Defence Dollars: UK Finance Chief Seeks EU Collaboration on Military Spending

Finance

2025-04-10 23:06:53

In a strategic move to strengthen international cooperation, British Shadow Chancellor Rachel Reeves is set to urge European Union finance ministers to deepen collaboration on defense financing. Her upcoming diplomatic initiative aims to forge stronger economic and national security ties between the United Kingdom and its European partners. Reeves will leverage her high-profile meeting on Friday to emphasize the critical importance of joint financial strategies in an increasingly complex global landscape. By proposing closer coordination on defense funding, she seeks to demonstrate how collaborative economic approaches can enhance regional stability and mutual protection. The proposed dialogue represents a significant diplomatic outreach, signaling Britain's commitment to maintaining robust international relationships despite recent political transitions. Her approach underscores the potential for constructive engagement and shared economic interests between the UK and EU member states. MORE...

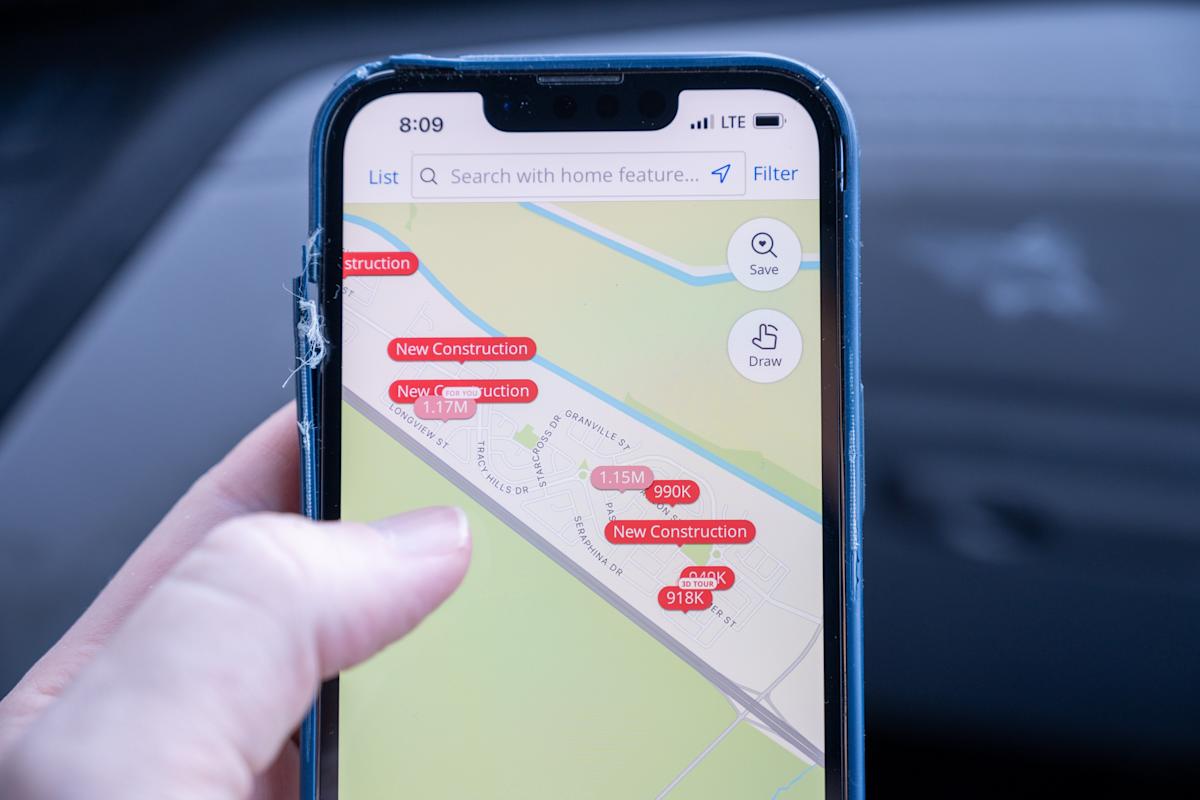

Real Estate Showdown: Zillow Strikes Back Against Hidden Home Marketplace

Finance

2025-04-10 22:19:25

Zillow is taking a bold stance against "pocket" listings by implementing a new policy that ensures maximum transparency in real estate marketing. The popular online real estate platform has decided to exclude homes that are not broadly marketed from its website, aiming to create a more open and accessible property marketplace. Pocket listings, which are properties secretly marketed to a select group of potential buyers or agents, have long been a point of contention in the real estate industry. These discreet sales often limit exposure and potentially prevent sellers from achieving the best possible price for their property. By blocking these hidden listings, Zillow is championing a more equitable approach to home sales. The move encourages sellers to list their properties publicly, giving all potential buyers an equal opportunity to view and consider the homes on the market. This policy change reflects Zillow's commitment to promoting fairness and transparency in real estate transactions. Homeowners and agents will now be required to ensure their listings are widely accessible, ultimately benefiting both sellers and potential buyers by creating a more competitive and inclusive property marketplace. MORE...

Trade War Escalation: Trump Slaps Massive 145% Tariff Hammer on China

Finance

2025-04-10 21:58:58

In an escalating trade confrontation, US President Donald Trump has dramatically raised tariff rates on Chinese imports to a staggering 145%, underscoring his administration's aggressive stance in the ongoing economic standoff with China. This bold move signals a continued hardline approach to international trade relations. To provide deeper insights into this complex economic landscape, Yahoo Finance Senior Columnist Rick Newman joined Market Domination Overtime to unpack the nuanced dynamics behind Trump's tariff strategy. Newman offered a comprehensive analysis of the factors driving the tariff pause and the intricate geopolitical tensions underlying the US-China trade war. The unprecedented tariff increase highlights the ongoing economic tensions between the world's two largest economies, reflecting a strategic approach to reshaping global trade dynamics. Experts continue to closely monitor the potential ripple effects of these aggressive trade policies on international markets and global economic stability. For those seeking more expert analysis and in-depth market insights, Market Domination Overtime provides comprehensive coverage of the latest market developments and economic trends. MORE...

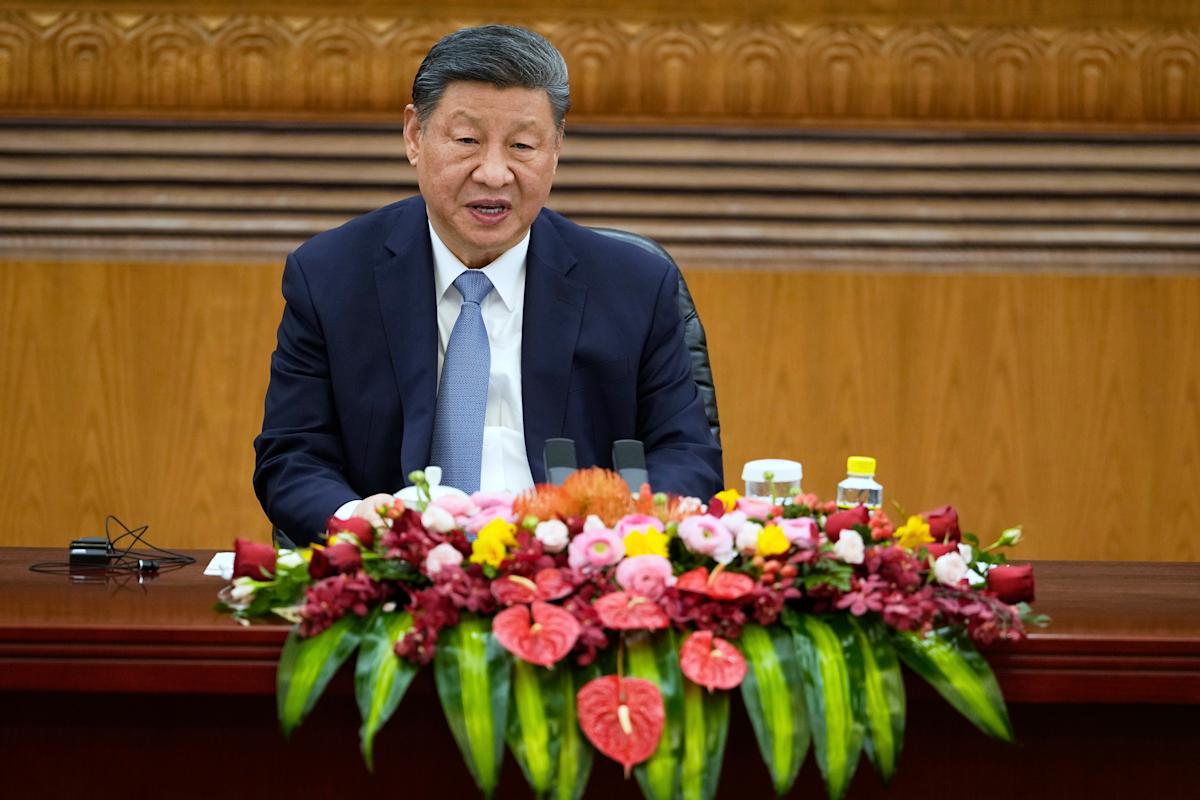

Inside Beijing's Playbook: How Trump's Pressure Points Could Reshape US-China Relations

Finance

2025-04-10 21:36:46

When market turbulence threatened to derail the U.S. economy, President Trump's resolute trade war stance suddenly seemed to waver. As stock prices plummeted toward bear market territory and credit markets began to show signs of stress, the administration's aggressive trade posture unexpectedly softened. China was undoubtedly watching closely, keenly observing the moment of hesitation. The sudden shift revealed a potential vulnerability in Trump's negotiating strategy, suggesting that economic pressure could indeed influence the administration's hardline approach to international trade relations. The markets' tremors appeared to penetrate the White House's typically unyielding trade war narrative, hinting at the delicate balance between economic brinksmanship and financial stability. For Beijing, this moment represented more than just a market fluctuation—it was a strategic insight into the potential limits of Trump's trade confrontation. As investors held their breath and global markets watched intently, the episode underscored the complex interplay between political rhetoric and economic reality. China, ever strategic, took note of every nuanced signal, understanding that moments of uncertainty could be leveraged in the ongoing trade negotiations. MORE...

Harley's Bold Move: Potential $1B Financing Unit Sell-Off Sparks Industry Buzz

Finance

2025-04-10 21:29:15

Harley-Davidson is considering a strategic move that could reshape its financial landscape, exploring potential options for its lending division that might result in a lucrative sale. Sources close to the matter suggest the company could attract a buyer willing to pay at least $1 billion for its financing arm, signaling a potentially transformative business decision. The iconic motorcycle manufacturer is carefully evaluating various scenarios that could unlock significant value from its financial services segment. By potentially divesting this division, Harley-Davidson could streamline its core operations and generate substantial capital for future investments or strategic initiatives. While specific details remain confidential, the potential sale represents a noteworthy development for the legendary motorcycle brand. Financial experts are closely watching how this potential transaction might impact the company's overall strategic positioning in the market. The move underscores Harley-Davidson's commitment to optimizing its business portfolio and exploring innovative approaches to enhance shareholder value in an increasingly competitive automotive and financial services landscape. MORE...

Market Mayhem: Dow Plummets as Trade Tensions Reignite Wall Street Selloff

Finance

2025-04-10 20:04:12

Wall Street Braces for Escalating US-China Trade Tensions as Trump Ramps Up Economic Pressure The financial markets are closely monitoring the dramatic intensification of trade hostilities between the United States and China, as former President Donald Trump signals a potentially aggressive economic strategy. In a bold move that has sent ripples through global financial circles, Trump is positioning himself to dramatically reshape the economic landscape of international trade. Investors and market analysts are carefully assessing the potential implications of Trump's increasingly confrontational approach toward China. His recent statements suggest a willingness to impose substantial tariffs and implement more restrictive trade policies that could significantly disrupt existing economic relationships. The potential economic fallout is causing considerable uncertainty on Wall Street, with traders and investment firms scrambling to understand the potential consequences of this escalating trade battle. Key sectors such as technology, manufacturing, and agriculture are particularly vulnerable to potential retaliatory measures and trade restrictions. As tensions continue to mount, the financial world remains on high alert, recognizing that the strategic economic moves between the United States and China could have far-reaching consequences for global markets, international trade dynamics, and geopolitical relationships. MORE...

Bond Market's Silent Revolt: How Wall Street Forced Trump to Back Down on Tariffs

Finance

2025-04-10 19:45:03

In a surprising turn of events, President Trump's trade strategy took an unexpected detour, with the bond market playing an influential role in his decision-making process. The administration's tough stance on international trade momentarily softened as economic signals from financial markets prompted a strategic retreat. What appeared to be a moment of diplomatic flexibility was, in essence, a calculated step back. The president, known for his unyielding negotiation tactics, found himself navigating a complex economic landscape where the bond market's whispers became a compelling argument for restraint. By hitting the pause button on reciprocal tariffs, Trump demonstrated a rare willingness to recalibrate his approach. The bond market's subtle pressure revealed the intricate dance between political bravado and economic pragmatism, showing that even the most resolute leaders can be swayed by sophisticated financial indicators. This episode underscores the delicate balance of international trade negotiations, where posturing meets economic reality. In the high-stakes game of global commerce, sometimes discretion truly is the better part of valor. MORE...

Musk's Latest Tweet Sends Dogecoin Investors on a Rollercoaster Ride

Finance

2025-04-10 18:44:06

In a recent development, Elon Musk has shared insights about the White House's Dogecoin (DOGE) office, projecting potential savings of $150 billion by fiscal year 2026. However, the current projection falls short of the more ambitious targets Musk had previously suggested were achievable. The tech entrepreneur, known for his enthusiastic support of the meme-inspired cryptocurrency, appears to have tempered his expectations. While the projected savings are substantial, they represent a more conservative estimate compared to his earlier, more optimistic forecasts. Musk's continued involvement and commentary on Dogecoin continue to spark interest and debate within the cryptocurrency community. The $150 billion savings projection highlights the potential financial impact of digital currencies in government operations, though it remains significantly less dramatic than Musk's initial predictions. As the cryptocurrency landscape evolves, stakeholders will be watching closely to see how these projections might translate into real-world financial strategies and potential cost-saving measures for government institutions. MORE...

Trade Tensions Simmer: US-China Economic Chess Match Enters Uncharted Territory

Finance

2025-04-10 17:07:04

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Congressional Showdown: GOP Moves to Block Biden's Bank Fee Crackdown

Finance

2025-04-10 17:04:03

The fate of the Consumer Financial Protection Bureau's (CFPB) controversial overdraft rule now rests with President Trump, following a decisive vote in the House of Representatives. On Wednesday, lawmakers passed House Joint Resolution 18 with a narrow margin of 217-211, setting the stage for a potential nullification of the banking regulation. The resolution, which aims to overturn the CFPB's recent overdraft rule, reflects ongoing tensions between regulatory agencies and financial institutions. By advancing this measure, congressional Republicans have signaled their intent to challenge what they perceive as overly restrictive banking guidelines. With the resolution now on the president's desk, the next critical step will be determining whether the administration will support the move to block the CFPB's proposed changes to overdraft practices. The outcome could have significant implications for both consumers and financial institutions across the United States. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421