Breaking: Truist Financial's Q1 Earnings Reveal Strategic Resilience in Challenging Market Landscape

Finance

2025-04-18 07:01:09

Truist Financial Corporation Navigates Challenging Market Landscape with Resilient Performance In a testament to its strategic adaptability, Truist Financial Corp (TFC) has demonstrated remarkable financial strength amid ongoing market uncertainties. The banking giant has successfully maintained solid net income while making significant strides in digital banking transformation. Despite facing notable revenue challenges and persistent market volatility, Truist has showcased its operational resilience. The company's digital banking platforms have experienced impressive growth, reflecting its commitment to technological innovation and customer-centric services. Investors and analysts are taking note of Truist's ability to navigate complex economic conditions, with the bank's leadership emphasizing a balanced approach to financial management. By focusing on digital expansion and operational efficiency, Truist continues to position itself as a robust player in the competitive financial services sector. The bank's performance underscores its strategic vision of leveraging technology and maintaining financial discipline, even in turbulent market environments. As Truist moves forward, its focus on digital transformation and customer experience remains a key differentiator in the banking industry. MORE...

Asia's Market Surge: Wall Street Trapped in Trade War's Lingering Shadow

Finance

2025-04-18 03:35:27

Asian markets showed resilience on Good Friday, trading mostly higher despite a volatile session on Wall Street. The Dow industrials experienced a notable decline of 1.3%, primarily driven by UnitedHealth's significant stock drop of over 20% following a disappointing quarterly profit report. In a bright spot for the region, Taiwan's Taiex index surged by 0.8%, with technology stocks gaining ground. The momentum was largely fueled by Taiwan Semiconductor Manufacturing Co.'s latest quarterly results, which met analysts' expectations. The global semiconductor giant provided additional reassurance to investors by reporting that it has not observed any substantial reduction in customer activity related to the ongoing trade tensions between the United States and China. This positive development suggests that some tech companies are navigating the complex geopolitical landscape more effectively than initially anticipated, offering a glimmer of hope for investors concerned about the potential economic fallout from international trade disputes. MORE...

Financial Breakthrough: Fathom Secures Enhanced Funding Boost

Finance

2025-04-18 03:32:00

Fathom Nickel Adjusts Financing Strategy with Amended Upsized Financing

Calgary, Alberta - Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) has announced significant modifications to its previously planned financing round, originally scheduled to close on April 21, 2025.

Following the company's press release on April 10, 2025, Fathom Nickel has made strategic adjustments to its upsized financing plan. The Amended Upsized Financing reflects careful consideration of two key factors that prompted the changes.

The initial closing date of April 21st was strategically selected to accommodate specific investor participation. However, recent developments have necessitated a flexible approach to the financing structure.

Investors and stakeholders can expect further details about the amended financing to be communicated in the coming days, as Fathom Nickel continues to optimize its capital raising efforts.

For more information, please contact Fathom Nickel's investor relations team.

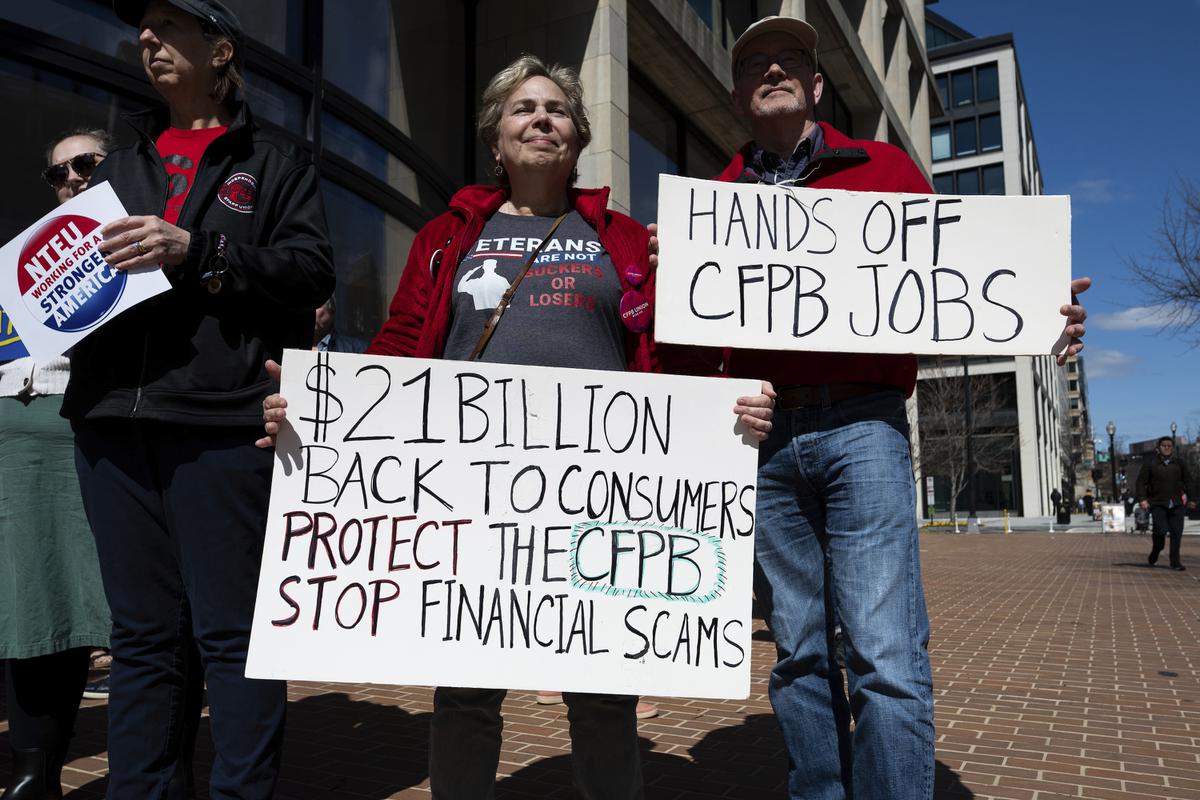

MORE...Financial Watchdog Under Siege: How CFPB's Brutal Budget Cut Could Shake Wall Street

Finance

2025-04-18 02:00:00

In a shocking move that has sent ripples through the financial sector, the agency abruptly terminated 1,500 employees on Thursday, potentially triggering a catastrophic disruption in mortgage markets. This drastic action not only defies a standing court order but also raises serious concerns about the stability of the housing finance landscape. The mass layoffs come at a critical moment, threatening to unravel delicate financial mechanisms and potentially causing widespread economic uncertainty. Legal experts are already warning that the agency's decision could have far-reaching consequences, challenging existing judicial directives and potentially destabilizing the mortgage industry. Stakeholders are watching closely as the situation unfolds, with many questioning the agency's motivations and the potential fallout from such a dramatic workforce reduction. The potential "meltdown" of mortgage markets looms large, casting a shadow of uncertainty over homeowners, financial institutions, and the broader economic ecosystem. As tensions rise and legal challenges mount, the agency's controversial decision stands as a stark reminder of the fragile interconnectedness of modern financial systems and the profound impact of corporate actions on millions of lives. MORE...

Trade Tensions Simmer: Trump Hints at China Deal Amid Tariff Standoff

Finance

2025-04-18 00:15:08

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Breaking: 2025 School Finance Overhaul Clears Critical Legislative Hurdle

Finance

2025-04-17 22:45:27

Colorado's education funding is set to receive a significant boost, with House Bill 25-1320 paving the way for an additional $256 million in K-12 public school funding for the upcoming 2025-26 academic year. Lawmakers demonstrated strong support today by passing the 2025 School Finance Act, signaling a commitment to strengthening the state's educational infrastructure. The substantial financial injection promises to provide critical resources for school districts across Colorado, potentially enhancing classroom experiences, supporting teacher salaries, and investing in educational programs that directly benefit students. This landmark legislation represents a meaningful step toward improving the quality and accessibility of public education in the state. By allocating these additional funds, Colorado legislators are sending a clear message about the importance of investing in the next generation's academic success and future opportunities. The bill's passage reflects a collaborative effort to prioritize education and ensure that schools have the necessary financial support to thrive. MORE...

Financial Shake-Up: IC Group Holdings Elevates Matan Gamliel, Grants Stock Options and Restructures Debt

Finance

2025-04-17 22:45:00

IC Group Holdings Inc. Elevates Matan Gamliel to Vice President of Finance Toronto, Ontario - In a strategic leadership move, IC Group Holdings Inc. (TSXV: ICGH) has announced the promotion of Matan Gamliel, a seasoned financial professional, to the role of Vice President, Finance. This promotion recognizes Gamliel's significant contributions and expertise within the technology-enabled consumer engagement company. With an impressive six-year tenure at IC Group, Gamliel previously served as Director of Finance, demonstrating consistent performance and deep understanding of the company's financial operations. As a Chartered Professional Accountant (CPA, CA), he brings a wealth of financial acumen to his new executive position. IC Group, known for helping Fortune 500 brands enhance consumer connections both nationally and internationally, continues to strengthen its leadership team with this strategic promotion. Gamliel's advanced financial insights are expected to play a crucial role in the company's ongoing growth and strategic initiatives. MORE...

Money Makeover: 5 Killer Apps That'll Revolutionize Your Financial Spring Cleaning

Finance

2025-04-17 22:08:46

Financial Spring Cleaning: Revitalize Your Money Management

Just as spring inspires us to declutter our living spaces and breathe new life into our homes, it's the perfect season to refresh and rejuvenate your financial landscape. Like a thorough spring cleaning that brings clarity and calm to your living environment, a strategic financial reset can help you regain control, alleviate money-related stress, and pave the way for future financial success.

Revamp Your Budget: A Fresh Financial Perspective

Begin your financial spring cleaning by taking a comprehensive look at your household budget. Dive deep into your recent spending patterns, meticulously tracking expenses to uncover hidden spending habits and unnecessary purchases. This careful examination will help you realign your budget with your current financial aspirations, whether that's building an emergency fund, saving for a dream vacation, or investing in personal growth.

By approaching your finances with the same intentionality you apply to spring cleaning your home, you'll create a more organized, purposeful, and stress-free financial future.

MORE...Carbon Cash and Prairie Secrets: How Montana's Grasslands Could Revolutionize Climate Finance

Finance

2025-04-17 21:33:15

Unlocking the Potential of Grassland Carbon Markets: A Sustainable Solution for Ranch Preservation While often overshadowed by forest carbon markets, grassland carbon markets are emerging as a powerful tool for environmental conservation and sustainable land management. In a recent illuminating webinar, Travis Croft from the Climate Trust shed light on the unique dynamics of these markets and shared a compelling success story that demonstrates their transformative potential. Croft's presentation highlighted the distinctive characteristics of grassland carbon markets, contrasting them with their forest-focused counterparts. The spotlight was on a groundbreaking carbon credit transaction that not only generated environmental benefits but also secured the long-term protection of an impressive 37,000 acres of ranchland in southeastern Montana. This innovative approach offers ranchers and landowners a financially viable pathway to preserve their lands while simultaneously contributing to carbon sequestration efforts. By monetizing the carbon-capturing capabilities of grasslands, these markets create a win-win scenario that supports both ecological sustainability and agricultural economic resilience. The Montana project serves as a powerful example of how carbon markets can drive meaningful environmental and economic change, proving that even smaller-scale initiatives can have significant, lasting impacts on landscape conservation and climate mitigation strategies. MORE...

Financial Forecast Unveiled: Dun & Bradstreet Set to Reveal Q1 Earnings Snapshot

Finance

2025-04-17 21:00:00

Dun & Bradstreet Set to Unveil Q1 2025 Financial Performance

JACKSONVILLE, Fla. - Global business intelligence leader Dun & Bradstreet Holdings, Inc. is preparing to share its first quarter 2025 financial results, promising investors and stakeholders a comprehensive overview of the company's recent performance.

The company has scheduled its financial report release for Thursday, May 1, 2025, with details to be made available around 7:30 a.m. Eastern Time. Investors and interested parties can access the complete financial report through Dun & Bradstreet's dedicated Investor Relations website at https://investor.dnb.com.

This upcoming financial disclosure comes in the wake of a significant proposed transaction announced on March 24, 2025, signaling potential strategic developments for the company.

Investors and market analysts are encouraged to review the comprehensive financial report when it becomes available.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421