Medway Schools Tap Financial Leader: New Director Set to Steer District's Fiscal Strategy

Finance

2025-04-14 09:16:02

Medway Public Schools Welcomes Patrick McIntyre as New Director of Finance and Operations The Medway Public Schools district has appointed Patrick McIntyre to the critical role of director of finance and operations. McIntyre brings a wealth of experience and expertise to this key administrative position, promising to provide strategic financial leadership and operational support for the school district. In his new role, McIntyre will be responsible for overseeing the district's financial management, budgeting, and operational efficiency. His appointment reflects the district's commitment to maintaining strong fiscal oversight and ensuring optimal resource allocation for the benefit of students, teachers, and staff. McIntyre's background and professional skills are expected to contribute significantly to the district's ongoing efforts to provide high-quality educational resources and maintain financial stability. His leadership is anticipated to play a crucial part in supporting Medway Public Schools' educational mission and strategic goals. MORE...

Breaking: Mauritius Ex-Finance Chief Walks Free Amid High-Stakes Fraud Allegations

Finance

2025-04-14 09:13:12

In a significant legal development, a Mauritian court has approved bail for a former finance minister embroiled in a high-profile fraud investigation. The politician, who stands accused of embezzlement at a state-owned enterprise, was granted temporary release following intense legal proceedings. Both his legal representation and the financial crimes commission confirmed the bail decision on Monday, marking a crucial moment in the ongoing corruption probe. The case has drawn considerable attention, highlighting the complex challenges of financial accountability in government circles. While the bail grant does not imply innocence, it provides the former minister an opportunity to prepare his defense outside of detention. Investigators continue to meticulously examine the allegations of misappropriation of state funds, signaling a commitment to transparency and judicial integrity. MORE...

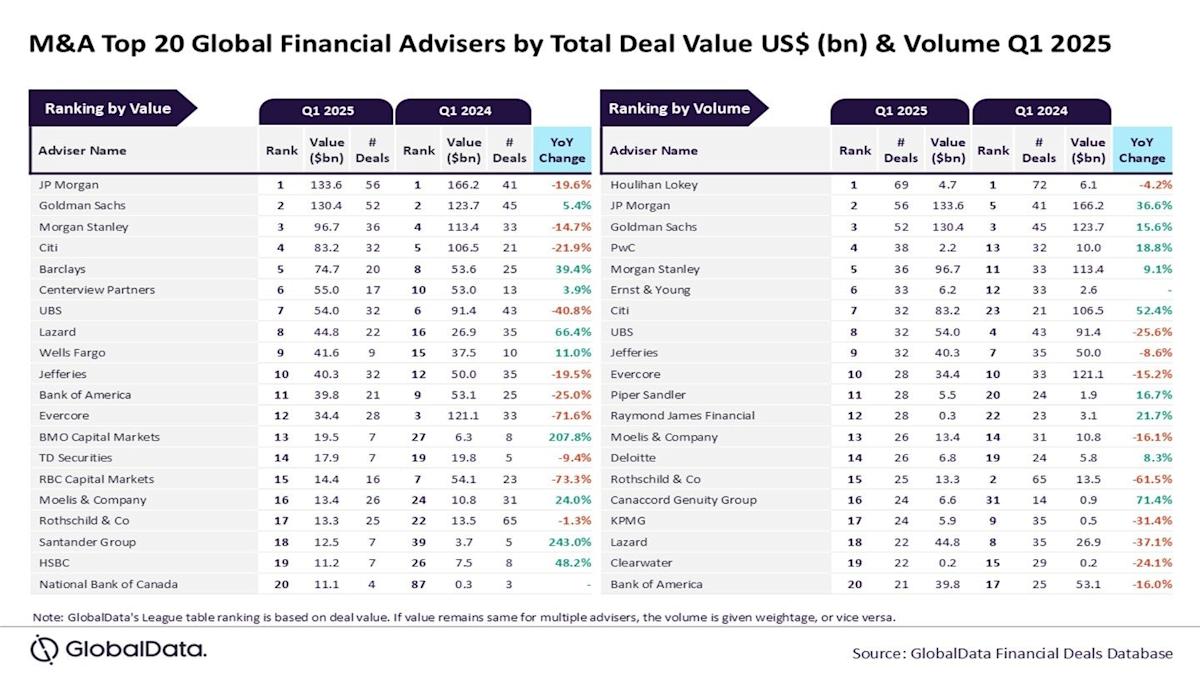

Wall Street Titans Dominate: JP Morgan and Houlihan Lokey Crush Q1 M&A Advisory Landscape

Finance

2025-04-14 09:08:55

JP Morgan and Houlihan Lokey Dominate M&A Advisory Landscape in Q1 2025 In a groundbreaking financial analysis, global research firm GlobalData has unveiled its latest league table, crowning JP Morgan and Houlihan Lokey as the undisputed champions of mergers and acquisitions (M&A) advisory for the first quarter of 2025. The comprehensive ranking, which meticulously evaluates financial advisers based on both transaction value and volume, highlights the exceptional performance of these two powerhouse firms. By demonstrating remarkable strategic insight and deal-making prowess, JP Morgan and Houlihan Lokey have set a new benchmark in the competitive world of corporate financial advisory. GlobalData's rigorous methodology provides a transparent and comprehensive view of the M&A advisory landscape, offering investors and industry professionals a critical lens into the most influential financial institutions driving corporate transformations. As the global business ecosystem continues to evolve, these top-tier financial advisers play a pivotal role in shaping strategic corporate decisions and facilitating complex merger and acquisition strategies. MORE...

Financial Firestorm: Mauritius Ex-Minister Fights Fraud Allegations with Bail Breakthrough

Finance

2025-04-14 08:30:05

In a significant development, Mauritian authorities have granted bail to former Finance Minister Renganaden Padayachy, bringing an end to his five-day detention. The high-profile politician was held in custody as part of an ongoing investigation by the Financial Crimes Commission, which is probing allegations of potential financial irregularities. Padayachy's release marks a critical moment in the unfolding legal saga, with investigators continuing to scrutinize the details surrounding the financial probe. While the specific charges remain under wraps, the detention and subsequent bail have drawn considerable attention to potential misconduct within the country's financial leadership. The Financial Crimes Commission's investigation signals a robust approach to transparency and accountability in Mauritian public finance, demonstrating the government's commitment to rooting out potential corruption. As the case progresses, many will be watching closely to see how the investigation unfolds and what implications it might have for the nation's political and financial landscape. MORE...

Navigating Market Chaos: 5 Expert Strategies Financial Advisors Are Using Now

Finance

2025-04-14 08:30:03

In the bustling world of financial advisory, client communication is reaching new heights. "Our phones are constantly ringing," shared a seasoned financial planner, highlighting the intense demand for professional financial guidance in today's complex economic landscape. The surge in client interactions underscores the growing need for personalized financial strategies and expert advice. Professionals across the industry are experiencing an unprecedented volume of client inquiries, reflecting the increasing complexity of personal and business financial planning. From investment strategies to retirement planning, clients are seeking comprehensive insights to navigate their financial futures with confidence. MORE...

Money Matters: How Different Generations Are Winning (and Losing) the Financial Game

Finance

2025-04-14 08:00:55

A groundbreaking study from the University of Georgia has unveiled striking disparities in financial well-being across generations, highlighting a significant economic gap between Millennials and Baby Boomers. The research reveals that younger adults are experiencing notably lower levels of financial stability compared to their older counterparts. The study delves into the complex financial landscape that Millennials navigate, exploring the challenges that have contributed to their reduced economic confidence. Factors such as rising student debt, a competitive job market, and changing economic conditions appear to play crucial roles in shaping their financial experiences. In contrast, Baby Boomers demonstrate a more robust financial standing, likely benefiting from decades of career growth, established investments, and more traditional economic opportunities. This generational divide underscores the evolving economic challenges faced by younger generations in today's rapidly changing financial environment. Researchers suggest that understanding these generational differences is key to developing targeted financial support and strategies that can help bridge the economic gap and improve financial well-being for younger adults. MORE...

Tech Revolution: How AI and Blockchain Are Reshaping the Future of Legal Funding

Finance

2025-04-14 07:00:18

In a captivating exploration of the financial landscape, Louisa Klouda delves deep into the dynamic world of direct lending, uncovering how groundbreaking innovations and emerging business models are radically reshaping traditional financial structures. Her insightful podcast reveals the transformative forces driving unprecedented change in the direct lending finance sector, highlighting the innovative approaches that are challenging long-established norms and creating new opportunities for financial engagement. Through her expert analysis, Klouda illuminates the disruptive technologies and novel strategies that are redefining how financial services operate, demonstrating how cutting-edge models are breaking down conventional barriers and introducing more flexible, adaptive approaches to lending and financial management. MORE...

Breaking Finance Barriers: How Cox Enterprises' CFO Is Reimagining Corporate Strategy

Finance

2025-04-14 06:00:09

In the dynamic world of corporate finance, Dallas Clement stands out as a strategic leader who understands that modern CFOs are far more than number crunchers. As the Chief Financial Officer of Cox Enterprises, Clement embodies a new breed of financial executive who combines analytical prowess with visionary leadership. Navigating the complex landscape of corporate finance requires more than just spreadsheets and financial reports. Clement believes that today's most effective CFOs must be storytellers, strategists, and change agents. They need to translate complex financial data into compelling narratives that inspire teams and guide strategic decision-making. Risk management is a critical aspect of Clement's approach. He emphasizes the importance of balanced risk-taking, understanding that innovation and growth cannot happen without carefully calculated strategic moves. His philosophy is not about avoiding risk, but about understanding and managing it intelligently. The evolving role of CFOs demands adaptability and long-term thinking. Clement advocates for what he calls "staying power" - the ability to maintain focus and resilience through economic shifts, technological disruptions, and organizational challenges. This mindset is crucial for driving sustainable financial performance and organizational success. Strategic vision sets exceptional financial leaders apart. For Clement, this means looking beyond quarterly results and developing comprehensive financial strategies that align with broader corporate goals. He sees the CFO's role as a critical bridge between financial operations and overall business strategy. In an era of rapid technological change and economic uncertainty, Clement's approach offers a blueprint for financial leadership that is both innovative and grounded. His insights remind us that the most effective financial executives are those who can blend analytical rigor with strategic imagination. MORE...

EU Pledges Massive Financial Lifeline to Palestinian Territories

Finance

2025-04-14 05:20:38

The European Union is set to significantly boost its financial commitment to the Palestinian Authority, announcing a substantial three-year aid package valued at approximately 1.6 billion euros ($1.8 billion). In an exclusive interview with Reuters, the European Commissioner overseeing Middle Eastern affairs revealed the details of this major financial support initiative. This generous funding package underscores the EU's continued dedication to supporting Palestinian economic stability and development. By providing such a substantial financial commitment, the European Union aims to strengthen its diplomatic and economic ties with the Palestinian territories while offering critical economic assistance during challenging times. The multi-year funding strategy demonstrates the EU's long-term approach to supporting the Palestinian Authority, signaling a sustained commitment to regional economic development and humanitarian support. This significant financial package is expected to play a crucial role in supporting infrastructure, social services, and economic initiatives in the Palestinian territories. MORE...

Financial Leadership Wanted: Columbus Launches High-Stakes Search for New Finance Director

Finance

2025-04-14 05:15:00

Columbus City Council Takes Bold Step in Financial Leadership Restructuring In a strategic move to enhance municipal financial management, the Columbus City Council has officially launched the recruitment process for a new finance director. This pivotal position represents a significant transformation from the traditional treasurer role, signaling the city's commitment to modernizing its financial governance. The newly created finance director position promises to bring fresh perspectives and innovative financial strategies to Columbus's municipal administration. By reimagining the traditional financial leadership structure, the council aims to improve fiscal oversight, financial planning, and resource management for the city. Potential candidates can expect a comprehensive search process designed to identify the most qualified professional who can lead Columbus's financial operations with expertise and vision. The council is seeking a dynamic leader who can navigate complex financial landscapes and contribute to the city's long-term economic goals. This strategic recruitment underscores Columbus's proactive approach to municipal governance and its dedication to maintaining strong, transparent financial management for the benefit of its residents and stakeholders. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421