Tech Tumbles: Markets Retreat as Trump Reignites Trade War Tensions

Finance

2025-02-24 21:04:30

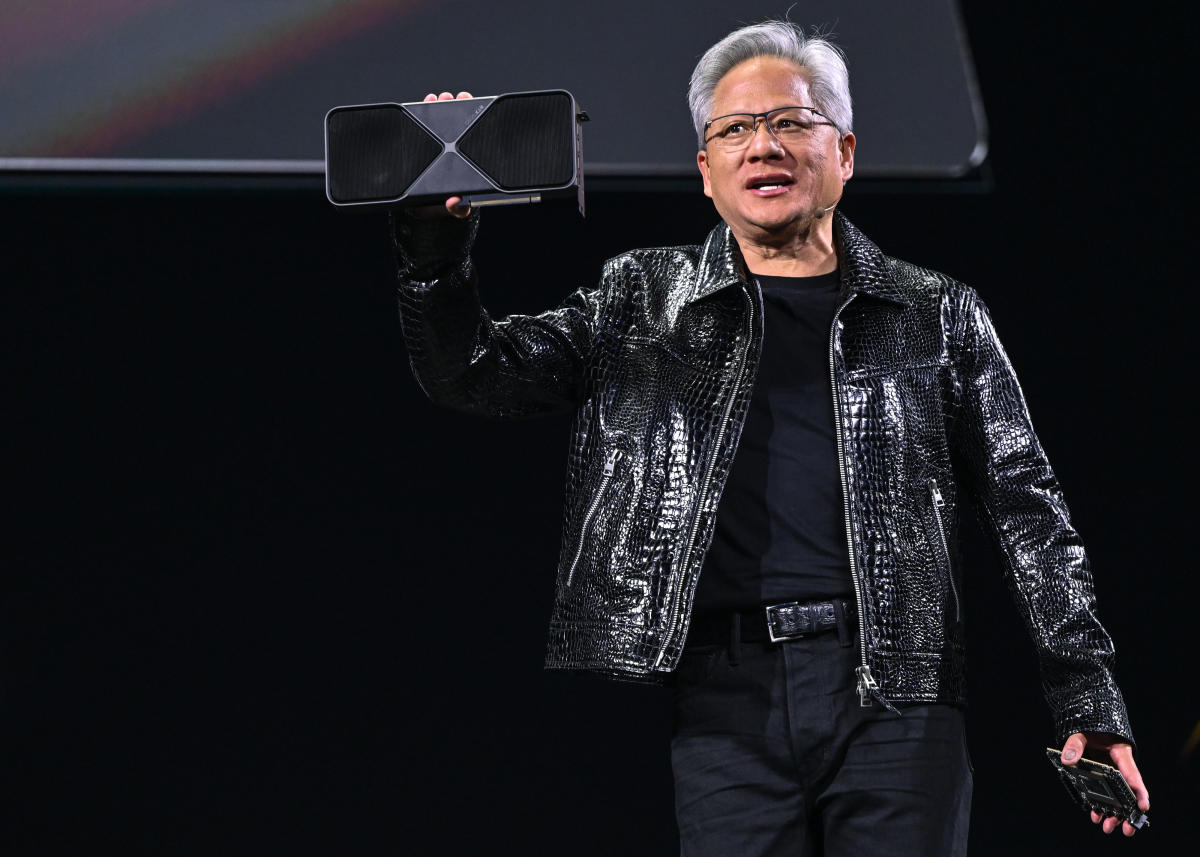

Market anticipation is building as investors closely watch Nvidia's upcoming earnings report, with potential tariff challenges casting a shadow over the tech giant's performance. Stocks are poised for a potential rebound, balancing between cautious optimism and concerns about international trade tensions that could impact the semiconductor leader. As traders and analysts hold their breath, the spotlight remains firmly on Nvidia, with market sentiment hanging in the balance. The looming possibility of new tariffs adds an extra layer of complexity to the company's financial outlook, creating a tense backdrop for what promises to be a pivotal earnings announcement. Investors are carefully weighing the potential risks and opportunities, monitoring every signal that might indicate how Nvidia will navigate the current geopolitical and economic landscape. The tech sector watches with keen interest, understanding that Nvidia's performance could set the tone for broader market movements in the coming weeks. MORE...

Real Estate Investment Heats Up: KKR Finance's Hidden Value Play Signals Potential Surge

Finance

2025-02-24 21:01:38

KKR Real Estate Finance: A High-Yield Investment Opportunity with Compelling Growth Potential

Investors seeking an attractive income stream and potential capital appreciation should take a closer look at KKR Real Estate Finance Trust (KREF). This innovative real estate investment vehicle stands out in the current market with its impressive 9% dividend yield and a substantial 24% discount to book value.

Attractive Financial Metrics

The company's strategic positioning offers investors a unique combination of high income and potential growth. With a dividend yield that significantly outperforms many competitors, KREF presents an enticing opportunity for income-focused investors looking to maximize their portfolio returns.

Strategic Growth Outlook for 2025

KKR Real Estate Finance is not just about current returns. The company has implemented forward-looking strategies designed to drive growth and create long-term value. Management's proactive approach to navigating the real estate market positions the trust for potential expansion and improved performance in the coming years.

Why Investors Should Pay Attention

- Impressive 9% dividend yield

- Significant 24% discount to book value

- Strategic growth-focused approach

- Potential for capital appreciation

As the real estate market continues to evolve, KKR Real Estate Finance Trust offers a compelling investment proposition that combines attractive income generation with strategic growth potential. Investors looking for a robust addition to their portfolio should carefully consider this opportunity.

MORE...Financial Fusion: How Vistra and Airwallex Are Revolutionizing Business Growth Through Embedded Finance

Finance

2025-02-24 20:58:24

Global business services provider Vistra has joined forces with innovative financial platform Airwallex to enhance cross-border financial solutions for businesses. Through this strategic partnership, Vistra will integrate Airwallex's cutting-edge financial technology into its platform, offering clients more streamlined and efficient international payment and banking capabilities. The collaboration aims to simplify complex financial processes for businesses operating across multiple jurisdictions, providing seamless access to global financial services. By combining Vistra's comprehensive business support infrastructure with Airwallex's advanced digital financial tools, the partnership promises to deliver a more integrated and user-friendly experience for corporate clients seeking international financial solutions. This strategic alliance represents a significant step in modernizing business financial services, leveraging technology to break down traditional barriers in cross-border transactions and financial management. MORE...

Market Resilience: Wall Street Brushes Off Setbacks with Surprising Confidence

Finance

2025-02-24 20:04:51

Despite Recent Market Volatility, Stocks Remain Primed for Growth Investors are maintaining an optimistic outlook on the stock market, even as recent risk-off sentiment has created temporary market turbulence. The underlying economic fundamentals and corporate performance continue to signal potential for further market appreciation. Market analysts suggest that the current pullback should be viewed as a healthy correction rather than a fundamental shift in market dynamics. Key sectors are showing resilience, with technology, healthcare, and select consumer discretionary stocks demonstrating strong potential for continued growth. While short-term market fluctuations can create uncertainty, long-term investors are advised to remain focused on robust company fundamentals, emerging market trends, and strategic investment opportunities. The current market environment presents a nuanced landscape where selective investment strategies can yield promising returns. Factors such as improving corporate earnings, potential Federal Reserve policy adjustments, and ongoing economic recovery are expected to provide sustained momentum for stock market performance in the coming months. Investors are recommended to maintain a balanced portfolio, diversify their holdings, and stay informed about evolving market conditions to capitalize on potential upside opportunities. MORE...

Dogecoin Infiltrates NIH: Crypto Meets Government Finance in Unexpected Twist

Finance

2025-02-24 18:36:09

In a surprising revelation, internal documents and records examined by WIRED have uncovered a potentially significant connection between Elon Musk's Dogecoin (DOGE) task force and the National Institutes of Health (NIH). At least three individuals associated with Musk's cryptocurrency initiative reportedly have secured access to critical NIH systems that control crucial administrative functions, including budget management and procurement processes. The discovery raises intriguing questions about potential conflicts of interest and the extent of cross-organizational access granted to individuals connected to high-profile tech and cryptocurrency networks. While the full implications remain unclear, the overlap between Musk's cryptocurrency team and a major federal health research institution presents an unusual and noteworthy intersection of technology, finance, and government infrastructure. WIRED's investigation suggests that these access points could provide unprecedented insights into the NIH's internal operations, potentially blurring the lines between private sector interests and public research institutions. As the story continues to develop, it remains to be seen what broader implications this unexpected connection might have for government transparency and technological governance. MORE...

Breaking: Agilitas Breaks Free, Unveils Bold New Commercial Finance Brokerage Venture

Finance

2025-02-24 18:12:16

As the embedded finance landscape continues to evolve, innovative financial firms are stepping up to revolutionize vendor-focused funding strategies. The emerging market is showing tremendous potential for growth, with cutting-edge solutions designed to bridge critical financial gaps for businesses. Embedded finance is rapidly transforming traditional funding models, offering vendors unprecedented access to flexible financial resources. By integrating financial services directly into existing business platforms, companies can now streamline their funding processes and unlock new opportunities for economic expansion. The latest developments signal a significant shift in how vendors can secure capital, with specialized firms developing tailored funding solutions that are more responsive to modern business needs. These innovative approaches are not just about providing money, but creating comprehensive financial ecosystems that support vendor growth and sustainability. Industry experts predict that embedded finance will continue to gain momentum, providing more agile and accessible funding options for businesses across various sectors. As technology advances and financial integration becomes more sophisticated, vendors can expect increasingly personalized and efficient financial support. With strategic investments and forward-thinking approaches, the embedded finance sector is poised to reshape the financial landscape, offering vendors more dynamic and responsive funding mechanisms that align closely with their unique business requirements. MORE...

Breaking: Kerr & Sigler's Financial Powerhouse Shakes Up LA Business Landscape

Finance

2025-02-24 17:36:54

Running Point Capital Advisors understands that true wealth management extends far beyond simple financial transactions. As a dedicated multifamily office, we recognize that each family's financial journey is unique and complex, requiring a holistic approach that addresses not just investments, but the broader spectrum of financial well-being and strategic planning. Our team is committed to providing comprehensive financial guidance that goes deeper than traditional wealth management. We view each client relationship as a partnership, carefully crafting personalized strategies that align with your family's specific goals, values, and long-term aspirations. By taking a 360-degree view of your financial landscape, we help you navigate challenges, seize opportunities, and build a robust financial foundation for generations to come. MORE...

Wall Street's Alarming Signal: The Dangerous Pattern Investors Can't Ignore

Finance

2025-02-24 17:30:15

Investors, take note: The market's leadership stocks are sending a potential warning signal that demands your attention. Recent market dynamics suggest that the stocks driving the current rally might be revealing critical insights about the broader economic landscape. Traditionally, top-performing stocks in major indices like the S&P 500 and Nasdaq serve as bellwether indicators of market health and investor sentiment. When these market leaders start showing signs of weakness or divergence, it could be a harbinger of upcoming market shifts. Analysts are closely monitoring the performance of tech giants, growth stocks, and sector leaders for any subtle changes in momentum. Unusual trading patterns, declining relative strength, or decreasing trading volumes among these key stocks might indicate a potential market correction or broader economic challenges on the horizon. Smart investors should pay careful attention to these early warning signs. While not definitive predictors, these leadership stock movements can provide valuable insights for portfolio positioning and risk management strategies. Don't wait for the market to make its move—stay proactive, analyze the trends, and be prepared to adjust your investment approach accordingly. MORE...

AI Gold Rush: Why Nvidia's Stock Is the Unexpected Bargain Investors Are Overlooking

Finance

2025-02-24 17:28:01

Nvidia's Stock: A Potential Bargain in the Tech Landscape

Investors and market enthusiasts are taking a closer look at Nvidia's stock, suggesting that the tech giant might be undervalued despite its recent impressive performance. Yahoo Finance readers have been sharing compelling insights about why the company's price-to-earnings (P/E) ratio could signal an unexpected investment opportunity.

The conversation centers around Nvidia's remarkable growth in the artificial intelligence and semiconductor sectors. Despite the stock's significant surge, many believe the current valuation doesn't fully reflect the company's potential and future earnings power.

Key points from investor discussions include:

- Nvidia's dominant position in AI chip manufacturing

- Strong financial fundamentals

- Continued innovation in cutting-edge technology

- Potential for sustained growth in emerging tech markets

While traditional metrics like P/E ratio provide one perspective, investors are increasingly recognizing that Nvidia's true value extends beyond conventional financial measurements. The company's strategic positioning in transformative technologies like machine learning and data center solutions suggests there might be more room for growth.

As the tech landscape continues to evolve, Nvidia remains a focal point for investors seeking exposure to innovative and potentially undervalued technology stocks.

MORE...City's Traffic Toll: MTA Weighs Congestion Pricing Bombshell

Finance

2025-02-24 17:14:00

Anticipation Builds as MTA Toll Revenue Data Prepares to Unveil Financial Impact Transportation officials are set to release crucial financial insights on Monday, shedding light on the revenue generated by the Metropolitan Transportation Authority's (MTA) toll collection program. The upcoming data release comes at a critical moment, as the future of the toll system hangs in the balance of ongoing discussions and evaluations. Stakeholders and city planners are eagerly awaiting the detailed breakdown, which will provide a comprehensive look at the economic contributions of the toll program. The figures are expected to offer key insights into how these tolls are supporting infrastructure improvements and transportation funding. With uncertainty surrounding the program's long-term sustainability, this upcoming data release could prove pivotal in determining the next steps for the MTA's financial strategy. Transportation experts and local officials are poised to analyze the numbers, potentially influencing future policy decisions and funding allocations. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421