Trade Tensions and Policy Fog: How Global Uncertainty Is Shaking Financial Markets

Finance

2025-04-25 20:14:23

In a significant economic assessment, the Federal Reserve's bi-annual survey of financial risks has emerged as a critical snapshot of the current financial landscape, marking its first release since Donald Trump's potential return to the political forefront. This comprehensive report provides crucial insights into the potential economic challenges and vulnerabilities facing the United States financial system. The survey, known for its detailed analysis and forward-looking perspective, offers policymakers, investors, and economic experts a nuanced understanding of emerging financial risks. By examining key indicators and potential economic pressures, the Fed continues to play a pivotal role in monitoring and anticipating potential economic disruptions. Notably, this edition of the survey comes at a particularly sensitive time, reflecting the complex economic environment shaped by recent political and global economic developments. Analysts and economists are closely examining the report's findings to gauge potential economic strategies and preparedness in an increasingly unpredictable financial climate. MORE...

From Classroom to Boardroom: How a Finance Grad Transformed Leadership at Grand Canyon University

Finance

2025-04-25 19:07:28

Kennedy Herschberger's college journey was anything but ordinary. Four years ago, she boldly stepped away from her familiar surroundings in Fort Wayne, Indiana, embracing the opportunity at Grand Canyon University (GCU) with unwavering enthusiasm. Now, as she prepares to return home, she brings with her not just a degree, but a promising full-time job and a wealth of experiences that have shaped her professional trajectory. Her decision to leave her hometown was driven by a combination of academic ambition and personal growth. GCU offered her more than just an educational path—it promised a transformative experience that would challenge and inspire her. As she reflects on her collegiate years, Kennedy sees her leap of faith as a pivotal moment that has ultimately positioned her for success. Returning to Fort Wayne, she stands ready to begin the next chapter of her life, armed with the knowledge, skills, and confidence gained during her time at GCU. Her story is a testament to the power of taking risks and pursuing opportunities beyond one's comfort zone. MORE...

Dividend Goldmine: Bank of America's Top Financial Picks Revealed

Finance

2025-04-25 19:01:38

Top 5 Dividend-Paying Financial Stocks Recommended by Bank of America

Investors seeking reliable income and potential growth in the financial sector should pay close attention to Bank of America's latest recommendations. The investment giant has identified five standout financial stocks that not only offer attractive dividend yields but also show promising investment potential.

Why These Financial Stocks Stand Out

In today's volatile market, finding stable dividend-paying stocks can be challenging. Bank of America's analysts have carefully screened the financial sector to highlight stocks that combine solid dividend payouts with strong financial fundamentals.

Key Considerations for Investors

- Consistent dividend history

- Strong financial performance

- Potential for long-term growth

- Attractive current valuation

These recommended stocks represent a strategic opportunity for investors looking to build a robust, income-generating portfolio in the financial sector. By focusing on companies with proven track records and promising future prospects, investors can potentially secure both steady income and capital appreciation.

As always, investors should conduct their own research and consider their individual financial goals before making any investment decisions.

MORE...Trade Tensions Thaw: China Signals Tariff Relief as Trump Demands Strategic Concessions

Finance

2025-04-25 18:50:15

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Trade Diplomacy: Zimbabwe's Finance Chief Lobbies Washington for Economic Relief

Finance

2025-04-25 18:27:14

Zimbabwe's Finance Minister Mthuli Ncube revealed today that high-level diplomatic discussions are underway with United States officials to explore potential trade tariff negotiations. In a candid statement, Ncube highlighted the government's proactive approach to strengthening economic relations and seeking favorable trade conditions. The ministerial-level talks aim to address existing trade barriers and create more opportunities for bilateral economic cooperation between Zimbabwe and the United States. By engaging directly with US trade representatives, Zimbabwe is signaling its commitment to improving international trade dynamics and attracting potential investment. Ncube emphasized that these negotiations are crucial for Zimbabwe's economic strategy, potentially opening new pathways for trade and economic growth. The discussions are expected to focus on reducing trade barriers, exploring mutual economic benefits, and establishing more transparent and equitable trade frameworks. While specific details of the negotiations remain confidential, the minister's announcement suggests a strategic diplomatic effort to reposition Zimbabwe in the global economic landscape. The ongoing talks represent a significant step towards rebuilding and enhancing Zimbabwe's international trade relationships. MORE...

Berlin's Budget Balancing Act: Germany Seeks EU Flexibility on Defense Funding

Finance

2025-04-25 18:25:07

In a strategic move to bolster national defense, Germany is preparing to seek a special dispensation from the European Commission that would allow increased military spending without violating EU fiscal regulations. German Finance Minister Joerg Kukies revealed these plans in an exclusive interview with Reuters on Friday, signaling a significant shift in the country's approach to defense funding. The proposed exemption would provide Germany with the flexibility to substantially boost its defense budget in response to growing geopolitical tensions and evolving security challenges. By seeking this special status, the German government aims to modernize its military capabilities while maintaining fiscal responsibility and adhering to the broader economic framework of the European Union. Kukies' announcement underscores Germany's commitment to strengthening its defense infrastructure without compromising its financial stability. The potential exemption represents a nuanced approach to balancing national security needs with EU budgetary constraints, reflecting the complex strategic considerations facing European nations in today's rapidly changing global landscape. MORE...

"Turbulent Finances: Flight Crew Demands Urgent Overhaul at American Airlines"

Finance

2025-04-25 18:20:00

In a bold move that underscores growing tensions within the airline industry, American Airlines flight attendants have launched a scathing critique of their senior leadership team. Represented by their union, the cabin crew members are voicing significant concerns about management practices at the Fort Worth-based carrier. The criticism comes at a critical time for American Airlines, highlighting potential internal friction that could impact the company's operational effectiveness and employee morale. Flight attendants are using their collective voice to draw attention to what they perceive as systemic issues within the airline's leadership structure. By speaking out through their union, the employees are signaling a desire for meaningful dialogue and potential organizational changes that could improve working conditions and overall airline performance. This public stance reflects the ongoing challenges facing major airlines in maintaining positive labor relations and addressing workforce concerns. MORE...

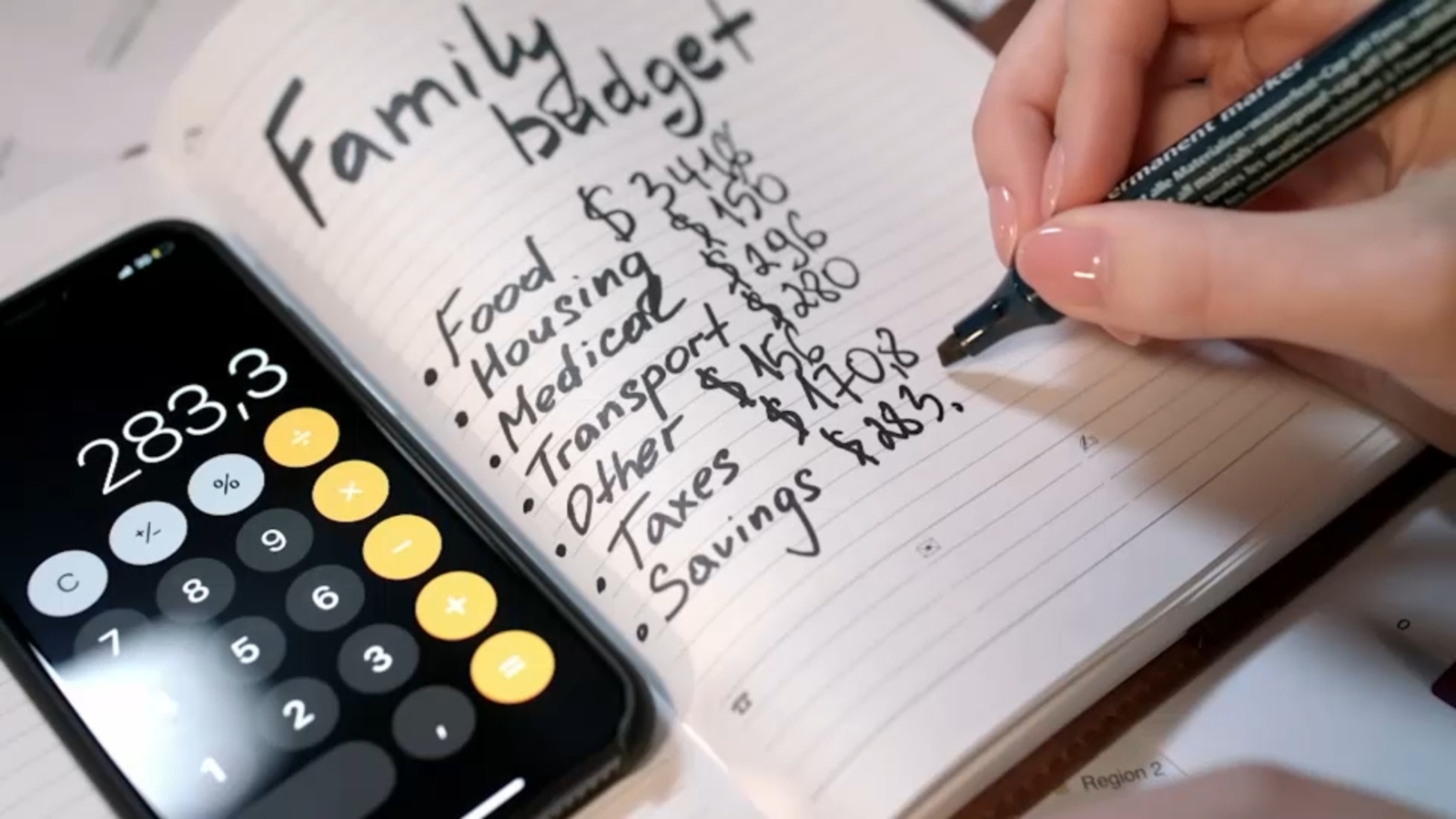

Money Mastery: Financial Guru Reveals Secrets to Crushing Your Cash Goals

Finance

2025-04-25 18:15:14

Take charge of your financial destiny and become the master of your money! This powerful message comes from Jamila Souffrant, a renowned personal finance expert and author of Your Journey to Financial Freedom. Souffrant empowers individuals to transform their relationship with money, offering practical strategies to seize control of their financial future and create lasting wealth. Her approach goes beyond simple budgeting—it's about developing a mindset of financial independence and strategic decision-making. By understanding your unique financial journey, you can break free from traditional money management constraints and design a personalized path to financial success. Whether you're just starting your financial journey or looking to level up your money management skills, Souffrant's insights provide a roadmap to financial empowerment. Her message is clear: you have the power to write your own financial story, one smart decision at a time. MORE...

Currency Clash: How Japan's Monetary Moves Could Reshape US-Japan Trade Dynamics

Finance

2025-04-25 17:25:39

In a delicate diplomatic dance, Japan appears to have successfully navigated potential pressure from the United States regarding the yen's valuation during recent bilateral financial discussions. While the immediate outcome seemed to sidestep direct confrontation, the underlying dynamics of currency markets and the Bank of Japan's monetary policy continue to simmer as potential focal points in broader trade negotiations. The nuanced exchanges between Japanese and American financial officials hint at a complex strategic landscape, where currency strength and interest rate policies remain critical chess pieces in the intricate game of international economic relations. Despite avoiding immediate escalation, the conversations underscore the ongoing tension and strategic considerations that shape economic interactions between these two major global powers. As both nations seek to balance their economic interests, the subtle interplay of monetary policy, currency valuation, and trade considerations continues to define their economic diplomacy, with each side carefully measuring its moves and potential consequences. MORE...

Breaking: Visionary Financier Joseph Schnaier Unleashes $1,000 Scholarship to Empower Next-Gen Financial Trailblazers

Finance

2025-04-25 17:22:00

Empowering Future Finance Professionals: Joseph Schnaier Scholarship Announces 2025 Application Period

Aspiring finance professionals now have an exciting opportunity to advance their academic journey, as the Joseph Schnaier Scholarship for Finance Students opens its application window for the year 2025. This distinguished scholarship offers a $1,000 one-time award to undergraduate students demonstrating exceptional academic potential and a passionate commitment to the finance industry.

Designed to support the next generation of financial leaders, the scholarship is open to students enrolled in accredited institutions across the United States who are pursuing finance-related degrees. The award aims to recognize and encourage talented individuals who show not just academic excellence, but also a clear, strategic vision for their future career in finance.

Joseph Schnaier, a respected veteran in the financial sector and the scholarship's founder, continues to invest in developing emerging talent. "We believe in supporting ambitious students who are dedicated to making meaningful contributions to the financial world," Schnaier stated.

Interested students are encouraged to review the scholarship requirements and submit their applications before the upcoming deadline. This is a unique chance to receive financial support and recognition for their academic and professional aspirations.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421