Chrome Breakup: OpenAI and Yahoo Scramble to Claim Google's Potential Browser Castoff

Finance

2025-04-25 16:49:00

In a surprising twist to the ongoing antitrust battle, OpenAI and Yahoo have expressed keen interest in potentially acquiring Google's Chrome web browser if a federal court mandates its sale. The tech giants are positioning themselves to capitalize on a potential landmark decision that could dramatically reshape the internet browsing landscape. Chrome, which currently dominates the global web browser market with over 60% market share, has long been a cornerstone of Google's digital ecosystem. The potential forced sale could represent an unprecedented opportunity for competitors like OpenAI and Yahoo to gain a significant foothold in the highly competitive browser market. Sources close to the negotiations suggest that both companies view Chrome as a strategic asset that could provide immediate access to millions of users worldwide. OpenAI, known for its groundbreaking AI technologies, and Yahoo, a veteran internet company seeking to revitalize its digital presence, see the potential acquisition as a transformative move. While the sale remains speculative, the mere possibility has sent ripples through the tech industry, highlighting the intense scrutiny facing major tech platforms under increasing antitrust regulations. Tech analysts are watching closely to see how this potential development might reshape digital competition and user access to web technologies. MORE...

Breaking the Glass Ceiling: 4 Powerful Investment Strategies for Women

Finance

2025-04-25 16:14:21

Women Investors Reveal: The Power of Starting Early

In a revealing new survey by Charles Schwab, a staggering 85% of women expressed a common regret: wishing they had begun their investment journey sooner. This eye-opening statistic highlights a critical opportunity for women to take control of their financial futures.

Jeannie Bidner, head of the Schwab Branch Network, recently shared valuable insights with Brad Smith on Wealth, offering practical advice for women looking to dive into the world of investing. Her expert guidance aims to empower women to overcome investment hesitation and start building wealth confidently.

The message is clear: it's never too late to start investing. Whether you're just beginning or looking to refine your financial strategy, taking that first step can make a significant difference in your long-term financial health.

For more expert analysis and market insights, be sure to explore additional resources on Wealth and take charge of your financial journey today.

MORE...City Dealmaker iO Finance Swoops in with £40m Seneca Trade Finance Acquisition

Finance

2025-04-25 15:43:15

At the heart of our financial services, we currently oversee a diverse portfolio of nearly 300 companies. Our flexible lending approach provides businesses with substantial financial support, offering loan facilities up to £300,000. While our maximum threshold is impressive, most of our clients benefit from strategic loans averaging around £100,000, tailored to meet their specific business needs and growth objectives. MORE...

Financial Roadblocks: How Outdated Systems Are Strangling M&A Potential

Finance

2025-04-25 15:22:46

M&A Success Hindered by Outdated Finance Systems, Unit4 Research Reveals

Professional services firms are encountering substantial challenges in mergers and acquisitions (M&A) due to legacy back-office finance technologies, according to groundbreaking research by Unit4. The study highlights how antiquated financial systems are creating significant integration bottlenecks and potential value erosion during critical business transformation processes.

Modern organizations increasingly recognize that technological infrastructure plays a pivotal role in seamless merger integration. Outdated financial platforms not only slow down consolidation efforts but also compromise a company's ability to realize the full strategic potential of strategic acquisitions.

The research underscores the urgent need for financial system modernization, emphasizing that firms with agile, adaptable back-office technologies can dramatically accelerate M&A processes, reduce integration risks, and maintain competitive momentum in rapidly evolving market landscapes.

By investing in contemporary financial management solutions, professional services firms can transform potential integration challenges into strategic opportunities, ensuring smoother transitions and more effective value realization in an increasingly complex business environment.

MORE...Wall Street Trembles: Is America's Financial Foundation Cracking?

Finance

2025-04-25 14:19:58

The landscape of public life, economic systems, and market dynamics has become increasingly troubling, with problematic behaviors, misguided concepts, and questionable policies taking root—a development that has caught even the most passionate Trump supporters off guard. What was once considered unthinkable has now become a disturbing new normal, challenging long-held assumptions about governance, economic integrity, and social norms. The proliferation of destructive patterns has reached a point where traditional safeguards seem ineffective, leaving many observers bewildered and concerned. Supporters who once viewed the current administration with unwavering optimism are now confronting uncomfortable realities that challenge their previous beliefs and expectations. As these troubling trends continue to spread, the potential long-term consequences for national stability, economic health, and social cohesion become increasingly apparent. The mounting evidence suggests a systemic shift that goes beyond mere political disagreement, pointing to deeper structural challenges that demand serious attention and thoughtful intervention. MORE...

Breaking: How Millennials Are Torching Traditional Retirement with FIRE Strategy

Finance

2025-04-25 13:52:00

Unlocking Early Retirement: Expert Insights from Financial Strategists

In a compelling conversation between WESH 2's Jason Guy and Reshell Smith, founder and CEO of AMES Financial Solutions, the path to early retirement was demystified, offering viewers a roadmap to financial freedom.

Smith shared critical strategies for those dreaming of leaving the traditional workforce ahead of schedule. The key, she emphasized, isn't just about saving money, but about smart, strategic financial planning that maximizes both savings and investments.

Key Strategies for Early Retirement Success

- Develop a comprehensive financial plan tailored to your personal goals

- Diversify investment portfolios to minimize risk

- Consistently invest a significant portion of your income

- Understand and leverage tax-advantaged retirement accounts

"Early retirement isn't a distant dream," Smith explained, "it's an achievable goal with disciplined financial management and strategic investment choices."

By implementing these expert-recommended approaches, individuals can transform their financial futures and potentially retire years—even decades—earlier than traditional retirement timelines suggest.

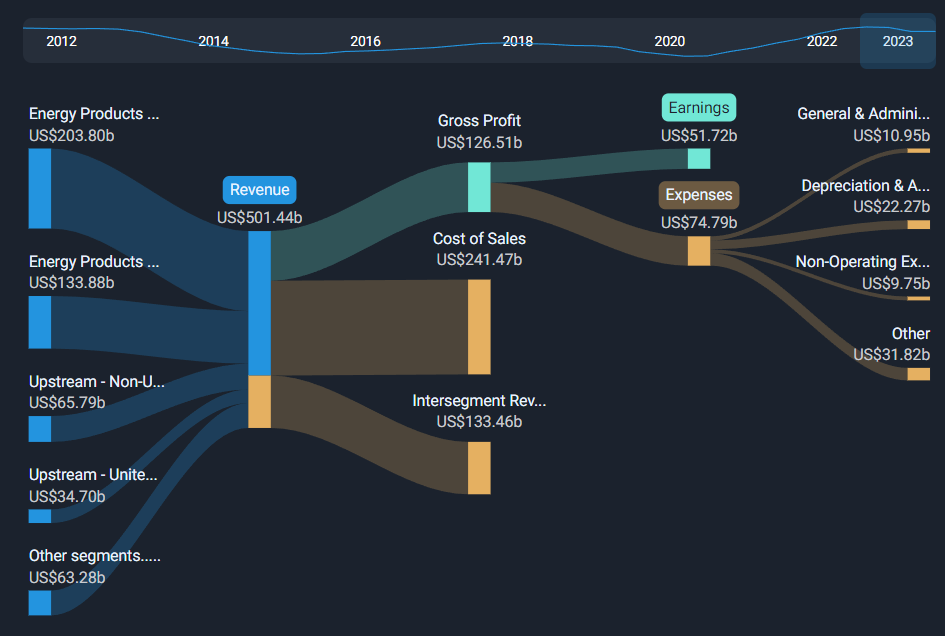

MORE...Wall Street Cheers: Google's Financial Triumph Sparks Investor Excitement

Finance

2025-04-25 13:36:52

Alphabet Delivers Strong Q1 Performance, Showcasing Tech Giant's Resilience Google's parent company, Alphabet, unveiled its first-quarter earnings report on Thursday, offering investors and tech enthusiasts a glimpse into the company's robust financial health. The tech behemoth demonstrated remarkable strength across its diverse portfolio of businesses, with notable performance in key segments like Google Cloud and digital advertising. The earnings report highlighted Alphabet's ability to navigate challenging economic landscapes while maintaining steady growth. Investors were particularly impressed by the company's strategic initiatives and continued innovation across its core platforms. Google Cloud showed significant momentum, reinforcing Alphabet's position as a formidable player in the cloud computing market. Despite ongoing economic uncertainties, Alphabet's diversified business model and strong revenue streams have positioned the company as a resilient force in the technology sector. The Q1 results underscore the company's continued commitment to technological advancement and strategic investment in emerging technologies. Analysts are closely watching how Alphabet will continue to leverage its strengths in artificial intelligence, cloud computing, and digital advertising in the coming quarters, as the company remains at the forefront of technological innovation. MORE...

Campaign Cash Crunch: Tuberville's Legal Tightrope Walk

Finance

2025-04-25 13:09:15

A controversial campaign claim by an Alabama senator has sparked legal scrutiny after asserting the ability to transfer over $600,000 in federal campaign funds to a state-level race—a move that would directly violate Alabama's stringent campaign finance regulations. Under Alabama law, candidates are strictly limited to transferring only $1,000 between campaign accounts. Any attempt to circumvent this restriction could result in serious legal consequences, potentially qualifying as a Class C felony. The senator's bold assertion has raised eyebrows among election law experts and political watchdogs who are closely examining the potential legal implications. The proposed fund transfer far exceeds the state's narrow legal threshold, suggesting a potential deliberate attempt to skirt established campaign finance rules. Legal experts warn that such actions could not only lead to criminal charges but also significant political and professional repercussions for the candidate. As the situation unfolds, the senator's campaign faces mounting pressure to clarify the statement and demonstrate compliance with Alabama's rigorous campaign finance regulations. The incident underscores the critical importance of understanding and adhering to state-specific electoral guidelines. MORE...

Money Traps Revealed: Where Your Wallet Bleeds Without You Noticing

Finance

2025-04-25 12:29:22

Unmasking Hidden Expenses: Your Guide to Smarter Spending

In the complex world of personal finance, hidden expenses can silently drain your bank account without you even realizing it. Financial expert Eric Brotman, a Certified Financial Planner (CFP®), reveals the subtle spending traps that many people unknowingly fall into and provides strategic insights to help you regain control of your financial health.

The Sneaky Culprits of Overspending

Most people don't intentionally waste money, but unconscious spending habits can quickly derail your financial goals. Brotman identifies several common money-draining behaviors:

- Impulse online shopping

- Subscription services you rarely use

- Frequent dining out or food delivery

- Unused gym memberships

- Automatic recurring charges

Strategies to Track and Reduce Hidden Expenses

Take control of your spending with these expert-recommended techniques:

- Conduct a comprehensive review of your monthly statements

- Use budgeting apps to categorize and monitor expenses

- Set up alerts for unusual spending patterns

- Regularly audit subscriptions and memberships

- Create a realistic budget with built-in flexibility

The Power of Mindful Spending

By understanding and addressing hidden expenses, you can transform your financial landscape. Brotman emphasizes that awareness is the first step toward meaningful financial change. Small adjustments can lead to significant savings and improved financial well-being.

"Financial freedom isn't about how much you earn, but how wisely you manage what you have," says Brotman.

Start your journey to smarter spending today by implementing these insights and taking a proactive approach to your personal finances.

MORE...Fintech Future: Iowa State Unveils Cutting-Edge Master's Degree in Financial Technology

Finance

2025-04-25 12:24:20

Iowa State University: A Beacon of Innovation and Academic Excellence

Nestled in the heart of Ames, Iowa, Iowa State University (ISU) stands as a premier public research institution with a rich history of academic achievement and groundbreaking innovation. Founded in 1858, the university has consistently been at the forefront of educational and research excellence.

Academic Prowess and Research Leadership

ISU is renowned for its exceptional programs in engineering, agriculture, and scientific research. As a land-grant university, it has a proud tradition of transforming knowledge into practical solutions that benefit communities both locally and globally. The campus boasts world-class facilities and attracts top-tier faculty and students from across the nation and around the world.

Vibrant Campus Life and Opportunities

With over 36,000 students, Iowa State offers a dynamic and inclusive learning environment. The university provides numerous opportunities for hands-on learning, research experiences, and personal growth. Students can choose from more than 100 undergraduate majors and participate in cutting-edge research projects that push the boundaries of human knowledge.

A Commitment to Innovation

The university's commitment to innovation is exemplified by its strong ties to industry and its entrepreneurial spirit. Iowa State has been a catalyst for technological advancements, with numerous patents and startup companies emerging from its research programs. The campus ecosystem encourages creativity, critical thinking, and practical problem-solving.

Community and Impact

Beyond academic excellence, Iowa State University is deeply committed to serving its community and making a positive impact on the world. Through extensive outreach programs, research initiatives, and community partnerships, the university continues to be a driving force of progress and innovation in Iowa and beyond.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421