Street's Rules

Finance

2025-02-17 15:00:00

In the complex landscape of modern American governance, administrative agencies have emerged as pivotal architects of policy, wielding unprecedented influence over financial regulation and economic direction. The traditional image of policymaking—once dominated by legislative chambers and congressional debates—has dramatically transformed, with regulatory bodies now playing a central role in shaping national economic strategies. At the heart of this regulatory ecosystem, lawyers have evolved into sophisticated strategic actors, functioning not just as legal professionals but as skilled lobbyists navigating the intricate corridors of administrative power. Their expertise goes far beyond traditional legal representation, encompassing nuanced advocacy, strategic communication, and deep understanding of regulatory mechanisms. These legal professionals leverage their specialized knowledge to influence policy development, working strategically to represent corporate interests, industry perspectives, and complex regulatory challenges. By bridging the gap between legal frameworks and policy implementation, lawyer-lobbyists have become critical intermediaries in the contemporary regulatory landscape. The intersection of legal expertise and policy advocacy represents a fascinating dimension of American administrative governance, where professional skills, strategic communication, and regulatory insight converge to shape economic and regulatory frameworks that impact millions of lives and billions of dollars in economic activity. MORE...

AI's Financial Firewall: How Machine Learning Is Crushing Fraud in Real-Time

Finance

2025-02-17 14:58:53

In a rapidly evolving digital landscape, artificial intelligence has become a double-edged sword for the financial sector. A startling new revelation shows that AI is now powering an alarming 42% of financial fraud attempts, sending shockwaves through banks and businesses worldwide. Financial institutions are now in a high-stakes race against sophisticated cybercriminals who are leveraging cutting-edge AI technologies to exploit vulnerabilities in digital security systems. The unprecedented rise of AI-driven fraud represents a critical challenge that demands immediate and innovative defensive strategies. As fraudsters become increasingly tech-savvy, traditional security measures are proving inadequate. Banks and businesses are urgently reassessing their cybersecurity frameworks, investing heavily in advanced AI-powered detection systems and machine learning algorithms designed to counteract these intelligent fraud mechanisms. The stakes are higher than ever, with potential financial losses and reputational damage looming large. Organizations must now adopt a proactive, adaptive approach to cybersecurity, continuously evolving their defensive technologies to stay one step ahead of malicious AI-driven fraud attempts. This emerging threat landscape underscores the critical importance of technological innovation, robust security protocols, and ongoing vigilance in protecting financial ecosystems from increasingly sophisticated cyber risks. MORE...

Financial Leadership Shake-Up: Pinnacle Tech Taps Joe Elebash as New CFO

Finance

2025-02-17 14:45:00

Pinnacle Technology Solutions (PTS) is thrilled to announce a strategic leadership enhancement with the appointment of Joe Elebash as its new Chief Financial Officer (CFO). Bringing an impressive two-decade track record of financial leadership, Elebash is set to be a transformative force in guiding the company's financial vision and accelerating its growth trajectory. With his extensive expertise, Elebash will be instrumental in refining PTS's financial strategy, optimizing operational efficiency, and supporting the company's ambitious expansion plans. His deep understanding of financial dynamics and strategic planning is expected to provide critical insights that will drive Pinnacle Technology Solutions toward continued success in the competitive hybrid IT solutions market. The addition of Elebash to the executive team underscores PTS's commitment to attracting top-tier talent and maintaining its position as an innovative leader in the technology services sector. His appointment signals a promising new chapter for the organization, promising enhanced financial stewardship and strategic growth. MORE...

Financial Myths Exposed: The Viral Savings Tip That Could Drain Your Wallet

Finance

2025-02-17 14:00:13

Social Media Savings Advice: Separating Fact from Fiction

In the age of viral content and instant financial tips, social media has become a double-edged sword for personal finance guidance. While platforms like TikTok, Instagram, and Twitter promise quick money-saving hacks, financial experts warn that not all advice is created equal.

Navigating the sea of online financial recommendations can be tricky. What seems like a brilliant money-saving strategy could actually be a recipe for financial disaster. One seasoned financial expert has highlighted some of the most dangerous and misleading savings advice currently circulating on social media.

The Danger of One-Size-Fits-All Financial Advice

Social media influencers often present financial tips as universal solutions, but the truth is far more nuanced. Personal finance is deeply individual, and what works for one person may be catastrophic for another. The rapid-fire, attention-grabbing nature of social media platforms doesn't leave room for the critical context and personalized approach that sound financial planning requires.

Red Flags to Watch Out For

- Unrealistic get-rich-quick schemes

- Oversimplified investment strategies

- Advice that ignores individual financial circumstances

- Trendy financial hacks without long-term sustainability

Before implementing any financial advice found online, it's crucial to consult with a qualified financial advisor who can provide personalized guidance tailored to your specific financial situation and goals.

Remember: If a money-saving tip sounds too good to be true, it probably is. Critical thinking and professional advice are your best tools in navigating the complex world of personal finance.

MORE...Climate Cash Crunch: Developing Nations Demand Fair Financial Lifeline

Finance

2025-02-17 13:03:13

As the developed world undergoes a transformative shift in its global interactions, the consequences of neglecting climate finance are becoming increasingly stark. The potential economic repercussions extend far beyond mere monetary losses, encompassing a complex web of challenges that threaten human well-being and planetary stability. Failing to invest in climate resilience and mitigation strategies could trigger a cascade of devastating impacts. These include not only substantial economic setbacks but also severe health risks, escalating disaster recovery costs, widespread food insecurity, dramatic biodiversity erosion, and extensive damage to critical infrastructure. The urgency of addressing climate finance is no longer a distant concern but an immediate imperative. By proactively supporting sustainable development and climate adaptation, nations can mitigate these potential catastrophic consequences and pave the way for a more resilient, equitable global future. MORE...

Behind Bars and Battling: The Untold Story of Victor Selormey's Judicial Ordeal

Finance

2025-02-17 12:42:16

In a dramatic turn of events, the name Francis Yao Selormey has once again emerged at the center of a high-profile legal controversy surrounding Ken Ofori-Atta, the former Minister of Finance. The Office of the Special Prosecutor has escalated the situation by declaring Ofori-Atta a wanted fugitive, thrusting Selormey's name back into the spotlight. The unfolding narrative has captured the attention of political observers and the public alike, as the intricate details of this legal pursuit continue to unfold. Selormey's connection to the case adds another layer of complexity to an already intricate political and legal landscape. While the specific details remain under investigation, the declaration of Ofori-Atta as a wanted fugitive signals a significant development in what appears to be a serious legal challenge. The involvement of Francis Yao Selormey suggests deeper interconnections that are yet to be fully revealed. As the story continues to develop, many are watching closely to understand the full implications of this unprecedented move by the Office of the Special Prosecutor and the potential consequences for the individuals involved. MORE...

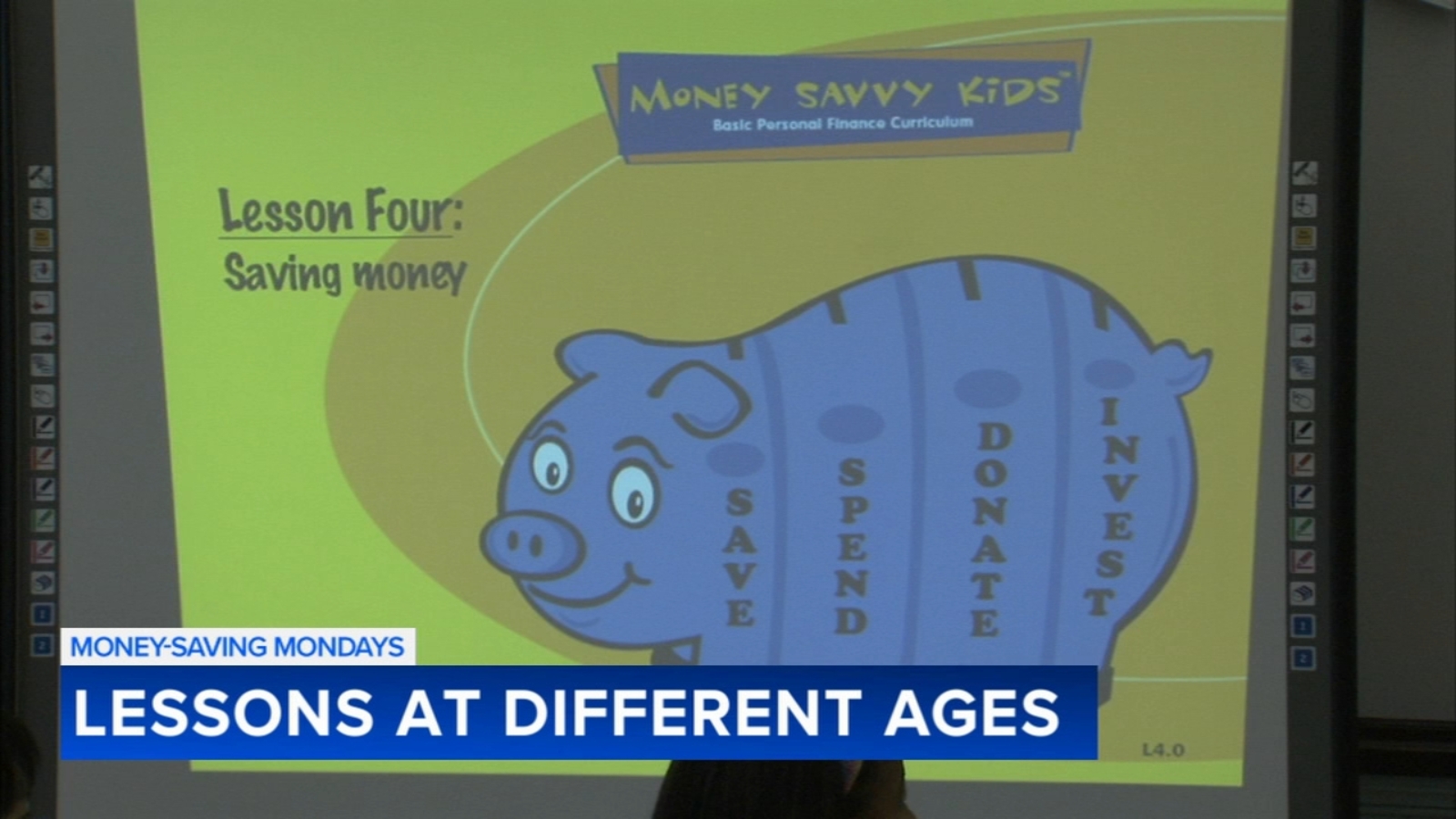

Money Smarts: Raising a Generation of Savvy Young Investors

Finance

2025-02-17 12:09:50

Empowering Kids: The Essential Guide to Financial Literacy

This Monday morning, we're diving deep into a crucial topic that every parent should prioritize: teaching children about money management. Joining us is Ross Mac, a renowned financial expert and successful entrepreneur who has made it his mission to transform how we approach financial education for young minds.

In today's complex economic landscape, financial literacy is no longer just a skill—it's a critical life tool. Children who understand the value of money, learn smart saving strategies, and develop responsible spending habits are better equipped to navigate their financial futures.

Ross Mac brings a wealth of experience and passion to this important conversation. Through his innovative approach, he breaks down complex financial concepts into digestible, engaging lessons that resonate with children and parents alike.

"Financial education shouldn't be intimidating," Mac explains. "It's about creating a positive, empowering relationship with money from an early age."

Whether you're a parent looking to start your child's financial journey or an educator seeking practical strategies, this discussion promises to provide invaluable insights into raising financially savvy kids.

MORE...Financial Crunch: Austin Schools Slam Brakes on Spending Amid Massive $110M Budget Shortfall

Finance

2025-02-17 11:45:27

Financial challenges have escalated for the district as its budget deficit unexpectedly swelled from $92 million to $110 million. The dramatic increase stems from a combination of mounting spending requests and a significant decline in anticipated revenue. In response to these mounting fiscal pressures, district leadership has implemented immediate cost-control measures, including a comprehensive hiring and spending freeze to stem the financial bleeding and stabilize the budget. The sudden deficit expansion has raised serious concerns about the district's financial health, forcing administrators to take swift and decisive action to prevent further economic strain. By halting new hires and restricting discretionary spending, officials hope to create a buffer and reassess the district's financial strategy in the coming months. MORE...

Trade Finance Revolution: Surecomp's Strategic ELCY Buyout Signals Digital Transformation

Finance

2025-02-17 11:33:38

Surecomp Expands Digital Trade Finance Capabilities with Strategic Acquisition of ELCY Ltd In a bold move to accelerate digital transformation in trade finance, Surecomp has strategically acquired ELCY Ltd, signaling a powerful commitment to innovation and technological advancement. This landmark acquisition underscores Surecomp's vision to revolutionize trade finance solutions by integrating cutting-edge technologies and expertise. By bringing ELCY Ltd into its portfolio, Surecomp is poised to enhance its digital trade finance ecosystem, offering more sophisticated, streamlined, and intelligent solutions for global financial institutions and businesses. The merger represents a significant step towards creating more efficient, transparent, and technologically advanced trade finance processes. This strategic expansion demonstrates Surecomp's ongoing dedication to pushing the boundaries of digital innovation and providing comprehensive, forward-thinking solutions in the rapidly evolving trade finance landscape. MORE...

Money Smarts Mandate: High Schoolers Could Soon Need Finance Class to Graduate

Finance

2025-02-17 11:30:00

A groundbreaking legislative proposal is gaining momentum in the state capitol, promising to equip high school students with essential life skills. The bipartisan bill aims to transform financial literacy by mandating personal finance courses as a graduation requirement. This innovative legislation recognizes that understanding money management is crucial in today's complex economic landscape. By ensuring every student learns practical financial skills before leaving high school, lawmakers hope to empower the next generation with the knowledge to make smart financial decisions. The proposed bill would require students to complete a comprehensive personal finance class covering critical topics like budgeting, saving, investing, understanding credit, and basic economic principles. This proactive approach could help young adults avoid common financial pitfalls and build a stronger foundation for their financial future. Supporters argue that this requirement will provide students with real-world skills often overlooked in traditional academic curricula, giving them a significant advantage as they transition into adulthood and financial independence. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421