Fashion Retail Rollercoaster: Forever 21's Second Bankruptcy Signals Retail Apocalypse

Finance

2025-03-17 12:03:09

Fashion retailer Forever 21 is facing another critical moment, filing for bankruptcy protection as the retail landscape continues to shift dramatically. The brand is struggling to maintain its footing amid declining mall traffic and fierce competition from online fashion giants like Amazon, Temu, and Shein. F21 OpCo, the company behind Forever 21, announced late Sunday its plans to wind down operations in the United States under Chapter 11 bankruptcy protection. The company is simultaneously exploring potential partnerships or asset sales that might preserve some aspect of its business. Chief Financial Officer Brad Sell candidly addressed the challenges, highlighting the significant pressure from international fast fashion competitors. "We've exhaustively evaluated every possible strategy to secure the company's future," Sell explained. "However, we've been unable to find a sustainable path forward, particularly given how foreign fashion brands leverage pricing advantages that fundamentally undermine our business model." This marks Forever 21's second bankruptcy filing, underscoring the increasingly challenging environment for traditional brick-and-mortar fashion retailers. The brand must now navigate a complex landscape of digital competition, changing consumer preferences, and razor-thin profit margins. MORE...

Mortgage Maze: Western Governors Unveil Groundbreaking Housing Finance Forecast

Finance

2025-03-17 12:00:00

Trump's Policy Reshapes Mortgage Landscape: A Deep Dive into Market Transformation

In a groundbreaking analysis, Whalen Global Advisors (WGA) has unveiled its latest Housing Finance Outlook, offering unprecedented insights into the dramatic shifts sweeping across the United States mortgage market. The comprehensive report, released on March 17, 2025, from the firm's Briarcliff Manor headquarters, provides a critical examination of both residential and commercial real estate financing sectors.

The study highlights the profound impact of recent policy changes, particularly those initiated during the Trump administration, which continue to reverberate through the complex financial ecosystem. Experts at WGA suggest that these policy interventions are fundamentally restructuring how mortgages are originated, traded, and managed across the nation.

Key findings indicate significant disruptions in traditional lending practices, with potential long-term implications for homeowners, investors, and financial institutions. The report meticulously dissects the intricate layers of mortgage market dynamics, offering stakeholders a nuanced understanding of the evolving landscape.

As the mortgage industry navigates these transformative changes, professionals and investors are advised to pay close attention to the strategic insights provided by Whalen Global Advisors' comprehensive analysis.

MORE...Surprising Corporate Portfolios: How Biodiversity Funds Are Investing in Unexpected Giants

Finance

2025-03-17 12:00:00

Biodiversity Funds: Surprising Corporate Powerhouses Driving Environmental Change

When you think of biodiversity investment funds, luxury brands and tech giants might not be the first companies that come to mind. Yet, surprising names like Hermes, Netflix, and Apple are emerging as key players in portfolios dedicated to protecting our planet's ecological diversity.

Diving deep into the top 10 holdings of these specialized funds reveals a fascinating landscape of corporate commitment to environmental sustainability. These aren't just token investments, but strategic selections that demonstrate how global corporations are increasingly aligning their business strategies with ecological preservation.

Investors looking to make a meaningful impact are discovering that biodiversity funds offer more than just financial returns—they provide a pathway to supporting companies actively working to protect and restore our planet's intricate ecosystems.

Join us as we explore the unexpected corporate champions driving biodiversity conservation through strategic investment and responsible business practices.

MORE...AI Showdown: Baidu Unleashes Powerful Rival to DeepSeek in China's Tech Battle

Finance

2025-03-17 11:58:07

Baidu Unveils Cutting-Edge AI Models, Challenging Market with Cost-Effective Innovation In a bold move to solidify its position in the artificial intelligence landscape, Chinese tech powerhouse Baidu has introduced two groundbreaking AI models. The standout release, ERNIE X1, promises to disrupt the market by delivering performance on par with DeepSeek R1 while dramatically reducing costs. The company confidently claims that its latest AI model achieves comparable capabilities to its competitor at just half the price, potentially reshaping the competitive dynamics of the AI technology sector. This strategic launch underscores Baidu's commitment to making advanced AI technologies more accessible and economically viable for businesses and developers. By offering high-performance AI solutions at a more attractive price point, Baidu is positioning itself as an innovative player in the rapidly evolving artificial intelligence market. The introduction of ERNIE X1 signals the company's technological prowess and its ambition to challenge established players in the AI ecosystem. MORE...

Recycling Revolution: $50M Breakthrough Transforms Plastic Waste Landscape

Finance

2025-03-17 11:56:00

In a groundbreaking move for sustainable innovation, a revolutionary $50 million facility is set to transform the plastic waste landscape by processing an impressive 180 million pounds of plastic annually. Global financial powerhouse ING has taken a bold step by backing the world's largest commercial upcycling plant, marking a significant milestone as the first project finance deal in this emerging sector. This cutting-edge facility represents a major leap forward in addressing the global plastic waste crisis. By converting discarded plastics into valuable resources, the plant promises to dramatically reduce environmental pollution while creating a circular economy model that could reshape how we think about waste management. The project signals a powerful commitment to sustainability, demonstrating how financial institutions can drive meaningful environmental change. ING's investment not only provides crucial funding but also sends a strong message about the economic viability of innovative recycling technologies. With the capacity to process 180 million pounds of plastic waste each year, this facility stands as a beacon of hope in the fight against plastic pollution, transforming what was once considered waste into a valuable resource for future production. MORE...

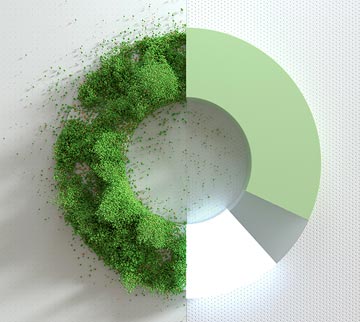

Climate Cash: How Green Finance Is Reshaping Our Uncertain Tomorrow

Finance

2025-03-17 11:45:37

Green Finance: Transforming Financial Landscapes in the Face of Climate Change In an era of unprecedented environmental challenges, green finance has emerged as a powerful catalyst for sustainable economic transformation. Financial institutions and investors are increasingly recognizing that addressing climate risks is not just an ethical imperative, but a strategic necessity. The Evolution of Sustainable Investment Green finance is revolutionizing how we approach economic development by integrating environmental, social, and governance (ESG) principles into financial decision-making. Investors are moving beyond traditional metrics, embracing strategies that balance financial returns with positive environmental impact. Key Drivers of Green Financial Innovation: • Net-zero investment strategies • Climate risk assessment and mitigation • Sustainable infrastructure financing • Adaptation finance for vulnerable regions Resilience Through Responsible Investing By channeling capital towards climate-friendly projects and technologies, green finance is creating a new paradigm of economic resilience. From renewable energy infrastructure to sustainable agriculture, these investments are not just protecting our planet—they're creating robust, future-proof economic opportunities. The Future is Green, The Future is Now As climate challenges intensify, green finance stands at the forefront of global economic adaptation, proving that financial innovation can be a powerful tool for environmental stewardship and sustainable growth. MORE...

Strategic Investment Alert: Summit Financial Backs Gateway Advisory in Garden State Expansion

Finance

2025-03-17 11:34:36

Gateway Advisory: Your Comprehensive Financial Partner At Gateway Advisory, we go beyond traditional financial services. Our expert team is dedicated to empowering clients with strategic financial solutions that transform their wealth management experience. We offer a holistic approach that seamlessly integrates investment advice, sophisticated tax planning, comprehensive risk management, and intelligent wealth transfer strategies. Our mission is to provide personalized financial guidance that helps you navigate complex financial landscapes with confidence. Whether you're looking to grow your investments, optimize your tax strategy, protect your assets, or create a lasting legacy for future generations, Gateway Advisory is your trusted ally. Our specialized services include: • Tailored Investment Advice • Strategic Tax Planning • Proactive Risk Management • Comprehensive Wealth Transfer Solutions Partner with Gateway Advisory and unlock the full potential of your financial future. MORE...

Bitcoin's Cosmic Disruptor: Saylor Unveils the 'Orange Dwarf' Revolutionizing Finance

Finance

2025-03-17 11:20:21

Bitcoin's Stellar Rise: A Financial Phenomenon Gaining Momentum In the ever-evolving landscape of digital finance, Bitcoin continues to shine brightly, attracting substantial capital and solidifying its position as a transformative asset. Michael Saylor, a prominent cryptocurrency advocate, draws a compelling analogy, comparing Bitcoin to a celestial body that grows more luminous and powerful over time. The cryptocurrency's trajectory resembles that of an intensifying star, radiating increasing influence across the global financial ecosystem. Investors and market analysts are witnessing Bitcoin's remarkable ability to capture attention, draw investment, and challenge traditional financial paradigms. Saylor's metaphorical description captures the essence of Bitcoin's ongoing evolution - a dynamic, resilient asset that continues to expand its reach and potential. As institutional interest grows and mainstream adoption accelerates, Bitcoin appears poised to redefine our understanding of value, investment, and financial innovation. The digital currency's journey is far from static; instead, it pulsates with energy, promise, and the potential to reshape the financial landscape in profound and unexpected ways. MORE...

Dividend Delight: Chicago Atlantic Real Estate Finance Drops Hefty $0.47 Payout for Q1 2025

Finance

2025-03-17 11:00:00

Chicago Atlantic Real Estate Finance Announces First Quarter 2025 Dividend

Chicago Atlantic Real Estate Finance, Inc. (NASDAQ: REFI), a leading commercial mortgage real estate investment trust, has exciting news for its shareholders. The company's board of directors has approved a robust quarterly cash dividend of $0.47 per share for the first quarter of 2025.

This consistent dividend translates to an attractive annualized rate of $1.88 per common share, demonstrating the company's commitment to delivering value to its investors. Shareholders of record as of the close of business on March 31, 2025, can look forward to receiving their dividend payment on April 15, 2025.

The announcement underscores Chicago Atlantic Real Estate Finance's financial stability and ongoing strategy of providing steady returns to its investment community.

MORE...Market Turbulence Validates Investors' Flight to Quality

Finance

2025-03-17 10:30:55

In the midst of market turbulence, high-net-worth investors are taking a strategic approach to wealth management. By carefully rebalancing their portfolios and gravitating towards high-quality assets, particularly in private markets and fixed income, the ultra-wealthy are navigating economic uncertainty with precision. Michael Tiedemann, CEO of AlTi Tiedemann Global (ALTI), recently shared exclusive insights into how sophisticated investors are adapting to the current financial landscape. In a candid conversation with Catalysts host Madison Mills, Tiedemann highlighted the growing importance of private credit as a robust and diversifying asset class. The key strategy emerging among top-tier investors is a nuanced, multi-faceted approach that prioritizes resilience and strategic asset allocation. By focusing on quality investments and exploring alternative markets, these investors are positioning themselves to weather market volatility and potentially capitalize on emerging opportunities. For those seeking deeper market analysis and expert perspectives, Catalysts continues to provide cutting-edge insights into the evolving financial ecosystem. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421