Retirement Goldmine? Why MUFG Could Be Your Financial Fountain of Youth

Finance

2025-02-23 16:53:49

Navigating Retirement Investments: A Closer Look at Mitsubishi UFJ Financial Group In our recent comprehensive analysis of the top 15 stocks ideal for retirement portfolios, we turn our spotlight on Mitsubishi UFJ Financial Group, Inc. (NYSE:MUFG) and its potential as a strategic investment choice. As the retirement landscape continues to evolve, savvy investors are increasingly seeking robust financial opportunities that can provide stability and growth. Recent insights reveal a compelling trend: retirees with diversified income streams—including private sources, pensions, and supplemental employment—are experiencing significantly better financial security. Mitsubishi UFJ Financial Group emerges as a noteworthy contender in this investment ecosystem, offering investors a potentially promising avenue for long-term financial planning. Our in-depth examination will explore MUFG's market position, financial performance, and its potential to contribute to a well-rounded retirement investment strategy. Stay tuned as we break down the key factors that make this financial institution stand out in the competitive investment landscape. MORE...

Breaking: Australasia Financial Services Marks Decade-Plus of Groundbreaking Investment Strategies

Finance

2025-02-23 15:30:00

Celebrating a Decade of Financial Excellence: Australasia Financial Services Marks 12 Years of Innovative Investment Advisory PEPPERMINT GROVE, Australia - In a milestone moment for the financial services industry, Australasia Financial Services Pty Ltd is proudly commemorating its 12th anniversary. Since its inception in April 2013, the company has consistently distinguished itself as a trailblazing leader in investment advisory, delivering exceptional strategic guidance and cutting-edge financial solutions to clients across the region. Over the past twelve years, Australasia Financial Services has built a reputation for innovative approaches, client-focused strategies, and unwavering commitment to financial excellence. What began as a visionary venture has grown into a respected institution, navigating complex market landscapes and empowering clients to achieve their financial goals. The company's journey reflects a remarkable trajectory of growth, adaptability, and sustained success in a dynamic and competitive financial services sector. As they celebrate this significant milestone, Australasia Financial Services remains dedicated to its core mission of providing transformative financial advice and creating lasting value for its diverse clientele. MORE...

Dollars and Diplomacy: USAID's $750 Million Development Footprint Unveiled by Finance Ministry

Finance

2025-02-23 15:22:48

In a dramatic turn of events, the Department of Government Efficiency (DOGE), spearheaded by tech mogul Elon Musk, has ignited a political firestorm with its recent controversial claim of cancelling a substantial $21 million contract. The timing of the report has thrust the agency into the national spotlight, sparking intense debate and scrutiny across political circles. The unexpected announcement has raised eyebrows and prompted widespread speculation about the motivations behind such a significant contract termination. Political analysts and government watchdogs are closely examining the details, seeking to understand the broader implications of DOGE's bold move. As tensions rise and questions mount, the incident underscores the growing influence of Musk's government efficiency initiative and its potential to disrupt traditional bureaucratic processes. The unfolding narrative promises to be a compelling case study in governmental transparency and strategic contract management. MORE...

Financial Lifeline: Southampton Council Expands Emergency Aid in Fiscal Crunch

Finance

2025-02-23 15:07:40

Southampton City Council Granted Crucial Financial Lifeline to Prevent Fiscal Collapse

In a dramatic financial intervention, Southampton City Council has been granted extraordinary flexibility for the 2024/25 fiscal year, narrowly averting a potential municipal financial crisis. This special dispensation comes as a critical rescue measure to prevent the council from sliding into effective bankruptcy.

The unprecedented financial accommodation allows the council to manage its precarious budget situation with greater strategic latitude. By providing this unique flexibility, local government authorities are offering Southampton a crucial opportunity to restructure its finances and stabilize its economic foundation.

This development highlights the challenging financial landscape facing many local councils across the United Kingdom, where budget constraints and increasing service demands create significant fiscal pressures. Southampton's situation serves as a stark reminder of the delicate financial balance municipal governments must maintain.

The council will now have the opportunity to implement strategic financial reforms, potentially including cost-cutting measures, revenue optimization, and more efficient resource allocation to prevent future financial vulnerabilities.

MORE...Market Mayhem: Why External Shocks Shouldn't Derail Your Investment Strategy

Finance

2025-02-23 15:00:43

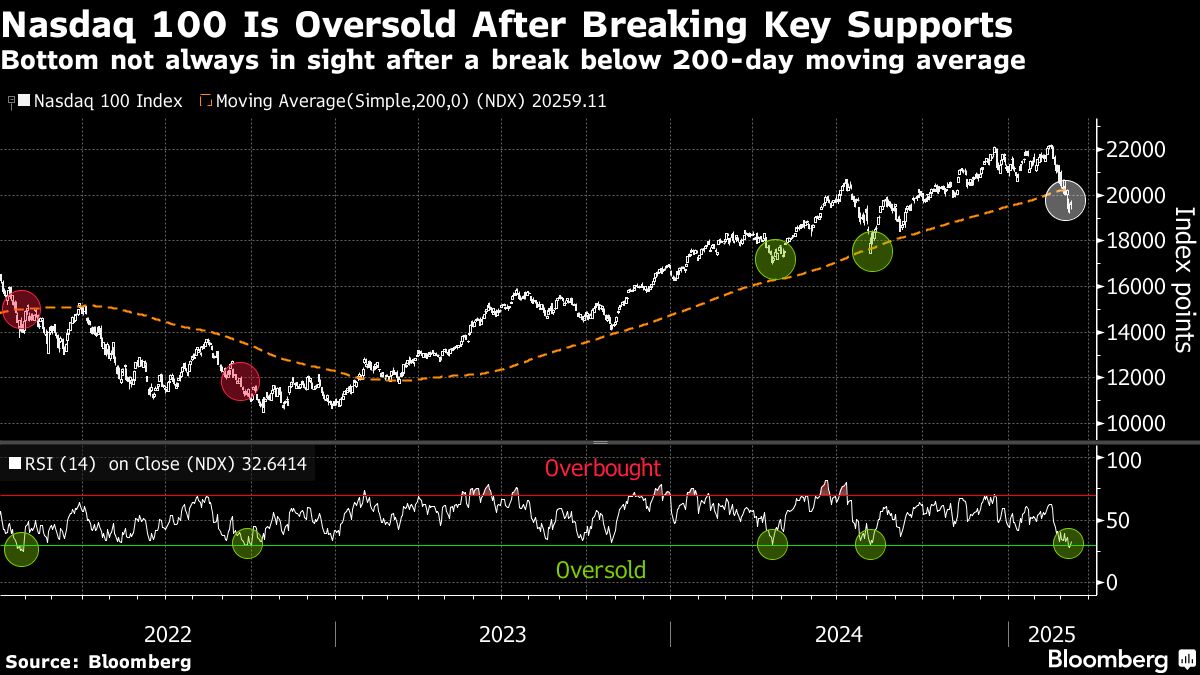

Nvidia Earnings: Tech Sector Outlook and Market Dynamics

As Nvidia prepares to report its earnings on Wednesday, market experts are closely watching the tech landscape. Mark Newton, managing director and global head of technical strategy at Fundstrat Global Advisors, shared his insights on the current market conditions during an appearance on Market Domination.

The Shifting Landscape of the Magnificent Seven

Newton noted a recent shift in the performance of the "Magnificent Seven" tech stocks, which include Nvidia, Alphabet, Tesla, Microsoft, Amazon, Meta, and Apple. While the group has experienced a temporary slowdown, Newton remains optimistic about their future potential.

"I don't expect this downturn to last too long," Newton explained. "I suspect most of these tech stocks will soon reignite and push higher."

Bright Spots in the Market

The strategist highlighted positive developments in other sectors, particularly:

- Industrial sector: Strong performance from companies like Caterpillar and Deere

- Financial sector: Notable gains, including standout performance from JPMorgan

Investor Strategy

Newton advises investors to maintain perspective, suggesting they should "ignore exogenous events until they directly impact the stock market."

For more in-depth market analysis and expert insights, viewers are encouraged to explore additional Market Domination coverage.

MORE...Buffett's Bold Prediction: How U.S. Businesses Triumph Against All Odds

Finance

2025-02-23 14:17:47

Warren Buffett, the investment oracle of Omaha, continues to champion American economic resilience with his unwavering optimism about the U.S. stock market. Despite market fluctuations and economic uncertainties, the legendary Berkshire Hathaway CEO remains steadfastly bullish on the long-term potential of American equities. With decades of investment wisdom behind him, Buffett's confidence in the U.S. stock market is more than just a passing sentiment—it's a deeply rooted belief in the innovative spirit and economic strength of American businesses. His track record of successful investments speaks volumes about his strategic approach to wealth creation and market understanding. Investors and market watchers alike continue to hang on Buffett's every word, recognizing that his long-term perspective has consistently proven more reliable than short-term market hysteria. His message remains clear: America's economic fundamentals are robust, and patient investors who believe in the country's potential will be rewarded over time. As always, Buffett's optimism serves as a beacon of hope and strategic guidance for investors navigating the complex landscape of financial markets, reinforcing his reputation as one of the most trusted voices in global investing. MORE...

Financial Shock: Ramsey Reveals Looming Retirement Crisis for Millions of Americans

Finance

2025-02-23 13:37:00

Navigating Retirement: A Hidden Financial Trap Revealed Bestselling personal finance author David Bach warns retirees about a critical financial pitfall that could derail their carefully planned retirement dreams. Many individuals approaching retirement fail to recognize a subtle yet significant risk that could dramatically impact their financial security. The core issue lies in underestimating the long-term financial challenges that can emerge during retirement years. Bach emphasizes that traditional retirement planning often overlooks crucial factors that can quickly erode savings and create unexpected financial strain. Key concerns include: • Escalating healthcare costs • Potential loss of income streams • Unexpected lifestyle expenses • Longer life expectancies requiring extended financial planning Retirees must adopt a proactive approach, carefully reassessing their financial strategies and building robust contingency plans. Bach recommends comprehensive financial reviews, diversified investment portfolios, and maintaining flexible spending strategies. By understanding these potential retirement perils and taking strategic preventative measures, individuals can protect their financial future and ensure a more secure, comfortable retirement experience. MORE...

Nvidia's Earnings Shocker: The Chart That's Turning Wall Street Upside Down

Finance

2025-02-23 13:30:20

In the high-stakes world of tech investing, Nvidia has emerged as a true powerhouse, defying conventional market expectations and leaving investors wondering: Is this stock still a bargain? Despite its astronomical rise in the artificial intelligence revolution, Nvidia's valuation might still be surprisingly attractive. The company's recent performance has been nothing short of spectacular, with its stock price skyrocketing over 200% in the past year, driven by the insatiable demand for AI chips and computing infrastructure. Wall Street analysts are increasingly bullish, with many arguing that Nvidia's current price doesn't fully reflect its massive growth potential. The company's dominance in AI semiconductor technology has positioned it as the critical backbone of the global AI transformation, serving tech giants, cloud providers, and emerging AI innovators. Key factors supporting Nvidia's compelling valuation include: • Unprecedented AI chip market leadership • Strong revenue growth in data center and gaming segments • Robust profit margins • Continuous technological innovation While some might view the stock as expensive, deeper analysis suggests Nvidia could still be undervalued given its strategic market position and future growth trajectory. The company's ability to consistently outperform expectations and drive technological innovation makes it an intriguing investment opportunity. Investors should, of course, conduct their own research and consider their individual financial goals. But for those betting on the AI revolution, Nvidia remains a compelling prospect that might be more attractively priced than it appears. MORE...

Dividend Alert: CNB Financial Drops Quick Cash Payout to Shareholders

Finance

2025-02-23 13:21:20

Investors eyeing CNB Financial Corporation (NASDAQ:CCNE) for its attractive dividend should act quickly. The company is approaching its ex-dividend date, which means time is of the essence for those looking to secure their upcoming dividend payment. For dividend-focused investors, timing is crucial. CNB Financial Corporation is set to distribute its next dividend soon, presenting a potential opportunity for shareholders seeking steady income streams. The stock's current dividend yield offers an appealing prospect for those interested in building a reliable investment portfolio. Potential investors should carefully review the company's financial health, dividend history, and future prospects before making an investment decision. While the dividend is attractive, it's essential to consider the broader financial context and the company's overall performance in the market. Those interested in capturing the upcoming dividend payment will need to purchase shares before the ex-dividend date. This strategic timing ensures eligibility for the upcoming dividend distribution, making it a critical moment for income-oriented investors. MORE...

Stablecoins: The Digital Currency Revolutionizing Crypto's Wild Ride

Finance

2025-02-23 13:04:52

In a high-stakes technological sprint, policymakers are scrambling to develop regulatory frameworks that can keep pace with the lightning-fast evolution of emerging technologies. As innovative platforms and groundbreaking solutions emerge at an unprecedented rate, government officials and regulatory bodies are working overtime to craft intelligent, adaptive policies that can effectively govern these rapidly transforming digital landscapes. The challenge is complex: how can traditional legislative approaches anticipate and address the dynamic nature of technological advancement? Lawmakers are increasingly recognizing that their traditional reactive strategies are no longer sufficient in an era of exponential technological growth. Instead, they must adopt more proactive, flexible approaches that can anticipate potential disruptions and create forward-thinking guidelines that protect public interests while fostering innovation. From artificial intelligence and blockchain to quantum computing and biotechnology, the race is on to develop comprehensive regulatory strategies that balance technological potential with critical ethical and safety considerations. Policymakers are now engaging with technologists, industry experts, and academic researchers to create nuanced, intelligent frameworks that can effectively navigate this complex and rapidly changing terrain. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421