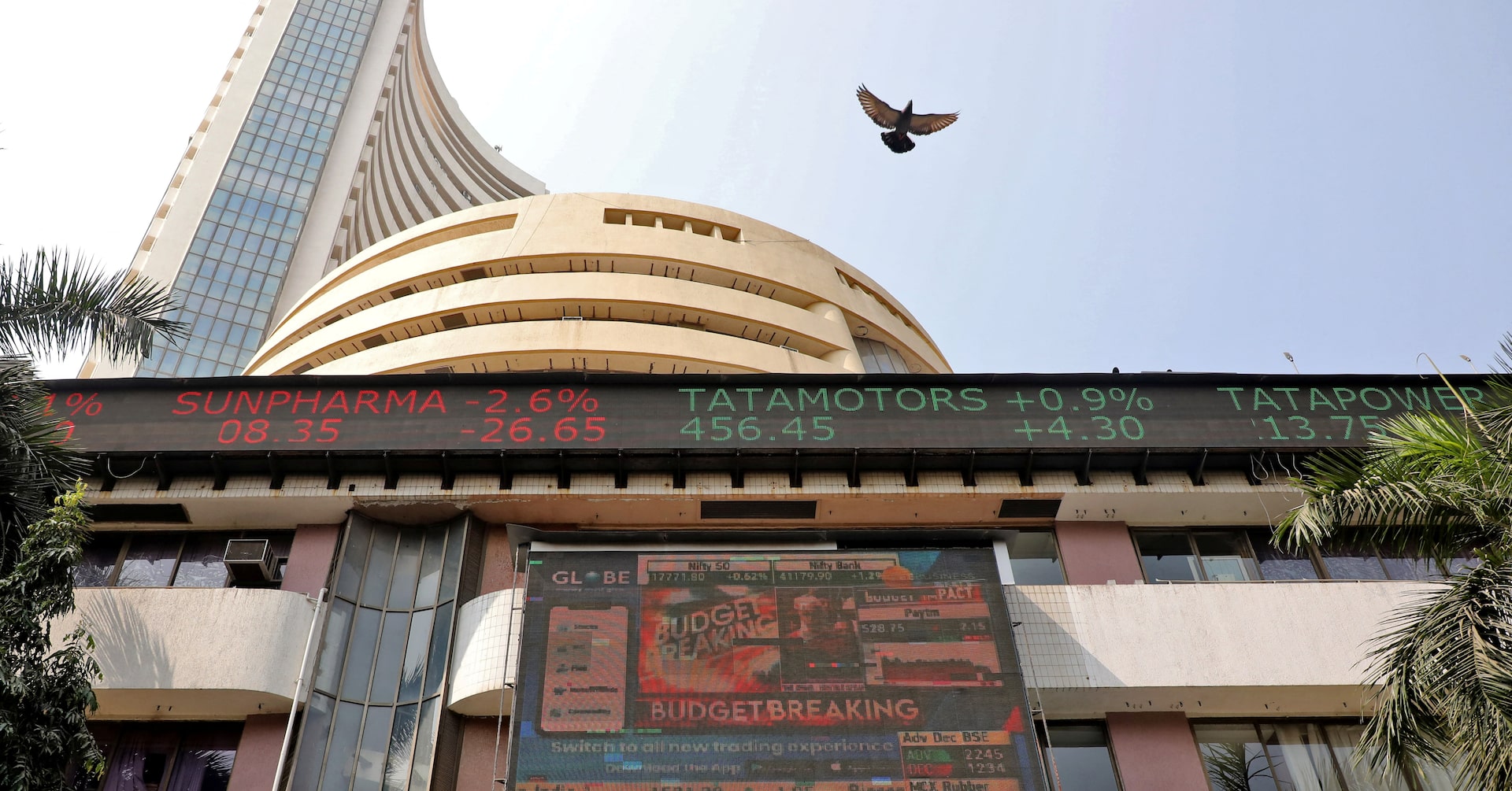

Beijing Unleashes New Strategy: Insurance Giants Set to Boost Stock Market Investments

Finance

2025-04-08 00:59:12

In a strategic move to bolster China's financial ecosystem, the country's top insurance regulator is set to expand investment opportunities for insurance funds in the stock market. This bold initiative aims to provide crucial support for both the capital markets and the broader real economy. The planned increase in stock market allocation signals a significant shift in investment strategy, potentially injecting much-needed liquidity and confidence into China's financial landscape. By allowing insurance funds to play a more active role in equity investments, regulators hope to create a more dynamic and interconnected financial environment. This approach not only promises to diversify investment portfolios for insurance companies but also offers a potential lifeline to domestic companies seeking robust financial backing. The move reflects China's ongoing efforts to strengthen its financial markets and provide sustainable economic growth pathways. As the financial sector continues to evolve, this strategic decision underscores the government's commitment to creating a more flexible and responsive investment ecosystem. Investors and market watchers will be closely monitoring the implementation and potential ripple effects of this innovative policy. MORE...

Navigating Turbulence: Smart Strategies to Secure Your Finances in a Roller-Coaster Market

Finance

2025-04-08 00:58:37

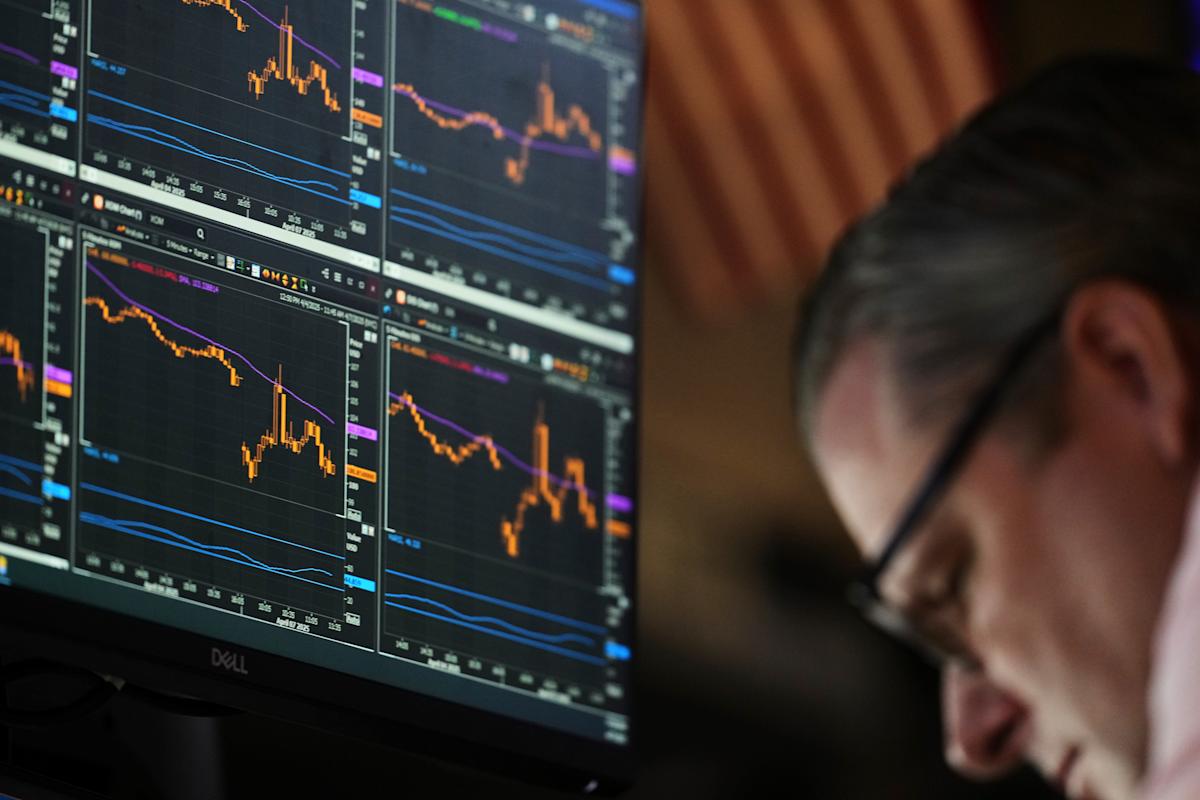

Wall Street Rollercoaster: Markets Reel from Trump's Tariff Bombshell Investors experienced a day of intense volatility on Monday as financial markets were thrown into turmoil following President Trump's unexpected announcement of comprehensive tariff measures. The sudden economic policy shift sent shockwaves through trading floors, triggering dramatic price fluctuations and leaving market participants scrambling to assess the potential fallout. The sweeping tariffs, which caught many by surprise, immediately sparked uncertainty and triggered rapid trading responses across multiple sectors. Stocks whipsawed as traders attempted to gauge the potential economic implications of the new trade restrictions, creating a atmosphere of tension and unpredictability. Investors found themselves navigating a complex landscape of market uncertainty, with each trading session becoming a high-stakes game of strategic repositioning and risk management. The dramatic market swings underscored the significant impact of presidential trade policies on global financial markets. As the day progressed, the initial shock gradually gave way to more measured analysis, but the underlying tension remained palpable. Wall Street's wild ride served as a stark reminder of the delicate balance between political decisions and market stability. MORE...

Breaking: Better Home & Finance Unveils Landmark 2025 Financial Outlook

Finance

2025-04-08 00:45:00

Better Home & Finance Set to Unveil Q1 2025 Financial Performance

Investors and financial enthusiasts, mark your calendars! Better Home & Finance is preparing to share its first-quarter 2025 financial results in an upcoming earnings webcast that promises to provide comprehensive insights into the company's recent performance.

Webcast Details:

- Date: May 13, 2025

- Time: 8:30 AM Eastern Time

Join us for an in-depth analysis of the company's financial achievements, strategic developments, and future outlook. Management will present key performance metrics and answer questions from analysts and investors.

Don't miss this opportunity to gain valuable insights into Better Home & Finance's Q1 2025 performance. Dial in or stream online to stay informed about the company's latest financial developments.

MORE...Market Surge: Nikkei 225 Defies Global Volatility with Impressive 5.5% Rally Amid Trade Tensions

Finance

2025-04-08 00:39:04

Asian financial markets staged a remarkable recovery on Tuesday, with Japan's Nikkei 225 index surging an impressive 5.5% after experiencing a dramatic plunge of nearly 8% just the previous day. This significant rebound came in the wake of a tumultuous session on Wall Street, where U.S. stocks experienced intense volatility following President Donald Trump's aggressive stance on trade tariffs. The market turbulence was triggered by Trump's threat to escalate existing tariffs to even higher double-digit levels, sending shockwaves through global financial markets. Despite the uncertainty, the S&P 500 managed to close only marginally lower, dropping 0.2% as investors anxiously awaited the next move in the ongoing trade war. Traders and analysts remained on high alert, carefully monitoring the potential economic implications of the escalating tensions between the world's largest economies. The sudden market swing underscored the fragile nature of international trade relations and the significant impact of geopolitical rhetoric on global financial markets. MORE...

Budget Bombshell: WV Lawmakers Slash School Safety Funds, Claim Counties Can Foot the Bill

Finance

2025-04-08 00:28:51

In a controversial move, the House Finance Committee has dramatically reduced school safety funding by $1.25 million, arguing that counties currently possess substantial surplus resources. The committee's decision highlights a complex debate about resource allocation and educational safety priorities. Committee members contend that existing county budgets contain sufficient financial reserves to support school safety initiatives without additional state funding. By redirecting these funds, they suggest counties can leverage their own financial cushions to maintain and enhance security measures. This funding cut raises significant questions about how local jurisdictions will address ongoing safety concerns in educational institutions. School administrators and local officials are now challenged to reassess their safety strategies within their existing budget constraints. The decision underscores the ongoing tension between fiscal conservatism and the critical need for comprehensive school safety programs. As communities grapple with this funding reduction, the long-term implications for student protection remain a pressing concern. MORE...

Market Turbulence Ahead? DU Finance Expert Reveals Calm Strategy for Long-Term Investors

Finance

2025-04-07 23:34:57

As trade tensions continue to simmer between the United States and China, investors are increasingly concerned about the potential impact on their retirement portfolios. In an exclusive interview with Denver7, Mac Clouse, a distinguished finance professor from the University of Denver's Daniels College of Business, offers critical insights for long-term investors and those approaching retirement. With the escalating trade war casting uncertainty over financial markets, Clouse provides strategic guidance on navigating 401(k) investments during these turbulent economic times. His expert advice aims to help investors protect their hard-earned savings and make informed decisions in a volatile economic landscape. Investors are urged to remain calm and consider a balanced approach to managing their retirement funds, taking into account the potential short-term fluctuations while maintaining a long-term perspective on their financial goals. MORE...

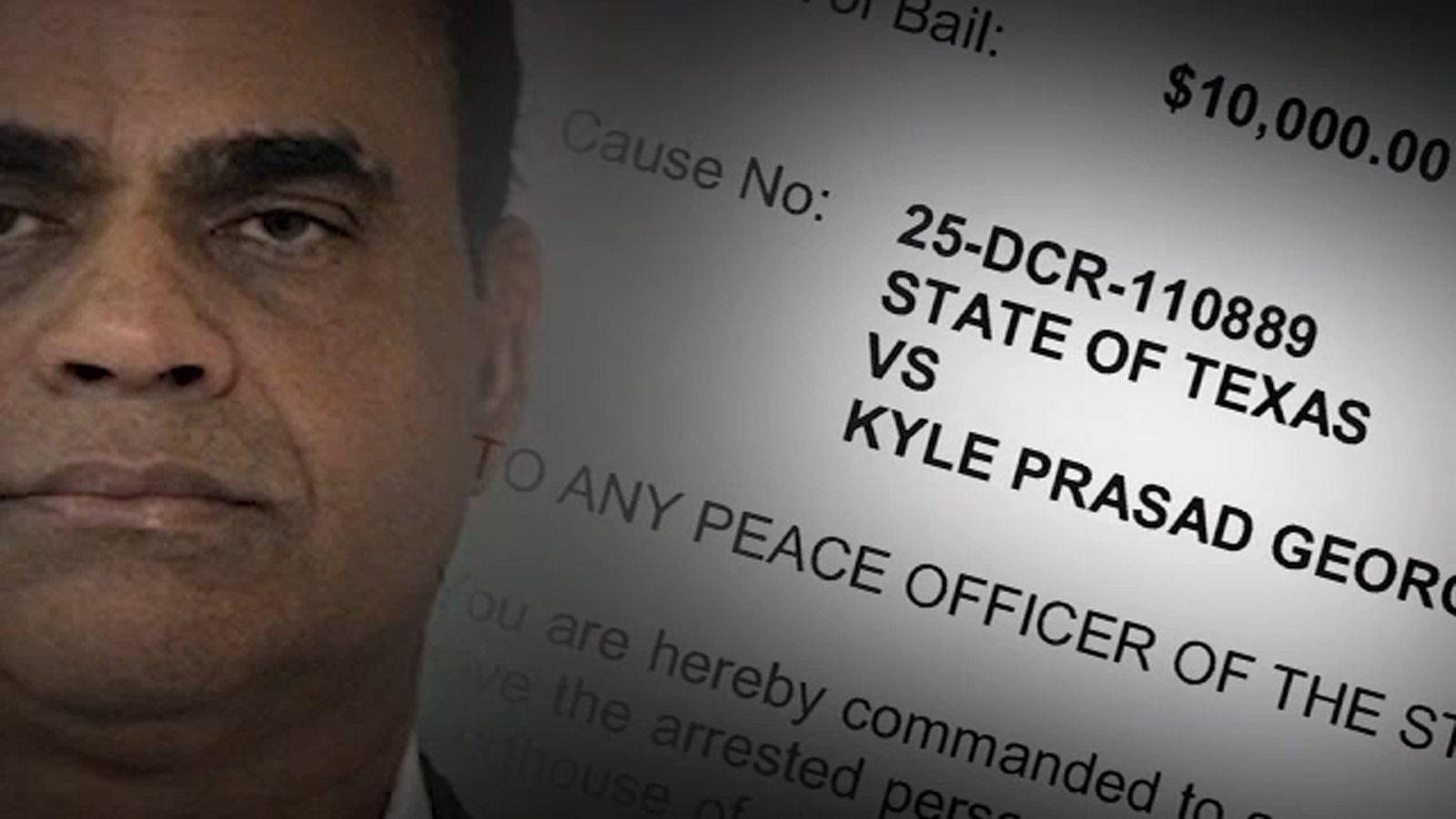

Financial Shadows: Judge George's Loan Mystery Deepens Amid New Criminal Allegations

Finance

2025-04-07 23:33:27

Fort Bend County Judge KP George finds himself embroiled in a complex campaign finance controversy that challenges his initial claims. While George maintains that a campaign loan should not be cause for concern, recently obtained campaign finance reports tell a different story. The documents, carefully examined by ABC13, reveal potential discrepancies that cast a shadow on the judge's financial reporting. These records suggest that the loan in question may have more significant implications than George initially suggested. The ongoing investigation highlights the intricate and often scrutinized world of local political campaign financing. Judge George's defense centers on the argument that the loan was a routine financial transaction, but the emerging evidence indicates that the matter might be more nuanced than a simple misunderstanding. As the story continues to unfold, local residents and political observers are closely watching how these campaign finance allegations will impact Judge George's reputation and political standing in Fort Bend County. MORE...

BlackRock Veteran Tapped as PNC's New Strategic Leader

Finance

2025-04-07 23:31:51

PNC Financial Services Group has made a strategic leadership move by welcoming Mark Wiedman, a seasoned executive from BlackRock, to its top management team. Effective immediately, Wiedman has been appointed as president, signaling the bank's commitment to bringing high-caliber talent into its leadership ranks. With his extensive experience at BlackRock, one of the world's largest investment management firms, Wiedman is expected to bring fresh perspectives and strategic insights to PNC's executive leadership. His appointment underscores the company's forward-thinking approach to corporate leadership and potential growth strategies. The move highlights PNC's ongoing efforts to strengthen its executive team and position itself competitively in the rapidly evolving financial services landscape. Wiedman's background and expertise are anticipated to play a crucial role in driving the bank's future strategic initiatives. MORE...

Small-Cap Gem: Insider Confidence Soars at Capitol Federal Financial as Q1 Signals Strategic Moves

Finance

2025-04-07 22:49:05

Insider Insights: Capitol Federal Financial's Q1 2025 Stock Performance

In our recent deep dive into small-cap stocks attracting insider attention during the first quarter of 2025, Capitol Federal Financial, Inc. (NASDAQ:CFFN) emerged as a particularly intriguing investment opportunity. As part of our comprehensive analysis, we're taking a closer look at how this financial institution stacks up against other small-cap stocks that have caught the discerning eyes of company insiders.

The investment landscape is always evolving, and insider buying can often signal potential value and confidence in a company's future prospects. Capitol Federal Financial stands out among its peers, offering investors a unique glimpse into the strategic moves of those who know the company best.

While economic factors like recent tariff implementations continue to shape market dynamics, savvy investors are paying close attention to insider trading patterns as a potential indicator of future performance. Our in-depth research provides valuable insights into the strategic positioning of Capitol Federal Financial in the current market environment.

Stay tuned as we break down the key factors that make this small-cap stock a compelling consideration for investors seeking opportunities in the financial sector.

MORE...Wall Street Whispers: Navigating Turbulent Markets with Expert Survival Strategies

Finance

2025-04-07 22:39:01

As Wall Street experiences a tumultuous three-day downturn, many investors are growing anxious about their retirement savings. However, seasoned financial experts are offering a calm and strategic perspective during this market volatility. Top financial advisors are unanimously recommending that investors maintain their composure and resist the urge to make hasty investment decisions. "In times of market uncertainty, having a well-crafted financial plan is your greatest asset," says one prominent wealth management expert. The key message is clear: panic selling or making impulsive changes to your investment portfolio can often do more harm than good. A solid, long-term investment strategy is designed to weather short-term market fluctuations. Investors are encouraged to stay focused on their original financial goals and trust in the diversification of their retirement portfolios. While market dips can be unsettling, financial professionals stress that knee-jerk reactions can potentially derail years of careful financial planning. Instead, they recommend taking a deep breath, reviewing your existing strategy, and maintaining a patient, disciplined approach to investing. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421