Motor Finance Scandal: UK Weighs Compensation Plan for Millions of Drivers

Finance

2025-03-11 07:23:16Content

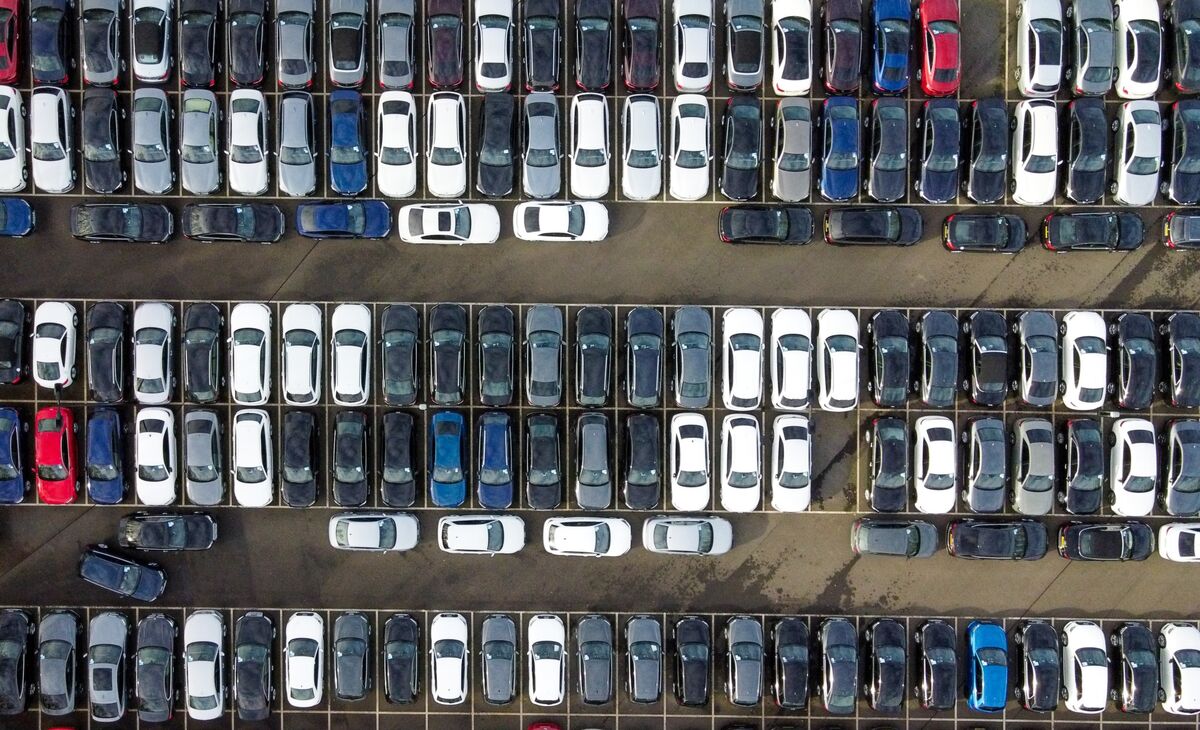

In a significant move to protect consumer interests, the UK's Financial Conduct Authority (FCA) is exploring the development of a comprehensive redress scheme targeting potential historical misconduct in motor finance sectors. The proposed framework would require banks to take decisive action if they uncover evidence of past practices that may have financially harmed consumers.

This potential new initiative signals the FCA's commitment to ensuring fair treatment and financial protection for individuals who might have been negatively impacted by questionable banking practices in the motor finance industry. By establishing a structured redress mechanism, the regulatory body aims to hold financial institutions accountable and provide a clear path for consumer compensation.

The proposed scheme represents a proactive approach to addressing historical financial irregularities, demonstrating the FCA's ongoing efforts to maintain transparency and integrity within the banking sector. As details of the potential redress framework continue to emerge, consumers and financial institutions alike are closely monitoring the developments.

Financial Watchdog Considers Groundbreaking Motor Finance Compensation Framework

In the ever-evolving landscape of financial regulation, the United Kingdom's Financial Conduct Authority (FCA) is poised to introduce a transformative approach to addressing historical misconduct within the motor finance sector, signaling a potential paradigm shift in consumer protection and industry accountability.Empowering Consumers: A Landmark Redress Mechanism Takes Shape

The Emerging Compensation Landscape

The Financial Conduct Authority's contemplated redress scheme represents a sophisticated response to potential systemic issues within motor finance practices. Financial institutions will now face unprecedented scrutiny, requiring comprehensive internal investigations to identify and rectify historical consumer harm. This proactive approach signals a significant evolution in regulatory oversight, moving beyond punitive measures to establish a more holistic consumer protection framework. Banks and financial service providers will be mandated to conduct exhaustive reviews of their historical motor finance operations, meticulously examining past transactions, lending practices, and potential areas of consumer disadvantage. The proposed scheme suggests a nuanced understanding that financial misconduct can manifest in complex, often subtle ways that require sophisticated detection and remediation strategies.Regulatory Implications and Industry Transformation

The potential implementation of this redress mechanism represents more than a mere procedural adjustment; it embodies a fundamental reimagining of financial institution responsibilities. By compelling banks to proactively identify and address historical consumer harm, the FCA is establishing a new standard of institutional accountability that extends far beyond traditional regulatory compliance. Financial institutions will need to develop robust internal audit mechanisms, leveraging advanced data analytics and forensic financial techniques to uncover potential historical irregularities. This approach demands significant investment in technological infrastructure, compliance expertise, and organizational culture transformation.Consumer Protection in the Digital Age

The proposed scheme reflects the increasing complexity of financial services in an increasingly digital and interconnected world. Traditional regulatory approaches are being replaced by more dynamic, responsive frameworks that recognize the rapid evolution of financial products and services. Consumers stand to benefit from this enhanced regulatory approach, which prioritizes transparency, fairness, and proactive harm prevention. The potential redress mechanism signals a shift from reactive compensation to preventative consumer protection, potentially reshaping the relationship between financial institutions and their customers.Technological and Analytical Challenges

Implementing such a comprehensive redress scheme will require sophisticated technological capabilities. Banks must develop advanced data mining and analysis tools capable of retrospectively examining potentially complex financial transactions spanning potentially decades of operational history. Machine learning algorithms, artificial intelligence, and advanced statistical modeling will likely play crucial roles in identifying patterns of potential consumer harm. This technological approach represents a significant departure from traditional manual review processes, introducing unprecedented levels of analytical precision and efficiency.Economic and Social Implications

Beyond immediate financial considerations, the proposed redress scheme could have broader economic and social ramifications. By establishing more stringent accountability mechanisms, the FCA may fundamentally alter risk assessment and lending practices within the motor finance sector. Financial institutions will likely reassess their historical operational strategies, potentially leading to more transparent, consumer-centric business models. This regulatory approach could serve as a blueprint for other financial service domains, promoting a culture of proactive consumer protection and institutional accountability.RELATED NEWS

Finance

Wall Street Stunner: Fairfax Financial Shatters Earnings Expectations in Q4 Blowout Performance

2025-02-17 15:00:22

Finance

Iran's Economic Shake-Up: Finance Minister's Ouster Signals Reformist Setback

2025-03-02 14:06:43