Wall Street Wobbles: Dow Plummets as Trade Tensions Spark Market Mayhem

Finance

2025-04-07 20:00:44

Wall Street Reels from Massive Market Selloff Triggered by Trade Tensions Investors experienced a turbulent week as financial markets suffered their most significant downturn since the early days of the COVID-19 pandemic. The stock market witnessed a staggering loss of over $5 trillion in total market value, driven by escalating concerns over potential trade tariffs and economic uncertainty. The dramatic market decline reflects growing investor anxiety about the potential economic impact of proposed trade policies. Uncertainty surrounding international trade relations has sparked widespread sell-offs across major indices, with investors rapidly repositioning their portfolios to mitigate potential risks. The substantial market correction underscores the fragile nature of global financial markets and the profound influence of geopolitical tensions on investor sentiment. As traders and analysts closely monitor developing economic signals, the week's dramatic market movements serve as a stark reminder of the complex interconnections within the global financial ecosystem. With billions of dollars in market capitalization evaporating in a matter of days, investors are bracing for potential continued volatility and reassessing their investment strategies in an increasingly unpredictable economic landscape. MORE...

Syria Taps Financial Veteran to Steer Central Bank Through Economic Turbulence

Finance

2025-04-07 19:57:00

In a significant administrative move, Syria's interim President Ahmed al-Sharaa has named Abdul Qadir al-Hasriya as the new governor of the country's central bank, according to state media reports on Monday. The appointment comes amid ongoing challenges in Syria's financial landscape, which has been severely impacted by years of conflict and economic instability. Al-Hasriya's selection signals a potential shift in the nation's monetary policy and economic management, as Syria continues to navigate the complex aftermath of its prolonged civil war. The central bank leadership change represents a critical step in the country's efforts to rebuild and stabilize its financial infrastructure. MORE...

Tech Titans Tremble: Trump's Tariff Tsunami Rocks Wall Street's Darlings

Finance

2025-04-07 19:06:20

Tech Giants Ride Market Turbulence as Trade Tensions Escalate The tech world's most celebrated stocks—collectively known as the "Magnificent Seven"—experienced a rollercoaster trading session on Monday, as global markets continued to reel from the Trump administration's controversial tariff strategy. For the third consecutive day, investors watched with bated breath as these tech titans navigated through unprecedented market volatility. The dramatic market swings underscored the delicate balance of international trade relations and the potential ripple effects on technology stocks. As uncertainty loomed, these influential companies demonstrated both resilience and vulnerability in the face of complex geopolitical challenges. Investors and market analysts closely monitored the performance of these tech giants, recognizing that their movements could signal broader economic trends and investor sentiment in an increasingly interconnected global marketplace. MORE...

Wallet-Wise: Surviving Trump's Trade Tsunami with 3 Financial Lifelines

Finance

2025-04-07 18:37:09

Trump's Tariffs: Navigating Market Uncertainty with Confidence

The recent wave of import tariffs imposed by President Trump is sending ripples of uncertainty through the U.S. financial landscape, creating what personal finance expert Michelle Singletary describes as a "scary ride" for investors and consumers alike.

To help Americans weather this economic turbulence, Singletary offers three crucial strategies for maintaining financial stability:

- Stay Informed: Keep a close eye on market trends and understand how tariffs might impact your personal finances

- Diversify Investments: Spread your portfolio across different sectors to minimize potential risks

- Maintain a Long-Term Perspective: Don't make hasty financial decisions based on short-term market fluctuations

By following these guidelines, consumers can navigate the current economic challenges with greater confidence and resilience.

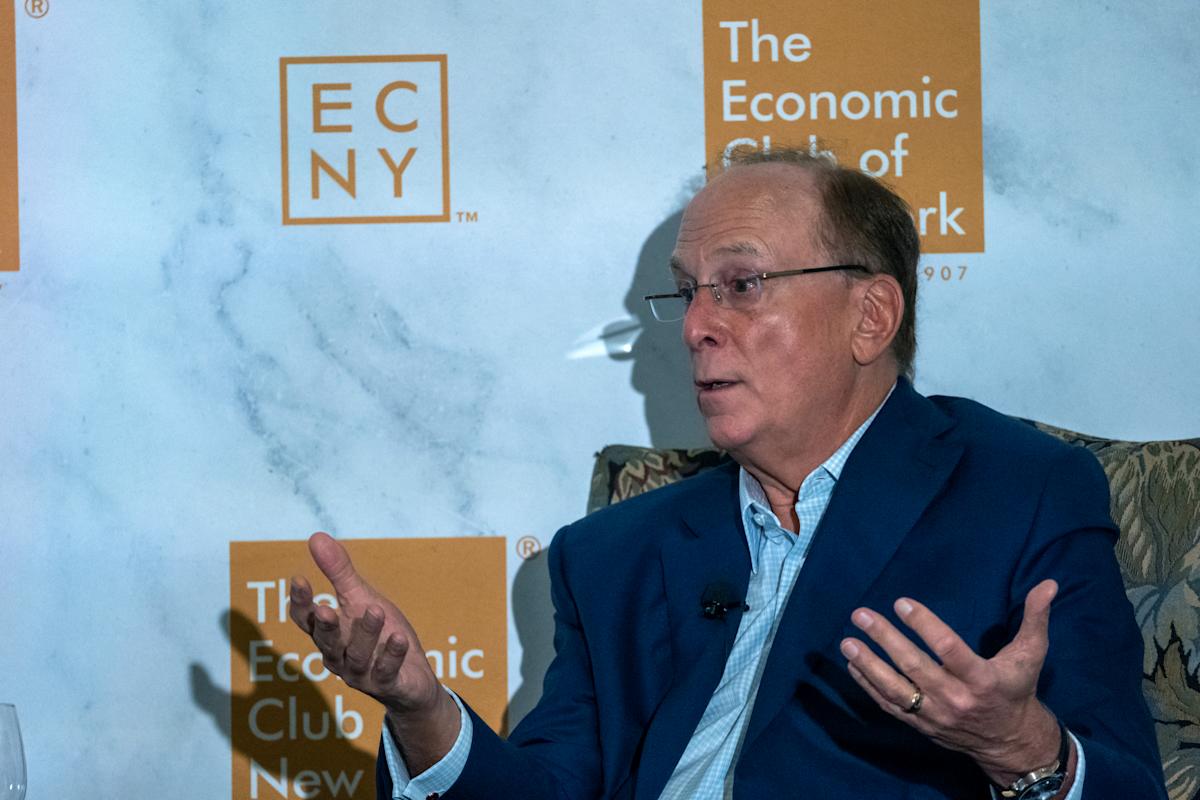

MORE...Corporate Pulse: CEOs Signal Economic Storm Brewing, BlackRock's Fink Reveals

Finance

2025-04-07 18:16:53

In a stark warning that sent ripples through financial markets, the chief executive of BlackRock, the world's largest investment management firm, painted a sobering picture of the current economic landscape. The top executive suggested that stock markets could potentially plummet an additional 20% from current levels, reflecting growing concerns about economic stability. Drawing from direct conversations with corporate leaders across various industries, the BlackRock boss revealed a consensus among executives that the United States may already be experiencing a recession. His candid assessment highlights the mounting economic challenges facing businesses and investors in the current volatile market environment. The comments underscore the increasing uncertainty and potential downside risks that investors and companies are navigating, signaling a potentially turbulent period ahead for financial markets and the broader economy. MORE...

Breaking: Haball Secures Massive $52M Funding, Revolutionizing Pakistan's Financial Tech Landscape

Finance

2025-04-07 18:00:00

Pakistan's Supply Chain Finance Sector Surges to Impressive $9 Billion Milestone The supply chain finance landscape in Pakistan is experiencing remarkable growth, with recent estimates revealing a staggering valuation exceeding $9 billion. This dynamic financial ecosystem is transforming how businesses manage working capital, streamline financial operations, and unlock new opportunities for economic expansion. As global economic challenges persist, Pakistani enterprises are increasingly turning to innovative supply chain finance solutions to enhance liquidity, reduce financial risks, and optimize their operational efficiency. The sector's substantial valuation reflects the growing sophistication of financial strategies among local and international businesses operating within the country. Key drivers behind this impressive growth include technological advancements, increased digital adoption, and a more progressive approach to financial management. Financial institutions and fintech companies are playing a crucial role in developing sophisticated supply chain finance platforms that connect suppliers, buyers, and financial institutions seamlessly. The $9 billion valuation not only highlights the sector's current strength but also signals significant potential for future expansion, positioning Pakistan as an emerging hub for innovative financial solutions in the supply chain finance domain. MORE...

Wall Street's Regret: How Trump Supporters in Finance Are Changing Their Tune

Finance

2025-04-07 17:11:41

The irony grows more palpable with each passing moment: Wall Street's once-enthusiastic supporters of Donald Trump are now experiencing a stark awakening. As the consequences of their political backing unfold, one can't help but ask the burning question - what exactly did they anticipate would happen? The very financiers who championed Trump's rise are now watching in disbelief as the policies they helped propel begin to reveal their true, potentially destructive nature. Their growing unease and reluctance speak volumes about the disconnect between political rhetoric and real-world implications. What seemed like a strategic alliance during the campaign now appears to be a classic case of political miscalculation. These Wall Street power brokers, who believed they could navigate and control the political landscape, are finding themselves increasingly marginalized and surprised by the unpredictable trajectory of the movement they helped create. The mounting sense of regret among Trump's financial backers serves as a potent reminder that political endorsements are never without risk, and the line between calculated support and unintended consequences can be razor-thin. MORE...

Market Optimism Rises: Wall Street Insider Predicts Stock Rally Amid Tax Tensions

Finance

2025-04-07 16:09:16

In the wake of President Trump's latest tariff bombshell, Wall Street strategists are scrambling to adjust their year-end projections. While most financial experts are trimming their price targets and bracing for market turbulence, one bold strategist stands apart, maintaining an optimistic outlook and predicting a potential market rebound. Despite the widespread pessimism sweeping through financial circles, this contrarian voice suggests that the current market volatility might be temporary. The strategist believes that the market's resilience and underlying economic fundamentals could help investors navigate through the current trade tensions. As investors and analysts continue to parse the potential implications of the new tariffs, this lone voice of optimism serves as a reminder that market predictions are never a one-size-fits-all proposition. The financial landscape remains dynamic, and unexpected opportunities can emerge even in challenging economic environments. MORE...

Wall Street's New Architects: How Artificial Intelligence Is Rewriting Financial Strategies

Finance

2025-04-07 15:40:53

In the rapidly evolving world of finance and accounting, leaders are increasingly turning to cutting-edge AI technologies to revolutionize their operations. Embedded predictive, generative, and agentic AI capabilities are emerging as powerful tools that promise to transform traditional workflows by driving unprecedented levels of automation, generating profound business insights, and dramatically enhancing operational efficiency. These advanced AI technologies are not just incremental improvements, but game-changing solutions that enable finance professionals to move beyond routine number-crunching and strategic decision-making. By leveraging intelligent algorithms and machine learning models, organizations can now predict financial trends, automate complex processes, and unlock strategic value with remarkable precision and speed. As businesses seek competitive advantages in an increasingly data-driven landscape, the integration of sophisticated AI capabilities represents a critical strategic imperative for finance and accounting departments looking to stay ahead of the curve and drive meaningful organizational transformation. MORE...

Trade War Titans: What Ackman, Marks, and Wall Street's Elite Are Really Saying About Tariffs

Finance

2025-04-07 15:39:36

Workplace Discontent: When Employees Feel Undervalued

In today's competitive job market, employee satisfaction is more than just a buzzword—it's a critical factor in organizational success. Recent studies reveal a growing trend of workplace dissatisfaction that should concern business leaders and managers alike.

Employees are increasingly vocal about their frustrations, citing issues ranging from stagnant wages to limited career advancement opportunities. The modern workforce doesn't just want a paycheck; they seek meaningful work, recognition, and a sense of purpose.

Key factors contributing to workplace unhappiness include:

- Lack of professional development

- Poor communication from management

- Inadequate compensation

- Limited work-life balance

Smart organizations are taking proactive steps to address these concerns. By implementing flexible work arrangements, offering continuous learning opportunities, and creating transparent communication channels, companies can transform workplace culture and boost employee morale.

The message is clear: happy employees are productive employees. It's time for businesses to listen, adapt, and invest in their most valuable asset—their people.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421