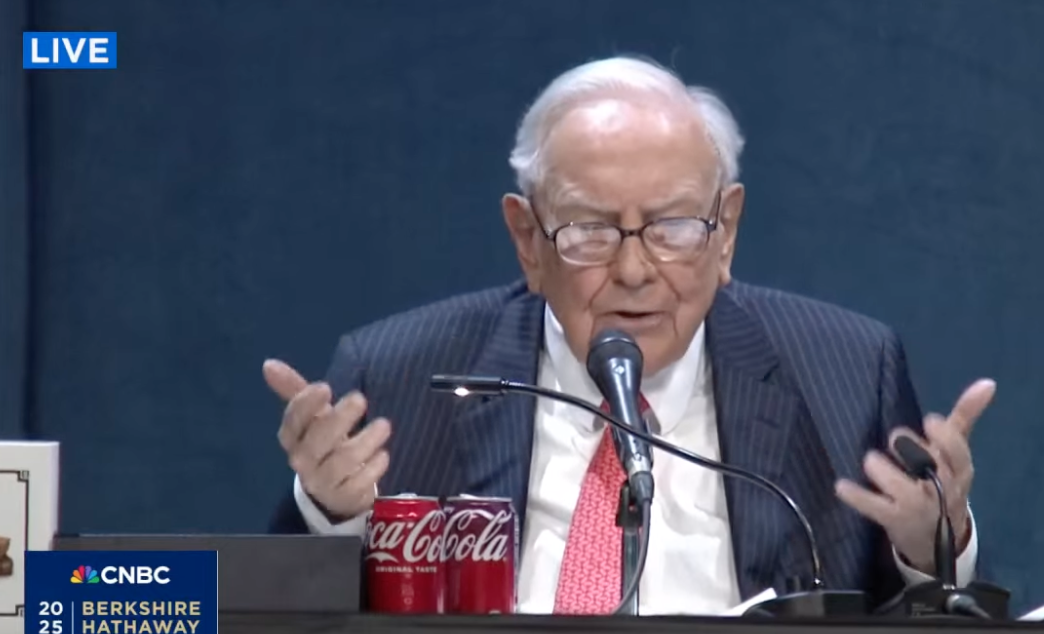

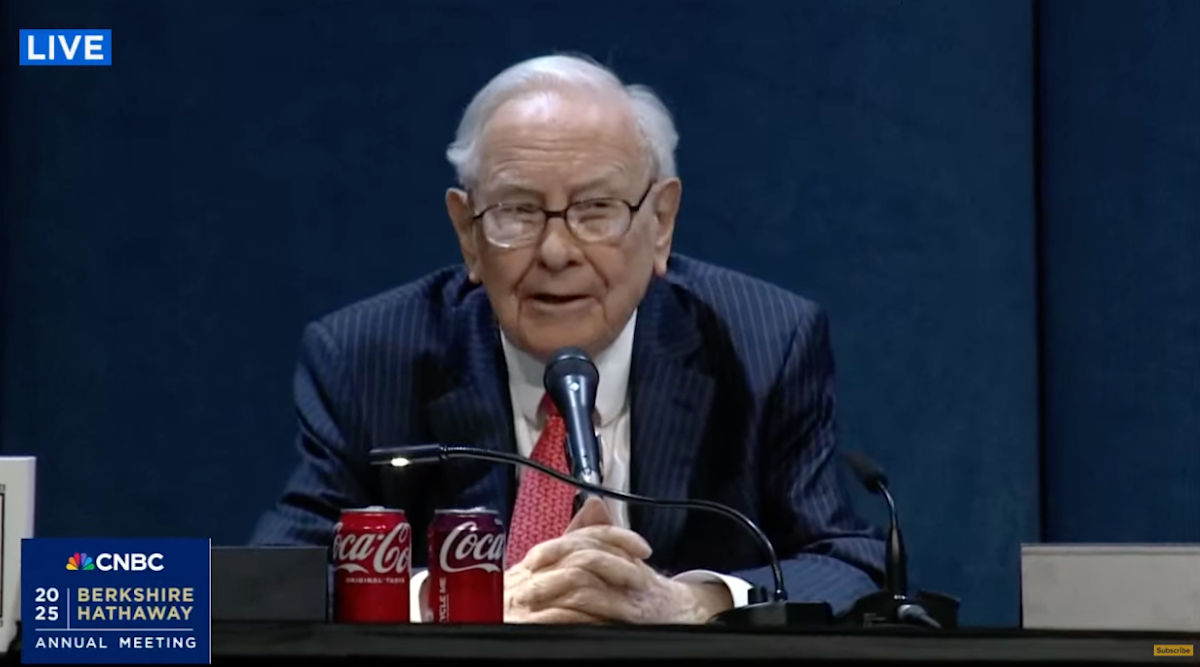

Succession Spotlight: Warren Buffett Backs Greg Abel as Berkshire's Next Leader

Finance

2025-05-03 18:11:43

The Legendary Berkshire Hathaway Annual Shareholder Meeting: A Gathering of Investment Wisdom Investors and business enthusiasts from around the world are eagerly anticipating the most anticipated financial event of the year - the annual Berkshire Hathaway shareholder meeting. Led by the iconic Warren Buffett, this extraordinary gathering is more than just a corporate meeting; it's a masterclass in investment strategy and business insight. Known affectionately as the "Woodstock of Capitalism," this annual event draws thousands of shareholders and market watchers to Omaha, Nebraska. Warren Buffett and his business partner Charlie Munger will once again take center stage, offering their unparalleled perspectives on investing, business trends, and economic landscapes. Shareholders holding both Class A (BRK-A) and Class B (BRK-B) stocks will have the unique opportunity to gain direct insights from two of the most successful investors in history. The meeting promises to be a blend of financial wisdom, candid discussions, and strategic revelations that have made Berkshire Hathaway a legendary investment powerhouse. MORE...

Wall Street Titan Warren Buffett Shrugs Off Market Chaos: 'Just Another Day'

Finance

2025-05-03 15:31:11

In the rollercoaster world of stock market investing, the S&P 500 has experienced a turbulent ride this year. The index has slipped approximately 3% in 2023, with a particularly dramatic dip that saw it plummet over 19% from its peak historical point. However, for legendary investor Warren Buffett, these market fluctuations are merely another day in the financial landscape. The seasoned billionaire investor, known for his calm demeanor and long-term investment strategy, seems unfazed by the current market volatility. While many investors might be nervously tracking every market movement, Buffett's legendary composure remains unshaken, reflecting his time-tested approach of looking beyond short-term market gyrations and focusing on fundamental value. This year's market performance serves as a reminder that investing is a marathon, not a sprint, and that resilience and strategic thinking are key to navigating uncertain financial terrain. MORE...

Recession Roulette: The Economic Referees Deciding America's Financial Fate

Finance

2025-05-03 15:30:12

Economic experts are sounding the alarm that the official declaration of a recession might not be as immediate as many anticipate. The National Bureau of Economic Research (NBER), the authoritative body responsible for identifying economic downturns, takes a meticulous approach that could delay the formal announcement by months or even years. Unlike quick-trigger economic assessments, the NBER employs a comprehensive methodology that goes beyond simple GDP measurements. Their evaluation involves analyzing a complex web of economic indicators and retrospective data, ensuring a thorough and nuanced understanding of economic trends before making a definitive recession declaration. This careful, deliberate process means that businesses, policymakers, and investors might be experiencing recessionary conditions long before an official proclamation is made. The NBER's commitment to accuracy and depth provides a more robust picture of economic health, but simultaneously creates uncertainty for those seeking immediate clarity about the nation's economic status. MORE...

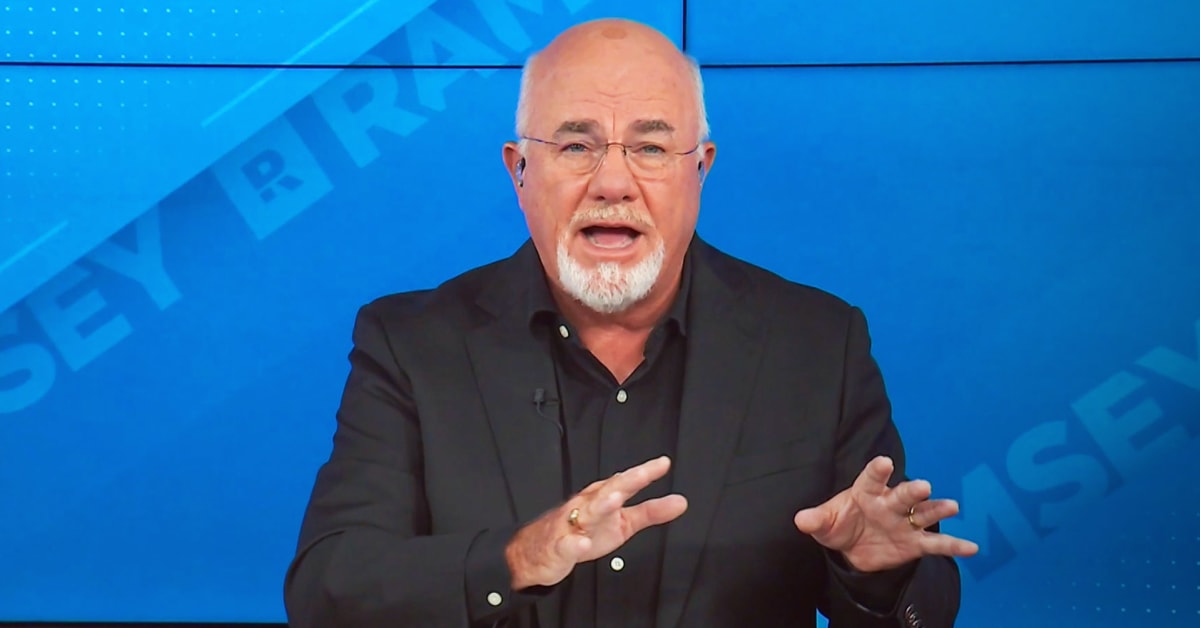

Homebuying Pitfall: Dave Ramsey Reveals the Critical Error Draining Your Wallet

Finance

2025-05-03 15:17:00

Navigating the Home Buying Journey: A Financial Perspective Purchasing a home is far more than just finding your dream living space—it's a complex financial decision with long-lasting implications. As a best-selling personal finance expert, I've witnessed countless individuals underestimate the profound economic impact of homeownership. When you decide to buy a home, you're not simply acquiring property; you're making a significant investment that can dramatically shape your financial future. From mortgage rates and property taxes to maintenance costs and potential appreciation, each aspect carries substantial weight in your overall financial landscape. Smart homebuyers understand that this decision extends beyond the initial purchase price. They consider factors like location, market trends, potential equity growth, and the total cost of ownership. It's not just about monthly mortgage payments, but about creating a strategic financial asset that can potentially build wealth over time. Moreover, the financial ramifications of home ownership ripple through multiple aspects of your personal economic ecosystem. Your credit score, long-term savings potential, tax deductions, and investment portfolio can all be influenced by this pivotal decision. Before taking the plunge, carefully evaluate your financial readiness, understand the market dynamics, and develop a comprehensive strategy that aligns with your personal and financial goals. MORE...

Global Markets on Edge: Trump's Economic Rollercoaster and the Worldwide Financial Tremors

Finance

2025-05-03 14:50:48

In a stark warning about the potential economic implications of the Trump presidency, progressive economist Gerald Epstein suggests that global capitalists might be reconsidering the United States as their traditional safe investment destination. Epstein's analysis points to growing uncertainty and volatility in the global investment landscape, potentially challenging the long-standing perception of the US as a reliable and stable economic environment. The economist argues that unpredictable policy shifts, international trade tensions, and geopolitical instability under the Trump administration could be eroding investor confidence. The implications are significant: if international investors begin to view the United States as a less secure investment haven, it could trigger substantial capital outflows and reshape global financial dynamics. This potential shift represents more than just an economic concern—it signals a fundamental reevaluation of America's global economic standing. As investors become increasingly sensitive to political risk and economic unpredictability, Epstein's insights underscore the delicate balance between political leadership and economic stability in the modern global marketplace. MORE...

Bank of the James Weathers Financial Headwinds: Earnings Dip Signals Challenging Quarter

Finance

2025-05-03 14:26:53

Bank of the James Financial Group Delivers Strong First Quarter Performance in 2025

Bank of the James Financial Group (NASDAQ: BOTJ) has released its financial results for the first quarter of 2025, showcasing robust financial performance and strategic growth.

Key Financial Highlights

- Revenue: The bank reported a solid revenue of $10.9 million, reflecting its continued market strength and operational efficiency.

- Strategic Positioning: The results underscore the bank's resilience and strategic approach in a dynamic financial landscape.

The first quarter results demonstrate Bank of the James Financial Group's commitment to delivering value to shareholders and maintaining a competitive edge in the regional banking sector.

Investors and financial analysts are encouraged by the bank's consistent performance and potential for future growth.

MORE...Financial Myths Busted: Why Retirement Gurus Might Be Steering You Wrong

Finance

2025-05-03 14:01:44

Financial Gurus Ramsey and Orman: When Expert Advice Misses the Mark

Financial experts Dave Ramsey and Suze Orman have built impressive reputations for providing money management advice. While their guidance can be valuable, not every recommendation fits perfectly with everyone's unique retirement strategy. Let's dive into some of their suggestions that might need a second look and explore alternative approaches that could better serve your financial future.

Challenging Traditional Financial Wisdom

Both Ramsey and Orman offer compelling insights into personal finance, but blindly following their advice without considering your individual circumstances can be risky. Retirement planning isn't a one-size-fits-all solution. What works brilliantly for one person might be less effective for another.

Rethinking Retirement Strategies

Instead of accepting every piece of advice at face value, it's crucial to:

- Assess your personal financial situation

- Consider your unique retirement goals

- Consult with a financial advisor who understands your specific needs

By taking a personalized approach, you can create a retirement plan that truly aligns with your financial aspirations and lifestyle expectations.

MORE...Insider Selling Signals Caution: Capital One Executives Cash Out $7.7M in Stock

Finance

2025-05-03 14:00:29

In a notable shift of corporate dynamics, Capital One Financial Corporation (NYSE:COF) has witnessed significant insider selling activity over the past year. The company's leadership and key stakeholders have been strategically reducing their equity positions, signaling potential strategic recalibrations or personal investment decisions. Insider trading patterns often provide valuable insights into a company's internal sentiment and future outlook. While these transactions don't always indicate negative implications, they do capture the attention of investors and market analysts who closely monitor such movements. Capital One's insider selling trend suggests a complex landscape of individual investment strategies and potential corporate repositioning. Investors are advised to view these transactions as part of a broader context, considering multiple factors beyond simple stock disposition. As the financial services sector continues to evolve, such insider movements reflect the dynamic nature of corporate ownership and strategic decision-making. Careful analysis and comprehensive research remain crucial for understanding the nuanced implications of these transactions. MORE...

Trade Wars Beware: Buffett Warns Against Economic Weaponization at Berkshire Powwow

Finance

2025-05-03 13:28:56

The Legendary Berkshire Hathaway Annual Shareholder Meeting: A Gathering of Investment Wisdom Investors and business enthusiasts from around the world are eagerly anticipating the most anticipated financial event of the year - the annual Berkshire Hathaway shareholder meeting. Led by the iconic Warren Buffett, this extraordinary gathering is more than just a corporate meeting; it's a masterclass in investment strategy and business insight. Known affectionately as the "Woodstock of Capitalism," this annual event draws thousands of shareholders and market watchers to Omaha, Nebraska. Warren Buffett and his business partner Charlie Munger will once again take center stage, offering their unparalleled perspectives on investing, business trends, and economic landscapes. Shareholders holding both Class A (BRK-A) and Class B (BRK-B) stocks will have the unique opportunity to gain direct insights from two of the most successful investors in history. The meeting promises to be a blend of financial wisdom, candid discussions, and strategic revelations that have made Berkshire Hathaway a legendary investment powerhouse. MORE...

The Sunshine State Trap: Why Rich Migrants Might Regret Their Florida Exodus

Finance

2025-05-03 13:01:49

Florida has become a magnet for America's wealthiest individuals, thanks to its attractive tax landscape and sunny appeal. The Sunshine State has witnessed a remarkable influx of billionaires seeking to optimize their financial strategies, with no state income tax serving as a powerful draw. Leading the pack of high-profile relocations is Amazon founder Jeff Bezos, who joins a growing list of ultra-wealthy entrepreneurs making Florida their home. The state's business-friendly environment and favorable tax policies have transformed it into a premier destination for the financial elite. Prominent business leaders and tech moguls are increasingly viewing Florida not just as a vacation spot, but as a strategic financial haven. The combination of zero state income tax, beautiful weather, and a welcoming business climate makes the state an irresistible option for those looking to maximize their wealth preservation. From tech titans to hedge fund managers, Florida's allure continues to grow, signaling a significant shift in where America's most successful individuals choose to establish their primary residences. The state's economic landscape is being reshaped by these influential newcomers, who are voting with their feet and their fortunes. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421