Breaking: Lansdnet's Fiscal Roadmap Unveiled - What the 2024 Numbers Reveal

Finance

2025-02-20 14:29:00

Strong Future Foundations: A Year of Remarkable Financial Growth

In a significant milestone, the Board of Directors officially approved the company's 2024 financial statements on February 20th, 2025, revealing an impressive year of financial performance and strategic advancement.

Highlights of Financial Success

- Profits soared to an impressive 43.1 million USD in 2024, representing a substantial 68% increase from the previous year's 25.6 million USD.

- Earnings Before Interest and Taxes (EBIT) demonstrated robust growth, climbing to 70.5 million USD compared to 52.7 million USD in 2023 - a clear indication of the company's operational efficiency and strategic management.

- The company's financial strength was further underscored by a healthy net cash availability of 78.8 million USD at year-end, with net cash provided by operating activities reaching a solid 87.0 million USD.

These results not only reflect the organization's resilience but also set a promising trajectory for future growth and innovation.

MORE...Money Moves: Breaking the Cycle of Financial Struggle for Gen Z and Millennials

Finance

2025-02-20 14:10:00

Forget Traditional Home Buying: Why a Sabbatical Might Be Your Smarter Investment In an era of rising housing costs and changing life priorities, young professionals are challenging conventional wisdom about homeownership. Instead of draining savings for a down payment, many are choosing to invest in transformative life experiences that could ultimately provide greater long-term value. A sabbatical isn't just a career break—it's a strategic life investment that can dramatically enhance personal and professional growth. Imagine trading a hefty mortgage deposit for an opportunity to learn a new language, gain international work experience, or develop skills that could significantly boost your career trajectory. Financial experts are increasingly recognizing the potential of experiential investments. Travel, cultural immersion, and skill development can create unexpected career opportunities and personal networks that traditional real estate investments might not offer. By redirecting funds typically earmarked for a down payment, individuals can create rich, meaningful experiences that potentially yield higher returns in personal capital. This approach isn't about avoiding responsibility, but about redefining value. A well-planned sabbatical can provide personal development, global perspectives, and potential career advancement that far exceed the immediate security of property ownership. While homeownership remains a worthy goal, today's dynamic job market and global opportunities suggest that flexibility might be more valuable than a fixed address. Your most significant investment could be in yourself—not just a piece of real estate. MORE...

Exclusive: Trump's Secret Plan to Sell Off Federal Lands for Massive Private Wealth Fund

Finance

2025-02-20 14:01:01

In a bold and controversial move, President Donald Trump's latest executive order has set the stage for a potential fire sale of America's most precious public lands. The directive demands a rapid influx of cash, creating a high-stakes financial challenge that could tempt policymakers to liquidate valuable federal properties. The sovereign wealth fund initiative puts immense pressure on the government to generate substantial funds in an extraordinarily short timeframe. This financial urgency may lead to the unprecedented selling off of public lands—natural treasures that have been held in trust for generations of Americans. With the clock ticking and the financial targets looming, the administration appears poised to consider drastic measures. The potential sell-off threatens to transform pristine public landscapes into quick cash, raising serious concerns about long-term conservation and public access to these irreplaceable natural resources. As the details of this executive order unfold, conservationists, land management experts, and concerned citizens are watching closely, wondering about the potential long-term consequences of this high-stakes financial strategy. MORE...

Breaking: Debt Titans PRA Group and StepChange Champion Consumer Financial Lifelines in Westminster Showdown

Finance

2025-02-20 13:15:00

In a groundbreaking collaboration, PRA Group, Inc. and StepChange have joined forces to shed light on the critical challenges facing individuals struggling with debt across the United Kingdom. The partnership brought together key stakeholders for an important dialogue at the prestigious House of Lords, where The Viscount Chandos facilitated a pivotal roundtable discussion. Led by Chris Leslie, the Credit Services Association's CEO and former Shadow Chancellor, the event aimed to spark meaningful conversation about the complex landscape of personal debt. PRA Group, a global leader in nonperforming loan acquisition and collection, partnered strategically with StepChange, the UK's most prominent debt advice charity, to amplify awareness and explore potential solutions for those facing financial hardship. This collaborative effort underscores a shared commitment to understanding and addressing the multifaceted challenges that individuals experiencing financial difficulties encounter in today's economic environment. By bringing together expertise from both the financial services sector and charitable support, the roundtable represented a significant step towards developing more compassionate and effective approaches to debt management. MORE...

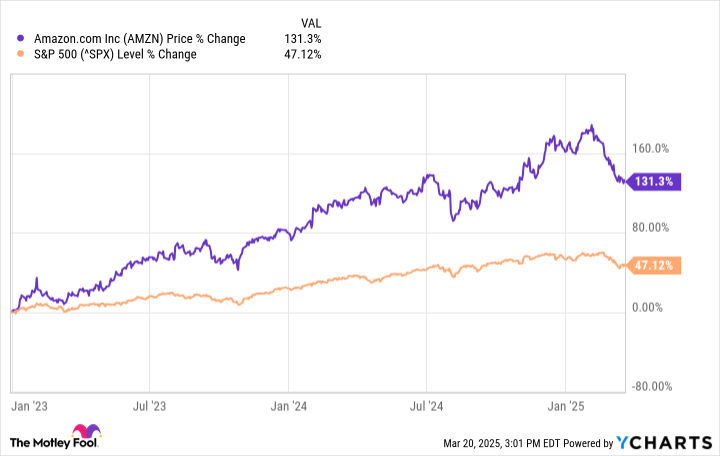

Wall Street Braces: Retail Giant's Earnings Set to Shake Market Sentiment

Finance

2025-02-20 13:06:20

The Trump administration continues to make waves with its aggressive economic strategy, focusing intently on trade policy and government spending reduction. As tariffs reshape international trade dynamics and budget cuts target federal expenditures, the administration's bold approach is drawing significant attention from economists, policymakers, and global markets. The ongoing tariff implementation signals a dramatic shift in America's economic engagement, challenging long-established international trade norms. Meanwhile, proposed governmental cost-cutting measures aim to streamline federal operations and reduce national spending, reflecting a commitment to fiscal discipline. These strategic moves underscore the administration's determination to redefine economic relationships, both domestically and internationally. By leveraging trade barriers and reducing government expenses, the policy approach seeks to strengthen American economic competitiveness and create a more lean, responsive federal infrastructure. Stakeholders across various sectors are closely monitoring these developments, recognizing the potential long-term implications for businesses, workers, and global economic relationships. The unfolding strategy represents a significant departure from previous administrative approaches, promising to reshape economic landscapes in unprecedented ways. MORE...

Wall Street Stunner: FTI Consulting Unveils Blockbuster Q4 and 2024 Financial Performance

Finance

2025-02-20 12:30:00

Company Delivers Solid Performance Despite Quarterly Challenges

In a comprehensive financial report released today, the company showcased resilience with fourth-quarter revenues of $894.9 million, reflecting a modest 3% decline from the previous year's $924.7 million. Despite the slight decrease, the organization maintained strong earnings per share (EPS).

Quarterly Highlights

- Fourth Quarter EPS: $1.38 (Adjusted EPS: $1.56)

- Compared to Prior Year Quarter: EPS of $2.28

Annual Performance Shines

The full year 2024 painted a more optimistic picture, with record revenues of $3.699 billion—a robust 6% increase from the previous year's $3.489 billion. Annual EPS reached $7.81, with an adjusted EPS of $7.99, slightly surpassing the prior year's $7.71.

Looking Forward

The company has unveiled its preliminary guidance for 2025, signaling confidence in continued growth and strategic positioning in the market.

Financial report released on February 20, 2025, in Washington

MORE...Money Smarts or Diploma Denied: Colorado's Bold Plan to School Students in Finance

Finance

2025-02-20 12:25:44

Colorado Takes a Bold Step Toward Financial Education for Teens In a groundbreaking move, lawmakers are pushing forward a bipartisan bill that could transform how high school students prepare for their financial futures. The proposed legislation would mandate that all public high school students complete a comprehensive financial literacy course before graduation. This innovative proposal aims to equip young adults with critical money management skills that are often overlooked in traditional academic curricula. By requiring students to pass a dedicated financial literacy class, Colorado hopes to empower the next generation with practical knowledge about budgeting, saving, investing, and understanding personal finance. The bill represents a proactive approach to addressing financial education, recognizing that practical money skills are just as important as traditional academic subjects. Students will learn essential life skills that can help them make informed financial decisions, avoid debt, and build a strong economic foundation for their future. As the bill moves through the legislative process, educators and financial experts are praising the initiative as a crucial step in preparing young people for the complex financial landscape of the 21st century. MORE...

Beijing's Financial Lifeline: Central Bank Moves to Rescue Private Sector

Finance

2025-02-20 12:17:35

In a significant move to bolster economic confidence, China's central bank has committed to delivering robust financial support aimed at empowering private businesses and fostering their sustainable growth. The announcement, made on Thursday, signals a strong governmental commitment to nurturing the private sector's development and addressing potential challenges faced by entrepreneurs. The People's Bank of China emphasized its dedication to creating a more supportive financial ecosystem that will enable private enterprises to thrive, innovate, and contribute meaningfully to the nation's economic landscape. By pledging comprehensive financial assistance, the central bank aims to inject renewed vitality into the private sector and provide businesses with the resources they need to expand and succeed. This strategic initiative underscores the government's recognition of private enterprises as crucial drivers of economic dynamism and job creation. The commitment reflects a proactive approach to addressing economic challenges and promoting a more inclusive and resilient business environment. MORE...

Climate Cash Countdown: IMF and Pakistan Set to Unlock $1 Billion Green Investment

Finance

2025-02-20 11:15:31

Pakistan is set to welcome a high-level International Monetary Fund (IMF) delegation next week, with climate financing taking center stage in crucial discussions. The upcoming mission is expected to explore approximately $1 billion in potential climate-related financial support for the country, according to a senior adviser to Pakistan's finance minister. The anticipated visit highlights the growing global focus on climate resilience and financial assistance for vulnerable nations. Pakistan, which has been increasingly impacted by extreme weather events and climate change, stands to benefit significantly from this potential funding. The IMF mission represents a critical opportunity for the country to secure much-needed resources to bolster its climate adaptation and mitigation strategies. Finance ministry sources suggest that the discussions will delve into detailed mechanisms for channeling the proposed climate financing, potentially addressing critical infrastructure, environmental protection, and sustainable development initiatives. This financial support could prove transformative for Pakistan's efforts to combat the escalating challenges posed by climate change. MORE...

Green Money Moves: How Global Finance Giants Are Betting Big on Climate Solutions

Finance

2025-02-20 11:09:44

Climate Chaos: January Shatters Temperature Records in Unprecedented Heatwave The world has just witnessed another alarming milestone in the ongoing climate crisis. January 2024 has officially been declared the warmest January in recorded history, leaving even seasoned climate experts stunned by the intensity of global temperature rises. Scientists are grappling with the unprecedented warmth, struggling to fully comprehend the magnitude of these record-breaking temperatures. The data paints a stark and concerning picture of our planet's rapidly changing climate, signaling potential long-term environmental consequences that could reshape our understanding of global weather patterns. This latest temperature record is not just a number—it's a loud, clear warning about the accelerating impacts of climate change. Researchers are now intensifying their investigations to understand the complex mechanisms driving these extraordinary temperature fluctuations. As the world continues to witness these dramatic climatic shifts, the urgency for comprehensive climate action has never been more critical. Each record-breaking month serves as a stark reminder that our planet is experiencing unprecedented transformations that demand immediate and decisive global response. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421