Economic Resilience: Hong Kong Forecasts Steady 2-3% Growth for 2025

Finance

2025-02-26 03:18:38

Hong Kong's Economic Outlook: Navigating Challenges with Cautious Optimism Financial Secretary Paul Chan unveiled a measured economic forecast on Wednesday, projecting Hong Kong's economic growth to range between 2% and 3% in the coming year. This projection follows a modest 2.5% growth in 2024, signaling the city's resilience amid complex global economic challenges. The forecast comes at a critical time as Hong Kong grapples with a fiscal deficit and navigates through turbulent economic waters. The city's economic strategy is being carefully calibrated to address ongoing challenges, including a persistently weak property market and increasing global uncertainties. Chan's projection reflects a pragmatic approach to economic management, acknowledging the potential headwinds while maintaining a sense of cautious optimism. The financial leadership is actively working on strategies to stabilize the economy, boost investor confidence, and create sustainable growth pathways. As Hong Kong continues to position itself as a key financial hub, these economic projections underscore the city's commitment to economic adaptability and strategic financial planning in an ever-changing global landscape. MORE...

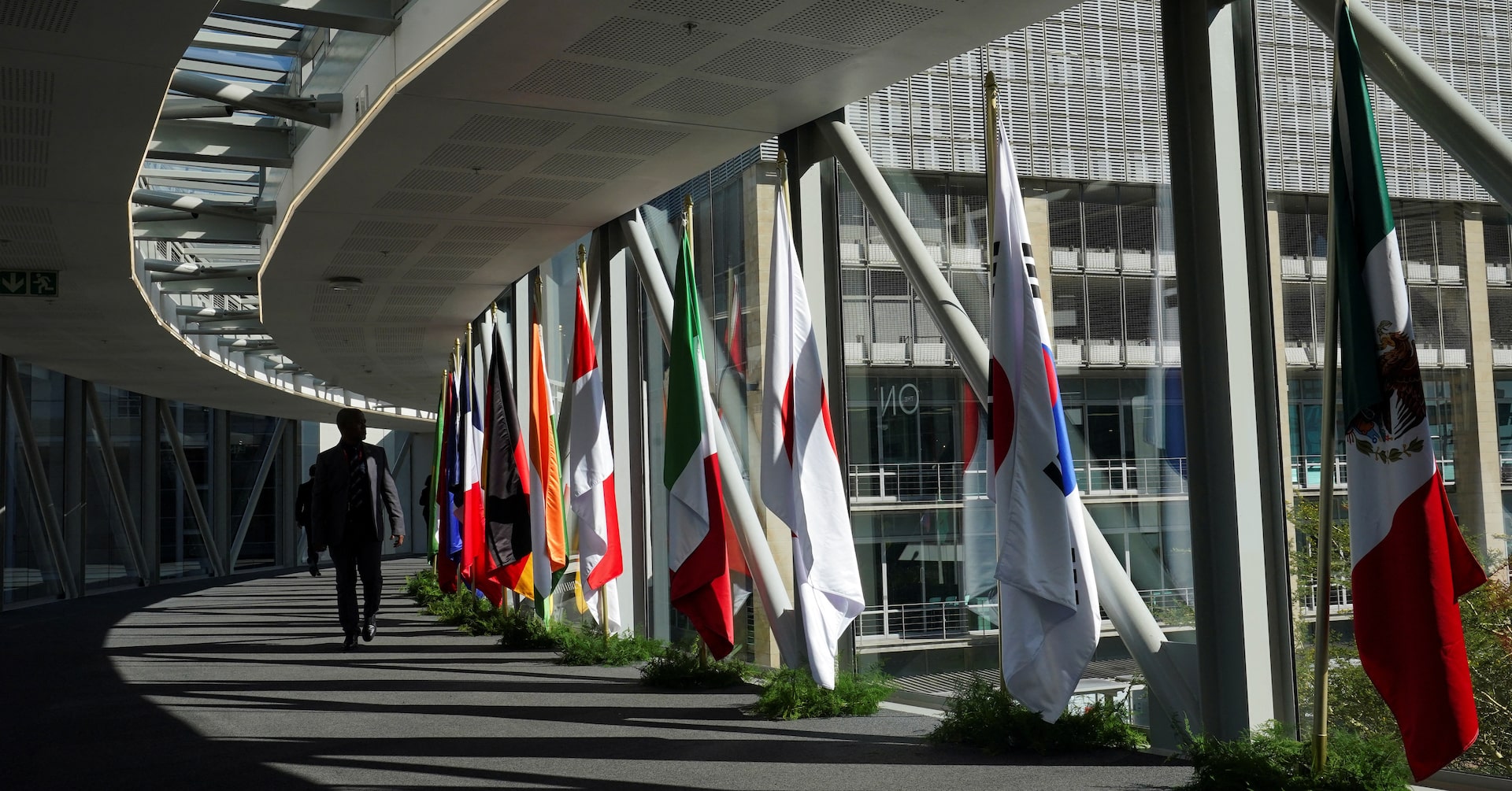

Global Economic Powerhouses Converge: G20 Finance Chiefs Brace for Turbulent Diplomatic Showdown

Finance

2025-02-26 01:09:22

The world's most influential financial leaders are converging in South Africa this week, as G20 finance ministers and central bankers prepare for a high-stakes summit overshadowed by diplomatic tensions and notable absences. The two-day gathering, set to unfold on Wednesday and Thursday, promises to be a complex diplomatic dance, with key members either missing or participating with limited engagement. At the heart of the discussions lie critical global challenges: climate change, mounting national debts, and the widening chasm of economic inequality. These pressing issues are set to take center stage, even as geopolitical undercurrents threaten to complicate meaningful dialogue and collaborative solutions. The meeting's subdued atmosphere reflects the current state of international economic cooperation, with underlying tensions potentially hampering the group's ability to forge unified strategies for addressing global financial challenges. Despite the obstacles, the summit remains a crucial platform for the world's top economies to engage in critical conversations about our shared economic future. MORE...

Mega AI Ambitions: Meta's Jaw-Dropping $200B Data Center Venture Unveiled

Finance

2025-02-26 00:56:54

Meta Platforms is exploring an ambitious plan to develop a massive data center campus dedicated to powering its cutting-edge artificial intelligence initiatives, with potential investments potentially soaring beyond $200 billion, according to an exclusive report by The Information on Tuesday. Sources close to the matter revealed that the tech giant is seriously considering constructing a sprawling complex that would serve as a technological powerhouse for its AI development and infrastructure. This unprecedented investment signals Meta's aggressive commitment to staying at the forefront of artificial intelligence innovation. The proposed data center campus represents a significant strategic move by Meta, underscoring the company's determination to compete aggressively in the rapidly evolving AI landscape. By potentially investing hundreds of billions of dollars, Meta aims to create a state-of-the-art facility that could revolutionize its AI capabilities and computational infrastructure. While specific details remain confidential, the scale of the proposed project suggests Meta is preparing for a major technological leap in its AI research and development efforts. Industry experts are closely watching this potential development, which could have far-reaching implications for the future of artificial intelligence. MORE...

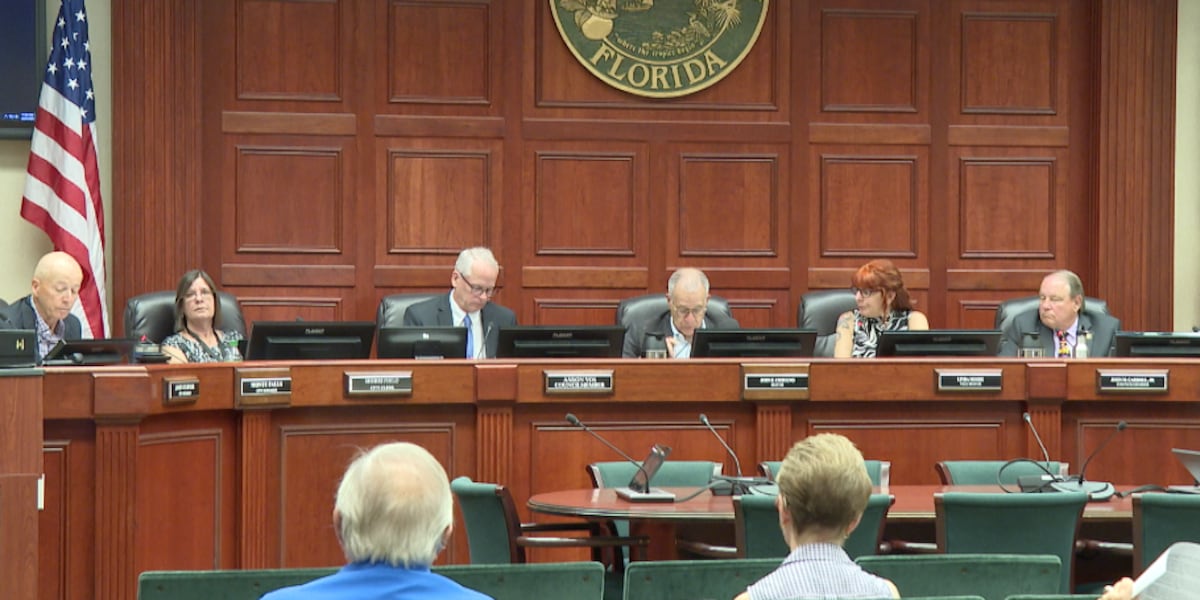

Financial Fallout: Vero Beach Director Axed for Audit Deadline Disaster

Finance

2025-02-25 23:46:00

In a swift response to recent financial challenges, the city has taken decisive action by appointing a new finance director. This proactive move demonstrates the city's commitment to financial stability and strategic planning. The newly appointed director is already diving deep into the city's financial landscape, with a primary focus on maximizing potential grant opportunities from the state. By bringing in fresh leadership and expertise, the city aims to ensure that no valuable funding sources are overlooked. The finance director is meticulously reviewing current grant applications and exploring additional funding avenues that could provide critical resources for municipal projects and community development. This strategic approach underscores the city's dedication to fiscal responsibility and proactive financial management. Residents can be confident that their local government is working diligently to secure every possible financial resource to support ongoing and future initiatives. MORE...

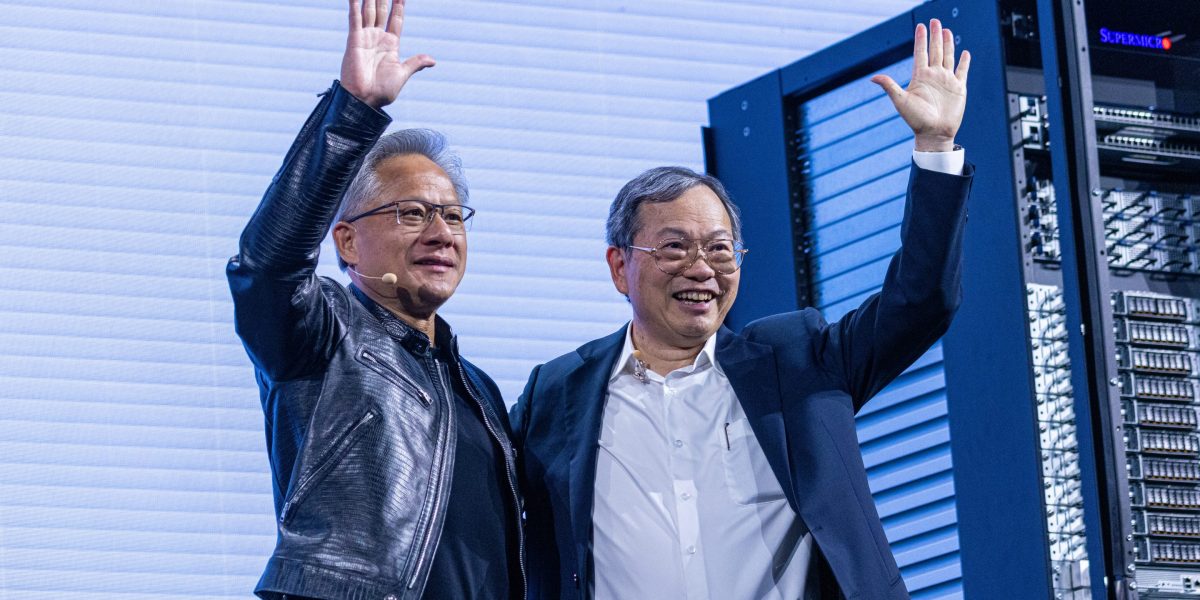

Delayed and Defiant: Super Micro's Financial Reveal Pins Blame on EY Audit Bottleneck

Finance

2025-02-25 23:31:22

Super Micro Computer, Inc. has proactively addressed market concerns by confirming its compliance with SEC financial reporting requirements. The technology company has emphatically stated that all of its financial filings remain current and accurate, with no need for any historical restatements. This announcement comes as a reassuring message to investors and stakeholders, underscoring the company's commitment to financial transparency and regulatory adherence. By promptly addressing potential uncertainties, Super Micro demonstrates its dedication to maintaining clear and reliable financial communications. The company's declaration serves to reinforce confidence in its financial reporting processes and ongoing corporate governance, signaling stability in its financial management approach. MORE...

Norway Steps In: Fueling Ukraine's Energy Lifeline Amid War

Finance

2025-02-25 23:21:27

In a strategic move to support Ukraine during its ongoing conflict with Russia, Norway has stepped forward to provide critical financial assistance for Ukraine's natural gas purchases. The announcement, made by Naftogaz, Ukraine's state energy company, comes at a crucial time when the country's energy infrastructure is under severe strain due to Russian military attacks. As Ukraine continues to face significant challenges to its energy system, Norway's financial support represents a lifeline for the nation's energy security. The increased natural gas imports are essential for maintaining Ukraine's energy stability amid the destructive impacts of the ongoing war. This gesture of solidarity not only provides practical economic support but also demonstrates international solidarity with Ukraine during its time of crisis. The financing arrangement is expected to help Ukraine maintain its energy supplies and mitigate the devastating effects of Russian attacks on its critical infrastructure, ensuring that Ukrainian citizens can continue to access essential energy resources during this difficult period. MORE...

Financial Shake-Up: EQB Reveals Strategic Leadership Transition

Finance

2025-02-25 22:35:00

EQB Inc. Announces Leadership Transition: Chadwick Westlake to Step Down as CFO In a strategic management update, EQB Inc. (TSX: EQB) revealed today that Chadwick Westlake will be departing from his role as Senior Vice President and Chief Financial Officer. Westlake is set to conclude his tenure effective March, marking a significant transition for the financial institution. The company's announcement signals a potential reshaping of its executive leadership team, with Westlake's departure creating an opportunity for new financial leadership. While specific details about his future plans or the immediate succession strategy were not disclosed, the move suggests EQB Inc. is preparing for potential organizational changes. Investors and stakeholders will likely be watching closely to see how the company navigates this leadership transition and who will be selected to fill the critical CFO position in the coming weeks. MORE...

Cava's Quarterly Rollercoaster: Investors Brace for Unexpected Turbulence

Finance

2025-02-25 22:13:32

Cava Group's Stock Takes a Dip After Mixed Earnings Report Mediterranean restaurant chain Cava Group experienced a stock pullback following its latest quarterly financial results, which presented a nuanced picture of the company's performance. While the restaurant brand exceeded revenue expectations, its earnings per share fell short of Wall Street predictions. The company reported impressive top-line revenue of $227.40 million, comfortably surpassing analysts' forecasts of $224.50 million. However, the bottom line told a different story, with adjusted earnings per share landing at $0.05, compared to the anticipated $0.07 projected by financial experts. Yahoo Finance Senior Reporter Brooke DiPalma delved into the earnings results, offering critical insights into how ongoing challenges like inflation and tariffs might shape Cava's strategic approach in the coming quarters. Her analysis provides investors and industry watchers with a comprehensive understanding of the restaurant chain's current financial landscape. For those seeking deeper market insights and expert analysis of the latest market movements, be sure to explore more coverage on Market Domination Overtime. MORE...

Sick Time Shake-Up: Local Finance Pros Reveal Game-Changing Workplace Reforms

Finance

2025-02-25 22:06:17

In the wake of recent workplace transformations, employers are rapidly adapting to the growing demand for paid sick leave. The pandemic has fundamentally reshaped how companies approach employee wellness and workplace policies. Forward-thinking organizations are now recognizing that comprehensive sick leave isn't just a benefit—it's a critical component of maintaining a healthy, productive workforce. Employees increasingly expect comprehensive health support that goes beyond traditional healthcare coverage. Key strategies employers are implementing include: • Developing flexible sick leave policies that accommodate various health scenarios • Creating clear communication channels about sick leave rights and procedures • Offering comprehensive paid time off that supports both physical and mental health • Implementing digital tracking systems to manage sick leave efficiently Companies that proactively address these workforce expectations are finding significant advantages. They're experiencing improved employee morale, reduced workplace transmission of illnesses, and enhanced overall organizational resilience. The shift towards robust sick leave policies represents more than a trend—it's a fundamental reimagining of workplace culture. Employers who embrace these changes are positioning themselves as employers of choice in an increasingly competitive talent marketplace. MORE...

AI Finance Startup Auditoria.AI Secures Massive $38M Funding to Revolutionize Enterprise Intelligence

Finance

2025-02-25 21:24:25

Auditoria.AI Secures Substantial $38 Million Funding to Revolutionize Enterprise Finance with Intelligent AI Agents In a significant milestone for enterprise artificial intelligence, Auditoria.AI has successfully closed a Series B funding round, raising an impressive $38 million. The investment signals strong market confidence in the company's innovative approach to transforming financial operations through advanced agentic AI technology. The funding will enable Auditoria.AI to accelerate its development of cutting-edge AI solutions specifically designed to empower finance teams across various industries. By leveraging sophisticated artificial intelligence, the company aims to streamline complex financial processes, enhance operational efficiency, and provide intelligent automation capabilities that can adapt and learn from intricate business workflows. With this substantial financial backing, Auditoria.AI is poised to expand its technological capabilities, strengthen its market presence, and continue pushing the boundaries of AI-driven financial intelligence. The company's commitment to developing intelligent, context-aware AI agents represents a pivotal advancement in how enterprises can optimize their financial management strategies. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421