Breaking: Borderless.xyz Supercharges Global Payments with Trace Finance Integration

Finance

2025-04-23 07:27:00

Borderless.xyz Elevates Payment Solutions with Trace Finance Integration Borderless.xyz has taken a significant leap forward in financial technology by partnering with Trace Finance, promising to revolutionize cross-border payment experiences. This strategic collaboration aims to streamline and enhance payment processes for users, offering a more seamless and efficient financial transaction ecosystem. The integration brings together Borderless.xyz's innovative platform with Trace Finance's robust payment infrastructure, creating a powerful synergy that addresses the complex challenges of international money transfers. By combining their technological strengths, the two companies are set to deliver a more transparent, faster, and more cost-effective payment solution for businesses and individuals alike. Users can now expect improved transaction speeds, reduced fees, and enhanced security features, marking a notable advancement in the digital payment landscape. This partnership underscores both companies' commitment to simplifying global financial interactions and providing cutting-edge financial services. As the digital finance world continues to evolve, collaborations like this demonstrate the ongoing innovation in fintech, promising more accessible and user-friendly financial solutions for a global audience. MORE...

Finance Revolution: How Embedded Banking is Transforming Corporate Treasury

Finance

2025-04-23 07:11:42

Celent Unveils Critical Insights: A Strategic Wake-Up Call for Banking Product Leaders A groundbreaking report from Celent has emerged, delivering a powerful message that demands immediate attention from banking product strategy and management executives. The comprehensive analysis serves as a compelling call to action, challenging financial institutions to reimagine their product development and strategic approach in an increasingly competitive landscape. The report highlights critical areas where banks must innovate, adapt, and transform their product management strategies to stay relevant in today's rapidly evolving financial ecosystem. By providing actionable insights and strategic recommendations, Celent is pushing banking leaders to think beyond traditional models and embrace a more dynamic, customer-centric approach to product development. Financial institutions are urged to take note of these pivotal recommendations, which could potentially reshape their competitive positioning and future growth trajectory. The time for incremental changes has passed; bold, strategic moves are now essential for survival and success in the modern banking environment. MORE...

Financial Tremors: BOJ Warns Banks to Brace for Market Turbulence

Finance

2025-04-23 06:29:44

In a stark warning to the financial sector, the Bank of Japan highlighted the growing challenges facing Japanese banks amid escalating global market uncertainties. On Wednesday, the central bank emphasized the critical need for financial institutions to remain vigilant about potential risks stemming from unpredictable international trade policies. The volatile landscape of global financial markets presents a complex web of challenges that demand careful navigation. With trade tensions and economic uncertainties creating unprecedented market fluctuations, Japanese banks must develop robust risk management strategies to protect their investments and maintain stability. The Bank of Japan's assessment underscores the importance of proactive monitoring and adaptive financial planning. As international economic dynamics continue to shift, banks must be prepared to quickly respond to emerging risks and potential market disruptions. Financial leaders are advised to closely track global economic trends, maintain flexible investment portfolios, and implement comprehensive risk mitigation techniques to safeguard their institutions against potential economic turbulence. MORE...

Fiscal Shock: Treasury Reveals Unexpected Surge in National Debt

Finance

2025-04-23 06:10:51

In a revealing financial snapshot, the United Kingdom's government has disclosed substantial borrowing figures, revealing a staggering £151.9 billion deficit for the fiscal year ending in March. This significant sum highlights the ongoing economic challenges and fiscal pressures facing the nation, reflecting the complex financial landscape in the wake of recent global economic disruptions. The substantial borrowing figure underscores the government's efforts to manage public finances during a period of economic uncertainty, potentially driven by factors such as pandemic recovery, infrastructure investments, and ongoing economic support measures. These numbers provide crucial insights into the country's fiscal health and the strategic financial approaches being employed to navigate current economic complexities. Economists and financial analysts will likely scrutinize these figures, examining the implications for future economic policy, potential tax strategies, and the long-term financial trajectory of the United Kingdom. MORE...

Breaking: Young Adults Left Behind - The Housing Crisis Facing Foster Care Survivors

Finance

2025-04-23 05:13:45

A critical gap exists in housing support for youth transitioning out of the care system. Currently, no dedicated funding source has been established to address the urgent housing needs of young people leaving foster care or residential programs. This lack of targeted financial support leaves vulnerable young adults at risk of homelessness and instability during a crucial period of their lives. The absence of specific funding mechanisms means that many young people find themselves without a safety net precisely when they need the most support. Transitioning from care to independent living is challenging, and without dedicated resources, these youth often struggle to secure stable housing, potentially derailing their future prospects and personal development. Addressing this funding gap is crucial to ensuring that young people aging out of care have a fair chance at building a successful and stable life. Policymakers and community leaders must recognize the importance of creating targeted financial support to help these vulnerable young adults establish themselves in society. MORE...

Swiss Financial Powerhouse Prepares to Checkmate Trade Tensions in Washington Showdown

Finance

2025-04-23 05:06:56

In a strategic diplomatic and economic maneuver, top Swiss officials are set to explore whether substantial investments in the United States can pave the way for tariff relief. Following a bold trend, pharmaceutical powerhouses Roche and Novartis are leading the charge by announcing significant expansions of their U.S. operations. This week, Swiss delegation members will leverage these major corporate commitments as a potential bargaining chip in trade negotiations. The pharmaceutical giants' substantial investments signal a proactive approach to strengthening economic ties between Switzerland and the United States, potentially creating a pathway to more favorable trade conditions. Roche's recent investment announcement, coming on the heels of Novartis's similar strategic move, underscores Switzerland's commitment to deepening its economic engagement with the U.S. market. By demonstrating tangible economic contributions, Swiss officials hope to negotiate more favorable import terms and reduce existing trade barriers. The diplomatic strategy hinges on showcasing direct economic benefits to the United States through increased corporate investment, job creation, and long-term economic partnerships. As negotiations unfold, the world will be watching to see if these substantial commitments translate into meaningful trade concessions. MORE...

Spurs' Financial Squeeze: How Tottenham's Wallet is Tightening the Transfer Market

Finance

2025-04-23 04:11:09

Tottenham Hotspur's financial landscape hints at a potentially restrained transfer window, with the club's current economic indicators suggesting that this summer's spending may not reach the heights of recent mercato periods. The Spurs' financial constraints could significantly impact their ability to make marquee signings, potentially forcing the club to adopt a more strategic and measured approach to squad reinforcement. While fans might be hoping for blockbuster transfers, the financial reality facing the North London club indicates a more prudent transfer strategy. The team's budget limitations may require creative recruitment and a focus on developing existing talent, rather than splashing out on high-profile acquisitions. MORE...

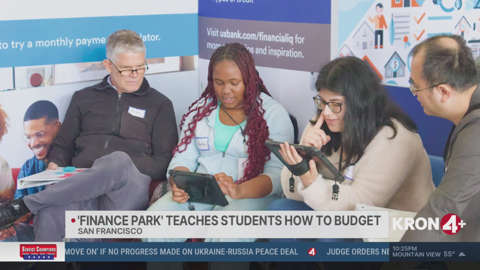

Money Matters 101: How Teens Are Learning Real-World Financial Survival Skills

Finance

2025-04-23 01:35:02

Financial Literacy Comes Alive for Bay Area Students

This April, Junior Achievement of Northern California is transforming financial education with its innovative Finance Park Pop-up program, bringing real-world financial skills directly into local classrooms. The interactive initiative has been making waves across the Bay Area, recently stopping at Thurgood Marshall Academic High School in San Francisco.

The program goes beyond traditional classroom learning, offering students a hands-on experience in understanding personal finance. By simulating real-life financial scenarios, students learn critical skills like budgeting, distinguishing between essential needs and discretionary wants, and making informed financial decisions.

Through engaging workshops and interactive sessions, students are gaining practical insights into money management that will serve them well beyond their school years. The Finance Park Pop-up not only educates but empowers young people to take control of their financial futures.

As Financial Literacy Month continues, this program stands as a beacon of practical education, preparing the next generation to navigate the complex world of personal finance with confidence and knowledge.

MORE...Fiscal Lifeline: Connecticut's Bold Move to Slash Transportation Debt

Finance

2025-04-23 00:39:23

Connecticut lawmakers are paving the way for significant financial relief, as a key legislative committee has green-lit groundbreaking bills aimed at transforming the state's transportation funding and vehicle taxation landscape. The proposed legislation promises to tackle two major financial challenges: reducing the state's transportation construction debt and gradually eliminating property taxes on vehicles over the next decade. The committee's approval marks a potential turning point for Connecticut residents, offering a glimpse of future financial reprieve. By addressing both transportation infrastructure costs and vehicle ownership expenses, these bills demonstrate a strategic approach to easing the financial burden on state residents. While the full implementation is set to unfold in the 2030s, the proposed changes signal a proactive stance on fiscal management and taxpayer support. Residents and local officials alike are watching closely as these innovative proposals move through the legislative process, holding hope for meaningful economic relief in the years to come. MORE...

WRISE Expands Strategic Horizons: New Corporate Finance Division Signals Bold Market Move

Finance

2025-04-23 00:00:00

In a strategic expansion move, WRISE has further strengthened its financial advisory presence by acquiring a licensed firm in Hong Kong. This latest addition to their portfolio positions the company to capitalize on high-stakes financial transactions, including complex initial public offerings (IPOs), privatization deals, and corporate takeovers. The Hong Kong-based licensed advisory firm brings specialized expertise in navigating the intricate landscape of corporate financial restructuring and strategic transactions. By integrating this new entity, WRISE demonstrates its commitment to broadening its international reach and enhancing its capabilities in one of Asia's most dynamic financial markets. This acquisition not only expands WRISE's geographical footprint but also provides clients with deeper insights and more comprehensive financial advisory services across critical business transformation opportunities. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421