College Cash Secrets: Insider Tips to Supercharge Your Financial Aid

Finance

2025-03-17 18:50:28

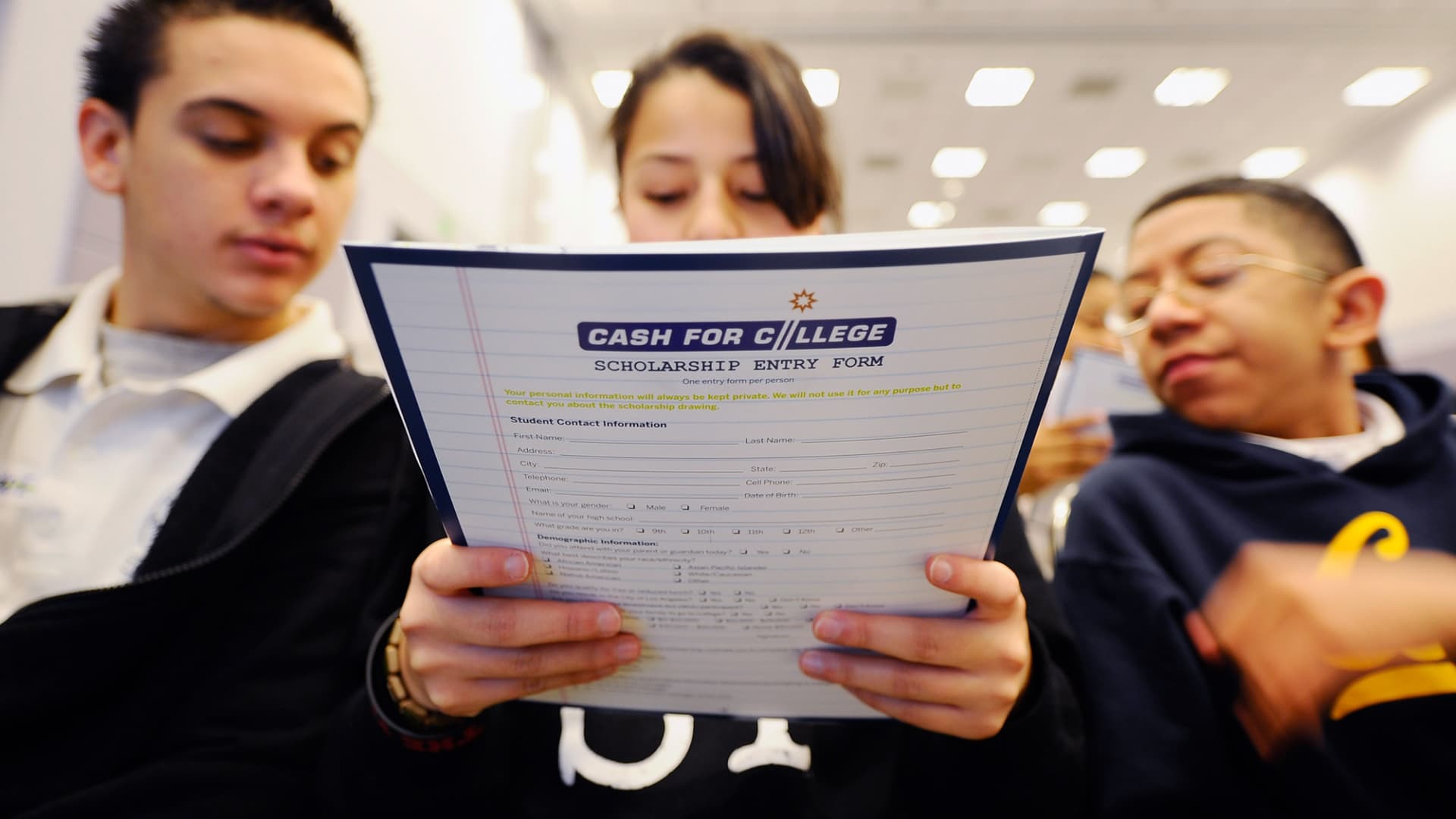

Navigating the College Affordability Maze: Why Financial Aid Matters Most Choosing the right college is a complex journey, and for many families, the financial landscape plays a pivotal role in this critical decision. Financial aid isn't just a helpful bonus—it's often the determining factor that transforms college dreams into achievable realities. For most students and their families, the cost of higher education can seem overwhelming. Tuition, books, housing, and living expenses can quickly add up to a daunting financial challenge. This is where financial aid becomes a game-changer, offering a lifeline that can make the difference between attending college or putting educational aspirations on hold. Smart students and parents understand that financial aid goes beyond simple dollar amounts. It's about finding the right combination of scholarships, grants, work-study programs, and loans that can make higher education accessible and affordable. Each financial aid package is unique, tailored to individual student needs and circumstances. The impact of financial aid extends far beyond immediate monetary relief. It opens doors to opportunities that might otherwise remain closed, allowing talented students from diverse economic backgrounds to pursue their academic and professional goals. By reducing financial barriers, financial aid becomes a powerful tool for educational equity and personal transformation. MORE...

Wall Street's Frustration: Trump's Economic Team Fails to Deliver the Message Investors Crave

Finance

2025-03-17 18:33:36

In recent weeks, the economic narrative from Trump administration officials has shifted dramatically. While tax cuts once dominated discussions, investors are now hearing a crescendo of commentary about tariffs and potential market corrections from key economic advisors like Scott Bessent. The changing rhetoric signals a nuanced approach to economic strategy, with officials increasingly emphasizing the potential benefits of market adjustments and trade protectionism. Instead of solely focusing on tax reduction policies, the administration appears to be exploring more complex economic levers that could reshape investment landscapes. Scott Bessent and other economic strategists are painting a picture of strategic market intervention, suggesting that controlled market corrections might actually create opportunities for more sustainable economic growth. This perspective challenges traditional investment wisdom and hints at a more interventionist economic philosophy emerging from the current administration. Investors are now urged to pay close attention to these evolving signals, as the economic discourse moves beyond simple tax cut narratives towards a more multifaceted approach to national economic management. MORE...

Budget Battle: German Political Leaders Confident in Fiscal Plan's Passage

Finance

2025-03-17 18:21:37

Germany is poised to push forward with its ambitious plan for debt-funded investments in national defense and infrastructure, with strong indications of broad parliamentary support. Conservative and Social Democrat lawmakers have signaled robust backing for the comprehensive spending bill, setting the stage for its likely approval on Tuesday. The proposed legislation represents a significant financial commitment, reflecting Germany's strategic priorities to modernize its military capabilities and enhance critical infrastructure. By leveraging debt financing, the government aims to make substantial investments that could potentially stimulate economic growth and strengthen national security. Political leaders from both major parties appear united in their support, suggesting the bill has a clear path to passage. This rare display of cross-party consensus underscores the importance of the proposed spending measures and their potential long-term impact on Germany's economic and strategic positioning. As the parliamentary vote approaches, the proposed spending bill stands as a testament to Germany's willingness to make bold financial decisions in pursuit of national development and security. MORE...

Quantum Leap: Why IonQ Is Poised to Revolutionize Computing's Next Frontier

Finance

2025-03-17 18:18:29

Diving into the Quantum Frontier: IonQ's Position in the Cutting-Edge Computing Landscape In the rapidly evolving world of quantum computing, investors are increasingly turning their attention to groundbreaking companies that are pushing the boundaries of technological innovation. Our recent exploration of the top quantum computing stocks highlighted IonQ, Inc. (NYSE:IONQ) as a standout player in this transformative field. As quantum computing continues its meteoric rise, IonQ stands at the forefront of a technological revolution that promises to reshape industries from artificial intelligence to cryptography. The company's unique approach to quantum computing has captured the imagination of tech enthusiasts and investors alike, positioning itself as a potential game-changer in the race to unlock the immense computational power of quantum technologies. With businesses increasingly seeking new opportunities in this cutting-edge domain, IonQ represents a compelling investment opportunity for those looking to capitalize on the next wave of computational innovation. The quantum computing sector is no longer just a theoretical concept but a rapidly materializing reality that could redefine how we solve complex computational challenges. Investors and technology watchers are closely monitoring IonQ's strategic moves, recognizing the potential for quantum computing to revolutionize everything from scientific research to financial modeling and beyond. As the landscape continues to evolve, IonQ remains a key player to watch in this exciting and transformative technological frontier. MORE...

Wall Street's Oil Rollercoaster: Robinhood and Incyte Navigate Market Turbulence

Finance

2025-03-17 18:09:24

Market Pulse: Oil Prices, Robinhood's Innovation, and Biotech Breakthroughs In today's fast-paced financial landscape, Yahoo Finance's Julie Hyman is diving deep into the most compelling market stories that are capturing investors' attention. Geopolitical tensions in the Red Sea are sending ripples through the oil markets, causing notable fluctuations in crude oil and Brent crude futures. Investors are closely monitoring how these regional dynamics might impact global energy prices and market stability. Meanwhile, Robinhood Markets is making waves with its innovative launch of a new prediction markets hub, signaling the trading platform's continued commitment to cutting-edge financial technologies. This strategic move could potentially reshape how retail investors engage with market forecasting. In the healthcare sector, Incyte is generating significant buzz with promising Phase 3 trial data for a groundbreaking skin condition treatment. The results could represent a potential game-changer for patients and represent an exciting development for the biotech industry. Stay tuned to Yahoo Finance for minute-by-minute updates on these unfolding market stories and more, ensuring you're always one step ahead in the dynamic world of finance. MORE...

Wall Street's Hidden Gem: Why Discover Financial Is Poised to Outperform in 2024

Finance

2025-03-17 17:49:15

Discover Financial Services: A Hidden Gem in the S&P 500 Undervalued Stock Landscape

In our ongoing exploration of promising investment opportunities, we've previously highlighted the top 10 most undervalued S&P 500 stocks. Today, we're diving deep into Discover Financial Services (NYSE:DFS) to uncover its potential as a compelling investment choice.

On March 13, Michael Cuggino, the esteemed President and Portfolio Manager of the Permanent Portfolio, shed light on the stock's intriguing market position. His insights offer investors a nuanced perspective on why Discover Financial Services might be flying under the radar of many market watchers.

As we analyze the stock's current valuation and market dynamics, it becomes clear that Discover Financial Services presents an interesting opportunity for investors seeking value in the financial sector. The company's strategic positioning and potential for growth make it a stock worth serious consideration.

Stay tuned as we break down the key factors that make Discover Financial Services a potential standout in the undervalued stocks market.

MORE...Breaking: Finance Committee Clears Controversial Levy Cap with Last-Minute Amendments

Finance

2025-03-17 17:38:33

Providence City Council Moves to Increase Local Funding Flexibility

In a pivotal decision during Thursday night's Committee on Finance meeting, Providence City Council members took a significant step toward financial adaptability by modifying a key resolution. Councilwoman Jo-Ann Ryan's proposed legislation aims to provide the city with greater fiscal latitude, seeking state approval to exceed the current tax levy cap.

The amended resolution would grant Providence the ability to increase its tax levy by an additional 4% for the upcoming fiscal year, offering municipal leaders more strategic financial maneuvering. This proposed adjustment could potentially unlock critical resources for city services and infrastructure improvements.

Council members demonstrated bipartisan support for the measure, recognizing the potential benefits of increased local funding flexibility. The resolution now moves forward, signaling a proactive approach to addressing the city's budgetary challenges and future financial planning.

The proposed legislation represents a nuanced effort to balance fiscal responsibility with the growing needs of Providence's municipal services and community development initiatives.

MORE...Financial Shock: Triumph's Unexpected Market Nosedive Explained

Finance

2025-03-17 17:24:57

Navigating the Turbulent Waters of Bank Stocks: A Deep Dive into Triumph Financial's Performance As the financial landscape of 2025 continues to evolve, bank stocks are experiencing unprecedented challenges and volatility. In our latest analysis, we turn our spotlight on Triumph Financial, Inc. (NASDAQ:TFIN) to understand its position amidst the broader banking sector's dramatic downturn. The banking industry is currently standing at a critical juncture, with numerous financial institutions facing significant headwinds. Triumph Financial emerges as a particularly intriguing case study in this complex economic environment. Our comprehensive examination reveals the intricate factors contributing to the stock's current performance and its standing relative to other struggling bank stocks. Investors and market watchers are closely monitoring how financial institutions like Triumph Financial are adapting to rapidly changing market conditions. The ongoing economic uncertainties, shifting interest rates, and regulatory challenges are creating a perfect storm that is reshaping the banking sector's landscape. Stay tuned as we unpack the nuanced dynamics driving Triumph Financial's stock performance and explore the broader implications for the banking industry in 2025. MORE...

Unlock Happiness: The Insider's Guide to Transforming Your Travel Budget into Unforgettable Memories

Finance

2025-03-17 17:00:00

Unlock the Secrets to Joyful and Budget-Friendly Travel Adventures

Dreaming of incredible travel experiences without breaking the bank? Discover how to maximize your travel budget and elevate your journey's happiness quotient with these five transformative tips.

1. Embrace Strategic Planning and Flexibility

The key to financial travel happiness lies in smart, flexible planning. Be open to traveling during off-peak seasons, exploring alternative destinations, and remaining adaptable with your travel dates. This approach can dramatically reduce costs while opening doors to unique experiences.

2. Leverage Travel Rewards and Credit Card Perks

Maximize your spending power by strategically using travel rewards credit cards. Accumulate points, enjoy complimentary travel insurance, and unlock exclusive discounts that can significantly reduce your overall travel expenses.

3. Immerse in Local Experiences Over Luxury

True travel joy comes from authentic experiences, not expensive hotels or fancy restaurants. Engage with local culture, try street food, use public transportation, and seek out free or low-cost activities that create lasting memories.

4. Master the Art of Budget Accommodation

Explore diverse lodging options like hostels, guesthouses, vacation rentals, and homestays. These alternatives not only save money but often provide more genuine and enriching travel experiences.

5. Practice Mindful Spending and Prioritization

Before and during your trip, carefully prioritize your spending. Allocate your budget to experiences that truly matter to you, cutting back on unnecessary expenses. Remember, the most precious travel souvenirs are memories, not material possessions.

By implementing these strategies, you'll transform your travel experiences from mere trips to meaningful, budget-conscious adventures that nourish your soul and wallet.

MORE...Nvidia's Stock Rollercoaster: Has the Tech Giant Hit Rock Bottom?

Finance

2025-03-17 16:31:23

After a remarkable rally that has seen Nvidia's stock soar to unprecedented heights, technical analysts are signaling a potential turning point for the semiconductor giant. Recent chart patterns suggest the stock might have reached an oversold condition, hinting at a possible consolidation or short-term pullback. Nvidia's extraordinary performance in 2023 has been nothing short of spectacular, driven by the AI boom and surging demand for its advanced graphics processing units. The stock has climbed an astounding 240% this year, making it one of the most impressive performers in the technology sector. However, even high-flying stocks need a breather. Technical indicators are now showing signs of potential exhaustion. Relative strength index (RSI) measurements and other momentum oscillators are pointing to an oversold scenario, which could indicate a temporary pause in the stock's relentless upward trajectory. Investors and traders should pay close attention to key support levels and potential consolidation zones. While the long-term outlook for Nvidia remains robust, the current technical signals suggest a potential short-term correction or sideways movement might be on the horizon. This doesn't necessarily mean a dramatic downturn, but rather a natural market mechanism to reset expectations and allow the stock to build momentum for its next potential advance. Savvy investors might view any pullback as an opportunity to reassess their positions or potentially add to existing holdings. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421