Young Money Makers: How Gen Z is Defying Economic Odds

Finance

2025-04-03 22:13:30

In a revealing snapshot of American wealth, the Federal Reserve's latest Survey of Consumer Finances unveils a striking economic landscape. By examining 4,602 households between 2019 and 2022, researchers discovered a remarkable surge in millionaire households across the United States. The comprehensive study paints a picture of unprecedented prosperity, highlighting the growing number of Americans who have crossed the coveted million-dollar net worth threshold. This financial milestone reflects not just individual success stories, but also broader economic trends that have enabled wealth accumulation during a complex and challenging period. With robust investment markets, rising property values, and strategic financial planning, more Americans than ever are joining the millionaire club. The survey provides compelling evidence of the nation's economic resilience and the expanding opportunities for wealth creation in today's dynamic financial environment. These findings offer an optimistic glimpse into the financial health of American households, demonstrating that despite economic uncertainties, many individuals are successfully building substantial personal wealth. MORE...

Market Meltdown: Trump Downplays Panic After Stocks Plunge on Trade War Fears

Finance

2025-04-03 22:07:59

Despite a dramatic plunge in stock markets, President Donald Trump remained optimistic, confidently declaring that the economic situation was "going very well" on Thursday. As the Dow Jones Industrial Average tumbled more than 1,600 points, triggering a global market selloff, the president maintained an upbeat stance. Departing the White House en route to his Florida golf club, Trump boldly predicted economic prosperity. "The markets are going to boom, the stock is going to boom, the country is going to boom," he asserted, seemingly unfazed by the significant market turbulence caused by his recent tariff announcements. The sharp market decline marked one of the most significant economic shocks since the COVID-19 pandemic, with investors reacting strongly to the president's sweeping tariff policies targeting international trade. Despite the widespread market anxiety, Trump's unwavering confidence suggested a stark contrast to the financial landscape unfolding around him. The president's remarks underscored his characteristic approach of projecting optimism in the face of economic challenges, even as global financial markets displayed clear signs of concern and volatility. MORE...

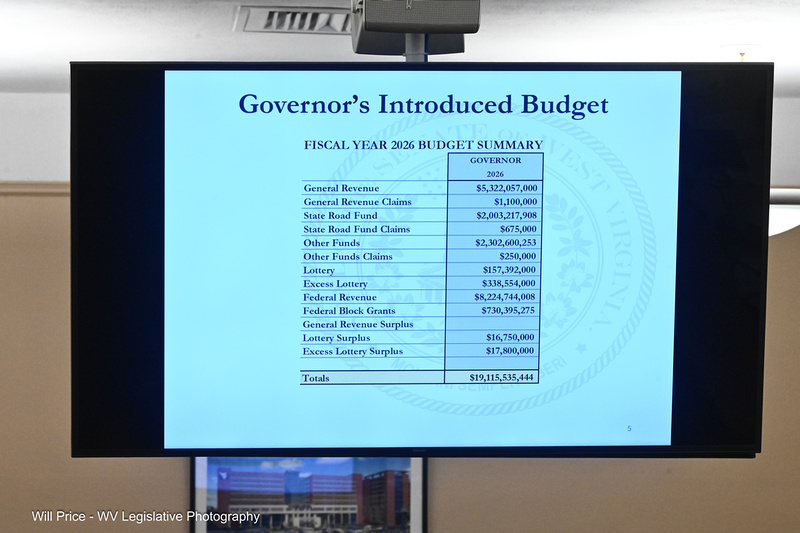

Budget Battle Begins: Senators Unveil Fiscal Plan in High-Stakes Financial Showdown

Finance

2025-04-03 21:52:33

In a pivotal legislative session, the Senate Finance Committee made significant strides toward finalizing the state's fiscal blueprint. Committee members carefully reviewed and advanced a budget bill that closely aligns with Governor's ambitious spending plan, setting the stage for a $5.323 billion general revenue budget for the upcoming fiscal year. The proposed budget, which mirrors the governor's initial recommendations, signals a collaborative approach to state financial planning. Lawmakers demonstrated their commitment to fiscal responsibility while addressing key state priorities through careful line-by-line deliberations. The advanced bill represents a balanced approach to meeting the state's economic needs and maintaining financial stability. As the budget moves forward in the legislative process, stakeholders are closely watching how these financial decisions will impact various state services and economic initiatives. The Senate Finance Committee's actions mark an important step in transforming the proposed budget from a preliminary plan to a potential fiscal reality. MORE...

Money Talks: Amarillo Candidates Reveal Campaign Coffers

Finance

2025-04-03 21:15:22

Campaign Momentum: Amarillo Mayoral Candidates Showcase Strong Fundraising Efforts The vibrant political landscape of Amarillo is heating up as leading mayoral candidates demonstrate impressive financial support through compelling television advertisements and strategic direct mail campaigns. Recent fundraising reports reveal a dynamic and competitive race, with candidates leveraging their financial resources to connect with voters and communicate their vision for the city's future. These sophisticated marketing efforts not only highlight the candidates' financial strength but also underscore their commitment to engaging Amarillo's electorate through multiple communication channels. The television ads and targeted mailers serve as powerful tools to showcase each candidate's platform, credentials, and potential to lead the city forward. As the mayoral race continues to evolve, these fundraising achievements signal growing public interest and the potential for a highly competitive election that will ultimately shape Amarillo's municipal leadership and direction. MORE...

Wall Street Bloodbath: Markets Crash in Worst Selloff Since Pandemic's Dark Days

Finance

2025-04-03 20:16:47

Financial markets were thrown into turmoil on Wednesday as President Trump's unexpected trade announcement sent shockwaves through global economic circles. In a bold and controversial move, the administration unveiled a sweeping 10% tariff that would be applied uniformly across all US trading partners, instantly transforming the international trade landscape. Investors watched in stunned silence as stock indices plummeted, reflecting deep uncertainty about the potential economic repercussions. The dramatic policy shift threatened to disrupt carefully established global supply chains and raised immediate concerns about potential retaliatory measures from key international trading nations. Wall Street's immediate reaction was swift and decisive, with major indexes experiencing significant downward pressure. The sudden tariff declaration signaled a dramatic escalation in the administration's trade strategy, potentially challenging decades of established international economic cooperation. Economists and market analysts scrambled to assess the potential long-term implications of this unprecedented blanket tariff approach, warning of potential ripple effects that could extend far beyond immediate market volatility. MORE...

Market Meltdown: Dow Nosedives 1,700 Points in Brutal Sell-Off Triggered by Trade Tensions

Finance

2025-04-03 20:02:07

Financial markets were thrown into turmoil on Wednesday as President Trump's unexpected trade announcement sent shockwaves through global economic circles. In a bold and controversial move, the administration unveiled a sweeping 10% tariff that would be applied uniformly across all US trading partners, instantly transforming the international trade landscape. Investors watched in stunned silence as stock indices plummeted, reflecting deep uncertainty about the potential economic repercussions. The dramatic policy shift threatened to disrupt carefully established global supply chains and raised immediate concerns about potential retaliatory measures from key international trading nations. Wall Street's immediate reaction was swift and decisive, with major indexes experiencing significant downward pressure. The sudden tariff declaration signaled a dramatic escalation in the administration's trade strategy, potentially challenging decades of established international economic cooperation. Economists and market analysts scrambled to assess the potential long-term implications of this unprecedented blanket tariff approach, warning of potential ripple effects that could extend far beyond immediate market volatility. MORE...

Breaking Financial Boundaries: Inside the Strategic Mind of SCHOTT Pharma's CFO

Finance

2025-04-03 19:53:11

CFO Corner: A Deep Dive with SCHOTT Pharma's Almuth Steinkühler

In the dynamic world of pharmaceutical manufacturing, financial leadership requires a unique blend of strategic vision and technical expertise. Almuth Steinkühler, the Chief Financial Officer of SCHOTT Pharma, embodies this perfect balance, bringing a wealth of experience and innovative thinking to her role.

With a career spanning multiple sectors and a deep understanding of global financial landscapes, Steinkühler has positioned SCHOTT Pharma as a forward-thinking organization. Her approach goes beyond traditional financial management, focusing on creating sustainable value and driving strategic growth.

Strategic Financial Leadership

Steinkühler's leadership is characterized by her ability to navigate complex financial challenges while maintaining a clear focus on the company's long-term objectives. She understands that in the pharmaceutical industry, financial strategy is intrinsically linked to innovation, patient care, and global health solutions.

Embracing Digital Transformation

Under her guidance, SCHOTT Pharma has been at the forefront of digital transformation, leveraging cutting-edge technologies to enhance financial processes and create more efficient operational models. Her strategic investments in digital infrastructure have positioned the company as a leader in technological adaptation within the pharmaceutical sector.

Commitment to Sustainability

Beyond financial metrics, Steinkühler is passionate about integrating sustainability into the company's core strategy. She believes that financial success and environmental responsibility are not mutually exclusive but can be powerful drivers of innovation and long-term growth.

Looking Ahead

As SCHOTT Pharma continues to expand its global footprint, Almuth Steinkühler remains committed to driving financial excellence, fostering innovation, and contributing to the advancement of pharmaceutical solutions that improve patient lives worldwide.

MORE...Financial Storm Ahead: Your Ultimate Guide to Weathering the Economic Downturn

Finance

2025-04-03 19:45:00

In the midst of global market turbulence, investors are left wondering: Should I hit the panic button or start stuffing cash under my mattress? Not so fast, says personal finance guru Vivian Tu, who offers a refreshingly practical perspective on navigating these uncertain economic waters. Instead of succumbing to financial fear, Tu advocates for a strategic approach that goes beyond knee-jerk reactions. Her advice? Stay calm, stay informed, and make smart, calculated moves that protect and potentially grow your wealth. While markets may be unpredictable, Tu believes that intelligent financial planning can turn chaos into opportunity. She suggests that now is not the time to retreat, but to reassess your financial strategy with a clear, level-headed mindset. From diversifying investments to understanding risk management, Tu provides insights that can help everyday investors weather economic storms without losing their cool – or their hard-earned savings. So before you consider turning your attic into a makeshift bank vault, tune in to expert advice that can help you navigate these challenging financial landscapes with confidence and wisdom. MORE...

Tariff Tremors: Navigating the Financial Minefield Ahead

Finance

2025-04-03 19:34:06

As trade tensions escalate, Americans are increasingly worried about the potential economic ripple effects of President Trump's tariff policies. With uncertainty looming over household budgets, personal finance expert Farnoosh Torabi offers timely insights to help families navigate these challenging financial waters. In an exclusive interview with Chris Jansing, Torabi breaks down the complex economic landscape, providing practical strategies for consumers to protect their financial well-being. From smart shopping techniques to strategic savings plans, her expert advice aims to empower Americans to weather the storm of potential price increases and market volatility. The ongoing trade disputes have the potential to impact everything from everyday consumer goods to long-term financial planning. By staying informed and proactive, households can develop resilient financial strategies that minimize the economic impact of these unprecedented trade challenges. MORE...

Wall Street Trembles: Trump's Tariff Tsunami Sends Stocks into Freefall

Finance

2025-04-03 19:04:56

Wall Street Trembles: Banking Stocks Dive Amid Recession Fears Investors experienced a turbulent Thursday as shares of major financial institutions and private-equity firms nosedived, reflecting growing anxiety about the potential economic downturn. The dramatic market movement signals deepening concerns about how top financial giants and their extensive client networks might weather an increasingly likely recession. The steep stock plunge underscores the financial sector's mounting unease, with investors rapidly reassessing the potential economic challenges ahead. As uncertainty looms, banks and investment firms are bracing for potential turbulence that could significantly impact their operations and bottom lines. Market analysts are closely monitoring these developments, recognizing that the current stock market volatility could be an early warning sign of broader economic instability. The sharp decline in banking stocks suggests that Wall Street is preparing for a potentially challenging economic landscape in the coming months. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421