Money Matters: Fort Sill Credit Union Empowers Community with Financial Literacy Workshop

Finance

2025-04-14 22:16:36

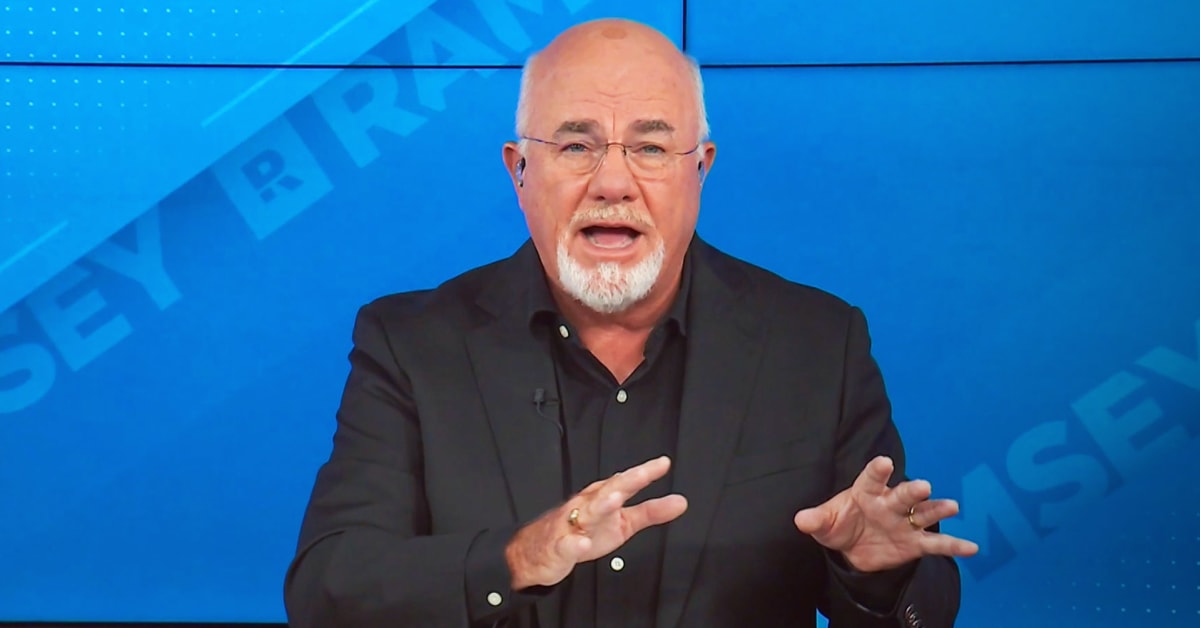

Fort Sill Federal Credit Union recently hosted an enlightening workshop designed to empower community members with essential financial literacy skills. The event brought together local residents eager to enhance their understanding of personal finance and money management strategies. Participants had the opportunity to learn practical techniques for budgeting, saving, and making smart financial decisions. Experienced financial advisors from the credit union shared valuable insights, breaking down complex financial concepts into easy-to-understand guidance. The workshop covered a range of critical topics, including: • Effective budgeting techniques • Smart saving strategies • Credit management • Investment fundamentals • Debt reduction methods Attendees praised the event for its practical approach and actionable advice, highlighting the credit union's commitment to supporting financial education in the local community. By providing these educational resources, Fort Sill Federal Credit Union demonstrates its dedication to helping members achieve greater financial stability and confidence. The interactive session not only provided crucial financial knowledge but also created a supportive environment where participants could ask questions and gain personalized financial guidance. MORE...

Wall Street's Ominous Signal: S&P 500's Bearish Crossroads Sparks Recession Alarm

Finance

2025-04-14 22:06:25

Today's trading session was packed with significant market movements that demand attention. The S&P 500 experienced a notable "death cross" - a technical indicator that often signals potential bearish trends, while the US dollar simultaneously saw a substantial decline. To help investors and traders make sense of these complex market dynamics, Yahoo Finance Markets and Data Editor Jared Blikre has provided an insightful breakdown of the day's key developments. His expert analysis offers a comprehensive look at the underlying trends and potential implications for investors. For those seeking deeper market insights and real-time analysis, we recommend checking out more of Blikre's expert commentary in the "Asking for a Trend" series. His nuanced perspective can help investors navigate the current market landscape and understand the subtle shifts that could impact investment strategies. Don't miss this opportunity to gain valuable market intelligence and stay ahead of the latest financial trends. MORE...

Global Cash Exodus: Investors Flee US Markets Amid Mounting Economic Uncertainty

Finance

2025-04-14 21:28:18

Market Signals: Is Capital Fleeing the US?

Recent market dynamics have sparked intense speculation among investors, as an unusual combination of financial indicators suggests potential shifts in global capital flows. The bond market's unexpected reaction, coupled with rising gold prices and a weakening dollar, has triggered widespread curiosity about the underlying economic currents.

RJ Gallo, a senior portfolio manager at Federated Hermes, offers critical insights into this intriguing market phenomenon. In an exclusive analysis, Gallo breaks down the complex interplay of these financial signals and what they might portend for investors.

The convergence of these market movements—stock sell-offs, gold's price surge, and the dollar's decline—raises fundamental questions about investor sentiment and potential capital migration. Are international investors losing confidence in US markets, or is this merely a temporary market fluctuation?

For a deeper understanding of these market dynamics and expert perspectives, investors are encouraged to explore additional insights through Market Domination Overtime's comprehensive market analysis.

MORE...Financial Comeback: DeFi Technologies Breaks Silence with Delayed Quarterly Reports

Finance

2025-04-14 21:00:00

DeFi Technologies Releases Restated Financial Statements for Q2 and Q3

DeFi Technologies Inc., a pioneering financial technology company bridging traditional capital markets with the innovative world of decentralized finance, has taken a significant step in financial transparency by filing restated interim financial statements.

The company, which trades under multiple stock exchanges including CBOE Canada (DEFI), German exchanges (R9B), and OTC markets (DEFTF), has completed the restatement of its financial documents for two critical reporting periods.

Specifically, the company has filed:

- Restated interim financial statements for the period ending June 30, 2024

- Corresponding management discussion and analysis (MD&A)

- Restated interim financial statements for the period ending September 30, 2024

This proactive approach demonstrates DeFi Technologies' commitment to maintaining the highest standards of financial reporting and transparency for its investors and stakeholders.

MORE...Trade Tensions Fail to Shake Fund Finance Market, KBRA Reports

Finance

2025-04-14 20:37:15

In a strategic assessment of market resilience, the rating agency highlights key financial safeguards that shield investments from potential trade-related market fluctuations. Loan-to-value (LTV) triggers and structured amortization schedules emerge as critical defensive mechanisms, providing robust protection against the unpredictable winds of economic volatility. These financial instruments serve as strategic buffers, creating a protective layer that helps investors navigate uncertain market conditions. By implementing carefully calibrated LTV triggers, financial institutions can proactively manage risk and maintain stability, even when trade dynamics become increasingly complex and challenging. The scheduled amortization approach further reinforces this defensive strategy, allowing for systematic risk reduction and providing a predictable framework for investment management. This methodical approach ensures that potential market disruptions can be absorbed and mitigated, offering investors a sense of security in an ever-changing economic landscape. MORE...

Trade Shock: How New Tariff Calculations Could Unravel a Century of Economic Progress

Finance

2025-04-14 20:34:45

Trade tensions are heating up as U.S. tariff rates surge to unprecedented levels not witnessed in over a hundred years. Despite temporary exemptions and strategic pauses, the shifting trade landscape is creating significant market turbulence. Yahoo Finance Senior Reporter Alexandra Canal recently joined Market Domination to unpack the complex dynamics driving these historic market fluctuations. Her insights reveal how evolving trade policies are sending ripples through major market indices like the S&P 500 (^GSPC), NASDAQ (^IXIC), and Dow Jones Industrial Average (^DJI). The escalating tariff environment is not just a numbers game—it's a complex economic chess match with far-reaching implications for investors, businesses, and global trade relationships. As trade policies continue to shift, market participants are closely monitoring every strategic move and potential economic impact. For those seeking deeper understanding and expert analysis of the latest market developments, Market Domination offers comprehensive coverage and cutting-edge insights into these critical economic trends. MORE...

Breaking: Glow Finance Launches, Set to Revolutionize Financial Technology

Finance

2025-04-14 20:32:51

Revolutionizing Solana's DeFi Landscape: Blueprint Finance Unveils Glow Finance In an exciting development for the Solana ecosystem, Blueprint Finance is set to launch Glow Finance, a cutting-edge liquidity engine designed to empower and enhance the experience of active Solana users. This innovative platform promises to bring a new level of sophistication and efficiency to decentralized finance on the Solana blockchain. Glow Finance emerges as a comprehensive full-stack solution, strategically crafted to address the evolving needs of crypto traders and liquidity providers. By leveraging the team's expertise behind the successful Concrete protocol, Glow Finance aims to streamline liquidity management and create more dynamic financial opportunities for users. The launch represents a significant milestone in Solana's rapidly expanding decentralized finance ecosystem, offering traders and investors a powerful new tool to optimize their crypto strategies and maximize their potential returns. MORE...

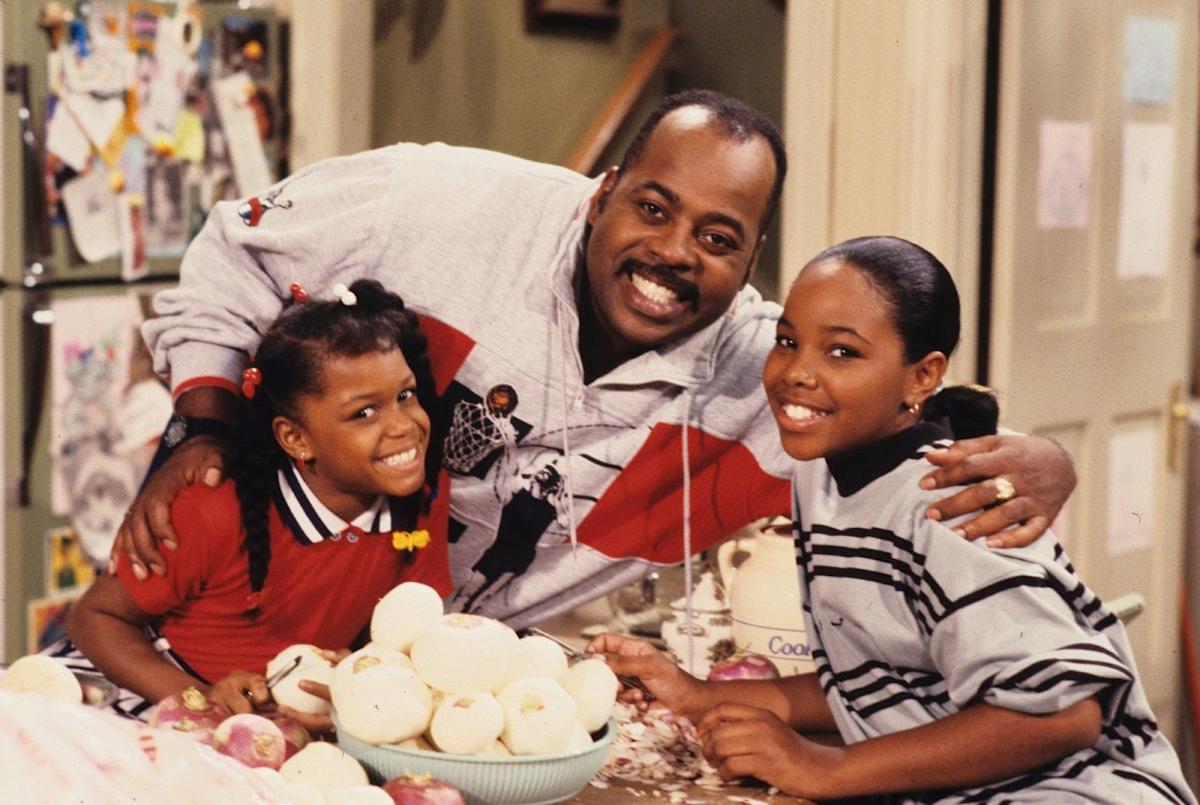

Money Wisdom from the Small Screen: What '90s TV Taught Us About Borrowing Smart

Finance

2025-04-14 20:22:48

Financial Wisdom from '90s TV: Unexpected Money Lessons

Who knew that classic '90s television could be a treasure trove of financial advice? Beyond the laugh tracks and memorable characters, many beloved shows from that era surprisingly offered valuable insights into personal finance and money management.

Friends: Budgeting and Career Resilience

Take the gang from "Friends" - their journey showcases the importance of financial adaptability. From Rachel's career transition to Chandler's job changes, they demonstrated that career paths aren't always linear, and being flexible can lead to unexpected opportunities.

Saved by the Bell: Early Financial Planning

Even teen sitcoms like "Saved by the Bell" subtly highlighted the significance of entrepreneurship and side hustles. Characters like Zack Morris often showed creative ways to earn money, teaching young viewers the value of initiative and financial creativity.

Fresh Prince of Bel-Air: Investment and Family Support

Will Smith's character illustrated how family support and strategic thinking can help overcome financial challenges. The show emphasized that networking, education, and leveraging family connections can be powerful financial tools.

So next time you're feeling nostalgic, remember that these '90s shows weren't just entertainment - they were unexpected financial education disguised as comedy!

MORE...Profits Surge: FB Financial's Q1 2025 Performance Breaks Expectations

Finance

2025-04-14 20:15:00

Nashville, Tennessee - FB Financial Corporation (NYSE: FBK), the parent company of FirstBank, has demonstrated robust financial performance in the first quarter of 2025, reporting a strong net income of $39.4 million. The company's diluted earnings per share reached $0.84, marking a significant improvement from $0.81 in the previous quarter and a substantial leap from $0.59 in the same period last year. When adjusting for certain financial factors, the company's net income stood at an impressive $40.1 million, translating to $0.85 per diluted common share. This consistent performance underscores FB Financial Corporation's strategic approach and resilience in a dynamic financial landscape. The steady earnings per share of $0.85 across the current quarter and the same quarter last year reflects the company's stable financial management and potential for continued growth. Investors and market analysts will likely view these results as a positive indicator of the company's financial health and strategic positioning in the banking sector. MORE...

GOP Financial Hawks Slam CFPB: Demand Immediate Rollback of Controversial Regulations

Finance

2025-04-14 19:03:43

In a bold move challenging the Consumer Financial Protection Bureau (CFPB), Republican members of the House Financial Services Financial Institutions Subcommittee have formally requested action from Acting Director Russell Vought. The lawmakers have dispatched a pointed letter urging the agency to address specific concerns about its current regulatory approach. The correspondence signals growing tension between congressional Republicans and the consumer protection agency, highlighting ongoing debates about the bureau's scope and regulatory practices. By directly challenging Vought, the subcommittee members are seeking transparency and potential reforms in the CFPB's operational strategies. While specific details of the letter's contents remain confidential, the communication underscores the continued political scrutiny facing the Consumer Financial Protection Bureau. Republican lawmakers appear intent on closely monitoring the agency's actions and potentially reshaping its regulatory framework. This latest development reflects the ongoing political dynamics surrounding financial regulation and the role of government oversight in consumer protection efforts. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421