Earnings Spotlight: First National Financial Set to Unveil Q1 Financial Performance

Finance

2025-03-25 12:30:00

First National Financial Corporation, a leading financial services provider listed on the Toronto Stock Exchange under multiple ticker symbols (FN, FN.PR.A, and FN.PR.B), has unveiled its strategic financial reporting timeline for the first quarter of 2025. Investors and market analysts can now mark their calendars with the company's upcoming financial disclosure dates, ensuring they stay informed about the corporation's performance and financial health. The announcement provides transparency and allows stakeholders to anticipate key financial updates, demonstrating First National's commitment to clear and timely communication with its investors and the broader financial community. MORE...

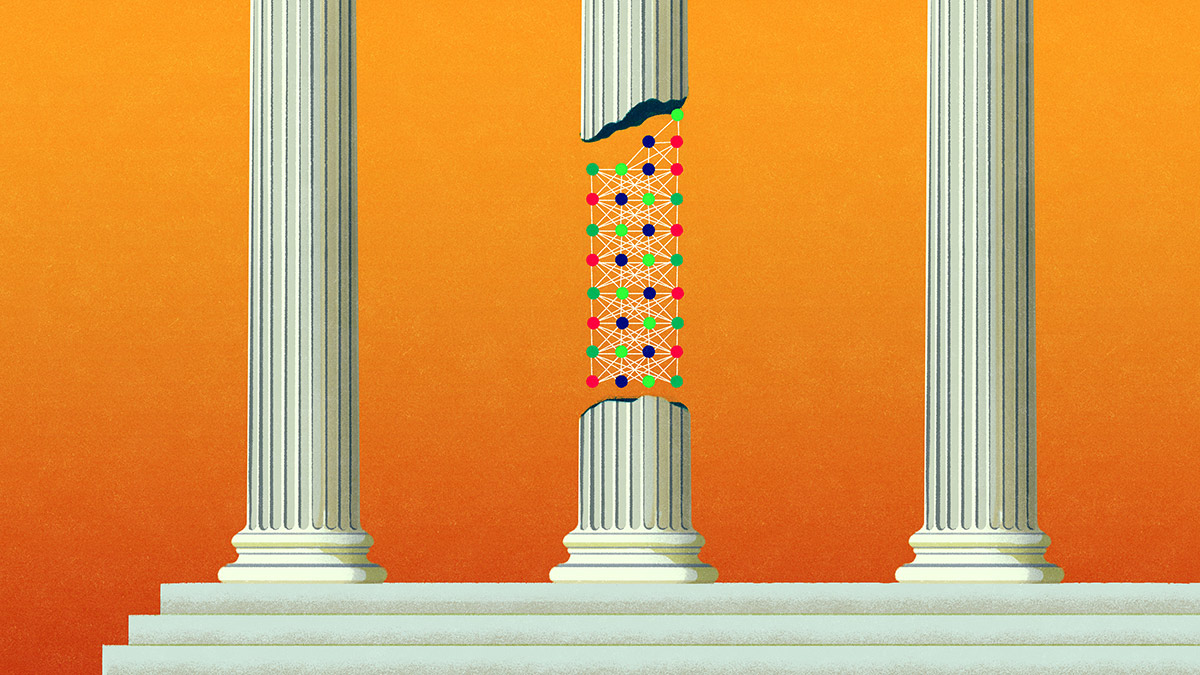

Breaking: Wall Street Giant Transforms Overnight with Generative AI Revolution

Finance

2025-03-25 12:05:04

In a bold strategic move, Moody's—a venerable financial institution renowned for risk assessment—has embraced generative AI with remarkable urgency. But why would a traditional company leap into an emerging, unproven technology? The answer lies in a calculated risk assessment: the potential danger of technological stagnation far outweighed the uncertainties of rapid innovation. Rather than adopting a tentative, incremental approach, Moody's leadership orchestrated a comprehensive transformation guided by three revolutionary principles. First, they mandated organization-wide participation, ensuring no employee was left behind. Second, they cultivated a culture of constructive ideation where novel concepts were nurtured rather than reflexively rejected. Third, they maintained a laser focus on tangible business outcomes. This approach represented a profound philosophical shift. Instead of viewing transformation as a linear journey toward a predetermined destination, Moody's reimagined it as a dynamic, continuous process of adaptive evolution. The company's audacious strategy offers invaluable insights for organizations navigating technological disruption: inaction carries its own significant risks, decentralized innovation can be powerful, organizational change must be perpetual, strategic partnerships are crucial, and ultimately, corporate culture is the primary catalyst for technological adoption. Moody's transformation serves as a compelling blueprint for enterprises seeking to thrive in an era of unprecedented technological acceleration. MORE...

Breaking Free: How Your Money Mindset Can Unlock Financial Zen

Finance

2025-03-25 12:00:00

Forbes Books is proud to announce the release of "Emotionally Invested" by acclaimed author Mary Clements Evans. This groundbreaking book offers readers a transformative exploration of emotional intelligence and personal financial management, bridging the gap between psychological insights and financial success. Evans draws from her extensive experience to provide a compelling narrative that challenges traditional approaches to personal finance. Through intimate storytelling and expert analysis, she reveals how emotional awareness can become a powerful tool for making smarter financial decisions and building lasting wealth. "Emotionally Invested" goes beyond typical financial advice, delving into the complex relationship between our emotions and money. Readers will discover practical strategies for understanding their financial behaviors, overcoming emotional barriers, and creating a more intentional approach to personal economics. The book promises to be an essential read for anyone seeking to transform their financial mindset, offering a unique perspective that combines psychological depth with practical financial guidance. Mary Clements Evans invites readers on a journey of self-discovery and financial empowerment, challenging them to rethink their relationship with money. Published by Forbes Books, this innovative work is set to make a significant impact in the fields of personal finance and emotional intelligence, providing readers with a fresh and insightful approach to managing their financial lives. MORE...

Market Tension Rises: Trump's Trade Moves Spark Wall Street Uncertainty

Finance

2025-03-25 11:26:58

Trade tensions and tariff dynamics continue to captivate global investors, driving market sentiment and strategic decision-making across international financial landscapes. As geopolitical complexities unfold, investors remain laser-focused on the intricate web of trade policies that can dramatically shift economic expectations and market performance. The ongoing tariff discussions between major economic powers are creating ripple effects that extend far beyond traditional trade boundaries. Sophisticated investors are closely monitoring these developments, recognizing that each policy shift can potentially trigger significant market volatility and reshape investment strategies. Key economic indicators suggest that tariff-related uncertainties are not merely background noise, but central drivers of investment sentiment. Multinational corporations, financial institutions, and individual investors are recalibrating their approaches, seeking to navigate the nuanced terrain of international trade regulations. With global economic dynamics in constant flux, understanding the subtle interplay between tariff policies and market reactions has become crucial. Investors are increasingly adopting agile strategies that can quickly adapt to the evolving trade landscape, ensuring resilience in an environment of persistent economic uncertainty. MORE...

Corruption Conviction: Ex-Austrian Finance Chief Karl-Heinz Grasser Faces Jail Time

Finance

2025-03-25 11:05:26

In a landmark legal decision, Austria's highest court has delivered a decisive blow to former Finance Minister Karl-Heinz Grasser, upholding his four-year prison sentence for corruption. The ruling on Tuesday firmly rejected Grasser's appeal against his 2020 conviction, marking a significant moment in the country's ongoing fight against political corruption. The court's decision sends a powerful message about accountability in public office, confirming the original charges that painted Grasser as a key figure in a complex web of financial misconduct. His fall from grace represents a dramatic turn for a once-prominent political figure who now faces the consequences of his alleged corrupt practices. This verdict not only serves as a personal setback for Grasser but also stands as a stern reminder that no one is above the law, regardless of their previous political standing or influence. The Austrian judicial system has demonstrated its commitment to transparency and integrity in public service through this uncompromising judgment. MORE...

Wallet Squeeze: Americans Tighten Purse Strings as Price Pressures Mount

Finance

2025-03-25 10:33:49

As economic pressures mount, U.S. consumers are increasingly tightening their financial belts, signaling a potential shift in spending habits. Synchrony Financial reports that Americans are becoming more cautious about their expenditures in response to persistently high prices and a cloudy economic horizon. The financial strain is becoming increasingly evident, with the Federal Reserve highlighting a concerning trend of rising debt and delinquencies across multiple credit sectors. Auto loans, credit cards, and home credit lines are experiencing a gradual uptick in missed payments, reflecting the growing financial challenges faced by households. Adding weight to these concerns, Philadelphia Federal Reserve President Patrick Harker has sounded a warning about potential economic turbulence ahead. Consumer confidence is visibly wavering, suggesting that households are growing increasingly anxious about their financial futures and are adapting their spending strategies accordingly. This emerging pattern of financial conservatism could have significant implications for the broader economy, as consumer spending traditionally plays a crucial role in driving economic growth. As Americans navigate these uncertain economic waters, their spending decisions will likely be closely watched by economists and policymakers alike. MORE...

Fiscal Roadmap Ahead: Finance Ministry and RBI Set to Chart Borrowing Strategy in Crucial March Meeting

Finance

2025-03-25 10:19:07

In a crucial financial strategy session, India's top economic policymakers are set to convene on Wednesday to chart out the nation's market borrowing blueprint for the upcoming fiscal quarters. Senior officials from the finance ministry and the central bank will deliberate on the borrowing plan covering April through September, aiming to provide clarity on the government's fiscal approach. Sources close to the discussions revealed to Reuters that the meeting will be a pivotal moment in determining India's financial strategy, with key decisions expected to be made regarding the government's debt management and market funding requirements. The collaborative effort between the finance ministry and central bank underscores the importance of a coordinated approach to economic planning. The upcoming meeting is expected to provide insights into the government's fiscal priorities and borrowing strategies, which could have significant implications for investors, financial markets, and the broader economic landscape. MORE...

Strategic Merger Approved: North Mill Equipment Finance Clinches Landmark Acquisition of Pawnee Leasing and Tandem Finance

Finance

2025-03-25 10:15:08

In a strategic move that promises to reshape the equipment finance landscape, North Mill Equipment Finance has successfully obtained court approval to acquire the assets of Pawnee Leasing and Tandem Finance. The U.S. Bankruptcy Court for the District of Delaware has green-lighted the transaction, which is set to be finalized by the end of March. This significant acquisition signals North Mill's commitment to expanding its market presence and capabilities in the equipment financing sector. By integrating the assets of Pawnee Leasing and Tandem Finance, the company is poised to strengthen its competitive position and offer enhanced financial solutions to its clients. The deal represents a pivotal moment for North Mill Equipment Finance, demonstrating its ability to capitalize on strategic opportunities in a dynamic market environment. Stakeholders and industry observers are closely watching this development, anticipating the potential synergies and growth prospects that will emerge from this asset acquisition. MORE...

Equipment Finance Surges Back: Navigating Choppy Financial Waters in February

Finance

2025-03-25 10:13:14

The equipment leasing and finance sector showed signs of resilience last month, with new business volumes rebounding as market demand gradually recovered. However, the industry landscape wasn't without challenges, as credit losses saw an uptick and overall business confidence experienced a slight decline. According to the latest data from the Equipment Leasing and Finance Association, the sector demonstrated both promising growth and underlying economic complexities. While the increase in new business volumes signals potential economic recovery, the rise in credit losses suggests ongoing financial uncertainties that businesses must navigate carefully. Industry analysts are closely monitoring these trends, recognizing that the current economic environment requires strategic adaptability. The modest slip in industry confidence reflects the cautious approach many businesses are taking in the current market conditions. Despite these challenges, the sector remains hopeful, with the recovery in new business volumes offering a glimmer of optimism for equipment leasing and finance professionals. MORE...

Silicon Valley's Hidden Rally: Tech Stocks Defy Trade War Shadows

Finance

2025-03-25 10:00:13

Tech Industry Enters New Era of Pragmatic Growth and Realistic Valuations The technology sector is undergoing a transformative reset, moving beyond the exuberant valuations of recent years toward a more measured and sustainable approach to growth. As investors and entrepreneurs recalibrate their expectations, the industry is embracing a pragmatic mindset that prioritizes fundamental business metrics over speculative enthusiasm. In this new landscape, companies are focusing on profitability, operational efficiency, and tangible value creation. The days of sky-high valuations based purely on potential are giving way to a more grounded assessment of real-world performance. Startups and established tech firms alike are adapting to a market that demands concrete results and clear paths to sustainable revenue. Venture capital and investment strategies are shifting, with a renewed emphasis on robust business models and practical innovation. Investors are now more discerning, seeking companies that demonstrate not just innovative potential, but also a solid strategy for long-term success. This evolution signals a maturation of the tech ecosystem, where quality and substance are taking precedence over hype and speculation. The current trend suggests a healthier, more sustainable approach to technological innovation and investment. By resetting expectations and embracing more realistic valuations, the tech industry is positioning itself for more stable and meaningful growth in the years ahead. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421