Campaign Cash Crackdown: North Dakota Lawmakers Shake Up Political Transparency Rules

Finance

2025-04-19 00:49:09

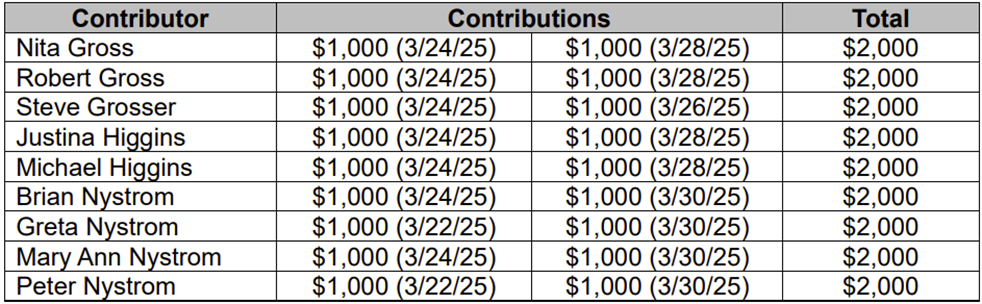

In a significant move to enhance transparency in political campaign financing, the new legislation introduces stricter guidelines for candidate disclosure of contributors. The bill aims to shed light on the financial backing behind political campaigns by lowering the threshold for mandatory contributor reporting. Under the proposed regulations, candidates will now be required to provide more detailed and timely information about their financial supporters. This approach seeks to give voters a clearer picture of the monetary influences shaping political campaigns and ensuring greater accountability in the electoral process. The updated disclosure requirements are designed to empower voters with comprehensive insights into the financial foundations of political campaigns. By mandating earlier and more comprehensive reporting, the bill represents a crucial step towards creating a more transparent and trustworthy political landscape. Political analysts suggest that this legislation could fundamentally transform how campaign finances are tracked and reported, potentially reducing the influence of undisclosed monetary contributions in electoral contests. The move is widely seen as a significant stride towards maintaining the integrity of the democratic process. MORE...

Green Revolution: How China's Climate Strategy Could Reshape Asian Finance

Finance

2025-04-19 00:00:00

Unlocking Asia's Green Potential: China's Pivotal Role in Sustainable Finance As the world grapples with the urgent challenge of climate change, China is emerging as a critical catalyst for sustainable transformation across Asia. The continent stands at a crucial crossroads, requiring massive financial investments to transition towards a low-carbon future. China's innovative approach to green finance presents a unique opportunity for collaborative progress. By leveraging its extensive financial resources and growing commitment to environmental sustainability, the country can help mobilize the trillions of dollars needed to drive meaningful climate action across the region. The potential for partnership is immense. Both China and other Asian nations share a fundamental goal: mitigating climate risks while promoting economic development. Green finance offers a strategic pathway to achieve these interconnected objectives, enabling investments in renewable energy, sustainable infrastructure, and clean technologies. Collaborative efforts can unlock unprecedented opportunities for sustainable growth. By aligning financial strategies, sharing technological expertise, and creating innovative funding mechanisms, Asian countries can accelerate their collective journey towards a more resilient and environmentally responsible future. The time for bold, coordinated action is now. China's leadership in green finance can be a transformative force, helping Asia chart a more sustainable course for generations to come. MORE...

Money Matters: Goodwill and Amarillo National Bank Team Up to Empower Local Finances

Finance

2025-04-18 23:27:52

Empowering Financial Knowledge: Local Nonprofit and Amarillo National Bank Launch Comprehensive Banking Education Series Amarillo residents are set to gain valuable financial insights through an innovative partnership between a local nonprofit and Amarillo National Bank. The collaborative initiative aims to demystify banking and finance, offering the community an opportunity to enhance their financial literacy and make more informed monetary decisions. The new educational series will provide comprehensive workshops and training sessions designed to help individuals of all ages and backgrounds understand complex financial concepts. Participants can expect to learn practical skills ranging from basic budgeting techniques to advanced investment strategies, all tailored to meet the diverse needs of the Amarillo community. By combining the nonprofit's educational expertise with the banking institution's real-world financial knowledge, this program promises to be a transformative resource for local residents seeking to improve their financial understanding and economic well-being. MORE...

Sky Warriors: A Marine Pilot's Bold Prediction for Defense Technology's Next Frontier

Finance

2025-04-18 21:00:00

Military Veteran Turns Investment Strategist: Tony Bancroft's Journey from Marine Corps to Wall Street

In the latest episode of Warrior Money, listeners get an exclusive peek into the remarkable career transition of Tony Bancroft, a Marine Corps veteran who has successfully navigated the complex world of aerospace investment management.

Bancroft brings a unique perspective to financial markets, leveraging his military background to analyze global defense spending and anticipate emerging technological trends. His expertise in forecasting the rise of autonomous systems sets him apart in the investment landscape.

The podcast, hosted by former Congressman Patrick Murphy and veteran investor Dan Kunze, continues its mission of empowering military veterans through financial education and inspiring career transitions. This week's episode highlights Bancroft's transformative journey from military service to Columbia Business School, demonstrating the incredible potential veterans possess in the private sector.

Listeners can tune into Warrior Money on popular platforms like Apple Podcasts, Spotify, and Amazon Music. Each episode offers invaluable insights for veterans seeking to leverage their military skills in new professional environments.

The show serves as a powerful reminder that military veterans bring exceptional strategic thinking, discipline, and adaptability to any career path they choose to pursue.

MORE...Breaking: 'Money Script' Reveals Shocking Secrets to Financial Transformation

Finance

2025-04-18 20:57:00

Binaural Technologies Unveils The Money Script: Revolutionizing Financial Wellness Through Faith-Driven Mindset

In an era of unprecedented economic complexity, Binaural Technologies is set to transform financial empowerment with its groundbreaking program, The Money Script, launching in 2025. This innovative mindset solution addresses the growing challenges of financial stress that millions of individuals face in today's volatile economic landscape.

Navigating Economic Uncertainty with Holistic Approach

As inflation, job market instability, and economic unpredictability continue to challenge individuals worldwide, The Money Script offers a unique faith-focused strategy for financial wellness. The program recognizes that financial success is not just about numbers, but about cultivating a powerful, purpose-driven mindset.

Key Program Highlights:

- Faith-integrated financial psychology

- Personalized mindset transformation techniques

- Comprehensive stress management strategies

- Practical financial empowerment tools

By combining spiritual principles with cutting-edge psychological insights, Binaural Technologies is poised to revolutionize how individuals approach their financial journey, offering hope and practical solutions in an increasingly complex economic world.

MORE...Judicial Blockade: Court Stops Trump Team's Radical Rollback of Consumer Protection Agency

Finance

2025-04-18 20:53:00

In a strategic shift, Trump administration officials announced this week their intention to redirect the agency's focus toward combating financial fraud that directly impacts consumers, with a particular emphasis on uncovering and preventing deceptive practices in mortgage markets. The move signals a renewed commitment to protecting everyday Americans from sophisticated financial schemes that can cause measurable economic harm. By targeting fraud with tangible consumer consequences, the administration aims to restore trust in financial markets and provide stronger safeguards for individuals navigating complex financial transactions. The proposed approach underscores a proactive stance against predatory lending and misleading financial practices that can devastate consumer financial stability. MORE...

The Retirement Riddle: What's Your Financial Freedom Figure?

Finance

2025-04-18 20:49:36

Americans are dreaming big when it comes to retirement savings, according to a recent survey that reveals ambitious financial expectations for their golden years. The study highlights how individuals are setting increasingly substantial financial targets to ensure a comfortable and secure retirement lifestyle. Retirement planning has become more critical than ever, with Americans carefully calculating the nest egg they'll need to maintain their desired standard of living after leaving the workforce. The survey uncovers a growing awareness among people about the importance of robust financial preparation for their post-career years. Respondents are showing remarkable insight into the financial challenges of retirement, demonstrating a proactive approach to long-term financial security. From healthcare costs to leisure activities, Americans are taking a comprehensive view of what it truly means to retire comfortably in today's economic landscape. While the specific financial goals vary, the underlying message is clear: people are more committed than ever to creating a financially stable and fulfilling retirement experience. This trend reflects a broader understanding that careful planning and strategic saving are key to achieving retirement dreams. MORE...

Trade Tensions Ease: Trump Claims Breakthrough in Global Tariff Negotiations

Finance

2025-04-18 20:37:37

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Behind the Numbers: Is Havilah Resources Painting a Misleading Financial Picture?

Finance

2025-04-18 20:35:39

Investors Remain Cautious as Havilah Resources Limited Reveals Latest Financial Performance Shareholders of Havilah Resources Limited (ASX:HAV) displayed a notably reserved reaction to the company's recent financial disclosure, signaling a complex landscape of investor sentiment. Despite the potential underlying developments, the market's response suggests a nuanced interpretation of the company's current financial standing. The tepid market reception highlights the intricate challenges facing resource exploration and development companies in today's volatile economic environment. While the earnings report may not have immediately sparked investor enthusiasm, it provides a critical snapshot of the company's strategic positioning and potential future trajectory. Investors and market analysts are likely scrutinizing the detailed financial metrics, looking beyond the headline numbers to understand the deeper implications for Havilah Resources' long-term growth prospects. The measured response underscores the importance of comprehensive financial analysis in making informed investment decisions. As the resource sector continues to navigate economic uncertainties, companies like Havilah Resources must demonstrate resilience, strategic vision, and the ability to create sustainable value for their shareholders. MORE...

Beyond Trades: How Financial Platforms Are Reinventing Digital Banking

Finance

2025-04-18 20:32:02

The financial landscape is witnessing a fascinating convergence as neobanks and investment platforms blur traditional industry boundaries. Digital-first banks are expanding their offerings beyond basic checking and savings accounts, now venturing into investment services and attractive credit card rewards programs. Simultaneously, established investment platforms are broadening their scope by introducing banking-like features. This strategic cross-pollination reflects a dynamic shift in the financial technology sector, where companies are no longer content to remain within narrowly defined niches. Instead, they're creating more comprehensive, integrated financial ecosystems that provide customers with seamless, multi-dimensional financial experiences. By breaking down traditional barriers between banking, investing, and rewards, these innovative platforms are reshaping how consumers manage and grow their money. The trend signals a growing consumer demand for more holistic, convenient financial solutions that can adapt to increasingly complex personal financial needs. As technology continues to drive financial innovation, we can expect to see even more creative convergence between different financial service domains. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421