Denver Shakeup: TIAA Slashes Jobs, Abandons Skyscraper in Major Corporate Restructuring

Finance

2025-05-05 12:15:51

In a significant corporate shift, TIAA, a heavyweight in retirement and investment services, is preparing to bid farewell to its current Denver skyscraper headquarters. The company's planned relocation was revealed through a Worker Adjustment and Retraining Notification (WARN) notice submitted to Colorado state authorities. This strategic move signals potential changes for the financial giant's operational footprint in the Mile High City. While specific details about the new location or reasons behind the move remain undisclosed, the WARN notice suggests a substantial transition for TIAA's Denver-based workforce. The decision to relocate underscores the dynamic nature of corporate real estate and workplace strategies in today's rapidly evolving business landscape. As companies continue to reassess their physical spaces in the wake of changing work environments, TIAA's move represents another example of this ongoing trend. Employees and stakeholders will be watching closely to see how this relocation might impact the company's local presence and future operational plans in Denver. MORE...

Credit Card Tactics: The Insider's Guide to Funding Your Small Business Without Breaking the Bank

Finance

2025-05-05 12:00:00

Navigating Financial Challenges: Strategies for Small Business Survival in a Tough Economic Landscape In today's challenging economic environment, small business owners are facing unprecedented financial pressures. With interest rates climbing, inflation eroding purchasing power, and financing becoming increasingly difficult to secure, entrepreneurs are being forced to get creative about maintaining their cash flow and financial stability. The current economic climate demands innovative approaches to financial management. Business owners are now exploring multiple strategies to weather the storm, including: • Streamlining operational expenses • Seeking alternative funding sources • Implementing cost-cutting measures • Diversifying revenue streams • Negotiating more favorable terms with suppliers Smart entrepreneurs understand that adaptability is key to survival. By proactively addressing financial challenges and remaining flexible, small businesses can not only survive but potentially thrive even in challenging economic conditions. The road ahead may be tough, but with strategic planning and resourceful thinking, small business owners can position themselves to overcome current economic obstacles and emerge stronger than ever. MORE...

Trade Talks Heat Up: Brazil and US Edge Closer to Tariff Breakthrough

Finance

2025-05-05 11:37:26

In a significant diplomatic and economic development, Brazilian Finance Minister Fernando Haddad revealed that Brazil and the United States are currently engaged in delicate negotiations to establish a comprehensive tariff agreement. The ongoing discussions aim to foster closer economic ties and potentially reduce trade barriers between the two nations, signaling a promising step towards enhanced bilateral cooperation. Haddad's announcement highlights the strategic importance of smoothing out trade relations and creating a more favorable environment for economic exchange. The potential understanding on tariffs could pave the way for increased trade opportunities and mutual economic benefits for both Brazil and the United States. While specific details of the negotiations remain confidential, the dialogue represents a proactive approach to strengthening international economic partnerships and addressing potential trade challenges through diplomatic channels. MORE...

Diplomatic Clash: Washington Blocks UN's Bold Vision for Global Economic Transformation

Finance

2025-05-05 10:51:24

In a revealing glimpse of global diplomatic tensions, a draft UN document exposes the United States' resistance to sweeping international financial reforms aimed at addressing climate change, promoting tax fairness, and accelerating the transition away from fossil fuels. The leaked document highlights the complex negotiations surrounding critical global economic policies, where the US appears to be pushing back against progressive proposals that could fundamentally reshape international financial systems. At the heart of the dispute are ambitious initiatives designed to support developing nations in combating climate change and creating more equitable economic structures. Key points of contention include proposed mechanisms for climate financing, efforts to close international tax loopholes, and strategies to reduce global dependence on fossil fuel industries. The US stance suggests a reluctance to embrace comprehensive reforms that could significantly impact existing economic power structures. Advocates for global financial reform argue that these proposed changes are essential for addressing the urgent challenges of climate change and economic inequality. They contend that meaningful international cooperation is crucial to creating a more sustainable and just global economic system. The draft document provides a rare behind-the-scenes look at the intricate negotiations that shape global economic policy, revealing the ongoing tensions between progressive reform efforts and more conservative economic approaches. As discussions continue, the international community watches closely, recognizing that the outcome of these negotiations could have far-reaching implications for global economic and environmental strategies in the years to come. MORE...

Trade Finance Boom: ADB Rides Wave of Economic Resilience Amid Global Tariff Tensions

Finance

2025-05-05 10:39:39

Asian developing economies are racing against time, strategically accelerating their export volumes in anticipation of the impending expiration of tariff grace periods. Manufacturers and trade strategists across the region are leveraging this critical window to maximize their global market positioning and economic advantages. Countries like Vietnam, Thailand, and Indonesia are witnessing a surge in export activities, carefully timing their shipments to capitalize on preferential trade conditions before potential tariff increases take effect. This proactive approach reflects a sophisticated understanding of international trade dynamics and a keen awareness of evolving economic landscapes. The frontloading strategy represents more than just a short-term tactical move; it signals a broader regional adaptation to complex global trade environments. Businesses are meticulously planning their export schedules, balancing inventory management with strategic timing to optimize financial outcomes. Economists suggest this trend highlights the agility and resilience of Asian developing economies, demonstrating their ability to swiftly respond to changing trade regulations and maintain competitive edges in the international marketplace. As the tariff grace period approaches its conclusion, these economies are not merely reacting but strategically positioning themselves for sustained economic growth and enhanced global trade competitiveness. MORE...

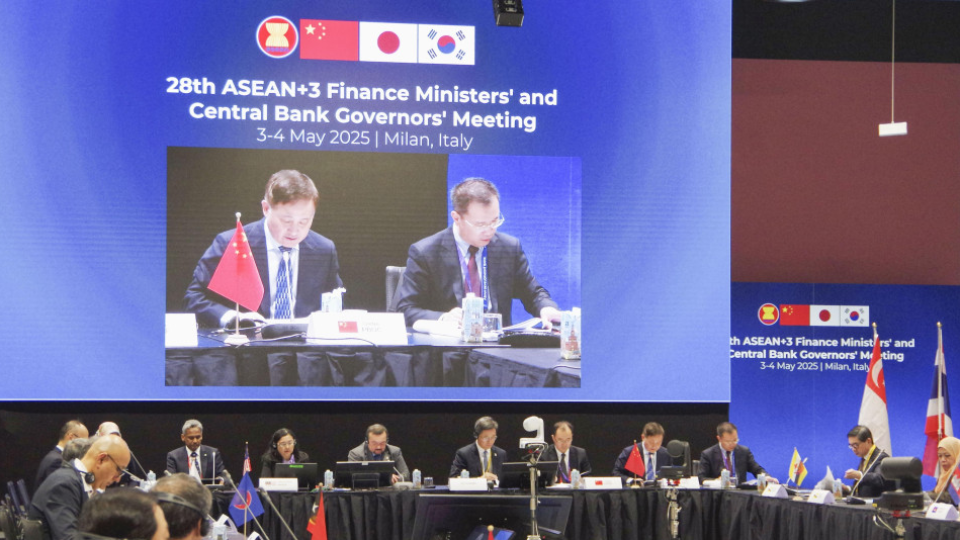

Trade Tensions Rise: ASEAN-Plus-3 Leaders Sound Alarm on Global Protectionist Threats

Finance

2025-05-05 10:36:33

Financial leaders from Southeast Asia, along with representatives from Japan, China, and South Korea, have raised urgent concerns about the potential global economic repercussions of escalating protectionist trade policies. Their warning comes in the wake of recent announcements by U.S. President Donald Trump regarding increased import tariffs, which threaten to disrupt international trade dynamics. The finance ministers from these key Asian economies are deeply worried about the broader implications of such restrictive trade measures. They fear that protectionist strategies could potentially trigger a domino effect, undermining global economic stability and hindering international economic cooperation. The collective stance emphasizes the importance of maintaining open, fair, and collaborative trade relationships in an increasingly interconnected global marketplace. By speaking with a unified voice, these nations are signaling their commitment to preserving economic growth and preventing potential trade conflicts that could harm businesses and consumers alike. As tensions continue to simmer in the international trade arena, these Asian economic leaders are calling for dialogue, mutual understanding, and strategies that promote economic integration rather than isolation. MORE...

Crypto.com Joins Forces with Green Dot to Revolutionize Digital Banking Landscape

Finance

2025-05-05 10:35:00

Crypto.com is making a strategic move to revolutionize its financial services in the United States by partnering with Green Dot, a leading banking technology provider. This collaboration aims to accelerate the company's embedded finance initiatives, promising to deliver innovative financial solutions to a broader audience. The partnership leverages Green Dot's robust banking infrastructure to help Crypto.com expand its financial product offerings seamlessly. By combining Crypto.com's digital currency expertise with Green Dot's established banking technology, the collaboration is set to create more accessible and integrated financial experiences for consumers. This strategic alliance signals Crypto.com's commitment to bridging the gap between traditional banking and cryptocurrency, offering users more flexible and comprehensive financial services. The embedded finance approach will enable customers to enjoy smoother, more interconnected financial interactions across digital and traditional platforms. Green Dot's proven track record in providing banking-as-a-service solutions makes them an ideal partner for Crypto.com's ambitious expansion plans. The collaboration is expected to unlock new opportunities in the rapidly evolving digital finance landscape, potentially transforming how consumers interact with financial services. As the financial technology sector continues to evolve, this partnership represents a significant step forward in creating more integrated and user-friendly financial ecosystems. MORE...

Breaking: Treasury Shakes Up Offshore Financial Safety Net with Bold New Rule

Finance

2025-05-05 10:33:16

A groundbreaking policy revision promises to unlock massive economic potential for American energy producers. This strategic move will empower domestic oil and gas companies with unprecedented opportunities to lease new territories, conduct comprehensive exploration, initiate drilling operations, and significantly boost production capabilities. By removing bureaucratic barriers and streamlining regulatory processes, the revision aims to inject billions of dollars directly into the American energy sector. This initiative not only strengthens domestic energy independence but also creates new jobs and stimulates economic growth across multiple regions. The policy change represents a bold step towards maximizing the United States' vast energy resources, positioning American producers to compete more effectively in the global energy marketplace while potentially reducing reliance on foreign oil imports. MORE...

Behind Closed Doors: US Moves to Undermine Global Development Financing

Finance

2025-05-05 10:11:19

In a controversial move, the United States is reportedly attempting to undermine a critical international agreement designed to support developing nations facing the mounting challenges of climate change and global economic pressures. An internal United Nations document, exclusively obtained by Reuters, reveals the potential diplomatic maneuver that could significantly impact vulnerable countries' ability to address environmental and economic challenges. The proposed intervention suggests a potential setback for multilateral efforts to provide financial and strategic assistance to nations most at risk from climate-related disruptions. By seeking to weaken the global deal, the United States may be signaling a shift in its approach to international climate cooperation and development support. While the specific details of the proposed changes remain unclear, the document hints at a complex diplomatic strategy that could have far-reaching consequences for global climate resilience and economic stability in developing regions. The revelation has already sparked concern among international policy experts and climate advocates who view such support mechanisms as crucial for addressing global environmental challenges. MORE...

Money Market Goldmine: Lock in 4.41% APY Before the Fed's Rate Rollercoaster Drops

Finance

2025-05-05 10:00:54

Unlock Exceptional Returns: Money Market Accounts Offering Stellar Rates

In today's dynamic financial landscape, savvy savers are discovering a golden opportunity: money market account (MMA) interest rates that are soaring well beyond traditional benchmarks. If you're looking to maximize your savings potential, now is the perfect time to explore these high-yield investment options.

Unlike standard savings accounts, money market accounts are offering unprecedented returns that can help your money work harder for you. Financial experts are noting that current rates are significantly more attractive than what we've seen in recent years, presenting a rare chance to boost your financial growth.

Smart investors are quickly capitalizing on these favorable conditions, seeking out financial institutions that are competing to offer the most competitive rates. From online banks to local credit unions, there are numerous opportunities to secure impressive returns on your hard-earned cash.

Key strategies for finding the best money market account rates include:

- Comparing rates across multiple financial institutions

- Checking online banks, which often offer higher yields

- Considering minimum balance requirements

- Evaluating additional account features and benefits

Don't miss out on this exceptional moment in the financial market. Take action now and explore money market accounts that can transform your savings strategy and maximize your financial potential.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421