Sustainable Supply Chain Finance Poised to Skyrocket: $7.7B Market Set to Revolutionize Global Business by 2034

Finance

2025-04-15 17:30:00

Global Sustainable Supply Chain Finance Market: A Comprehensive Market Insight

The sustainable supply chain finance sector is experiencing remarkable growth, according to a groundbreaking market research study by Custom Market Insights. The latest report reveals a compelling trajectory of market expansion and potential.

Market Valuation and Forecast

- Current Market Value (2024): Approximately USD 7,002.41 Million

- Projected Market Value (2025): USD 7,112.36 Million

- Expected Market Size (2034): Around USD 7,735.58 Million

- Compound Annual Growth Rate (CAGR): 8.15% between 2025 and 2034

Market Dynamics

The sustainable supply chain finance market is witnessing significant transformation, driven by increasing corporate sustainability initiatives, environmental consciousness, and innovative financial technologies. Businesses are increasingly recognizing the importance of integrating sustainable practices into their financial strategies.

Key Market Insights

The comprehensive report highlights the following critical aspects:

- Robust growth potential in sustainable financial solutions

- Emerging trends in supply chain financing

- Technological advancements driving market expansion

- Strategic investments by leading market players

Future Outlook

With an impressive projected CAGR of 8.15%, the sustainable supply chain finance market is poised for substantial growth. Investors, corporations, and financial institutions are expected to increasingly adopt and invest in sustainable supply chain financing models.

MORE...Quantum Leap: 3 Tech Stocks Poised to Revolutionize Computing in 2024

Finance

2025-04-15 17:21:00

Quantum Computing: The Revolutionary Technology Reshaping Our Digital Future

Imagine a computing paradigm so powerful it could transform how we process information, solve complex problems, and revolutionize cloud-based services. Welcome to the world of quantum computing—a technological frontier that promises to redefine the boundaries of computational capabilities.

Unlike traditional computers that rely on binary bits representing zeros and ones, quantum computers leverage a groundbreaking approach using qubits. These quantum bits can simultaneously exist in multiple states, enabling unprecedented computational speed and complexity that traditional computing architectures could never achieve.

For investors looking to capitalize on this cutting-edge technological revolution, three standout companies are positioning themselves at the forefront of quantum innovation:

- IonQ (NYSE: IONQ): A pioneering quantum computing company developing advanced quantum systems

- D-Wave Quantum (NYSE: QBTS): A leader in quantum computing solutions and research

- IBM (NYSE: IBM): A technology giant making significant investments in quantum computing infrastructure

As quantum computing continues to evolve, these companies represent promising opportunities for those seeking to invest in the next generation of computational technology.

MORE...Retirement Roulette: 4 Deadly Myths That Could Drain Your Nest Egg

Finance

2025-04-15 16:27:50

When planning your investment portfolio's future, it's tempting to be overly optimistic about potential returns. However, financial experts caution against setting unrealistic expectations that could derail your long-term financial strategy. Instead of dreaming about sky-high market gains, smart investors take a more measured approach. The key is to dial back your return projections and adjust your withdrawal strategy accordingly. Recent research from Morningstar provides valuable insight, suggesting that a conservative 3.7% withdrawal rate is the sweet spot for maintaining a balanced portfolio over a 30-year period. By tempering your expectations and creating a more realistic financial roadmap, you'll be better positioned to weather market fluctuations and protect your financial future. Think of it as financial prudence – hope for the best, but plan for a more moderate scenario that keeps your investments sustainable and your retirement dreams intact. MORE...

Strategic Shift: Pulse Finance Secures Transformative Backing in Management Buyout Coup

Finance

2025-04-15 16:26:16

In a strategic comeback, the founding team of a dynamic SME finance provider has successfully reclaimed leadership, bolstered by a significant investment from US-based Arena Investors. This pivotal moment not only marks a triumphant return for the original visionaries but also signals ambitious plans for growth and innovative product development. The partnership with Arena Investors represents more than just a financial injection; it's a vote of confidence in the company's potential and the founding team's expertise. By reuniting the original leadership with strategic capital, the finance provider is poised to expand its market reach and introduce cutting-edge financial solutions tailored to small and medium enterprises. With renewed energy and financial backing, the team is set to leverage their deep industry knowledge and entrepreneurial spirit to drive the company's next phase of expansion. The collaboration promises to bring fresh perspectives, advanced technologies, and enhanced financial products that can empower SMEs in an increasingly competitive business landscape. MORE...

Trade Tensions Threaten Homebuyers' Spring Dreams: Tariffs Could Shake Up Real Estate Market

Finance

2025-04-15 16:12:09

Spring Home Buying: Navigating Market Uncertainties in the Face of Tariffs

As the traditional spring home-buying season heats up, prospective homeowners are facing an increasingly complex real estate landscape. The market, already characterized by tight inventory and competitive pricing, now confronts a new layer of complexity: the potential impact of tariffs.

In an insightful analysis, Yahoo Finance Senior Reporter Claire Boston breaks down the current market dynamics, highlighting how trade tensions and economic uncertainties are reshaping home-buying strategies. Her expert perspective offers crucial insights for buyers navigating this challenging terrain.

While spring remains a popular time for real estate transactions, potential buyers must now factor in additional economic variables that could influence home prices and overall market stability. From construction material costs to broader economic implications, the tariff landscape adds an unprecedented dimension to home purchasing decisions.

For those seeking deeper understanding of these market trends, Claire Boston's comprehensive video report provides an essential overview of the current real estate environment. Investors and homebuyers alike will find her analysis both timely and illuminating.

To stay informed about the latest market insights and expert analysis, viewers are encouraged to explore more financial coverage on Wealth.

MORE...The Fannie Mae Mistake: How Congress Birthed a Financial Frankenstein

Finance

2025-04-15 15:47:12

The Government-Sponsored Enterprises (GSEs) represent a stark departure from the core principles of limited government and individual freedom that America was founded upon. These entities have long operated in a problematic gray area, challenging the fundamental ideals of free-market economics and responsible governance. For decades, Fannie Mae and Freddie Mac have existed as quasi-governmental institutions that distort the housing market and create systemic risks to the American financial landscape. Their very existence is a testament to political overreach and misguided intervention in the private sector. It's time for Congress to take decisive action. The most responsible path forward is to completely divest from these enterprises, cutting taxpayers' potential losses and returning the housing finance market to true market-driven principles. By dismantling the GSEs, lawmakers can restore economic integrity, reduce government exposure, and create a more transparent and efficient housing finance system. The continued support of these entities undermines the free-market principles that have made the American economy a global powerhouse. A clean break from the GSEs is not just an economic imperative, but a return to the foundational principles of limited government and individual economic freedom. MORE...

Asset Finance Bounces Back: Modest 1% Growth Signals Market Resilience in February

Finance

2025-04-15 15:40:26

Driving economic momentum, the IT equipment finance and plant and machinery finance sectors demonstrated robust growth, playing a pivotal role in expanding financial opportunities. These dynamic sectors have emerged as key contributors, showcasing strong performance and injecting significant vitality into the broader financial landscape. By providing innovative financing solutions for cutting-edge technology and essential industrial machinery, these sectors are not just facilitating business investments but also fueling economic progress and technological advancement. MORE...

Local Financial Powerhouse: Heritage Financial Clinches Top 4 Spot in Forbes' Prestigious 2025 Advisor Rankings

Finance

2025-04-15 15:40:00

Heritage Financial Services Achieves Top Ranking Among Massachusetts Wealth Advisors

We are thrilled to announce that Heritage Financial Services has once again been distinguished by Forbes, securing a prestigious spot among the top 10 wealth advisors in Massachusetts. In a competitive landscape of 162 wealth management professionals statewide, our Founder and Chairman, Chuck Bean, has impressively clinched the #4 position.

This remarkable recognition underscores our commitment to delivering exceptional financial guidance and our dedication to helping clients achieve their financial goals. Chuck Bean's leadership and expertise continue to set a high standard in the wealth management industry.

At Heritage Financial Services, we take pride in our consistent performance and the trust our clients place in us. This Forbes ranking is a testament to our team's hard work, strategic approach, and unwavering commitment to financial excellence.

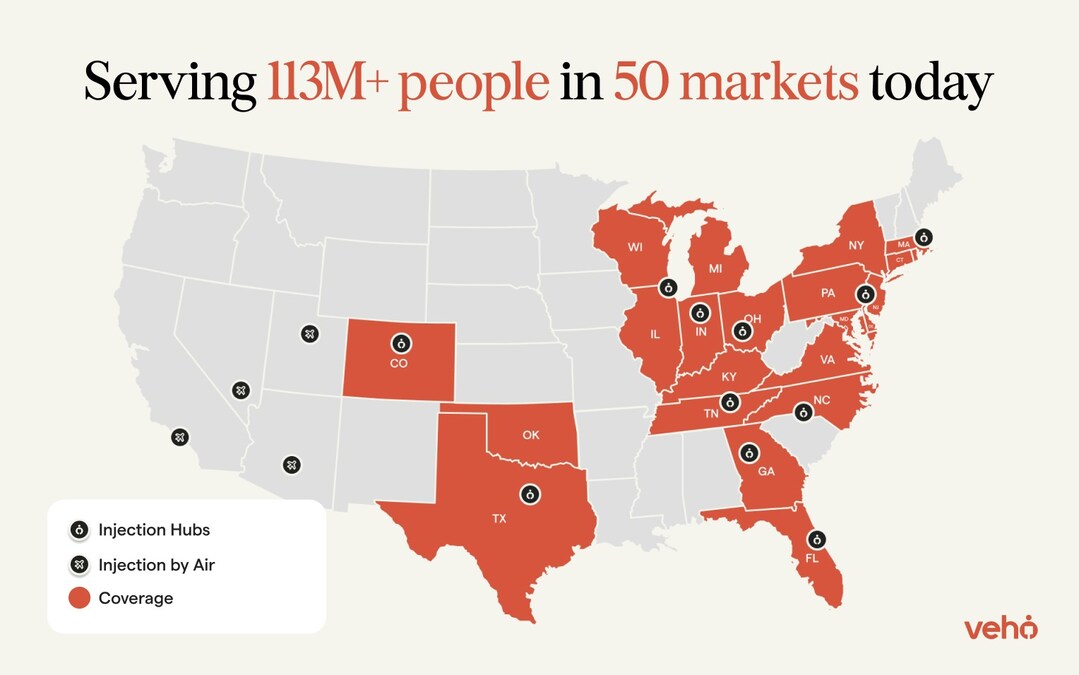

MORE...Financial Powerhouse Alex Estevez Joins Veho's Strategic Leadership

Finance

2025-04-15 15:30:00

Veho, a cutting-edge logistics and technology innovator, has elevated its leadership team by bringing aboard a seasoned industry veteran to drive strategic growth and operational excellence. The company, which operates one of the most expansive parcel delivery platforms in the United States, continues to demonstrate its commitment to transforming the logistics landscape through innovative technology and strategic talent acquisition. The new leadership addition signals Veho's ambitious plans to further solidify its position as a disruptive force in the rapidly evolving delivery and transportation sector. By recruiting an experienced professional with a proven track record, the company aims to accelerate its technological capabilities and expand its market reach. As the logistics industry becomes increasingly competitive and technology-driven, Veho remains at the forefront of innovation, leveraging advanced digital solutions to streamline delivery processes and enhance customer experiences. This strategic hire underscores the company's dedication to maintaining its competitive edge and driving meaningful transformation in the logistics ecosystem. MORE...

Money Moves: Smart Strategies to Maximize Your Child Tax Credit Like a Pro

Finance

2025-04-15 15:01:22

Maximizing Your Child Tax Credit: Smart Strategies for Families

Navigating the complexities of the Child Tax Credit can feel like solving a financial puzzle. But with the right approach, you can transform this valuable tax benefit into a powerful tool for your family's financial well-being.

Whether you're looking to address immediate financial needs or build a long-term financial strategy, the Child Tax Credit offers multiple opportunities to support your family's economic health. From covering essential expenses to investing in your children's future, smart planning can help you make the most of this valuable tax credit.

Key Strategies to Optimize Your Child Tax Credit

- Understand the full scope of eligibility requirements

- Plan how to allocate the credit strategically

- Consider both short-term needs and long-term financial goals

- Consult with a tax professional for personalized advice

By taking a proactive and informed approach, you can leverage the Child Tax Credit to create meaningful financial opportunities for your family.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421