Private Equity Titans: Reshaping Finance's Landscape, One Deal at a Time

Finance

2025-04-17 10:03:05

In the high-stakes world of alternative investments, private equity firms like Blackstone, KKR, Apollo Global Management, and Carlyle have long promised a steady hand when public markets become turbulent. Yet, as recent market volatility triggered by global trade tensions unfolds, these financial powerhouses are finding it challenging to maintain their carefully crafted image of calm and strategic resilience. Once known simply as buyout firms, these financial giants have rebranded themselves as sophisticated alternative asset managers, positioning their approach as a more nuanced and sophisticated alternative to traditional investment strategies. However, the current market landscape is testing their narrative, with stock performance failing to substantiate their claims of superior market navigation. Despite their reputation for patience and long-term thinking, these firms are discovering that insulating themselves from market panic is far more complex than their polished marketing materials suggest. The recent economic turbulence has exposed the delicate balance between their promised stability and the harsh realities of global financial dynamics. As investors watch closely, the performance of these private equity titans will reveal whether they can truly deliver on their promise of being a more resilient investment option in an increasingly unpredictable economic environment. MORE...

Financial Powerhouse Recruit: Pool Re Snags Top Executive from AllianceBernstein

Finance

2025-04-17 08:50:56

The strategic appointment arrives in anticipation of significant leadership transitions, with Chief Information Officer Ian Coulman and Chief Financial Officer Peter Aves set to retire in 2025. This forward-looking move ensures a smooth succession plan and maintains organizational continuity during a critical leadership transformation period. MORE...

Market Pulse: FTSE 100 Braces for ECB's Rate Verdict - Will Investors Feel the Squeeze?

Finance

2025-04-17 08:32:55

In a bold move to stimulate economic recovery, the European Central Bank (ECB) is poised to deliver its seventh interest rate cut this year, signaling a proactive approach to combat economic challenges. The anticipated rate reduction comes at a critical time, as the Eurozone economy grapples with mounting pressures, including the potential fallout from escalating US tariffs. Policymakers are strategically positioning themselves to provide much-needed economic relief, recognizing the fragile state of the region's financial landscape. The consecutive rate cuts reflect a determined effort to boost economic growth, encourage lending, and provide a lifeline to businesses struggling in an increasingly complex global market. The ECB's decision underscores the delicate balancing act facing economic leaders: navigating international trade tensions while attempting to protect domestic economic interests. With each rate cut, the central bank aims to inject confidence and momentum into an economy that has been treading water amid global uncertainties. As the financial world watches closely, this latest intervention could prove pivotal in preventing a potential economic downturn and setting the stage for future recovery. MORE...

Currency Crossroads: Japanese Yen Braces for Turbulent Week Ahead of Critical Talks

Finance

2025-04-17 08:30:42

The Japanese yen stands at a critical crossroads, narrowly escaping immediate currency discussions in US-Japan trade negotiations, but experts predict its fate remains uncertain in future diplomatic exchanges. While the yen has momentarily avoided direct scrutiny, financial analysts warn that the currency remains poised for potential volatility. The delicate balance of international trade dynamics suggests that currency valuation could become a significant point of discussion in upcoming bilateral talks. Recent market movements indicate the yen's vulnerability to geopolitical and economic shifts. Investors and policymakers are closely monitoring the currency's performance, anticipating potential interventions or strategic negotiations that could impact its global standing. The underlying tension stems from complex economic relationships between the United States and Japan, where trade policies, currency fluctuations, and strategic economic interests intersect. As global markets continue to evolve, the yen's role and value remain a critical focal point for international financial strategists. Traders and economists recommend maintaining a vigilant approach, recognizing that while the current moment might seem calm, the potential for sudden currency market movements remains ever-present. MORE...

Trade Tensions Escalate: Japan's Finance Chief Warns of Trump Tariff Fallout

Finance

2025-04-17 08:25:04

In a candid interview with Reuters, Japan's Finance Minister Katsunobu Kato offered insights into the country's current economic landscape and financial strategies. Speaking with confidence, Kato addressed key economic challenges and potential pathways for growth, providing a nuanced perspective on Japan's financial outlook. The minister emphasized the importance of maintaining economic stability while navigating complex global financial dynamics. His remarks shed light on the government's proactive approach to addressing economic uncertainties and supporting sustainable development. Kato's interview comes at a critical time, as Japan continues to balance economic recovery efforts with strategic financial planning. His comments reflect the government's commitment to implementing robust economic policies that can withstand global economic fluctuations. While specific details of the interview were not fully disclosed, Kato's statements suggest a cautiously optimistic view of Japan's economic potential. The finance minister's insights offer a glimpse into the strategic thinking driving Japan's financial decision-making in these challenging times. MORE...

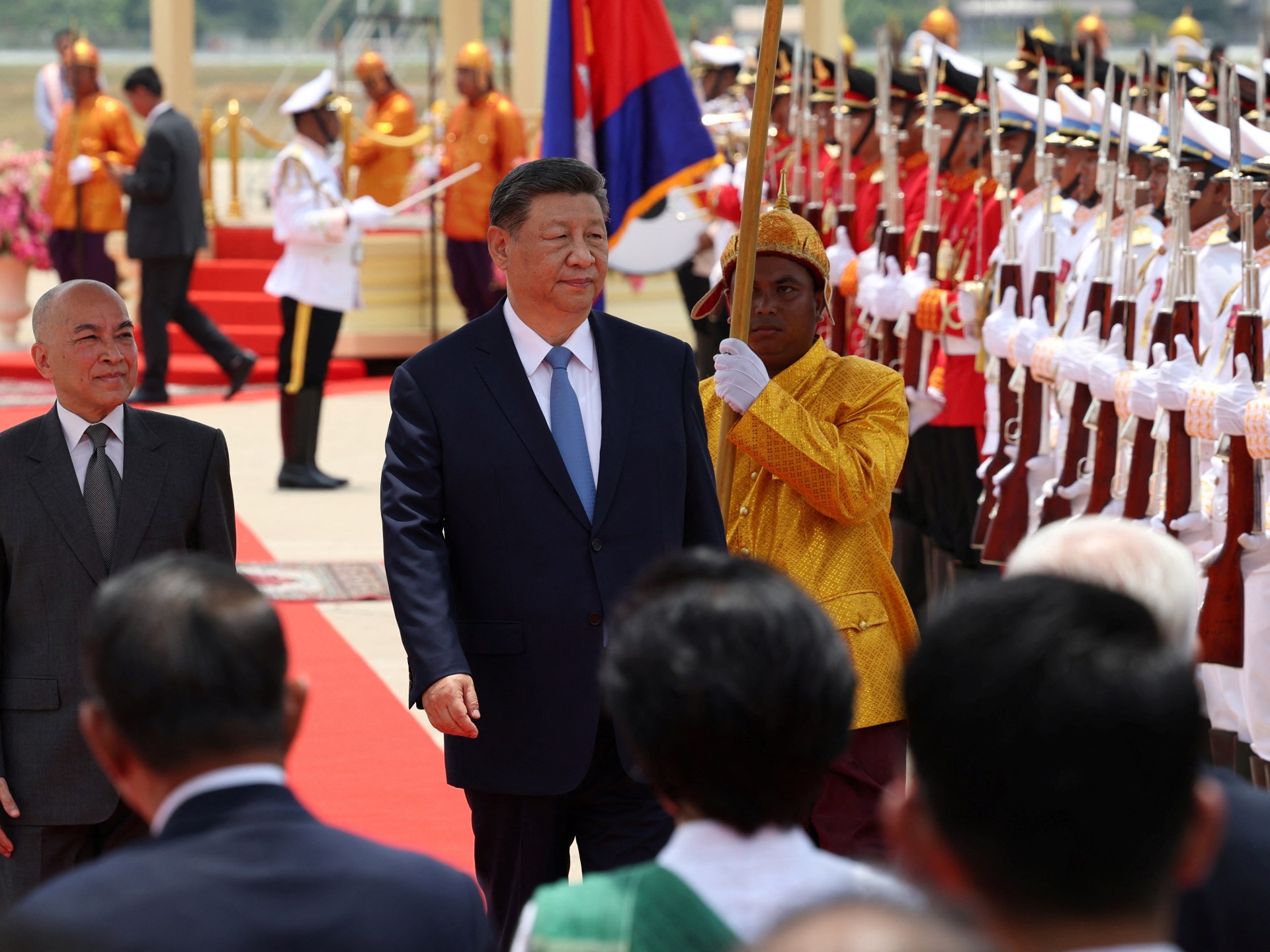

Xi's Diplomatic Lifeline: Cambodia Turns to China Amid US Trade Tensions

Finance

2025-04-17 07:58:54

Cambodia Emerges as Strategic Focal Point in Xi Jinping's Regional Diplomacy As Chinese President Xi Jinping continues his diplomatic tour of Southeast Asia, Cambodia has taken center stage, revealing the profound economic and strategic ties between Beijing and Phnom Penh. A striking economic insight underscores the depth of this relationship: Chinese investors and businesses currently control approximately 50% of Cambodian enterprises exporting to the United States. This significant economic footprint highlights Cambodia's growing importance in China's regional strategy, demonstrating how economic influence can be a powerful tool of diplomatic engagement. The bilateral relationship extends beyond mere trade, reflecting a complex interplay of economic interdependence and strategic alignment. The substantial Chinese stake in Cambodian export businesses not only provides Beijing with economic leverage but also strengthens its geopolitical positioning in a region of increasing global strategic importance. For Cambodia, this partnership offers economic opportunities and potential development pathways, while simultaneously positioning the country as a key player in China's expansive regional economic network. As Xi's tour continues, the Cambodia leg serves as a compelling illustration of China's nuanced approach to regional diplomacy, blending economic investment with strategic relationship-building. MORE...

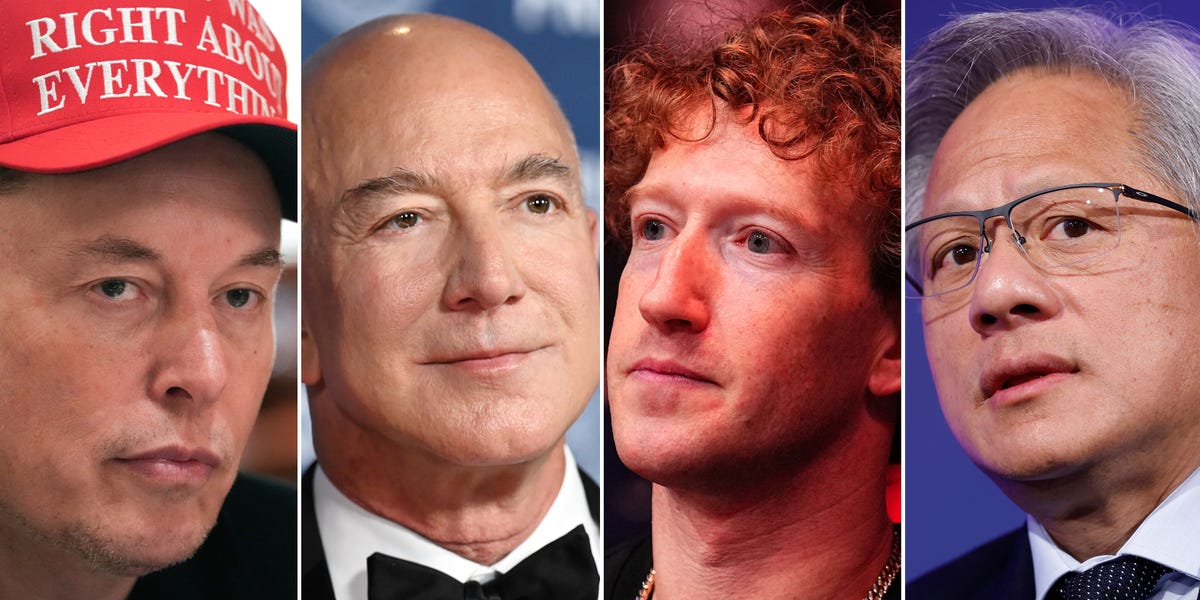

Is Big Tech's Capital Strategy Leaving Investors Worried?

Finance

2025-04-17 07:15:01

Unlocking the Secrets of Multi-Bagger Investments: Key Financial Metrics to Watch Have you ever wondered how some investors consistently identify stocks that skyrocket in value, delivering extraordinary returns? The key lies in understanding and analyzing specific financial metrics that can signal a potential multi-bagger investment. Savvy investors know that beyond surface-level numbers, there are hidden indicators that can reveal a company's true growth potential. These financial metrics act like a treasure map, guiding investors toward stocks that could multiply their initial investment several times over. From robust revenue growth and consistent profitability to strong return on equity and innovative business models, multi-baggers often share certain characteristics that set them apart from ordinary stocks. By learning to decode these financial signals, you can develop a more strategic approach to investing and potentially uncover those rare gems that transform modest investments into substantial wealth. Whether you're a seasoned investor or just starting your financial journey, understanding these critical metrics can be your secret weapon in building a high-performance investment portfolio. Are you ready to dive deeper and learn how to spot the next potential multi-bagger? MORE...

Breaking: Fulton Financial's Q1 Earnings Reveal Bold Moves Amid Market Turbulence

Finance

2025-04-17 07:02:11

Fulton Financial Corporation Navigates Challenging Banking Landscape with Resilient Performance

Fulton Financial Corporation (FULT) has demonstrated financial strength and strategic adaptability in its latest financial report, showcasing positive earnings momentum despite ongoing market challenges. The regional banking powerhouse reported a notable increase in operating earnings per share, signaling the company's ability to maintain profitability in a complex economic environment.

While the bank experienced growth in deposit volumes, which reflects customer confidence and effective relationship management, it simultaneously confronted headwinds in its loan portfolio. The decline in loan balances suggests a cautious lending approach in response to current economic uncertainties and potential credit risk management strategies.

The financial institution's leadership remains focused on strategic initiatives aimed at optimizing operational efficiency and maintaining a robust financial position. By balancing prudent risk management with growth opportunities, Fulton Financial is positioning itself to navigate the evolving banking landscape with resilience and strategic foresight.

Investors and market analysts will be closely monitoring the company's continued performance and its ability to adapt to changing market dynamics in the coming quarters.

MORE...Wall Street Defies Trade Tensions: Futures Surge Despite Global Tariff Tremors

Finance

2025-04-17 06:45:12

Wall Street Braces for Uncertain Trading as Trade Tensions Simmer U.S. stock futures hovered near neutral territory Wednesday morning, following a tumultuous trading session that laid bare growing investor anxieties about the potential economic fallout from escalating trade tensions. The previous day's market volatility served as a stark reminder of the mounting pressure created by President Trump's aggressive tariff strategies. Investors remain on edge, carefully parsing every signal that might indicate the direction of international trade relations and their potential impact on corporate earnings and economic growth. The market's fragile sentiment reflects deep uncertainty about how ongoing trade disputes could reshape global economic dynamics. As traders prepare for another potentially turbulent day, all eyes are focused on potential developments in the ongoing trade negotiations and their potential ripple effects across various market sectors. The delicate balance of international commerce hangs in the balance, with each new policy announcement capable of triggering significant market movements. MORE...

Beyond the Ledger: How Fraud Prevention is Transforming Entire Organizations

Finance

2025-04-17 06:43:27

UK's Corporate Fraud Prevention Law: A Game-Changing Compliance Challenge

Starting September 1, 2025, UK businesses will face a significant new legal landscape with the introduction of the Failure to Prevent Fraud offense. This groundbreaking legislation places unprecedented pressure on companies to proactively safeguard against fraudulent activities within their organizations.

The new law represents a critical shift in corporate accountability, compelling businesses to implement robust fraud prevention strategies. Companies that cannot demonstrate comprehensive preventative measures will now be at substantial legal and financial risk.

Under this regulation, organizations will be held responsible for fraudulent actions committed by employees or associated persons, even if senior management was unaware of the misconduct. This means businesses must develop sophisticated compliance frameworks and internal control mechanisms to protect themselves from potential legal consequences.

Executives and compliance officers are advised to immediately review and strengthen their existing fraud prevention protocols. Proactive risk assessment, employee training, and transparent reporting systems will be crucial in navigating this new regulatory environment.

The stakes are high: companies found in violation could face significant financial penalties and reputational damage. As the September 2025 deadline approaches, forward-thinking organizations are already preparing comprehensive strategies to ensure full compliance.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421