Weathering Financial Storms: Why Your Retirement Nest Egg Needs Steady Hands

Finance

2025-03-29 13:00:00

Navigating Financial Stability in Uncertain Economic Times In today's unpredictable economic landscape, maintaining a balanced financial strategy remains crucial. Despite the challenges, some fundamental investment principles continue to provide a solid foundation for financial security. The core strategy of diversifying your portfolio with a mix of cash reserves and equities still holds significant merit. While economic uncertainties can create anxiety, having a balanced approach can help protect and potentially grow your wealth. Retirement planning becomes particularly nuanced for those approaching or already in their retirement years. The closer you are to retirement, the more carefully you'll need to consider your investment mix and risk tolerance. It's essential to strike a delicate balance between preserving your hard-earned savings and maintaining potential for modest growth. Key considerations include: • Maintaining an emergency cash fund • Keeping a portion of investments in stable, diversified equities • Regularly reviewing and adjusting your financial strategy • Consulting with a financial advisor who understands your unique circumstances Remember, financial resilience isn't about making perfect predictions, but about creating a flexible, thoughtful approach that can weather economic fluctuations. MORE...

Trade War Tactics: Wall Street's Strategic Playbook for Navigating Tariff Turbulence

Finance

2025-03-29 12:00:56

Wall Street Braces for Uncertainty as Trump's Tariff Announcement Looms Investors are holding their breath as President Trump prepares to unveil critical auto tariffs on April 2, creating a climate of market anxiety and volatility. The recent late-night announcement of potential trade restrictions has sent ripples through financial markets, contributing to a challenging period for the S&P 500. The index has experienced significant turbulence, falling in five out of the past six weeks, reflecting the growing unease among investors about potential trade policy implications. Market participants are closely monitoring the situation, anticipating how these potential tariffs could impact global trade dynamics and corporate performance. With tensions mounting and uncertainty at the forefront, investors are seeking expert insights to navigate the complex landscape of international trade and market fluctuations. The upcoming tariff announcement promises to be a pivotal moment that could reshape market sentiment and investment strategies in the near term. MORE...

Suze Orman's Mortgage Refinancing Checklist: 4 Critical Insights Before You Sign

Finance

2025-03-29 11:02:48

When interest rates start to dip, the allure of mortgage refinancing can be incredibly tempting. However, financial guru Suze Orman warns homeowners that the decision isn't as straightforward as simply chasing a lower percentage point. Refinancing isn't a one-size-fits-all solution. Smart homeowners understand that while a reduced interest rate might seem attractive, multiple factors must be carefully considered before making this significant financial move. The potential savings need to be weighed against closing costs, your current loan term, and how long you plan to remain in your home. Before diving into refinancing, ask yourself critical questions: Will the new loan's terms genuinely benefit your long-term financial health? Have you calculated the break-even point where your savings offset the refinancing expenses? Are you comfortable with potential changes to your loan duration or monthly payments? Expert tip: Don't just look at the interest rate. Examine the entire financial landscape, including closing costs, loan terms, and your personal financial goals. A seemingly attractive rate might not always translate to meaningful savings. By approaching mortgage refinancing strategically and holistically, you can make an informed decision that truly supports your financial well-being. MORE...

Danger Ahead: The Economic Timebomb Threatening America's Financial Stability

Finance

2025-03-29 10:00:27

The Stock Market's Tremors: A Potential Turning Point for the US Economy As equity markets experience a significant downturn, investors and economists are closely watching a critical economic indicator that could signal a dramatic shift in the post-pandemic financial landscape. The recent market sell-off threatens to disrupt a stabilizing trend that has been instrumental in helping the United States navigate economic uncertainty. Since the pandemic's peak, financial markets have been a surprising source of resilience, providing a buffer against recessionary pressures. However, the current market volatility suggests this protective mechanism might be weakening. Investors are growing increasingly anxious about the potential domino effect of sustained market declines on broader economic health. The sell-off could potentially unravel the delicate economic balance that has kept the US economy relatively robust in the face of multiple challenges. What was once a source of financial strength and consumer confidence may now be transforming into a potential harbinger of economic contraction. As market dynamics continue to evolve, economists and policymakers are closely monitoring these developments, understanding that each percentage point of market decline could have far-reaching implications for economic growth, employment, and consumer sentiment. MORE...

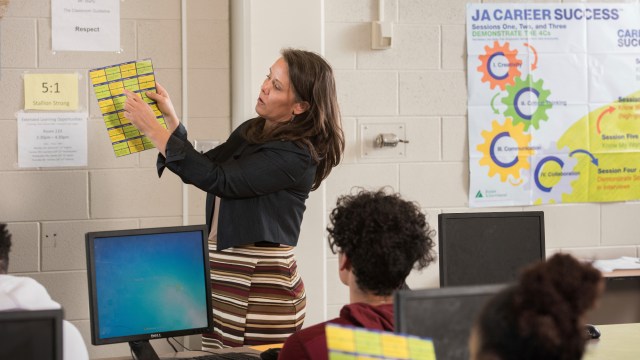

Money Matters: How Young Learners Are Mastering Financial Literacy Before Graduation

Finance

2025-03-29 09:00:00

Empowering Young Minds: Junior Achievement Launches Innovative Financial Literacy Summer Camp This summer, Junior Achievement of the Michigan Great Lakes is taking financial education to the next level by introducing an exciting weeklong summer camp designed to equip students with essential money management skills. Beyond traditional classroom learning, this immersive program offers young learners a unique opportunity to dive deep into the world of personal finance, budgeting, and economic understanding. The summer camp goes beyond textbook learning, providing interactive and hands-on experiences that will help students build a strong foundation in financial literacy. Participants will engage in dynamic workshops, real-world simulations, and collaborative activities that transform complex financial concepts into accessible and engaging lessons. By offering this innovative program, Junior Achievement continues its commitment to preparing the next generation of financially savvy individuals, empowering students with the knowledge and confidence to make smart financial decisions throughout their lives. MORE...

Breaking: Believers' Budget Balancing Act - Tithing Without Drowning in Debt

Finance

2025-03-29 08:00:00

When Financial Challenges Meet Spiritual Commitment: Navigating Tithing and Debt For many individuals wrestling with financial strain, every single penny becomes precious. But what happens when a significant portion of your income—specifically 10%—is already dedicated not to a pressing bill, but to a spiritual commitment to God? This delicate balance between financial responsibility and religious devotion presents a complex challenge for many believers. Tithing, the practice of giving a tenth of one's income to religious institutions, can feel like an additional financial burden when debt and economic pressures are already mounting. The Shadyside-based community offers a nuanced perspective on this intricate financial and spiritual dilemma. Recognizing that faith and fiscal prudence can coexist, local financial advisors and religious leaders are working together to provide guidance that respects both monetary constraints and spiritual obligations. By offering compassionate strategies and understanding, they help individuals navigate the intricate landscape of financial stewardship while maintaining their spiritual integrity. The goal is not to create additional stress, but to empower people to make informed decisions that honor both their financial health and their faith commitments. MORE...

WashTec Shatters Financial Forecasts: Surprising Earnings Surge in 2024

Finance

2025-03-29 06:19:45

WashTec Navigates Challenging Market with Resilient Financial Performance in 2024

WashTec (ETR:WSU), a leading global car wash solutions provider, has released its full-year financial results for 2024, demonstrating strategic adaptability in a complex business landscape.

Key Financial Highlights

- Revenue: €476.9 million, reflecting a modest 2.6% decline compared to the previous year

- Despite market headwinds, the company maintained a robust financial position

- Strategic initiatives continue to drive operational efficiency

The slight revenue reduction underscores the challenging economic environment WashTec has navigated, yet the company remains committed to innovation and market leadership in automotive cleaning technologies.

Investors and stakeholders can expect continued focus on strategic growth and operational optimization in the coming fiscal year.

MORE...Digital Revolution: Russia's Financial Vision Reshapes BRICS Economic Landscape

Finance

2025-03-29 03:30:50

In a bold move towards financial innovation, Russian Finance Minister Anton Siluanov revealed that BRICS nations are exploring digital assets as a strategic tool to enhance trade independence. The group is actively investigating how cutting-edge digital currencies could potentially revolutionize international financial transactions and reduce reliance on traditional monetary systems. Siluanov's statement highlights the collective ambition of BRICS countries—Brazil, Russia, India, China, and South Africa—to create a more flexible and autonomous financial ecosystem. By considering digital assets, the bloc aims to develop alternative mechanisms that could provide greater economic sovereignty and resilience against external financial pressures. The exploration of digital assets represents a significant step towards reimagining international trade and financial interactions, signaling the group's commitment to technological innovation and economic independence. As global financial landscapes continue to evolve, BRICS is positioning itself at the forefront of this transformative movement. MORE...

Green Light: Cranberry Township Moves Forward with Massive Wastewater Treatment Upgrade

Finance

2025-03-29 00:00:00

Cranberry Township is on the brink of transforming its water infrastructure, with supervisors poised to finalize critical financial arrangements for a comprehensive upgrade to the Brush Creek Treatment Plant. This week marked a significant milestone as municipal officials carefully reviewed competitive bids for major plant improvements, signaling a substantial investment in the community's essential water treatment capabilities. The proposed upgrades promise to enhance the township's water management infrastructure, potentially improving service reliability and efficiency for local residents. By moving forward with these strategic improvements, Cranberry Township demonstrates its commitment to maintaining and modernizing critical public utilities. While specific details of the bids are still being evaluated, the project represents a forward-thinking approach to municipal infrastructure development. Supervisors are meticulously examining the proposals to ensure the most cost-effective and technologically advanced solution for the Brush Creek Treatment Plant. Residents can expect more information about the project timeline and potential impacts in the coming weeks as the township progresses with these important infrastructure enhancements. MORE...

Wall Street Reveals: Q4 2024 Financial Scorecard Breaks Records and Defies Expectations

Finance

2025-03-29 00:00:00

Helios Fairfax Partners Announces Significant Strategic Development

In a groundbreaking announcement today, Helios Fairfax Partners Corporation revealed a pivotal strategic initiative that promises to reshape its corporate landscape. The company is poised to make substantial moves that could potentially transform its market positioning and future growth trajectory.

Leveraging its extensive experience and deep market insights, Helios Fairfax is demonstrating its commitment to innovation and strategic expansion. The organization's leadership team has carefully crafted this approach to maximize shareholder value and capitalize on emerging opportunities in the current business environment.

While specific details remain confidential, industry analysts are closely watching the potential implications of this strategic development. The announcement signals Helios Fairfax's proactive stance in navigating complex market dynamics and positioning itself for future success.

Investors and stakeholders are encouraged to stay tuned for further updates as more information becomes available about this significant corporate initiative.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421