Tech Titan's Rocket Ride: Why Nvidia Could Dominate the Next 10 Years

Finance

2025-02-24 13:37:31

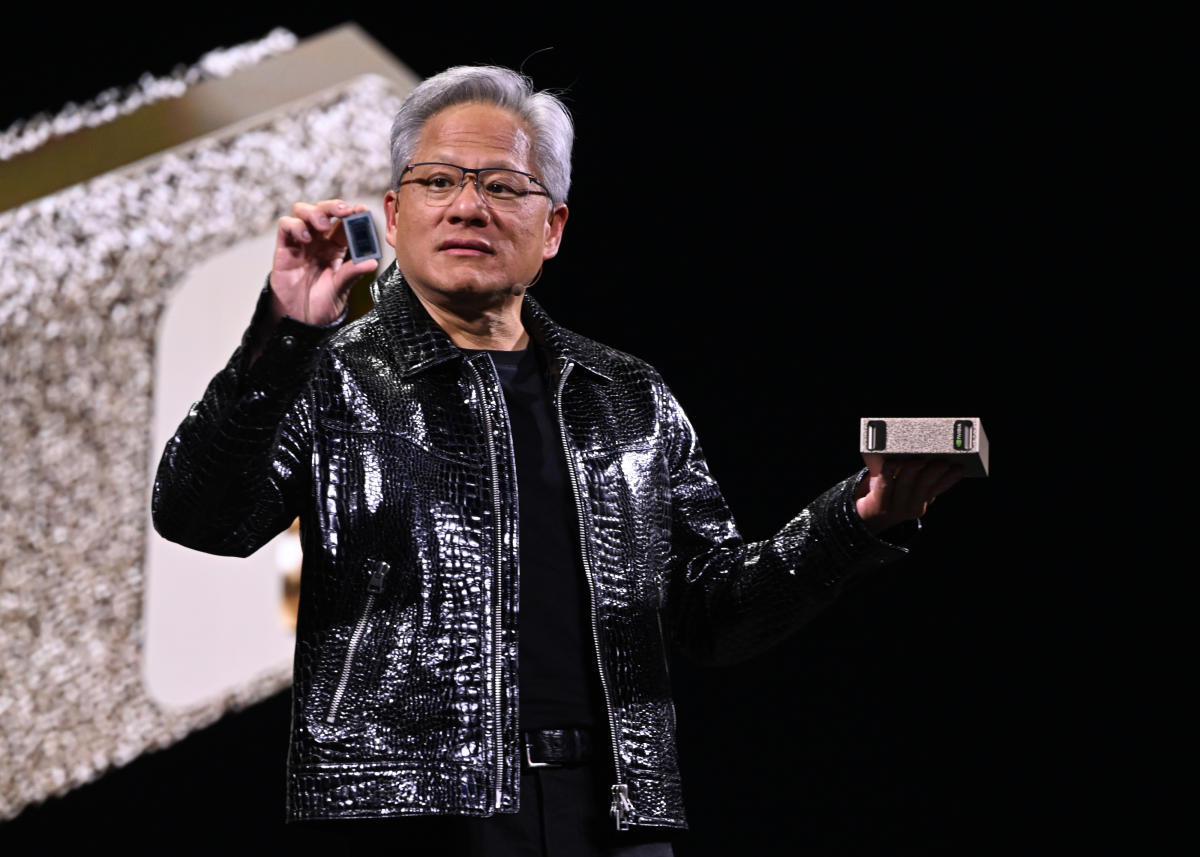

In the fast-paced world of technology investing, Nvidia continues to stand tall as a titan of innovation, according to a seasoned market veteran. The company's remarkable performance and strategic positioning in artificial intelligence and graphics processing have solidified its market leadership. Investors are increasingly recognizing Nvidia's unparalleled strength in the semiconductor industry. With its cutting-edge GPU technologies and pivotal role in AI development, the company has demonstrated an extraordinary ability to maintain its competitive edge. The investor noted that Nvidia's dominance is not just a temporary trend, but a testament to its deep technological expertise and forward-thinking approach. Recent market developments have only reinforced Nvidia's strategic position. The company's breakthrough AI chips and robust ecosystem have created a formidable moat that competitors find challenging to breach. From data centers to autonomous vehicles, Nvidia's technologies continue to drive innovation across multiple critical sectors. While the tech landscape remains dynamic and unpredictable, this veteran investor remains confident in Nvidia's ability to navigate market complexities and maintain its leadership position. The company's consistent innovation and strategic vision suggest that its current success is more than just a momentary triumph. MORE...

Financial Leadership Shake-Up: Crinetics Taps Veteran Exec Tobin Schilke as New CFO

Finance

2025-02-24 13:30:00

Crinetics Pharmaceuticals Appoints Tobin Schilke as New Chief Financial Officer

San Diego, California - Crinetics Pharmaceuticals (Nasdaq: CRNX) announced today the strategic appointment of Tobin "Toby" Schilke as its chief financial officer, effective February 28, 2025.

Mr. Schilke brings an impressive track record to the role, boasting over 25 years of extensive global pharmaceutical experience. Throughout his career, he has distinguished himself by successfully guiding biotech companies through critical transformational phases, helping transition organizations from research-focused environments to fully integrated commercial enterprises.

"We are thrilled to welcome Toby to our leadership team," said a company spokesperson. "His deep industry expertise and proven track record of driving strategic financial growth make him an exceptional addition to Crinetics Pharmaceuticals."

The appointment underscores Crinetics Pharmaceuticals' commitment to strengthening its executive leadership and positioning the company for continued growth and innovation in the biopharmaceutical sector.

MORE...Digital Banking Triumph: WeBank Sweeps Top Honors in Asian Financial Excellence Awards

Finance

2025-02-24 13:19:00

WeBank Shines at The Asian Banker's 2025 Banking Innovation Awards, Securing Triple Honors In a remarkable display of technological prowess and financial innovation, WeBank has been recognized with three distinguished awards at the prestigious 2025 Banking Innovation Annual Meeting and Global Excellence in Retail Banking Awards. The accolades underscore the bank's commitment to cutting-edge digital transformation and customer-centric banking solutions. The awards highlight WeBank's exceptional performance in leveraging advanced technologies, demonstrating its leadership in the rapidly evolving financial technology landscape. By consistently pushing the boundaries of digital banking, WeBank has established itself as a trailblazer in the industry, setting new standards for technological innovation and customer experience. These prestigious recognitions not only validate WeBank's strategic approach to digital banking but also reinforce its position as a forward-thinking financial institution committed to delivering exceptional value to its customers through innovative technological solutions. The multiple awards serve as a testament to WeBank's ongoing dedication to excellence, digital transformation, and its ability to anticipate and meet the changing needs of modern banking customers. MORE...

College Cash Countdown: Your FAFSA Ticket to Thousands in Financial Aid

Finance

2025-02-24 13:00:01

Your Complete Guide to Maximizing Financial Aid: FAFSA 2025–26 Insider Secrets

Imagine unlocking thousands of dollars in financial support for your education with just a few simple steps. The Free Application for Federal Student Aid (FAFSA) is your golden ticket to making college more affordable, and the time to act is now!

Why Submit Your FAFSA Today?

- Access multiple financial aid opportunities

- Potentially reduce your out-of-pocket education expenses

- Qualify for grants, scholarships, and low-interest student loans

Who Should Apply?

Whether you're a first-time college student, returning to complete your degree, or planning your academic journey, the FAFSA is designed for you. Don't miss out on potential funding that could transform your educational dreams into reality.

Pro Tips for a Successful Application

- Gather all necessary financial documents in advance

- Double-check information for accuracy

- Submit early to maximize your chances of receiving aid

- Consider professional guidance if you're unsure

Your future starts with taking action today. Complete your 2025–26 FAFSA and open the door to incredible educational opportunities!

MORE...Avocado Giant Mission Produce® Prepares to Unveil Q1 Financial Performance

Finance

2025-02-24 13:00:00

Mission Produce Set to Unveil First Quarter Financial Results for 2025

OXNARD, Calif. - Leading global avocado innovator Mission Produce (NASDAQ: AVO) is preparing to share its financial performance for the first quarter of fiscal year 2025. The company will release its comprehensive financial results after market close on Monday, March 10, 2025.

Investors and industry analysts are invited to join Mission Produce's detailed financial conference call and live webcast, scheduled for 5:00 PM Eastern Time on the same day. This presentation will provide insights into the company's recent operational achievements and financial standing in the dynamic fresh produce market.

As a world-renowned leader in avocado sourcing, production, and distribution, Mission Produce continues to demonstrate its commitment to transparency and investor communication through this upcoming financial disclosure.

Conference Call Details

Date: Monday, March 10, 2025

Time: 5:00 PM Eastern Time

Platform: Conference Call and Webcast

Breaking: Fort Bend County Launches Lifeline for First-Time Homebuyers with Groundbreaking Down Payment Program

Finance

2025-02-24 13:00:00

Exciting Opportunity: Local Houston Organization Offers Generous Homebuyer Support A Houston-area nonprofit is set to provide a significant boost to aspiring homeowners, offering a substantial $5,000 assistance grant to qualified buyers. The program will support up to 60 fortunate homebuyers through a first-come, first-served allocation, giving potential homeowners a valuable financial head start in their property journey. Interested individuals are encouraged to act quickly, as these coveted assistance grants will be distributed on a rapid, first-come, first-served basis. This initiative represents a remarkable chance for local residents to make their homeownership dreams a reality with meaningful financial support. MORE...

Furniture Shopping Lifeline: How Finance Pros Are Helping Consumers Beat Economic Uncertainty

Finance

2025-02-24 12:19:27

In the wake of economic uncertainties and persistent market challenges, consumers are approaching big-ticket discretionary purchases with increased caution. Home furnishings, once a vibrant sector of retail spending, now face a more hesitant market as shoppers carefully weigh their spending decisions against lingering financial concerns and economic headlines. The combination of last year's economic headwinds and this year's ongoing financial narratives has created a more conservative consumer landscape. Potential buyers are taking a more measured approach to home decor and furniture investments, carefully evaluating each purchase against their broader financial priorities and economic outlook. As retailers and manufacturers navigate this nuanced market, they must find innovative ways to attract and reassure consumers, demonstrating value, quality, and long-term investment potential in their home furnishing offerings. MORE...

Wall Street's New AI Powerhouse: Amazon Alexa's Quantum Leap in Investor Tech

Finance

2025-02-24 12:11:59

Amazon Set to Unveil Rufus: A Next-Generation AI Assistant

Amazon is preparing to revolutionize its digital assistant technology with the anticipated launch of Rufus, a cutting-edge generative AI assistant, at an upcoming event in New York City on Wednesday.

According to insider information shared with Yahoo Finance Executive Editor Brian Sozzi, the tech giant plans to showcase a sophisticated AI companion that could potentially come with a modest monthly subscription fee. With Amazon's massive global Prime subscriber base of over 200 million, even a fraction of users adopting Rufus could create a significant new revenue stream.

The event is expected to highlight Amazon's substantial two-year investment in enhancing Alexa's intelligence through advanced generative AI technologies. This strategic move appears to be a direct challenge to competitors, particularly Apple, which has struggled to meaningfully upgrade Siri.

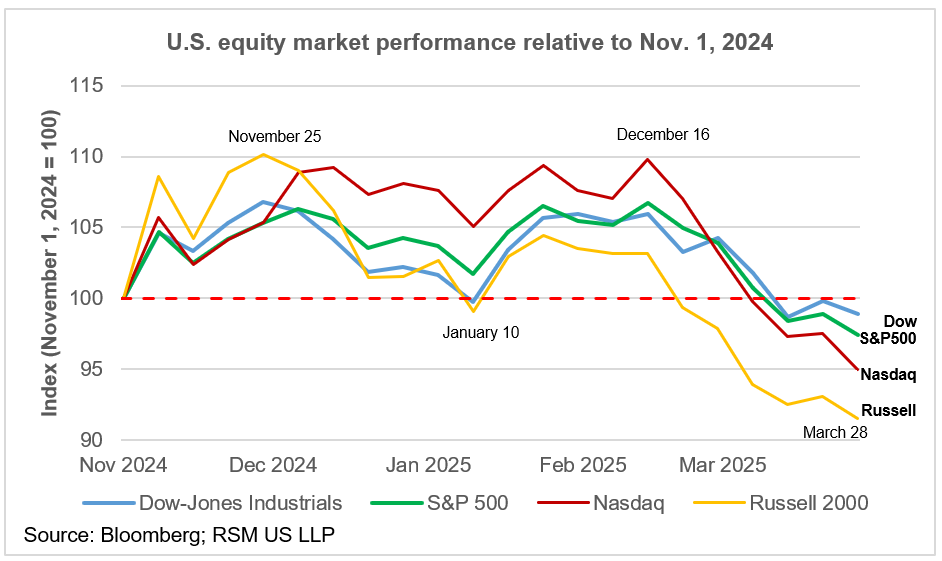

Interestingly, the market's initial reaction seems muted. Amazon's stock is currently down 1.3% year-to-date, contrasting with the S&P 500's 2% gain and modest increases among other Magnificent Seven tech stocks like Nvidia.

As the tech world eagerly awaits Wednesday's reveal, all eyes are on Amazon to see how Rufus might redefine the landscape of AI digital assistants.

MORE...Financial Forecast Ahead: BoardwalkTech Prepares to Unveil Q3 Performance Insights

Finance

2025-02-24 12:00:00

Boardwalktech Software Corp. Set to Unveil Q3 Fiscal 2025 Financial Results

Boardwalktech Software Corp. (TSXV: BWLK) (OTCQB: BWLKF), a pioneering digital ledger platform and enterprise software solutions provider, is preparing to release its financial performance for the third quarter of Fiscal Year 2025.

The company will announce its Q3 Fiscal 2025 financial results on Tuesday, February 25, 2025, after the market closes. Following the release, Boardwalktech's management team will host a comprehensive conference call at 4:30 PM Eastern Time to dive deep into the quarterly results and address investor inquiries.

Investors, analysts, and interested stakeholders are encouraged to mark their calendars for this important financial update, which will provide insights into the company's recent performance and strategic developments.

Stay tuned for detailed financial insights and the company's forward-looking perspective during the upcoming earnings call.

MORE...Silicon Valley Giant Doubles Down: Apple's Massive $500B Bet on American Tech Frontier

Finance

2025-02-24 11:01:06

In a bold strategic move, Apple has unveiled an ambitious plan to significantly boost its domestic investment and workforce. The tech giant announced it will pour a staggering $500 billion into the United States economy over the next four years, signaling a major commitment to American innovation and technological advancement. At the heart of this initiative is Apple's focus on expanding its engineering and artificial intelligence capabilities. The company plans to create 20,000 new jobs, targeting top talent in cutting-edge technological fields. This substantial investment not only underscores Apple's confidence in the US market but also promises to drive significant economic growth and technological innovation. The announcement highlights Apple's continued dedication to strengthening its domestic presence and contributing to the United States' technological ecosystem. By investing heavily in engineering and AI, the company is positioning itself at the forefront of technological development and demonstrating its commitment to creating high-quality jobs in the American workforce. Industry experts are viewing this move as a potential game-changer, potentially setting a new standard for tech industry investment and job creation in the United States. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421