Market Tremors: Wall Street Braces for Economic Uncertainty as Trade Tensions Simmer

Finance

2025-03-13 10:18:06

As financial markets navigate the turbulent waters of escalating trade tensions, a potential government shutdown looms, adding another layer of uncertainty to an already volatile economic landscape. The ongoing trade war, characterized by President Trump's aggressive tariff strategies, has been creating significant ripples across global financial markets, and now the specter of a government shutdown threatens to further destabilize investor confidence. The combination of unpredictable trade policies and potential legislative gridlock is sending tremors through Wall Street, with investors growing increasingly anxious about the potential economic fallout. Uncertainty has become the new normal, as markets struggle to predict the potential consequences of these simultaneous challenges. Traders and economic analysts are closely monitoring the situation, recognizing that both the trade tensions and the potential government shutdown could have far-reaching implications for economic growth, market stability, and international trade relationships. The mounting pressure underscores the delicate balance of global economic dynamics and the profound impact of political decision-making on financial markets. As the deadline for potential government funding approaches, investors are bracing themselves for potential market volatility, hoping for a resolution that can provide some much-needed stability in an increasingly unpredictable economic environment. MORE...

Wall Street's Surprise Twist: Goldman's Bearish Forecast Signals Hidden Market Opportunity

Finance

2025-03-13 10:00:17

In the high-stakes world of Wall Street, where market sentiment can shift faster than trading algorithms, a stock downgrade isn't always the harbinger of doom it appears to be. In fact, sometimes a seemingly negative analyst report can be a strategic opportunity for savvy investors. Recent market dynamics have revealed an intriguing phenomenon: downgrades that paradoxically signal potential investment opportunities. When analysts adjust their recommendations, they're not just throwing darts at a financial dartboard—they're often providing nuanced insights into complex market conditions. Take, for instance, the current landscape of trade tensions and tariff uncertainties. What might look like a pessimistic outlook could actually be a calculated assessment of a company's resilience and adaptability. Investors who understand the deeper narrative behind these downgrades can position themselves strategically, turning potential market turbulence into a calculated advantage. The key is to look beyond the surface-level rating and dig into the underlying rationale. Are the concerns temporary? Does the company have robust mechanisms to navigate challenging economic environments? These are the questions that transform a downgrade from a red flag into a potential green light for strategic investment. In today's volatile market, information is currency, and a well-interpreted downgrade can be more valuable than a simplistic upgrade. Smart investors know that true opportunity often lurks in the nuanced spaces between market sentiment and fundamental value. MORE...

The BNPL Dilemma: 6 Shocking Truths Financial Experts Want You to Know

Finance

2025-03-13 09:00:00

Buy Now, Pay Later: Decoding the Rise of Installment Payments

Ever spotted that tempting "pay in four easy installments" option while shopping online? You're not alone. This increasingly popular payment method has transformed the way consumers approach online shopping, offering flexibility and financial breathing room.

These installment payment services, often called "Buy Now, Pay Later" (BNPL), allow shoppers to split their total purchase into smaller, more manageable payments. Instead of paying the full amount upfront, you can spread the cost over several weeks or months, typically without traditional credit checks.

While these services can be convenient, they're not without potential pitfalls. It's crucial to understand the terms, potential fees, and impact on your personal financial health before diving in. Some key considerations include:

- Interest rates and potential late payment penalties

- Impact on credit score

- Total cost of the purchase

- Repayment schedule and flexibility

Smart shoppers will read the fine print and use these services strategically, ensuring they don't overextend their finances while enjoying the convenience of modern payment options.

MORE...Ping An Dominates Global Insurance Branding: Crowned Brand Value Champion for Ninth Consecutive Year

Finance

2025-03-13 08:40:00

Ping An Insurance Group Continues Its Remarkable Streak, Crowned Top Insurer in Global Brand Ranking For the ninth consecutive year, Ping An Insurance (Group) Company of China, Ltd. has secured the pinnacle position in the prestigious Brand Finance Insurance 100 2025 ranking. The company's exceptional performance has been recognized with an impressive brand value of US$33.6 billion, solidifying its status as the most valuable brand in the insurance sector. Brand Finance highlighted Ping An's remarkable resilience, attributing its success to deep-rooted brand recognition within China and consistent growth across multiple insurance segments. The company has demonstrated strong performance in life, health, property & casualty (P&C) insurance, and accidental injury insurance, showcasing its comprehensive and robust business model. This sustained achievement underscores Ping An's strategic prowess and its ability to maintain market leadership in an increasingly competitive insurance landscape. The company's continued dominance reflects its commitment to innovation, customer service, and strategic expansion. MORE...

Fiscal Tightrope: Godongwana's Budget Balancing Act Amid Political Crosswinds

Finance

2025-03-13 08:34:22

In a bold political move that's sparking tension within the government, the finance minister is standing firm on controversial tax increases, despite growing resistance from his coalition partners. The decision signals a potential fracture in the ruling alliance, as the minister prioritizes fiscal strategy over political harmony. Sources close to the negotiations reveal that the proposed tax hikes have created significant internal friction, with coalition partners expressing deep concerns about the potential economic impact. The finance minister, however, remains resolute, arguing that the measures are crucial for stabilizing the national budget and supporting long-term economic recovery. The standoff highlights the delicate balance of power within the coalition government, where competing priorities and divergent economic philosophies are now coming to a head. As negotiations continue behind closed doors, political observers are watching closely to see whether compromise can be reached or if this disagreement could lead to more serious political consequences. With the tax proposal moving forward despite opposition, the finance minister is effectively challenging his coalition partners to either fall in line or risk destabilizing the government's unified front. The coming weeks will be critical in determining whether this fiscal strategy will prevail or if political pressure will force a strategic retreat. MORE...

Trade War Tensions: Will Tariffs Make or Break Wall Street's Next Move?

Finance

2025-03-13 08:00:26

Market Volatility Surges as Trade Tensions Keep Investors on Edge The stock market continues to ride a rollercoaster of uncertainty, with tariff negotiations sending daily shockwaves through investor sentiment. As global trade tensions simmer, market participants are desperately trying to forecast the potential impact of shifting trade policies on corporate bottom lines. Each day brings a new wave of speculation, with investors carefully parsing every headline and diplomatic signal for clues about potential trade resolutions. The unpredictable nature of current tariff discussions has created a high-stakes guessing game, where even minor policy hints can trigger significant market swings. Corporate leaders and financial strategists are working overtime to model potential scenarios, understanding that the ripple effects of trade policies could dramatically reshape profit margins and strategic planning. The ongoing uncertainty has transformed the investment landscape into a complex chess match, where anticipating policy moves has become as crucial as traditional financial analysis. MORE...

Fiscal Flexibility: South Africa's Budget Faces Potential Overhaul

Finance

2025-03-13 06:54:18

South Africa's budget could undergo further refinement as political parties continue negotiations to resolve disagreements surrounding the controversial proposal to increase value-added tax. In an exclusive interview with Reuters, the country's finance minister hinted at potential modifications, signaling ongoing discussions to bridge political divides and find a consensus on the sensitive fiscal matter. The potential tax adjustment has sparked intense debate among political stakeholders, with each party seeking to protect their constituents' interests while balancing the nation's economic needs. The finance minister's comments suggest a collaborative approach to resolving the impasse, demonstrating a commitment to transparent and inclusive economic policymaking. As negotiations progress, the government remains focused on crafting a budget that addresses economic challenges while maintaining fiscal responsibility and minimizing the potential burden on South African citizens. MORE...

Breaking: OCBC Transforms Global Financial Operations with Oracle's Cloud Revolution

Finance

2025-03-13 06:40:00

OCBC Transforms Digital Strategy with Oracle Cloud Solutions

In a groundbreaking digital transformation initiative, OCBC Bank, a leading financial services powerhouse in Southeast Asia, has partnered with Oracle to revolutionize its enterprise operations through Oracle Fusion Cloud Enterprise solutions.

As the region's second-largest financial institution by total assets, OCBC is leveraging cutting-edge cloud technology to enhance operational efficiency, streamline business processes, and drive innovative digital experiences for its customers.

The strategic implementation of Oracle's cloud enterprise solutions demonstrates OCBC's commitment to digital innovation and technological advancement in the rapidly evolving financial services landscape.

By embracing Oracle's comprehensive cloud platform, OCBC is positioning itself at the forefront of digital banking transformation, setting a new standard for technological integration in the Southeast Asian financial sector.

This collaboration underscores the bank's forward-thinking approach to digital strategy and its dedication to providing superior technological capabilities for its clients and stakeholders.

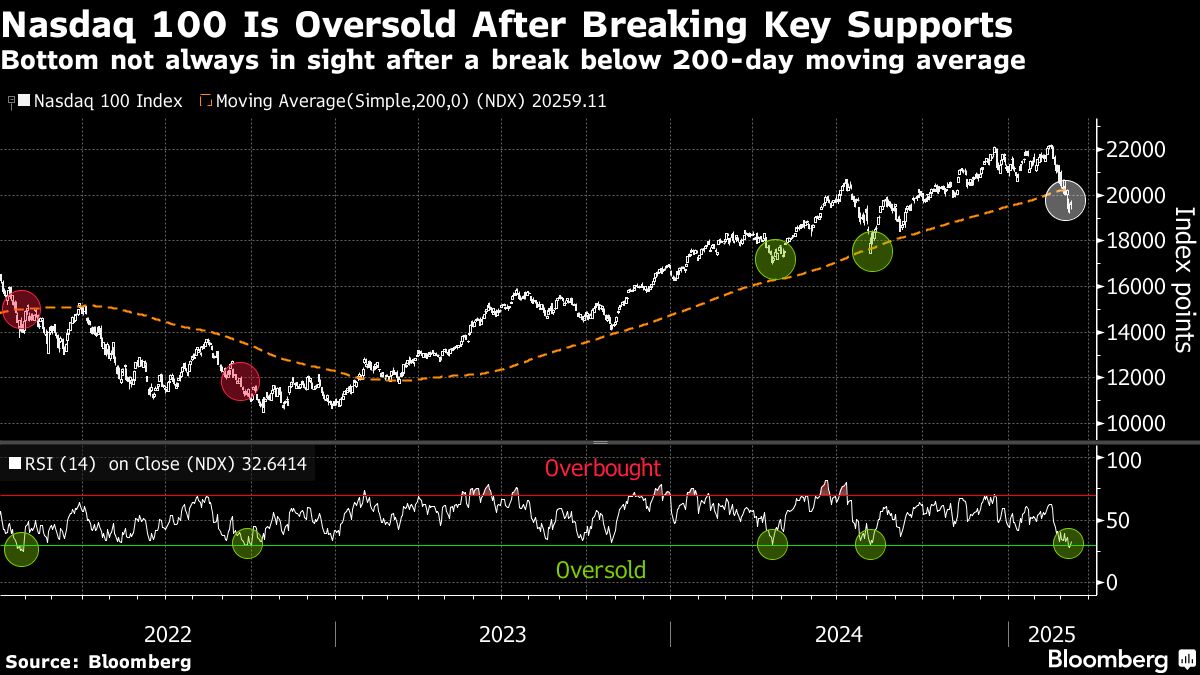

MORE...Market Turning Point: JPMorgan Signals End of Stock Market Downturn

Finance

2025-03-13 04:34:27

JPMorgan Signals Potential End to US Equity Market Correction

Financial experts at JPMorgan Chase & Co. suggest that the recent downturn in US equity markets may be reaching its conclusion, with promising indicators emerging from credit markets that hint at a reduced likelihood of an economic recession.

The investment banking giant's analysis points to stabilizing credit conditions as a key signal of potential market recovery. By closely examining credit market dynamics, JPMorgan's analysts believe investors might be witnessing the early stages of a market stabilization period.

This assessment comes at a critical time when investors have been anxiously monitoring economic indicators for signs of potential economic turbulence. The credit market's current state suggests a more optimistic outlook compared to previous predictions of widespread economic downturn.

While market volatility remains a concern, JPMorgan's insights offer a glimmer of hope for investors seeking reassurance in an uncertain financial landscape. The bank's research team recommends cautious optimism and continued close monitoring of economic trends.

MORE...State Bank of India Unleashes AI-Powered Fintech Frontier: A Billion-Dollar Innovation Leap

Finance

2025-03-13 04:19:06

State Bank of India (SBI) is pioneering a groundbreaking initiative by establishing a dedicated unit focused on providing innovative project financing solutions for emerging industries. The new division will specifically target cutting-edge sectors like artificial intelligence, e-commerce, and financial technology, signaling the bank's commitment to supporting India's rapidly evolving technological landscape. A senior executive at SBI revealed that this strategic move is designed to address the unique financial needs of next-generation businesses, offering tailored financing approaches that understand the dynamic nature of these innovative industries. By creating this specialized unit, the country's largest lender aims to bridge the funding gap and provide crucial financial support to startups and companies at the forefront of technological transformation. The initiative underscores SBI's forward-thinking approach, recognizing the critical role that emerging sectors play in driving economic growth and technological advancement. This strategic expansion demonstrates the bank's adaptability and commitment to supporting India's most promising and innovative business ecosystems. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421