Home Sweet Hurdle: How Soaring Mortgage Rates Are Cooling Spring's Housing Fever

Finance

2025-04-17 16:34:11

Mortgage Rates Surge: Spring Home Buying Becomes More Challenging

Prospective homebuyers are facing another hurdle as mortgage rates continue to climb, casting a shadow over the traditionally vibrant spring real estate market. In an exclusive breakdown, Yahoo Finance Senior Reporter Claire Boston reveals the latest trends that are making home ownership increasingly difficult for many Americans.

The recent spike in mortgage rates is sending ripples through the housing market, potentially reshaping consumer purchasing strategies. Potential buyers are now confronting a more expensive landscape, with borrowing costs pushing the dream of homeownership further out of reach for many.

Boston's expert analysis highlights how these rising rates, combined with potential new economic factors like tariffs, are dramatically influencing consumer behavior and real estate planning. Families and first-time homebuyers are being forced to reassess their budgets and housing expectations in this challenging economic environment.

For more in-depth insights and comprehensive market analysis, viewers are encouraged to explore additional coverage on Wealth, where industry experts continue to unpack the complex dynamics of today's real estate and financial markets.

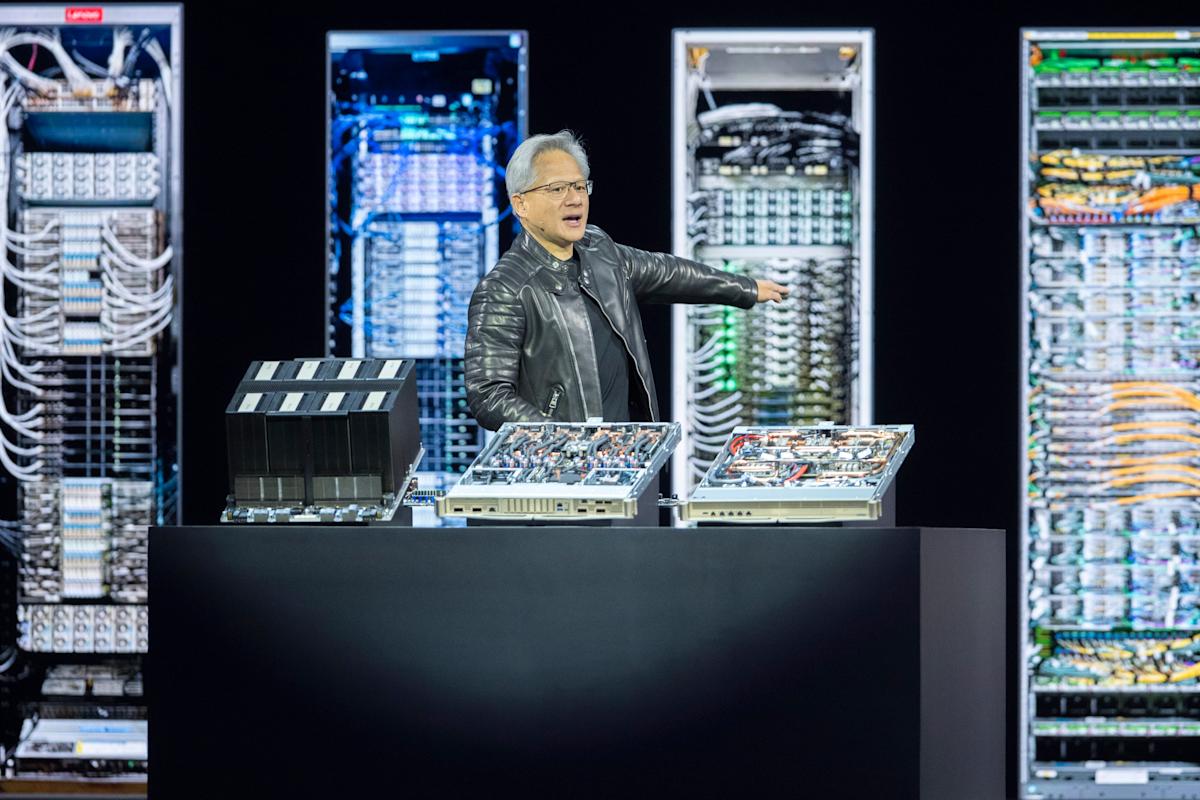

MORE...Nvidia's Market Meltdown: $250B Vanishes as Trump's Tech Blockade Strikes Chip Giant

Finance

2025-04-17 16:04:22

Nvidia's stock market rollercoaster continues as the tech giant experiences a significant downturn, with its market capitalization plummeting by over $250 billion since the revelation of new export restrictions. The semiconductor leader has been navigating turbulent waters following the latest regulatory challenges, sending ripples through the investment landscape. Investors are closely watching the company's response to these export controls, which have triggered a substantial sell-off and raised questions about Nvidia's future growth potential in international markets. The dramatic market cap erosion underscores the sensitivity of tech stocks to geopolitical and regulatory developments, highlighting the delicate balance tech companies must maintain in an increasingly complex global business environment. As Nvidia grapples with these challenges, the market remains on edge, anticipating the company's strategic moves and potential mitigation efforts in the face of these unexpected regulatory hurdles. MORE...

Retirement Rescue: Rachel Cruze Reveals 3 Lifeline Strategies to Prevent Financial Meltdown

Finance

2025-04-17 16:02:19

Rachel Cruze: Your Financial Compass in a Sea of Money Challenges When it comes to mastering personal finance, Rachel Cruze stands out as a beacon of hope and practical wisdom. As a renowned financial coach, she crisscrosses the nation, empowering individuals with transformative strategies to conquer debt, supercharge savings, and build a rock-solid financial future. Her mission? To help people break free from financial stress and create a life of financial freedom. With her dynamic speaking style and actionable advice, Cruze doesn't just talk about money—she provides a roadmap for financial success that resonates with people from all walks of life. Whether you're struggling with mounting bills, dreaming of financial independence, or simply wanting to make smarter money choices, Rachel Cruze offers the insights and inspiration to turn your financial goals into reality. Her passionate approach to personal finance goes beyond numbers, focusing on creating lasting financial habits that can transform lives. MORE...

Digital Goliath Crumbles: Google's Ad Empire Faces Antitrust Earthquake

Finance

2025-04-17 16:02:15

In a landmark ruling that could reshape the digital advertising landscape, a federal judge has decisively concluded that Google wields an illegal monopoly within key segments of its online advertising empire. The groundbreaking decision marks a significant legal challenge to the tech giant's dominance in the digital marketing ecosystem. The judge's ruling suggests that Google has been leveraging its market power in ways that stifle competition and potentially harm consumers and smaller advertising technology companies. This verdict represents a critical moment in the ongoing scrutiny of big tech's market practices, potentially setting the stage for substantial changes in how online advertising is conducted. By finding Google's practices anticompetitive, the court has signaled that the company's control over digital ad technologies may have crossed legal boundaries. The decision could lead to major structural changes in Google's advertising business and open up opportunities for other players in the digital advertising market. This ruling is not just a legal setback for Google, but a potential turning point in the broader conversation about market fairness and technological monopolies in the digital age. MORE...

Mortgage Rates Skyrocket: Investors Brace for Turbulent Financial Landscape

Finance

2025-04-17 16:00:15

The housing market is experiencing a notable shift as mortgage rates continue their upward trajectory, casting a shadow over home loan applications. According to the latest data from Freddie Mac, the average 30-year fixed mortgage rate has climbed to 6.83%, creating a challenging landscape for potential homebuyers. This surge in interest rates is having a tangible impact on the real estate market, with prospective homeowners becoming increasingly hesitant to lock in loans at these elevated rates. The rising cost of borrowing is effectively cooling down the once-heated housing market, causing a noticeable dip in mortgage application activity. Potential buyers are now carefully weighing their options, with many choosing to postpone home purchases or explore alternative financing strategies. The current rate environment is a stark reminder of how quickly market conditions can change, forcing both buyers and sellers to adapt to the new financial reality. MORE...

Breaking: Adocia Unveils Financial Roadmap for 2024 - Investors Take Note

Finance

2025-04-17 16:00:00

Adocia Reveals Comprehensive Financial Results for 2024

LYON, France - Adocia, a pioneering biopharmaceutical company dedicated to developing innovative therapeutic solutions for diabetes and obesity, has unveiled its annual financial statements for the fiscal year ending December 31, 2024.

On April 16, 2025, the company's board of directors formally approved the consolidated financial statements after a thorough review. The comprehensive audit procedures have been successfully completed, providing a transparent and detailed overview of Adocia's financial performance.

As a clinical-stage biotechnology firm listed on Euronext Paris (ticker: ADOC), Adocia continues to demonstrate its commitment to advancing medical treatments for metabolic health conditions. The annual financial report offers insights into the company's strategic progress and financial stability throughout the past year.

Investors and stakeholders can find the complete financial details in the company's official financial report, which highlights Adocia's ongoing research and development efforts in diabetes and obesity therapeutics.

MORE...Tech Titan Meets Trade Tensions: Nvidia CEO's China Trip Amid Trump's Tariff Talks

Finance

2025-04-17 15:00:42

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Umbrella Locks Down Enterprise Trust: Aces SOC 1 and SOC 2 Security Certifications

Finance

2025-04-17 14:46:00

Anodot's Umbrella Elevates Cloud Financial Management with Prestigious Security Certifications Umbrella, the cutting-edge Cloud Financial Management (CFM) platform by Anodot, has achieved a significant milestone by securing both SOC 1 Type II and SOC 2 Type II compliance. These rigorous certifications, meticulously conducted by the renowned Ernst & Young (EY), underscore Umbrella's unwavering dedication to maintaining the highest standards of operational excellence, data protection, and financial transparency. By successfully obtaining these prestigious certifications, Umbrella demonstrates its commitment to providing enterprise and Managed Service Provider (MSP) customers with a robust, secure, and reliable financial management solution. The SOC 1 and SOC 2 Type II compliance serves as a testament to the platform's comprehensive security protocols and its ability to safeguard sensitive financial data with the utmost precision and care. Customers can now have increased confidence in Umbrella's ability to deliver a secure, reliable, and innovative Cloud Financial Management platform that meets the most stringent industry standards. MORE...

Behind the Billions: Harvard's Financial Secrets Unveiled

Finance

2025-04-17 13:41:39

In a dramatic escalation of tensions surrounding campus protests, former President Donald Trump has launched a direct challenge to Harvard University's tax-exempt status, signaling a potential financial and legal showdown over the institution's response to the Israel-Gaza conflict. The controversy intensifies as federal funding of $2.3 billion hangs in the balance, with Trump calling for immediate action against the prestigious university. The Internal Revenue Service (IRS) is now closely examining Harvard's endowment, potentially preparing to impose significant tax penalties that could dramatically impact the institution's financial landscape. At the heart of the dispute are student protests related to the ongoing conflict in Gaza, which Trump and his supporters argue have crossed the line from peaceful demonstration to antisemitic rhetoric. Harvard's administration finds itself caught in a high-stakes political and legal crossfire, with its tax-exempt status and substantial federal funding now under direct threat. The move represents an unprecedented intervention by a former president directly challenging a major academic institution's financial standing. Legal experts are closely watching the developing situation, noting the potential broader implications for university governance and free speech on college campuses. As the standoff continues, Harvard faces mounting pressure to address concerns about campus discourse while simultaneously defending its institutional autonomy and financial integrity. The outcome could set a significant precedent for how universities navigate complex political and social tensions in the future. MORE...

Wall Street Whiplash: UnitedHealth Drags Dow Down as Tech Stocks Stage Surprising Comeback

Finance

2025-04-17 13:30:36

Wall Street Braces for Uncertain Trading as Trade Tensions Simmer U.S. stock futures hovered near neutral territory Wednesday morning, following a tumultuous trading session that laid bare growing investor anxieties about the potential economic fallout from escalating trade tensions. The previous day's market volatility served as a stark reminder of the mounting pressure created by President Trump's aggressive tariff strategies. Investors remain on edge, carefully parsing every signal that might indicate the direction of international trade relations and their potential impact on corporate earnings and economic growth. The market's fragile sentiment reflects deep uncertainty about how ongoing trade disputes could reshape global economic dynamics. As traders prepare for another potentially turbulent day, all eyes are focused on potential developments in the ongoing trade negotiations and their potential ripple effects across various market sectors. The delicate balance of international commerce hangs in the balance, with each new policy announcement capable of triggering significant market movements. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421