Wall Street's Hidden Gem: Why Prudential Financial Is Catching Savvy Investors' Eyes

Finance

2025-03-18 08:14:03

Prudential Financial: A Deep Dive into Extreme Value Investing

In the ever-evolving world of investment strategies, value stocks are making a compelling comeback. Our recent exploration of the Top 12 Extreme Value Stocks has sparked significant interest, and today we're turning our spotlight on Prudential Financial, Inc. (NYSE:PRU) to understand its potential in the current market landscape.

The Shifting Investment Paradigm: Value vs. Growth

As market dynamics continue to transform, investors are asking a critical question: Are value stocks poised to dethrone growth stocks? The recent market trends suggest a fascinating shift that could reshape investment portfolios.

Prudential Financial stands at an intriguing crossroads, offering investors a unique opportunity to explore the potential of extreme value investing. By examining its financial fundamentals, market positioning, and growth prospects, we aim to provide insights that could help you make informed investment decisions.

Why Prudential Financial Demands Attention

With its robust financial structure and strategic market approach, Prudential Financial represents more than just another stock—it's a potential cornerstone for value-focused investors seeking stability and potential growth in an unpredictable market.

Stay tuned as we unpack the nuances of this compelling investment opportunity and its place in the broader landscape of extreme value stocks.

MORE...Trade Tensions Simmer: Japan's Finance Chief Blasts U.S. Tariffs at G7 Summit

Finance

2025-03-18 08:13:00

In a recent virtual gathering of G7 finance ministers, Japanese Finance Minister Katsunobu Kato voiced his concerns over the United States' broad-sweeping tariffs on steel and aluminum imports. During the online meeting, Kato expressed his disappointment, describing the trade measures as "regrettable" and underscoring the critical importance of maintaining fair and transparent global trade regulations. The minister's comments highlight the growing tensions surrounding international trade policies, particularly the unilateral approach taken by the United States. By sharing his perspective with G7 counterparts, Kato aims to draw attention to the potential negative consequences of such protectionist measures on the global economic landscape. The discussion reflects the ongoing challenges nations face in balancing national economic interests with the principles of open and collaborative international trade. As countries continue to navigate these complex diplomatic and economic waters, dialogue and mutual understanding remain key to resolving trade disputes and promoting economic stability. MORE...

Crypto Clash: ECB Chief Sounds Alarm on Trump's Radical Financial Gambit

Finance

2025-03-18 08:07:22

In a stark warning that reverberates through the global financial landscape, Francois Villeroy de Galhau, the influential Governor of the Bank of France and a prominent figure at the European Central Bank (ECB), has raised serious concerns about the United States' growing cryptocurrency adoption. His cautionary message highlights the potential risks and systemic challenges that could emerge from the rapid integration of digital currencies into the mainstream financial ecosystem. Villeroy de Galhau's intervention signals a critical moment of reflection for policymakers and financial experts worldwide. By drawing attention to the complex implications of cryptocurrency expansion, he underscores the need for careful regulatory oversight and strategic assessment of digital financial innovations. The statement comes at a time when cryptocurrencies are experiencing unprecedented mainstream acceptance, challenging traditional banking structures and pushing the boundaries of financial technology. As the U.S. continues to explore and embrace these digital assets, European financial leaders like Villeroy de Galhau are closely monitoring the potential global economic ramifications. His warning serves as a crucial reminder that while technological innovation is essential, it must be balanced with robust risk management and comprehensive regulatory frameworks to ensure financial stability and protect economic interests. MORE...

Money Matters: Navigating the Financial Landscape of Trump's America

Finance

2025-03-18 07:00:59

Since the start of his second term, President Donald Trump has been implementing bold and controversial policy changes that are reshaping the federal landscape. His aggressive agenda has sent ripples through the economic and employment sectors, creating significant uncertainty for many Americans. The administration's most notable actions include a massive restructuring of the federal workforce, with thousands of government employees facing layoffs from what has traditionally been the nation's largest employer. Simultaneously, Trump has targeted the student loan system, proposing substantial limitations on existing repayment plans that could impact millions of borrowers. In a move that quickly rattled financial markets, the president imposed a 25 percent tariff on imports from Mexico and Canada. While these tariffs were subsequently suspended, their brief implementation was enough to trigger a notable stock market decline, underscoring the potential economic volatility of such policy shifts. These sweeping changes have left many Americans concerned about their financial stability and future prospects. Experts recommend proactive financial planning and staying informed about potential policy impacts to navigate this uncertain economic environment. For those seeking more insights and analysis, tune in to 1A and consider supporting local public radio stations. Additional resources and in-depth discussions are available through 1A+ at plus.npr.org/the1a. MORE...

Rumor Mill Overheats: Indonesia Swiftly Debunks Finance Minister Resignation Speculation

Finance

2025-03-18 06:49:46

In a swift response to mounting speculation, Indonesian authorities have categorically rejected rumors surrounding the potential departure of Finance Minister Sri Mulyani Indrawati. The high-profile minister, renowned for her strategic leadership and economic expertise, finds herself at the center of speculation that could potentially trigger significant market volatility. The unfolding narrative has sent ripples through Indonesia's financial landscape, with stock markets already showing signs of substantial turbulence. Analysts suggest that any potential leadership change at this critical juncture could exacerbate existing economic uncertainties and potentially trigger the most significant market downturn in over a decade. Sri Mulyani Indrawati, a seasoned economic policymaker with a distinguished track record, has been instrumental in navigating Indonesia's complex financial terrain. Her potential exit would not only create a leadership vacuum but could also introduce unprecedented instability in the country's economic governance. As rumors continue to swirl, the government remains resolute in its stance, emphasizing the minister's continued commitment to her role and the nation's economic strategy. Investors and market watchers are closely monitoring the situation, awaiting further official clarifications. MORE...

Hidden Cost Trap: How Insurers Are Secretly Milking Customers with Sky-High Monthly Payment Rates

Finance

2025-03-18 06:00:05

Car and home insurance customers are facing steep financial burdens as some insurers continue to impose hefty interest rates on monthly payment plans, according to a revealing investigation by consumer advocacy group Which? The research exposes a troubling trend in the insurance industry, where policyholders are being charged what experts describe as "exorbitant" interest rates when spreading their insurance costs over monthly installments. This practice effectively penalizes consumers who cannot afford to pay their entire premium upfront. Which? has highlighted that these inflated interest charges can significantly increase the overall cost of insurance, placing an additional financial strain on households already struggling with rising living expenses. The consumer group is calling for greater transparency and fairness in insurance pricing structures. Consumers are advised to carefully compare payment options, consider annual lump-sum payments where possible, and shop around for insurers offering more competitive monthly payment terms. The investigation serves as a crucial reminder for individuals to scrutinize the total cost of their insurance policies beyond the headline premium. MORE...

Zvilo Taps Fintech Veteran Admir Imami to Steer Trade Finance Innovation

Finance

2025-03-18 06:00:04

Zvilo, a prominent trade finance firm, has appointed Admir Imami as its new Chief Executive Officer. Imami, who previously served as a director at British International Investment, brings a wealth of international finance expertise to his new leadership role. With an impressive background in global investment strategies, Imami is expected to drive Zvilo's growth and strategic vision. His extensive experience in the financial sector positions him as a key leader to navigate the complex landscape of trade finance. The appointment signals a significant milestone for Zvilo, as they continue to strengthen their leadership team with top-tier financial talent. Imami's track record of success and strategic insight is anticipated to propel the company's future development and market positioning. MORE...

Financial Regulation Backfires: How the FCA's Strict Policies Are Choking UK Business and Consumer Choice

Finance

2025-03-18 06:00:00

The United Kingdom, once a beacon of global financial innovation, now finds itself at a crossroads in the rapidly evolving digital asset landscape. What was once a promising environment for cryptocurrency and blockchain technologies is increasingly becoming a cautionary tale of regulatory hesitation and missed opportunities. As other nations embrace and regulate digital assets with forward-thinking strategies, the UK's uncertain approach is creating a chilling effect on the financial technology sector. Innovative businesses are increasingly looking elsewhere, seeking jurisdictions that offer clearer guidance and more supportive regulatory frameworks. This regulatory uncertainty is not just a minor setback—it's actively eroding the UK's competitive edge in the global financial technology market. Entrepreneurs and investors are voting with their feet, relocating to more crypto-friendly environments that promise both clarity and opportunity. The consequences are stark: reduced investor choice, diminished technological innovation, and a potential long-term economic impact that could see the UK marginalized in one of the most dynamic financial sectors of the 21st century. What was once a potential leadership position is rapidly transforming into a tale of missed potential and regulatory indecision. As the digital asset landscape continues to evolve, the UK stands at a critical juncture. The choices made today will determine whether it remains a global financial center or becomes a cautionary footnote in the digital economic revolution. MORE...

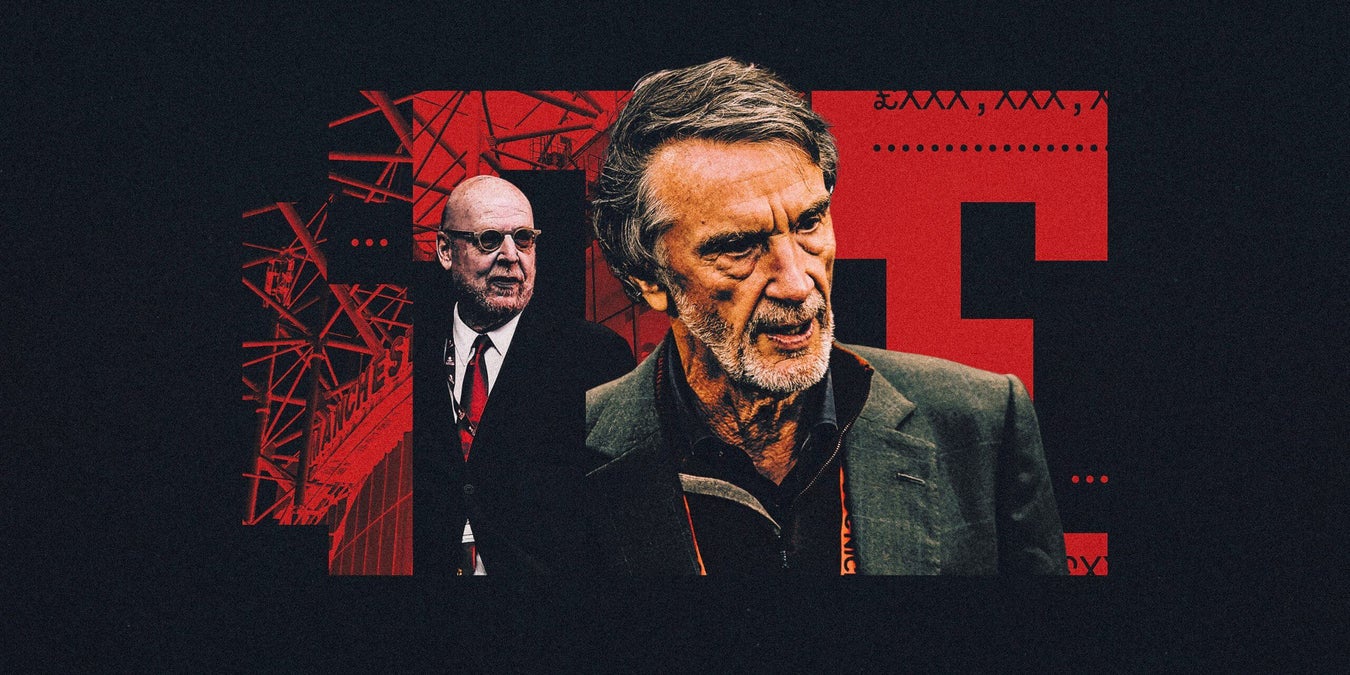

Red Devils in the Red: Inside Manchester United's Financial Freefall

Finance

2025-03-18 05:14:03

Navigating Uncertain Waters: The Critical Challenge of PSR in Europe

In the complex landscape of European regulatory frameworks, companies find themselves at a critical crossroads, facing unprecedented challenges in the realm of Persistent Structural Reforms (PSR). The current environment presents a multifaceted challenge that demands strategic insight and adaptive thinking.

The Evolving Regulatory Landscape

European businesses are experiencing a seismic shift in regulatory expectations, with PSR emerging as a pivotal force that could fundamentally reshape corporate strategies. The intricate web of regulations creates a high-stakes environment where compliance is no longer just a checkbox, but a critical survival mechanism.

Perilous Positioning: The High-Stakes Challenge

Organizations are precariously balanced on a razor's edge, where a single misstep could result in significant financial and reputational consequences. The PSR framework introduces unprecedented levels of scrutiny, demanding comprehensive transformation across operational, financial, and governance domains.

Future Implications

The long-term implications of PSR are profound. Companies must not merely adapt but fundamentally reimagine their approach to regulatory compliance. Those who can successfully navigate this complex terrain will emerge as industry leaders, while those who falter risk marginalization and potential market exclusion.

Key Strategic Considerations

- Proactive regulatory intelligence

- Agile compliance frameworks

- Technology-driven transformation

- Continuous organizational learning

As the European regulatory landscape continues to evolve, businesses must remain vigilant, adaptive, and strategically positioned to transform challenges into opportunities.

MORE...Behind the Scenes: My Journey from Sunderland Passion to Football's Financial Labyrinth

Finance

2025-03-18 05:05:30

Diving Deep: Uncovering the Hidden Narratives of Gaming I'm plunging into the intricate and often mysterious world of gaming, carefully excavating the most compelling stories that lie beneath the surface. Like a digital archaeologist, I'll be exploring the rich narratives and untold tales that breathe life into virtual worlds, bringing you insights that go far beyond mere gameplay. My mission is to illuminate the hidden gems, the extraordinary stories that often go unnoticed by casual players. From indie game masterpieces to overlooked storylines in mainstream titles, I'll be your guide through the complex and fascinating landscape of interactive storytelling. Get ready to embark on a journey that reveals the heart and soul of gaming—where every pixel has a story, and every character holds a secret waiting to be discovered. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421