Campaign Cash Controversy: Evan Low's $106,000 Financial Disclosure Scandal Unveiled

Finance

2025-04-01 05:32:23

In a twist of events, Low's initial statement to investigators portrayed Baldwin's attendance at the February 7, 2020 fundraiser as a voluntary, independent act. However, the commission uncovered a complex web of communication that told a different story. Numerous internal messages revealed a deliberate attempt by organizers to obscure the nonprofit's financial arrangements with Baldwin, carefully crafting draft contracts to conceal the true nature of his involvement. The correspondence between event organizers exposed a calculated effort to mask the financial transactions, suggesting that Baldwin's participation was far from the spontaneous, altruistic engagement Low had initially claimed. These hidden communications painted a picture of a more orchestrated and potentially problematic relationship between the nonprofit and Baldwin. MORE...

High-Stakes Showdown: UK Supreme Court Weighs Landmark Motor Finance Ruling

Finance

2025-04-01 05:00:00

A High-Stakes Legal Battle Looms: Motor Finance Compensation Case Heads to UK Supreme Court The British financial landscape is bracing for a landmark legal showdown that could potentially reshape motor finance regulations and trigger billions in consumer compensation. The Supreme Court is set to hear one of the most closely watched legal cases in recent years, which centers on the accountability of lenders in the motor finance industry. This pivotal case promises to scrutinize the extent of financial institutions' responsibilities and could have far-reaching implications for consumers and the automotive lending sector. At the heart of the dispute is a complex question: Should lenders be held liable for potentially massive compensation claims that could fundamentally alter the motor finance market? Legal experts and industry insiders are eagerly anticipating the Supreme Court's deliberations, recognizing that the outcome could set a critical precedent for future consumer protection and financial regulation in the United Kingdom. The hearing represents a crucial moment for both consumers and financial institutions, with billions of pounds hanging in the balance and the potential to dramatically transform motor finance practices across the country. MORE...

Money Matters Unveiled: Your Financial Roadmap for April 2025 Revealed

Finance

2025-04-01 04:30:00

Celestial Financial Forecast: Navigating Money Matters Across the Zodiac

Today's astrological insights reveal a critical moment for financial planning and strategic money management across all zodiac signs. The cosmic alignment suggests a period of careful financial navigation, urging individuals to approach their monetary decisions with wisdom and restraint.

Key Financial Guidance

- Exercise prudence in financial investments

- Avoid impulsive spending and speculative ventures

- Focus on long-term financial stability

The stars are signaling a time for measured financial strategies. Whether you're a risk-taking Aries or a methodical Capricorn, the current cosmic energy emphasizes the importance of thoughtful money management. Unexpected opportunities may arise, but caution should be your primary companion.

Practical Recommendations

Financial experts and astrological advisors recommend:

- Review current financial commitments

- Create a detailed budget

- Postpone major purchases

- Prioritize savings and emergency funds

Remember, while the stars offer guidance, personal financial responsibility remains paramount. Use this period to strengthen your financial foundation and make informed decisions that align with your long-term goals.

MORE...Interest Rate Standstill: RBA's Tough Love Advice for Mortgage-Stressed Australians

Finance

2025-04-01 03:30:13

RBA Holds Steady: Interest Rates Remain Unchanged at 4.10%

In a closely watched decision, the Reserve Bank of Australia (RBA) has opted to maintain its current cash rate at 4.10%, signaling a pause in its aggressive monetary tightening strategy. This latest move comes after a series of rate hikes aimed at curbing persistent inflation.

The central bank's decision reflects a delicate balancing act between controlling rising prices and avoiding potential economic strain. By keeping interest rates on hold, the RBA is taking a cautious approach to assess the full impact of previous rate increases on the Australian economy.

Key factors influencing this decision include:

- Moderating inflation trends

- Ongoing global economic uncertainties

- Potential risks to household spending and business investment

While borrowers might breathe a temporary sigh of relief, economists continue to watch closely for any signals of future monetary policy shifts. The RBA remains committed to bringing inflation back to its target range while minimizing economic disruption.

Australians are advised to stay informed and prepare for potential future changes in the interest rate landscape.

MORE...Armenia Pulls Back: Defying Moscow's Security Alliance Demands

Finance

2025-04-01 03:13:47

In a significant diplomatic move, Armenia has declined to fulfill its financial obligations to the Collective Security Treaty Organization (CSTO), a military alliance led by Moscow. The country's Foreign Ministry announced on March 31 that it would withhold its budgetary contributions for the previous year, following its decision to suspend participation in the organization last August. This latest development underscores the growing tensions between Armenia and the CSTO, a Russia-dominated security bloc that has been increasingly scrutinized for its effectiveness in regional conflicts. By refusing to pay its dues, Armenia is sending a clear signal of its dissatisfaction with the organization's performance and its perceived inability to provide meaningful security guarantees. The suspension of Armenia's membership and subsequent financial non-compliance highlight the shifting geopolitical dynamics in the Caucasus region, where traditional alliances are being reevaluated in light of recent regional challenges and changing strategic priorities. MORE...

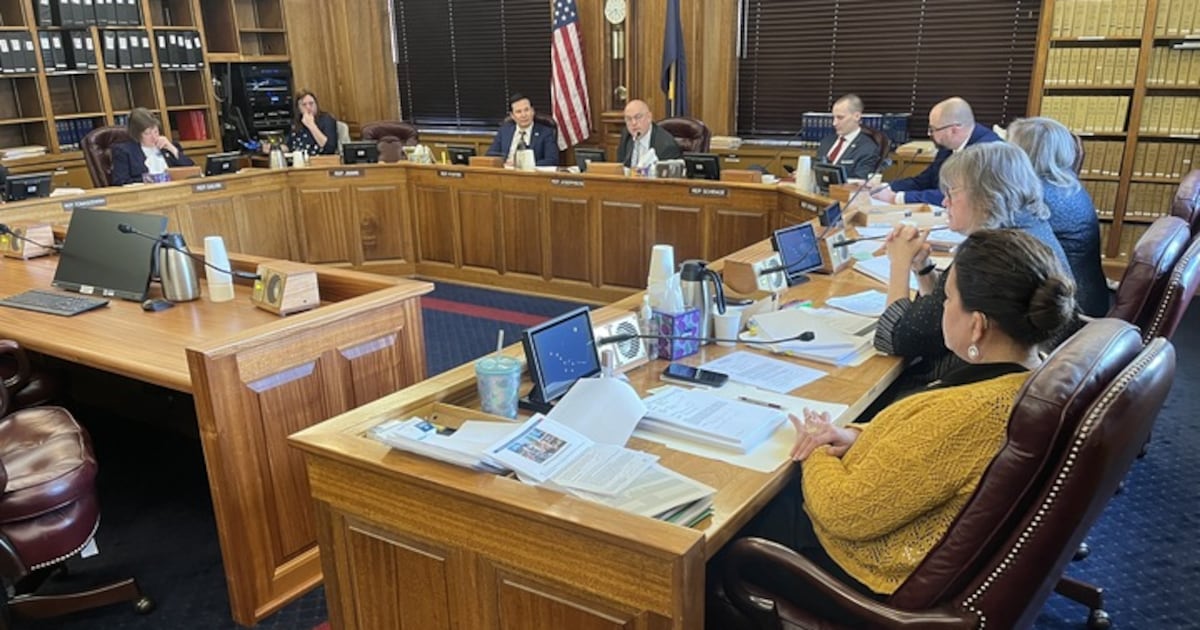

Gridlock in Juneau: Alaska's Budget Talks Hit Unexpected Roadblock

Finance

2025-04-01 02:03:40

As the legislative session progresses, two critical financial challenges continue to dominate budget negotiations: the Permanent Fund Dividend (PFD) and school funding. These complex issues remain at the heart of ongoing debates, with lawmakers struggling to find a balanced solution that meets the needs of Alaskan residents and the state's educational system. The Permanent Fund Dividend, a cornerstone of Alaska's unique financial landscape, has become a contentious point of discussion. Simultaneously, education funding hangs in the balance, with stakeholders eagerly awaiting a comprehensive resolution that will support the state's schools and students. Lawmakers are working diligently to bridge the gap between competing priorities, seeking a compromise that addresses both the PFD distribution and adequate school funding. The outcome of these negotiations will have far-reaching implications for Alaska's economic future and educational infrastructure. As tensions rise and deadlines approach, the pressure mounts to find a sustainable solution that balances fiscal responsibility with the community's expectations and needs. MORE...

Breaking Barriers: How African Finance Professionals Are Redefining Global Success

Finance

2025-04-01 00:00:35

Empowering Africa's Financial Future: A Conversation with Doris Odit Achenga In the dynamic world of finance, mentorship stands as a powerful catalyst for professional growth, especially across the African continent. Doris Odit Achenga, recognized as one of Private Funds CFO's New Faces of Finance, embodies this transformative approach to nurturing talent. As a rising star in the financial sector, Achenga understands the critical importance of guidance and support in developing the next generation of finance professionals. Her journey reflects the vibrant potential of African talent and the pivotal role mentorship plays in unlocking professional potential. Through her work and leadership, Achenga is not just advancing her own career but actively contributing to the broader narrative of professional development across Africa. She represents a new wave of financial leaders committed to lifting others as they climb, creating pathways for emerging professionals to excel and innovate in the financial landscape. Her story is a testament to the power of mentorship in bridging knowledge gaps, inspiring confidence, and creating sustainable professional ecosystems that drive economic growth and opportunity across the Mother Continent. MORE...

Runway Growth Finance: Howard Marks' Hidden Gem or Risky Investment?

Finance

2025-03-31 23:51:28

Runway Growth Finance Corp: A Deep Dive into Howard Marks' Investment Landscape

In our recent exploration of top investment opportunities, we highlighted 10 standout stocks recommended by the legendary Howard Marks of Oaktree Capital Management. Today, we're turning our spotlight on Runway Growth Finance Corp. (NASDAQ:RWAY), examining its potential and positioning within this elite investment portfolio.

Howard Marks, the renowned American billionaire investor, has built a reputation for identifying exceptional investment opportunities. His strategic approach at Oaktree Capital Management has consistently delivered remarkable insights into the financial markets.

Runway Growth Finance Corp. emerges as a particularly intriguing candidate in Marks' investment strategy. By delving into its fundamentals, market performance, and potential growth trajectory, investors can gain valuable insights into why this stock stands out among Marks' top recommendations.

As we continue to analyze the most promising investment opportunities, Runway Growth Finance Corp. represents a compelling case study in strategic financial selection. Investors looking to understand the nuanced approach of a world-class investor like Howard Marks will find this deep dive both informative and enlightening.

MORE...Trump's Financial Earthquake: Global Markets on High Alert

Finance

2025-03-31 23:12:41

A Potential Seismic Shift in Global Financial Dynamics The Trump administration may be on the brink of dramatically reshaping international organizational landscapes. In a bold move this February, the White House initiated a comprehensive six-month review of America's participation in global intergovernmental organizations, signaling a potentially transformative approach to international cooperation. The State Department has been tasked with conducting an extensive audit of all international bodies where the United States holds membership. The primary objective is to critically evaluate each organization's alignment with American national interests, with a clear willingness to withdraw from entities deemed contrary to the country's strategic goals. This unprecedented review suggests a significant departure from traditional diplomatic engagement, potentially setting the stage for a major reconfiguration of global institutional frameworks. By scrutinizing every international organization through a stringent lens of national benefit, the administration is demonstrating its commitment to a more transactional approach to global partnerships. The implications of such a review could be far-reaching, potentially challenging long-standing international collaborations and forcing a reevaluation of multilateral relationships that have been established over decades. MORE...

Wall Street's Grim Forecast: Recession Risks Climb as Markets Brace for Potential Downturn

Finance

2025-03-31 23:03:18

Investor sentiment has taken a sharp turn as financial markets grapple with mounting economic uncertainties. The stock market is experiencing significant turbulence, driven by a dramatic decline in consumer confidence and a sudden surge in inflation expectations. Investors are growing increasingly anxious as economic indicators point to potential challenges ahead. The recent market volatility reflects deeper concerns about the economic landscape. Consumers are feeling the pinch of rising prices and growing economic instability, which has translated into a notable drop in confidence levels. This shift in consumer sentiment is sending ripples through equity markets, causing investors to reassess their strategies and risk exposure. Particularly alarming is the spike in inflation expectations, which has become a key focal point for market participants. As prices continue to climb and economic pressures mount, investors are becoming more cautious, leading to increased market volatility and a more conservative approach to investment decisions. The interconnected nature of consumer confidence and market performance is becoming increasingly apparent, highlighting the delicate balance that drives economic sentiment and investment strategies in today's complex financial environment. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421