Wall Street's Wild Week: Fed Signals, Tech Titans' Stumble, and the Short Sellers' Gambit

Finance

2025-02-19 22:28:00Content

Market Resilience: S&P 500 Hits Record High Despite Policy Uncertainties

The S&P 500 demonstrated remarkable strength on Wednesday, setting a new record close even as investors navigate the complex landscape of trade policies and economic indicators. Yahoo Finance's senior markets reporter Josh Schafer delved into the day's critical market dynamics, offering insights into several key developments.

The Federal Reserve's January FOMC minutes revealed underlying concerns about tariff policies, casting a shadow of uncertainty over market sentiment. Despite these potential headwinds, the market showed impressive resilience, with the major indices displaying notable performance.

Of particular interest was the recent performance lag among the Magnificent Seven stocks, which have been instrumental in driving market momentum. Schafer also explored emerging short seller strategies, providing a nuanced perspective on current market trends.

Investors and market watchers are closely monitoring these developments, seeking to understand the intricate interplay between policy decisions, market sentiment, and stock performance.

For more in-depth analysis and expert insights into the latest market movements, be sure to check out more "Asking for a Trend" segments.

Market Momentum: Navigating Uncertainty in the Financial Landscape

In the ever-evolving world of financial markets, investors find themselves at a critical juncture, balancing between optimism and caution. The intricate dance of economic indicators, policy decisions, and market trends continues to challenge even the most seasoned financial experts, creating a landscape of both opportunity and complexity.Unraveling the Market's Hidden Dynamics: Insights That Could Transform Your Investment Strategy

The S&P 500's Resilient Performance

The S&P 500's recent record-breaking close represents more than just a numerical milestone. It's a testament to the market's underlying strength and investor confidence, despite the swirling winds of economic uncertainty. Analysts have been closely examining the nuanced factors driving this performance, particularly in the context of complex geopolitical and economic environments. Financial experts are diving deep into the market's psychological underpinnings, exploring how investor sentiment interplays with broader economic indicators. The index's ability to reach new heights suggests a robust underlying economic framework, capable of absorbing potential shocks and maintaining momentum.Federal Reserve's Policy Insights and Market Implications

The January FOMC minutes have emerged as a critical document, offering unprecedented insights into the Federal Reserve's strategic thinking. Tariff policies and their potential economic ramifications have become a focal point of intense discussion and analysis among market strategists. Economists are meticulously parsing through the nuanced language of the minutes, extracting subtle signals about potential monetary policy shifts. The interplay between geopolitical tensions, trade policies, and monetary strategy creates a complex ecosystem that demands sophisticated interpretation.Magnificent Seven Stocks: Performance Dynamics

The recent performance lag in the Magnificent Seven stocks has sparked significant interest and speculation. These technology and innovation-driven companies have long been considered market bellwethers, and their current trajectory offers fascinating insights into broader market trends. Investors and analysts are conducting deep-dive investigations into the factors contributing to this performance variation. From technological innovation cycles to macroeconomic pressures, multiple variables are potentially influencing these stocks' current market behavior.Short Seller Strategies in a Volatile Market

Short selling has emerged as a sophisticated strategy for navigating market uncertainties. Sophisticated investors are employing increasingly nuanced approaches to identify potential market inefficiencies and capitalize on short-term fluctuations. The current market environment demands a multi-dimensional approach to investment strategies. Short sellers are leveraging advanced analytical tools, combining quantitative models with qualitative market insights to make informed decisions.Market Trends and Future Outlook

The current financial landscape represents a complex interplay of technological innovation, economic policy, and global market dynamics. Investors must remain agile, continuously adapting their strategies to navigate this intricate environment. Emerging trends suggest a market that is simultaneously challenging and opportunistic. The ability to interpret subtle market signals and maintain a forward-looking perspective will be crucial for successful investment strategies in the coming months.RELATED NEWS

Finance

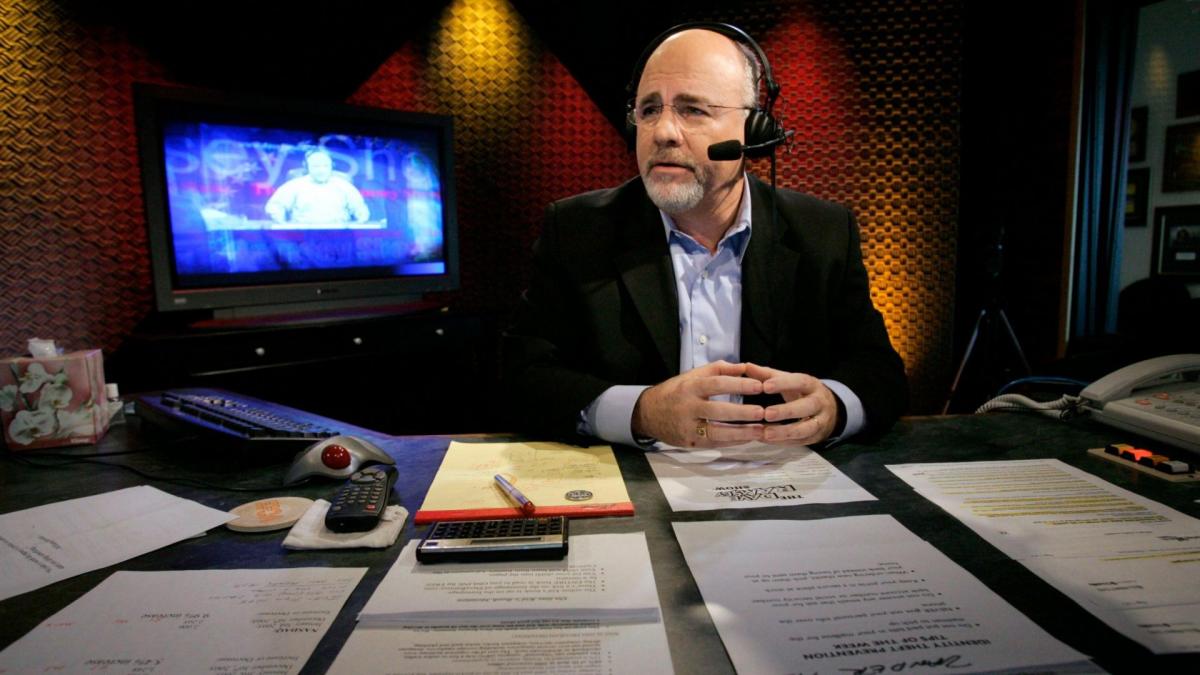

Money Makeover: Dave Ramsey's Game-Changing Financial Strategies for 2025

2025-02-19 15:00:14

Finance

Toyota Shakes Up Leadership: Fresh Faces and Auditors Join Board in Strategic Overhaul

2025-02-25 09:47:36

Finance

Trade Tensions Spark Global Economic Reshuffling: Scale Dynamics Unveiled

2025-04-15 10:00:42