Market Mayhem: Nikkei 225 Crashes in Brutal Selloff Following Wall Street's Bloodbath

Finance

2025-04-07 00:41:53

Asian markets experienced a dramatic sell-off on Monday, triggered by the shocking market meltdown on Wall Street following President Trump's aggressive tariff escalation. The financial landscape was painted in deep red as investors reacted with widespread panic. Tokyo's benchmark Nikkei 225 index plummeted nearly 8% within minutes of market opening, signaling a severe investor sentiment. Similarly, Australia's S&P/ASX 200 index tumbled more than 6%, reflecting the widespread market anxiety. South Korea's Kospi index was not spared either, dropping a substantial 4.4%. The sudden market turbulence underscores the growing tensions in global trade relations and the potential economic ripple effects of escalating trade disputes. Investors are now closely watching how these market movements might impact future economic strategies and international trade negotiations. MORE...

Trade War Tensions: Trump Stands Firm as Markets Brace for Economic Turbulence

Finance

2025-04-07 00:07:45

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Central Banks Under Siege: Navigating Financial Storms in the Global Economic Battlefield

Finance

2025-04-07 00:00:00

In recent years, central banks have been navigating a complex financial landscape, battling inflation through aggressive interest rate hikes that have resulted in substantial valuation challenges. The financial ecosystem confronting these critical institutions has become increasingly intricate, with multiple pressures converging simultaneously. Beyond the immediate challenge of inflation control, central banks are wrestling with a perfect storm of economic complications. High public debt levels, deepening political polarization, rapid technological disruption, and growing geopolitical fragmentation are creating unprecedented stress on monetary policy frameworks. Recognizing these challenges, financial experts propose a comprehensive three-pronged strategy to fortify central banks' financial resilience. The recommended approach focuses on three key areas: revolutionizing accounting and capital structures, discovering innovative revenue streams, and strategically recalibrating monetary policy and financial stability mechanisms. By implementing these strategic reforms, central banks can develop more robust, adaptive financial systems. The ultimate goal is to enhance their capacity to effectively manage economic shocks without becoming overly dependent on fiscal authorities for emergency support. These transformative measures represent a critical evolution in central banking, positioning these institutions to more confidently navigate the increasingly complex global economic landscape. MORE...

Beyond Stocks and Bonds: How Insurers Are Reshaping Investment Strategies

Finance

2025-04-06 23:36:11

The Rise of Alternative Investments: Insurers' Strategic Pivot

In an era of unprecedented financial complexity, insurance companies are increasingly turning to alternative investments as a powerful strategy to navigate volatile markets and enhance portfolio performance. This bold shift represents more than just a trend—it's a fundamental reimagining of investment approaches in the financial services sector.

Breaking Traditional Investment Boundaries

Traditionally conservative insurers are now embracing a more dynamic investment landscape. Alternative investments, which include private equity, real estate, infrastructure, and hedge funds, are offering compelling opportunities beyond conventional bond and stock portfolios. These sophisticated asset classes provide insurers with potential for higher returns and improved portfolio diversification.

Driving Forces Behind the Shift

Several key factors are propelling insurers toward alternative investments:

- Persistently low interest rates challenging traditional fixed-income returns

- Growing appetite for investments with lower correlation to public markets

- Increasing regulatory flexibility allowing more innovative investment strategies

Strategic Advantages

By strategically allocating capital to alternative investments, insurers can:

- Generate more stable, long-term returns

- Mitigate portfolio risk through enhanced diversification

- Tap into emerging market opportunities

- Potentially improve overall investment performance

Looking Forward

As financial markets continue to evolve, insurers' commitment to alternative investments signals a sophisticated approach to wealth management. This strategic pivot demonstrates their adaptability and forward-thinking investment philosophy in an increasingly complex global financial ecosystem.

MORE...Market Meltdown: Stocks Brace for Further Tumble as Trump's Tariff Standoff Intensifies

Finance

2025-04-06 22:55:15

Wall Street Braces for Turbulent Times as Market Sentiment Plummets Investors are reeling from the most significant downturn in the S&P 500 since the early days of the COVID-19 pandemic, with market strategists warning that the current volatility shows no signs of abating. The dramatic sell-off comes in the wake of President Trump's latest tariff announcements, which have sent shockwaves through financial markets. Market participants are now in a frenzied race to assess and price in potential worst-case scenarios, creating an atmosphere of uncertainty and anxiety. The sudden market correction reflects deep concerns about the potential economic implications of escalating trade tensions and the broader impact on corporate earnings and global economic growth. Equity strategists are closely monitoring the situation, suggesting that the current market turbulence might persist as investors continue to recalibrate their portfolios and risk assessments. The unprecedented market movement underscores the fragility of current economic conditions and the significant influence of geopolitical decisions on financial markets. As uncertainty looms, investors are advised to remain cautious and prepared for potential further market fluctuations in the coming weeks. MORE...

Market Meltdown: Futures Plunge as Wall Street Braces for Turbulent Trading Day

Finance

2025-04-06 22:19:22

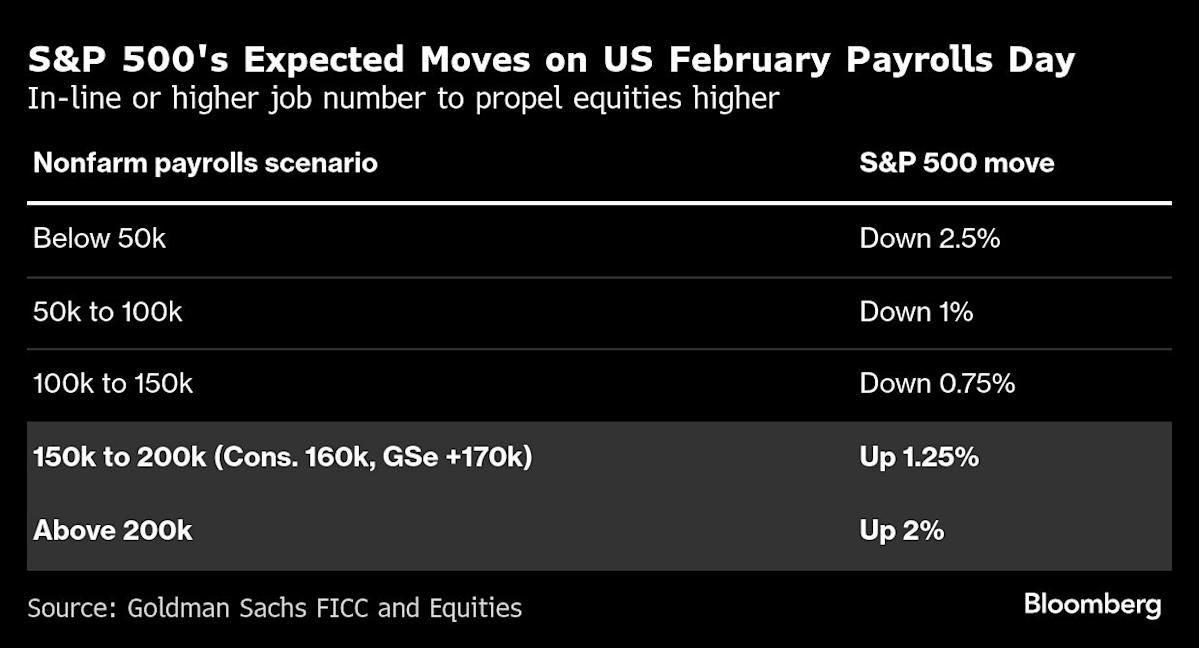

Global financial markets braced for turbulence as Wall Street stock futures plummeted on Sunday, signaling a potentially volatile start to the trading week. Investor sentiment turned sharply negative following President Donald Trump's recent announcement of comprehensive tariffs against key U.S. trading partners, raising serious concerns about a potential economic recession. The pre-market indicators painted a grim picture of market sentiment. S&P 500 E-minis futures nosedived by 4.27%, dropping 218 points to 4,892.25. Similarly, Dow E-minis experienced a dramatic decline of 3.96%, tumbling 1,524 points, while Nasdaq 100 E-minis fell 4.58%, shedding 804 points. These steep declines reflect growing investor anxiety about the escalating trade tensions and their potential long-term economic implications. Market participants are closely monitoring the situation, anticipating significant market volatility in the coming days as the potential trade war threatens to disrupt global economic stability. MORE...

Market Mayhem: Futures Tumble as Trump's Tariff Showdown Threatens Wall Street

Finance

2025-04-06 22:08:58

Wall Street Reels from Massive Market Selloff Triggered by Trade Tensions Investors experienced a turbulent week as financial markets suffered their most significant downturn since the early days of the COVID-19 pandemic. The stock market witnessed a staggering loss of over $5 trillion in total market value, driven by escalating concerns over potential trade tariffs and economic uncertainty. The dramatic market decline reflects growing investor anxiety about the potential economic impact of proposed trade policies. Uncertainty surrounding international trade relations has sparked widespread sell-offs across major indices, with investors rapidly repositioning their portfolios to mitigate potential risks. The substantial market correction underscores the fragile nature of global financial markets and the profound influence of geopolitical tensions on investor sentiment. As traders and analysts closely monitor developing economic signals, the week's dramatic market movements serve as a stark reminder of the complex interconnections within the global financial ecosystem. With billions of dollars in market capitalization evaporating in a matter of days, investors are bracing for potential continued volatility and reassessing their investment strategies in an increasingly unpredictable economic landscape. MORE...

Tesla's Rollercoaster: Analyst Drops Bombshell Price Target Amid Musk-Trump Turbulence

Finance

2025-04-06 18:44:18

In a dramatic shift, one of Tesla's most ardent Wall Street supporters has dramatically scaled back expectations for the electric vehicle manufacturer. The analyst, previously known for an optimistic outlook, has slashed the stock's price target by a staggering 43%, pointing to two critical challenges facing the company. The unprecedented downgrade stems from a complex intersection of factors: Elon Musk's increasingly controversial public persona and the turbulent landscape of international trade policies under the Trump administration. These interconnected issues have created a perfect storm of uncertainty for Tesla's market positioning. The price target reduction signals more than just a financial adjustment—it reflects growing concerns about Tesla's brand reputation and its ability to navigate increasingly complex geopolitical and corporate communication challenges. Musk's high-profile statements and actions have increasingly become a focal point for investors evaluating the company's long-term stability and potential. While Tesla continues to be a pioneering force in electric vehicles, this analyst's dramatic revision underscores the delicate balance between innovative leadership and potential brand risk in today's hyper-connected business environment. MORE...

Wall Street Titans Prepare for Turbulent Ride as Market Meltdown Sparks Panic

Finance

2025-04-06 18:35:38

Wall Street's most influential financial leaders are grappling with the unexpected consequences of President Trump's aggressive trade policies. After last week's dramatic market tumble, top executives and investment strategists spent the weekend carefully analyzing the widespread economic ripple effects triggered by escalating tariffs. The sudden market volatility has caught many of Trump's once-staunch financial supporters off guard, forcing them to reassess their previous optimistic stance on the administration's economic strategies. What began as confident support has now transformed into a complex landscape of uncertainty and financial risk. Key financial titans are now huddled in emergency meetings, meticulously examining the potential long-term implications of the trade tensions and their impact on global markets. The weekend's intense strategic discussions reflect a growing concern about the potential economic fallout from the current trade confrontations. As markets continue to react unpredictably, these influential financial leaders are working to develop contingency plans and mitigate potential losses, signaling a significant shift in their relationship with the administration's economic approach. MORE...

Campaign Cash Controversy: Royce White's Financial Crossroads and the Insider Scoop

Finance

2025-04-06 18:10:51

In this week's compelling episode of At Issue, investigative journalist Tom Hauser takes a deep dive into the financial intricacies of Royce White's campaign, uncovering a controversial spending pattern. The spotlight is on White's campaign finance reports, which reveal an eyebrow-raising expenditure of over $1 million in donor funds allocated to "credit card fees" - a detail that is sure to spark intense scrutiny and debate. Adding to the episode's intrigue, Hauser sits down for an exclusive one-on-one interview with Adam Schwarze, a Republican candidate vying for a coveted U.S. Senate seat. The in-depth conversation promises to shed light on Schwarze's political aspirations, campaign strategy, and vision for the future. Viewers can expect a riveting exploration of campaign finance transparency and the personal narratives driving this election cycle, as Hauser brings his trademark investigative prowess to the forefront of political reporting. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421