Notion's Money Management Maze: Why Your Wallet Might Want to Look Elsewhere

Finance

2025-05-01 13:00:00

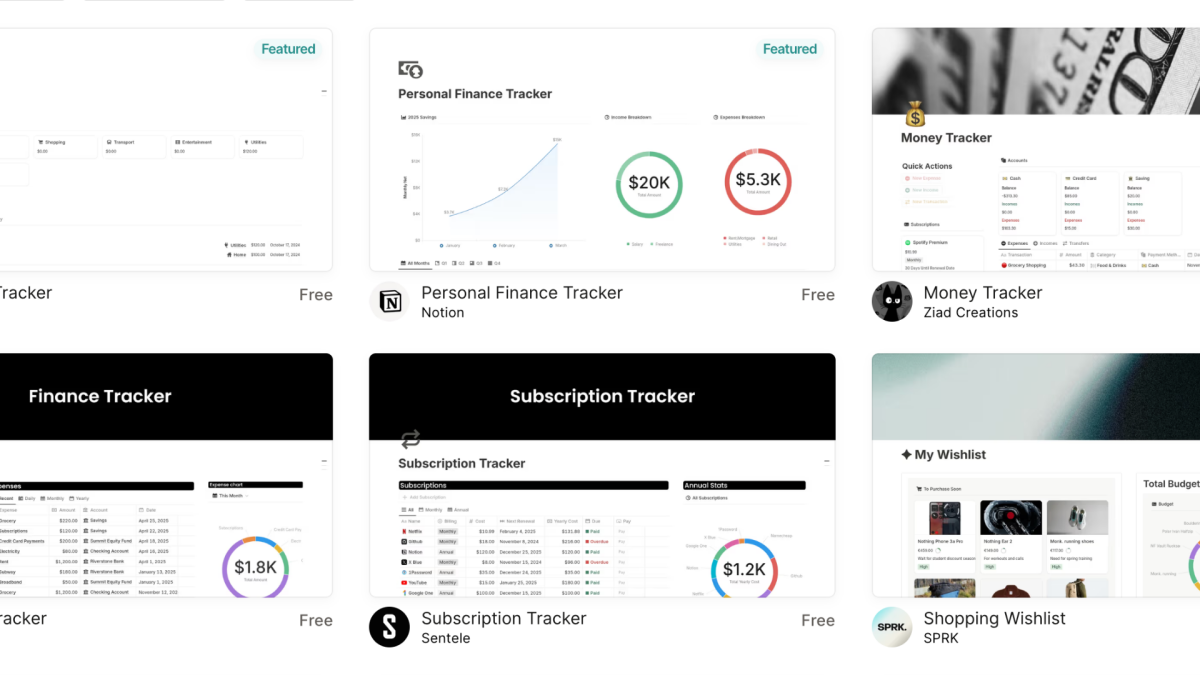

Navigating Personal Finance with Narrative and Nuance: Why Notion Matters For those who don't just see numbers, but weave financial stories—individuals who process monetary decisions through context, visualization, and holistic life planning—Notion emerges as a transformative tool. While it may not completely replace specialized financial software for intricate money management, Notion serves as an intelligent, adaptable companion on your financial wellness journey. Imagine a platform that doesn't just track dollars and cents, but understands the human narrative behind each transaction. Notion bridges the gap between cold, hard data and the rich, personal context of your financial choices. It's perfect for visual thinkers who crave organized insights, storytellers who want their financial documentation to reflect their life's broader tapestry, and pragmatic planners seeking an integrated approach to tracking wealth and goals. More than a spreadsheet, Notion becomes a dynamic financial storytelling canvas—where numbers meet meaning, and personal finance becomes a truly personalized experience. MORE...

Green Money Meets Harvest: The Climate Finance Revolution Transforming Global Agriculture

Finance

2025-05-01 12:27:18

Get ready for an illuminating dive into the world of climate finance! The ClimateShot Investor Coalition (CLIC) is set to unveil its highly anticipated 2025 Landscape of Climate Finance for Agrifood Systems in an upcoming launch webinar. Scheduled for release on May 14th, this groundbreaking report promises to provide a comprehensive overview of climate investment trends in global agriculture and food systems. Attendees can look forward to an in-depth exploration of the latest financial data, revealing critical insights into how climate investments are distributed across various financial sources, innovative investment instruments, climate adaptation strategies, and key agricultural sectors. This report is poised to be an essential resource for investors, policymakers, and sustainability experts seeking to understand the evolving landscape of climate finance in agriculture. Don't miss this opportunity to gain cutting-edge insights into how financial resources are being channeled to support sustainable agricultural practices and climate resilience worldwide. MORE...

Green Finance Revolution: Gulf Leaders Unveil Sustainable Economic Roadmap at 2025 Summit

Finance

2025-05-01 12:00:00

Bridging Climate Action: UAE's Pragmatic Path Forward Nearly a year and a half after hosting the groundbreaking COP28 climate summit, the United Arab Emirates continues to demonstrate its commitment to environmental progress. Environmental Finance's recent event in Abu Dhabi showcased the region's innovative and strategic approach to sustainable transformation, revealing a nuanced vision that balances practical considerations with bold environmental ambitions. The gathering highlighted the UAE's emerging role as a thoughtful leader in climate transition, presenting a model that combines pragmatic planning with proactive environmental strategies. By bringing together key stakeholders and thought leaders, the event underscored the region's determination to play a meaningful role in global climate action while acknowledging the complex economic realities of sustainable development. MORE...

Beyond the Spreadsheet: Finance Chiefs Reveal Radical Role Transformation

Finance

2025-05-01 11:31:53

The Role of the Modern CFO: Beyond Numbers and Spreadsheets Gone are the days when Chief Financial Officers were confined to number-crunching and financial reporting. Today's CFOs have evolved into strategic powerhouses, bridging financial expertise with broader organizational leadership. They are no longer just guardians of financial data, but critical architects of business transformation and innovation. Modern CFOs are expected to wear multiple hats - from traditional financial stewardship to strategic planning, technological innovation, and organizational risk management. They play a pivotal role in driving digital transformation, leveraging advanced analytics, and providing insights that guide critical business decisions. The expanding responsibilities now include: • Developing comprehensive digital strategies • Driving operational efficiency • Managing complex global financial ecosystems • Navigating increasingly complex regulatory landscapes • Supporting sustainable business growth • Fostering a culture of financial agility and innovation This transformation reflects the dynamic business environment where financial leadership is intrinsically linked to overall organizational strategy. CFOs are now key strategic partners, working closely with CEOs and board members to shape the future of their enterprises. The most successful CFOs are those who can seamlessly blend financial acumen with strategic vision, technological understanding, and adaptive leadership skills. MORE...

Regulatory Veteran Joins Square 4 Partners: Ex-FCA Insider Brings Consumer Finance Expertise

Finance

2025-05-01 11:03:28

In a strategic move to navigate the complex landscape of financial regulations, a leading financial institution has appointed a Senior Advisory Director to spearhead compliance efforts under the evolving Consumer Duty regime. This high-profile appointment comes at a critical time when financial firms are facing increasingly stringent regulatory requirements aimed at protecting consumer interests. The newly appointed Senior Advisory Director brings extensive expertise in regulatory compliance and strategic governance, positioning the organization to proactively address the challenging demands of the Consumer Duty framework. With regulators intensifying their focus on consumer protection and fair treatment, this leadership addition signals a robust commitment to meeting and exceeding regulatory standards. The appointment underscores the organization's dedication to transparency, customer-centric practices, and maintaining the highest levels of professional integrity in an ever-changing financial services environment. By bringing in top-tier regulatory talent, the firm demonstrates its proactive approach to adapting to new regulatory landscapes and prioritizing consumer welfare. MORE...

Golden Arches Stumble: McDonald's Profits Dip as Consumer Confidence Wavers

Finance

2025-05-01 11:01:34

McDonald's Stumbles with Surprising Dip in Domestic Sales In a unexpected turn of events, McDonald's unveiled quarterly results that caught Wall Street off guard on Thursday morning, revealing a surprising decline in same-store sales across its U.S. locations. The fast-food giant's financial report highlighted challenges in maintaining its typically robust domestic performance, signaling potential shifts in consumer dining habits or competitive pressures. The unexpected downturn comes at a time when the restaurant industry continues to navigate complex economic landscapes, including changing consumer preferences and ongoing pricing strategies. Investors and analysts will be closely examining the underlying factors contributing to this sales decline, wondering whether this represents a temporary blip or a more significant trend for the global fast-food leader. While specific details of the sales drop were not immediately elaborated, the report underscores the ongoing volatility in the restaurant sector and McDonald's need to remain agile in its market approach. The company's leadership will likely be pressed to provide deeper insights into the factors driving this unexpected performance during upcoming investor communications. MORE...

Talent Drought: Finance Pros Scramble as Skilled Workers Vanish

Finance

2025-05-01 10:11:55

A Perfect Storm of Talent Scarcity: Finance and Accounting Sector Confronts Critical Workforce Challenge The finance and accounting industry is experiencing an unprecedented talent shortage that threatens to disrupt business operations and strategic growth, according to a groundbreaking new report by Personiv. This emerging crisis highlights the urgent need for innovative recruitment and retention strategies in a rapidly evolving professional landscape. The comprehensive study reveals a complex web of challenges facing the sector, including an aging workforce, skills gaps, and increasing competition for top-tier financial professionals. Organizations are finding themselves in a high-stakes battle to attract and retain skilled talent capable of navigating the intricate financial environments of today's dynamic business world. Key findings from the report underscore the critical nature of the talent shortage, suggesting that companies must reimagine their approach to workforce development. This may include investing in professional development programs, embracing flexible work arrangements, and creating more compelling career pathways for emerging financial professionals. As the industry continues to transform, driven by technological advancements and changing workforce expectations, organizations that proactively address these talent challenges will be best positioned to thrive in an increasingly competitive marketplace. MORE...

Thailand's Economic Outlook Dims: Finance Ministry Slashes 2025 Growth Projection

Finance

2025-05-01 10:09:19

Thailand's economic outlook has taken a cautious turn, with the finance ministry revising its growth forecast downward amid global economic challenges. In a press conference on Thursday, officials announced a reduced growth projection of 2.1%, scaling back from the previous estimate of 3%. The downgrade reflects mounting pressures from international trade tensions and a broader global economic slowdown. Pornchai Thiraveja, head of the ministry's fiscal policy office, highlighted the significant impact of U.S. tariffs and weakening global demand on Southeast Asia's second-largest economy. Particularly concerning is the export sector, traditionally a critical engine of Thai economic growth. The ministry now anticipates export growth of just 2.3%, a notable decline from the earlier optimistic projection of 4.4%. This adjustment signals the challenging economic landscape facing Thailand in the current global environment. The revised forecast underscores the delicate balance Thailand must maintain in navigating international trade complexities and economic uncertainties, potentially requiring strategic economic interventions to sustain growth momentum. MORE...

Financial Helm Restored: Choi Sang-mok Reclaims Leadership in South Korean Economic Landscape

Finance

2025-05-01 09:57:04

In a dramatic development that underscores South Korea's ongoing political upheaval, Finance Minister Choi Sang-mok is set to assume the critical dual roles of president and prime minister starting at midnight on Thursday. This significant transition comes on the heels of interim leader Han Duck-soo's unexpected resignation, marking yet another chapter in the nation's complex political landscape. The sudden leadership shift highlights the volatility and rapid changes currently characterizing South Korean governance. Minister Choi, previously serving as the Finance Minister, will now step into a pivotal position of national leadership, tasked with navigating the country through its current political challenges. As the clock strikes midnight, Choi will officially take the reins, inheriting the responsibilities of both presidential and prime ministerial roles—an unprecedented arrangement that reflects the unique political circumstances facing the country. His immediate challenge will be to provide stability and clear direction during this period of uncertainty. MORE...

Banking Shake-Up: Major Merger Signals Transformation in Italian Financial Landscape

Finance

2025-05-01 09:14:28

I apologize, but there seems to be no previous article content provided in your request. Could you please share the original article text that you would like me to rewrite? Once you provide the content, I'll be happy to help you rewrite it in a more fluent and engaging manner, formatted within HTML body tags. If you'd like me to generate a sample article, I can do that as well. Just let me know your preference. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421