Motor Finance Scandal: UK Weighs Compensation Plan for Millions of Drivers

Finance

2025-03-11 07:23:16

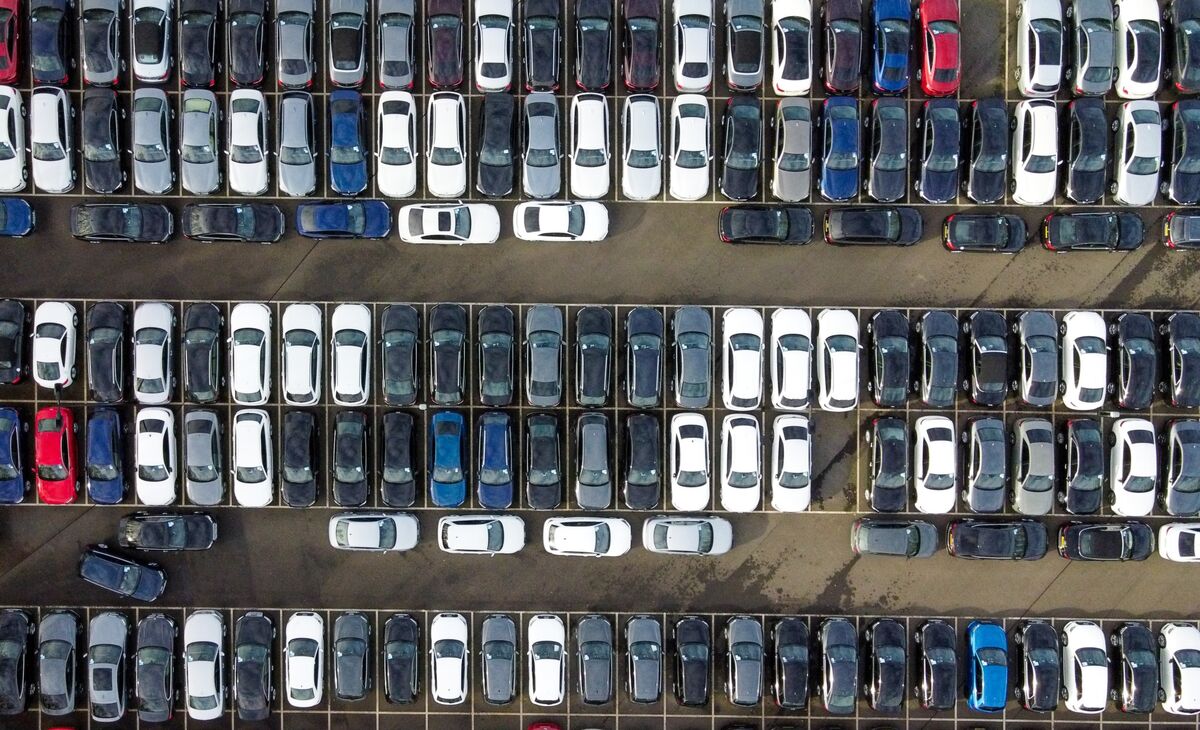

In a significant move to protect consumer interests, the UK's Financial Conduct Authority (FCA) is exploring the development of a comprehensive redress scheme targeting potential historical misconduct in motor finance sectors. The proposed framework would require banks to take decisive action if they uncover evidence of past practices that may have financially harmed consumers. This potential new initiative signals the FCA's commitment to ensuring fair treatment and financial protection for individuals who might have been negatively impacted by questionable banking practices in the motor finance industry. By establishing a structured redress mechanism, the regulatory body aims to hold financial institutions accountable and provide a clear path for consumer compensation. The proposed scheme represents a proactive approach to addressing historical financial irregularities, demonstrating the FCA's ongoing efforts to maintain transparency and integrity within the banking sector. As details of the potential redress framework continue to emerge, consumers and financial institutions alike are closely monitoring the developments. MORE...

Beyond ChatGPT: The AI Revolution Transforming Financial Services from the Ground Up

Finance

2025-03-11 06:51:20

The financial world is witnessing a groundbreaking transformation as major banking institutions pour substantial investments into cutting-edge technology that transcends traditional artificial intelligence. These revolutionary systems represent a quantum leap beyond conventional AI, featuring unprecedented capabilities to learn, dynamically adapt, and execute extraordinarily complex tasks with remarkable precision. Unlike previous generations of technological solutions, these advanced systems are designed to think and evolve in ways that mirror human cognitive processes. They can analyze intricate patterns, make nuanced decisions, and continuously improve their performance without explicit reprogramming. By leveraging sophisticated machine learning algorithms and neural networks, these technologies are poised to revolutionize how financial institutions operate, make strategic decisions, and serve their customers. Leading banks are recognizing that this isn't just an incremental improvement, but a fundamental shift in technological capability. They are investing billions of dollars to position themselves at the forefront of this technological revolution, understanding that early adoption could provide significant competitive advantages in an increasingly digital financial landscape. MORE...

Rising Bond Yields: Japan's Finance Chief Sees Silver Lining in Economic Shift

Finance

2025-03-11 04:23:59

Japan's Finance Minister Offers Nuanced Perspective on Rising Bond Yields In a carefully crafted statement on Tuesday, Japan's finance minister addressed the growing market concerns surrounding escalating bond yields, offering a balanced view of their potential economic implications. The official acknowledged that the rising borrowing costs present a complex landscape of both opportunities and challenges for the nation's financial ecosystem. By framing the bond yield increase as a multifaceted economic phenomenon, the minister sought to calm market jitters and provide a measured perspective on the potential impacts. The statement suggests that while higher yields could create some economic pressures, they might also signal underlying strengths in Japan's financial markets. Investors and economic analysts are closely watching these developments, recognizing that the bond yield trajectory could have significant ripple effects across various sectors of the Japanese economy. The finance minister's comments aim to provide reassurance and context during a period of financial uncertainty. MORE...

Currency Waves: Japan's Finance Chief Warns of Forex Impact on Daily Life

Finance

2025-03-11 02:07:20

Navigating the Global Financial Landscape: Strategic Forex Monitoring and Response In today's interconnected financial world, successful businesses and investors must remain agile and responsive to dynamic currency market fluctuations. Effective forex monitoring isn't just about tracking exchange rates—it's about understanding complex global economic signals and strategically positioning oneself to mitigate risks and capitalize on emerging opportunities. Key strategies for comprehensive forex impact management include: • Real-time Market Intelligence: Leveraging advanced technological tools and analytics platforms to gain instant insights into currency movements • Comprehensive Economic Analysis: Examining geopolitical events, central bank policies, and macroeconomic indicators that influence currency valuations • Risk Mitigation Techniques: Developing robust hedging strategies to protect against unexpected market volatility • Proactive Decision-Making: Creating flexible financial frameworks that can quickly adapt to changing international economic conditions By maintaining a sophisticated, data-driven approach to forex monitoring, organizations can transform potential currency challenges into strategic advantages. The ability to respond swiftly and intelligently to market dynamics is no longer a luxury—it's a fundamental requirement for sustainable global financial success. MORE...

Wall Street on Edge: CFOs Scramble to Fortify Cash Reserves Amid Banking Turmoil

Finance

2025-03-11 01:17:40

The Banking Landscape Transformed: How Depositors Are Reshaping Financial Strategies In the wake of the tumultuous banking crisis of 2023, depositors have emerged as strategic architects of their financial futures. What began as a five-day whirlwind of uncertainty has evolved into a profound shift in banking behaviors, driven by a desire to protect assets and align investments with personal values. The brief but intense banking turbulence has left an indelible mark on how individuals and businesses approach their financial relationships. No longer content with passive account management, depositors are now actively reassessing risks, diversifying their holdings, and seeking institutions that offer both security and alignment with their core principles. This transformation goes beyond mere risk mitigation. It represents a fundamental reimagining of the relationship between depositors and financial institutions. Consumers are demanding greater transparency, more robust safeguards, and a commitment to ethical banking practices that reflect their personal and professional values. As the aftershocks of the 2023 banking crisis continue to reverberate, one thing is clear: the financial landscape has been permanently altered. Depositors are no longer just account holders; they are informed, empowered decision-makers charting a new course in corporate finance. MORE...

Bond Market Shock: Japan's Finance Chief Warns of Rate Tsunami

Finance

2025-03-11 00:52:01

In a pivotal moment for Japan's economic landscape, Finance Minister Shunichi Kato has emerged as a key figure navigating the country's complex financial challenges. With a steady hand and strategic vision, Kato is working to stabilize Japan's economic trajectory and address critical monetary policy concerns. Kato brings a wealth of experience to his role, demonstrating a nuanced understanding of Japan's economic intricacies. His approach combines pragmatic policy-making with a forward-looking perspective, aiming to bolster Japan's financial resilience in an increasingly volatile global market. Recent statements from the minister have signaled a commitment to carefully managing economic pressures, including inflation concerns and currency fluctuations. Kato's leadership comes at a crucial time, as Japan seeks to reinvigorate its economic growth and maintain its position as a major global economic power. The finance minister has been particularly focused on implementing strategies that can stimulate economic recovery while maintaining fiscal responsibility. His balanced approach has garnered attention from both domestic and international economic observers, who see his leadership as potentially transformative for Japan's economic future. As Japan continues to navigate complex economic challenges, Minister Kato remains at the forefront, working to craft policies that will support sustainable growth and economic stability for the nation. MORE...

Lithium Deal Breakthrough: Rio Tinto's Bold $825M Bond Strategy to Secure Arcadium

Finance

2025-03-11 00:31:48

Mining giant Rio Tinto is making strategic financial moves to streamline its recent acquisition of Arcadium Lithium Plc. The company plans to issue bonds in the United States market, with the primary goal of refinancing a short-term bridging loan used to fund its $6.7 billion purchase. By tapping into the US bond market, Rio Tinto aims to convert its temporary financing into a more stable, long-term debt instrument. This approach demonstrates the company's proactive financial management and commitment to optimizing its capital structure following the significant lithium-focused acquisition. The move underscores Rio Tinto's continued investment in critical minerals and its strategic positioning in the growing lithium market, which is crucial for electric vehicle and renewable energy technologies. MORE...

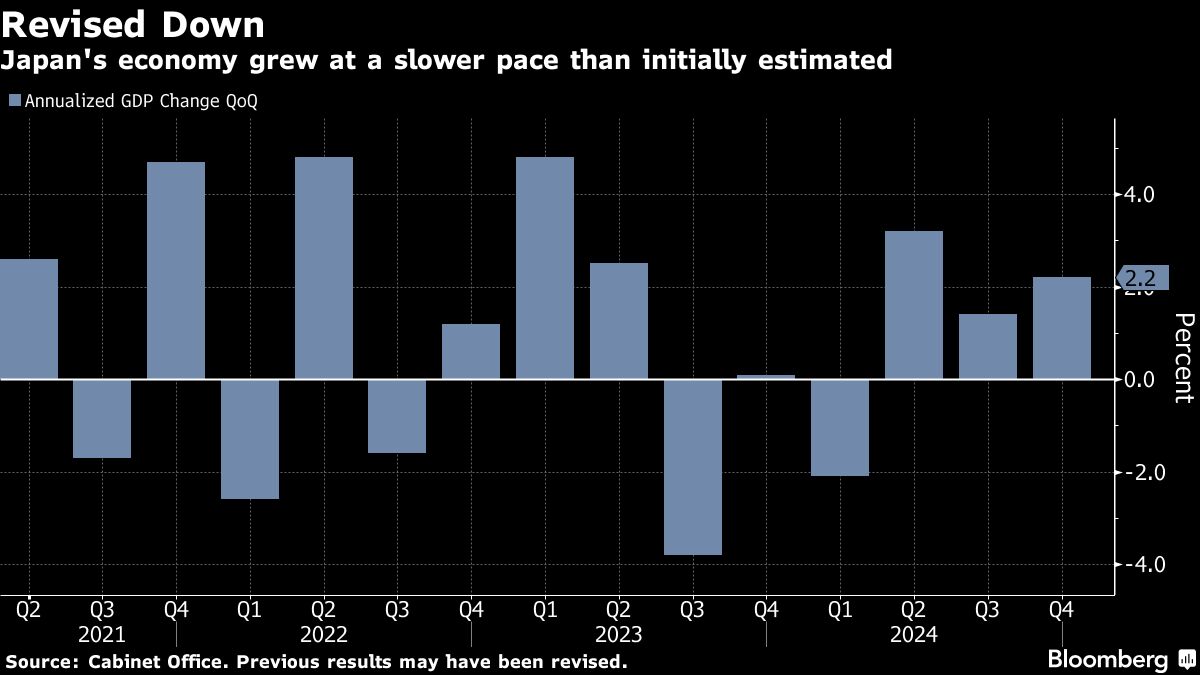

Japan's Economic Outlook Stumbles: Growth Forecast Slashed Before Central Bank Showdown

Finance

2025-03-11 00:09:04

Japan's Economic Growth Downshifts, Signaling Cautious Path for Central Bank In a recent economic update, Japan's economic expansion during the final quarter of 2024 has revealed a more modest growth trajectory than initially anticipated. This nuanced development could potentially influence the Bank of Japan's upcoming policy deliberations, suggesting a likelihood of maintaining current monetary strategies. The revised economic data provides a more tempered view of Japan's economic performance, reflecting the complex challenges facing the world's third-largest economy. Analysts and policymakers are closely examining these figures to gauge the nation's economic resilience and potential future monetary interventions. With the Bank of Japan set to convene next week, these latest economic indicators could play a crucial role in shaping their decision-making process. The more subdued growth figures might reinforce the central bank's current stance of cautious monetary policy management. Investors and economic observers are now keenly awaiting further insights into Japan's economic outlook, as the country navigates global economic uncertainties and seeks sustainable growth strategies. MORE...

Navigating Turbulent Waters: China's Financial Chief Confronts Economic Crossroads

Finance

2025-03-10 23:49:52

On Valentine's Day, Chinese investors were caught off guard by an extraordinary market development. Across the financial landscape, numerous listed companies simultaneously announced a significant shareholder update: Central Huijin had entered the scene. This strategic move by China's domestic sovereign wealth fund subsidiary, China Investment Corp, signaled a bold restructuring of state-owned enterprises (SOEs) with far-reaching implications for the country's financial ecosystem. The unexpected intervention suggests a calculated effort to consolidate and strengthen state-controlled financial entities. By taking control of multiple firms with diverse onshore market interests, Central Huijin is positioning itself to tackle China's most intricate financial challenges with unprecedented scale and coordination. This unprecedented consolidation represents more than just a routine corporate maneuver. It reflects a sophisticated approach to managing complex economic landscapes, potentially reshaping the dynamics of China's financial sector and demonstrating the government's proactive strategy in navigating economic uncertainties. Investors and market analysts are now closely watching how this newly empowered super-sized state-owned enterprise will leverage its expanded influence and resources to drive strategic economic objectives. MORE...

Breaking: The Silent Financial Anxiety Consuming Millennials and Gen X – Money Dysmorphia Explained

Finance

2025-03-10 23:31:01

Financial burnout isn't just a buzzword—it's a real emotional and mental exhaustion that transcends age groups and income levels. While millennials and Gen Z might seem most vocal about this phenomenon, the truth is that anyone can feel overwhelmed by the constant financial pressures of modern life. Whether you're living paycheck to paycheck or have a comfortable savings cushion, the stress of managing money, meeting financial expectations, and navigating an increasingly complex economic landscape can take a significant toll on your mental well-being. The relentless pursuit of financial stability can leave even the most financially secure individuals feeling drained and disconnected. From mounting student loans and rising living costs to the pressure of maintaining a certain lifestyle, financial burnout creeps in silently, affecting people across all socioeconomic backgrounds. It's not about how much money you have, but how the constant financial juggling act impacts your mental and emotional health. Recognizing and addressing financial burnout is crucial for maintaining overall life satisfaction and personal resilience in today's challenging economic environment. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421