Annaly Capital Management: The Quiet Giant Shaking Up Finance Stocks in 2023

Finance

2025-04-04 13:40:14

Investment Insights: Annaly Capital Management and Amerisafe Performance Breakdown

Investors are closely tracking the performance of two notable companies, Annaly Capital Management (NLY) and Amerisafe (AMSF), as they navigate the complex financial landscape of 2023. Both companies have demonstrated unique trajectories within their respective sectors, offering intriguing insights for market watchers and potential investors.

Annaly Capital Management, a prominent real estate investment trust (REIT) specializing in mortgage-backed securities, has been experiencing notable market dynamics. The company's performance reflects the ongoing volatility in the financial and real estate investment sectors, with investors carefully monitoring its strategic moves and market positioning.

Similarly, Amerisafe, a workers' compensation insurance provider, has been charting its own course in the insurance industry. The company's performance provides a compelling snapshot of how specialized insurance firms are adapting to current economic challenges and opportunities.

Comparative analysis reveals nuanced insights into how these companies are performing relative to their respective sector benchmarks, highlighting the importance of strategic management and market adaptability in today's competitive business environment.

MORE...Wall Street Trembles: How Trump's Trade Battles Are Reshaping Financial Landscapes

Finance

2025-04-04 13:38:14

The banking sector stands on the precipice of a potential financial storm, with mounting pressures threatening to squeeze financial institutions from every conceivable angle. As economic uncertainties intensify, banks are facing a perfect storm of challenges that could dramatically reshape the financial landscape. Market volatility, tightening regulatory environments, and shifting economic conditions are converging to create unprecedented pressure on banking institutions. Traditional revenue streams are being eroded, while emerging technologies and aggressive fintech competitors continue to challenge established banking models. The risk is not just theoretical—it's becoming increasingly tangible. Banks are being forced to rapidly adapt, innovate, and reimagine their core strategies to survive in an increasingly complex and competitive financial ecosystem. Those who fail to respond quickly and strategically may find themselves marginalized or worse, facing existential threats. Without swift and decisive action, the banking sector could be looking at a transformative period that will separate the adaptable from the obsolete. The stakes are high, and the window for meaningful intervention is rapidly closing. MORE...

Market Meltdown: Global Tensions Spark Steep Sell-Off as China Strikes Back with Tariff Bombshell

Finance

2025-04-04 13:33:56

Wall Street braced for volatility as stock futures tumbled in the wake of President Trump's sweeping tariff announcements, which sent shockwaves through global financial markets. Investors nervously watched as the potential for escalating trade tensions threatened to unsettle the delicate economic balance. The sudden market downturn reflected growing concerns about the potential ripple effects of broad reciprocal tariffs, with traders and analysts alike scrambling to assess the potential economic implications. Market sentiment quickly shifted from cautious optimism to heightened uncertainty, as the prospect of an intensifying trade conflict loomed large. Futures contracts for major indices showed significant downward pressure, signaling a potentially turbulent trading session ahead. The market's jittery response underscored the fragile nature of international trade relations and the profound impact of presidential trade policies on global financial markets. MORE...

Market Meltdown: Global Tensions Spark Sharp Sell-Off as China Escalates Trade War Pressure

Finance

2025-04-04 13:30:33

Wall Street braced for volatility as stock futures tumbled in the wake of President Trump's sweeping tariff announcements, which sent shockwaves through global financial markets. Investors nervously watched as the potential for escalating trade tensions threatened to unsettle the delicate economic balance. The sudden market downturn reflected growing concerns about the potential ripple effects of broad reciprocal tariffs, with traders and analysts alike scrambling to assess the potential economic implications. Market sentiment quickly shifted from cautious optimism to heightened uncertainty, as the prospect of an intensifying trade conflict loomed large. Futures contracts for major indices showed significant downward pressure, signaling a potentially turbulent trading session ahead. The market's jittery response underscored the fragile nature of international trade relations and the profound impact of presidential trade policies on global financial markets. MORE...

First Western Financial Gears Up for Q1 2025 Earnings Reveal: What Investors Need to Know

Finance

2025-04-04 13:00:00

First Western Financial, Inc. Set to Unveil First Quarter 2025 Financial Performance Denver, Colorado - First Western Financial, Inc. (NASDAQ: MYFW), a leading financial services holding company, is preparing to share its comprehensive financial results for the first quarter of 2025. The company has scheduled its financial disclosure and investor conference call to provide stakeholders with insights into its recent performance. Financial Results Release Details: - Date of Financial Results: Thursday, April 24, 2025 (after market close) - Conference Call: Friday, April 25, 2025 - Time: 10:00 a.m. Mountain Time / 12:00 p.m. Eastern Time Investors, analysts, and financial enthusiasts are invited to join the conference call, where First Western's management team will offer a detailed breakdown of the company's quarterly achievements, strategic initiatives, and financial outlook. The upcoming financial report promises to provide a comprehensive view of the company's performance during the first quarter of 2025, offering valuable insights into its operational strengths and market positioning. MORE...

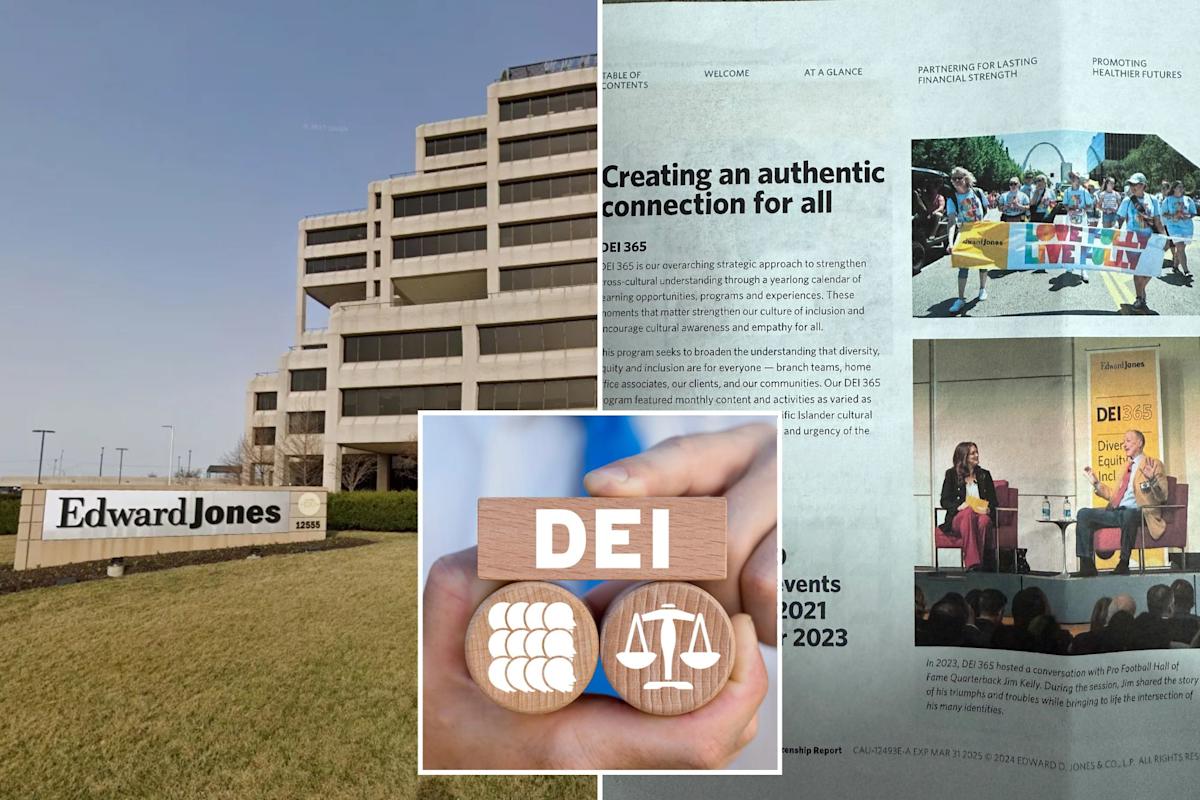

Inside Edward Jones: Whistleblower Exposes Hidden DEI Strategy Amid Corporate Silence

Finance

2025-04-04 13:00:00

In a revealing exclusive, leaked documents obtained by the New York Post shed light on a broader corporate trend beyond Costco, highlighting how major financial institutions like Edward Jones are strategically maintaining and even expanding their diversity, equity, and inclusion (DEI) initiatives in anticipation of potential political shifts. The confidential files suggest that despite changing political landscapes, companies are recommitting to workplace diversity programs, signaling a robust corporate commitment to fostering inclusive environments. Edward Jones, a prominent financial services firm, appears to be at the forefront of this strategic approach, demonstrating that DEI efforts remain a critical priority for progressive organizations. These leaked documents provide a rare glimpse into corporate decision-making processes, revealing how businesses are navigating complex social and political dynamics while staying true to their core values of equality and representation in the workplace. MORE...

Job Market Surge: 228K New Positions Emerge, Unemployment Climbs to 4.2%

Finance

2025-04-04 12:35:49

As Wall Street braces for economic signals, the March employment report emerges as a critical indicator amid growing market uncertainty. Investors are keenly scrutinizing every detail, searching for potential signs of economic deceleration while navigating a turbulent stock market landscape. The latest employment data promises to offer crucial insights into the health of the U.S. economy, potentially revealing whether recent market volatility reflects deeper structural challenges or represents a temporary fluctuation. With stocks experiencing significant sell-offs, market participants are hungry for concrete evidence about economic momentum and potential shifts in employment trends. Analysts and traders alike are poised to dissect the report's nuanced metrics, looking beyond headline numbers to understand the underlying economic dynamics. The employment figures could provide critical context for Federal Reserve decision-making and investor sentiment in the coming months. As uncertainty continues to ripple through financial markets, this employment report stands as a potential watershed moment, offering a snapshot of economic resilience and potential future trajectories. MORE...

Green Energy Breakthrough: OKKO Secures Massive $173M Wind Power Financing

Finance

2025-04-04 11:36:16

OKKO Group Secures Significant Financing to Advance Wind Energy Development in Ukraine In a strategic move to expand its renewable energy portfolio, OKKO has secured a comprehensive finance package that will empower the company to develop and operate wind power plants across Ukraine. The ambitious project is set to generate an impressive 147 megawatts of clean, sustainable energy, marking a significant milestone in the country's green energy transformation. This substantial investment demonstrates OKKO's commitment to sustainable infrastructure and Ukraine's growing renewable energy sector. By leveraging this financial support, the company will be able to construct and manage wind power facilities that contribute to the nation's energy independence and environmental goals. The 147MW wind power initiative represents a bold step forward in Ukraine's transition to cleaner, more sustainable energy sources. OKKO's project is not just an economic investment, but a crucial contribution to the country's long-term environmental strategy and energy resilience. MORE...

Glass Ceiling Persists: Women Struggle to Climb Corporate Ladder in UK Finance

Finance

2025-04-04 11:31:35

Despite years of promises and diversity initiatives, Britain's financial sector continues to struggle with gender representation at its highest levels, according to a revealing new report from the UK Treasury. The study exposes a persistent glass ceiling that has stubbornly resisted efforts to promote women into senior leadership roles. Despite growing awareness and repeated commitments to improve gender diversity, the financial industry remains overwhelmingly male-dominated at executive and board levels. The report highlights a stark disconnect between the sector's public pledges of inclusivity and the actual progress made in recent years. Key findings suggest that while entry-level and mid-management positions have seen some improvement in gender balance, the upper echelons of financial institutions remain largely unchanged. This systemic challenge continues to prevent talented women from reaching top strategic and decision-making positions within the industry. The Treasury's analysis serves as a critical wake-up call, challenging financial institutions to move beyond superficial diversity statements and implement meaningful, structural changes that genuinely support women's career advancement. MORE...

Breaking: Cases&Faces 2025 Unveils Global Titans of Innovation, AI, and Finance

Finance

2025-04-04 11:30:00

Digital Revolution: Pioneering Leaders Reshape Business Landscape In the rapidly evolving world of global business, a transformative wave is sweeping across industries, driven by groundbreaking digital technologies and visionary leadership. The convergence of artificial intelligence, innovative strategies, and bold entrepreneurial thinking is fundamentally reimagining how companies operate, compete, and create value. As we stand on the cusp of unprecedented technological advancement, forward-thinking leaders are challenging traditional paradigms and pushing the boundaries of what's possible. The upcoming International Cases&Faces Award promises to celebrate these trailblazers who are not just adapting to change, but actively driving it. From Fort Lauderdale to the global stage, the narrative of business success is being rewritten. Cutting-edge AI breakthroughs, sophisticated digital transformation strategies, and a new generation of innovative thinkers are dismantling old models and constructing more agile, intelligent, and responsive organizational frameworks. The future belongs to those who can anticipate, innovate, and transform—and the journey has only just begun. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421