Gas War Funding: Naftogaz Lands $466M Lifeline in Energy Showdown

Finance

2025-04-29 15:09:55

A robust financial support package has been secured, combining strategic funding from two key international sources. The European Bank for Reconstruction and Development (EBRD) will provide a substantial loan, complemented by a generous grant from the Norwegian government. This collaborative financial approach demonstrates a strong commitment to supporting economic development and infrastructure initiatives. The comprehensive funding strategy leverages the expertise and resources of both the EBRD and Norway, creating a powerful financial mechanism to drive forward critical projects. By blending loan and grant funding, the package offers flexible and sustainable financial support that can address complex economic challenges. MORE...

Trade Boost: WTO and IFC Unveil GroundTransforming Landscape in Mexico and Central America

Finance

2025-04-29 15:01:17

In a significant milestone for regional economic development, the International Finance Corporation (IFC) and a key representative from a prominent international organization unveiled a groundbreaking report on trade finance in Latin America. On April 29th, Deputy Director-General Johanna Hill and IFC Global Director Nathalie Louat launched a comprehensive publication in Mexico City, shedding light on the critical role of trade finance in emerging economies. The joint publication meticulously examines the trade finance landscape across three dynamic Latin American nations: Guatemala, Honduras, and Mexico. By delving deep into the financial mechanisms that drive cross-border commerce, the report highlights the pivotal importance of trade finance in empowering businesses to seize international market opportunities. At its core, the study underscores how access to robust trade finance solutions enables firms to navigate complex economic terrains, effectively manage inherent trade risks, and secure essential working capital. This strategic financial support serves as a catalyst for economic growth, helping businesses in these developing economies expand their global footprint and enhance their competitive edge. The publication not only provides valuable insights but also serves as a strategic roadmap for policymakers, financial institutions, and entrepreneurs seeking to understand and leverage trade finance as a powerful tool for economic advancement. MORE...

Economic Tremor: China Faces Massive Job Exodus as Tariff Tensions Escalate

Finance

2025-04-29 14:37:19

In a bold statement that underscores the escalating trade tensions, Treasury Secretary Scott Bessent challenged China to take the first step towards de-escalation by significantly reducing its tariffs. Highlighting the potential economic fallout, Bessent emphasized the substantial job losses China could face in the event of a prolonged trade war with the United States. Bessent's remarks come at a critical moment, signaling the U.S. government's stance that China must demonstrate a willingness to create a more balanced and fair trade environment. By pointing to the potential economic consequences for China's workforce, the Treasury Secretary is applying strategic pressure to encourage meaningful negotiations and trade reforms. The statement serves as a stark warning about the economic risks facing China's economy, suggesting that the current trade standoff could have far-reaching implications for global economic stability and bilateral relations between the two economic superpowers. MORE...

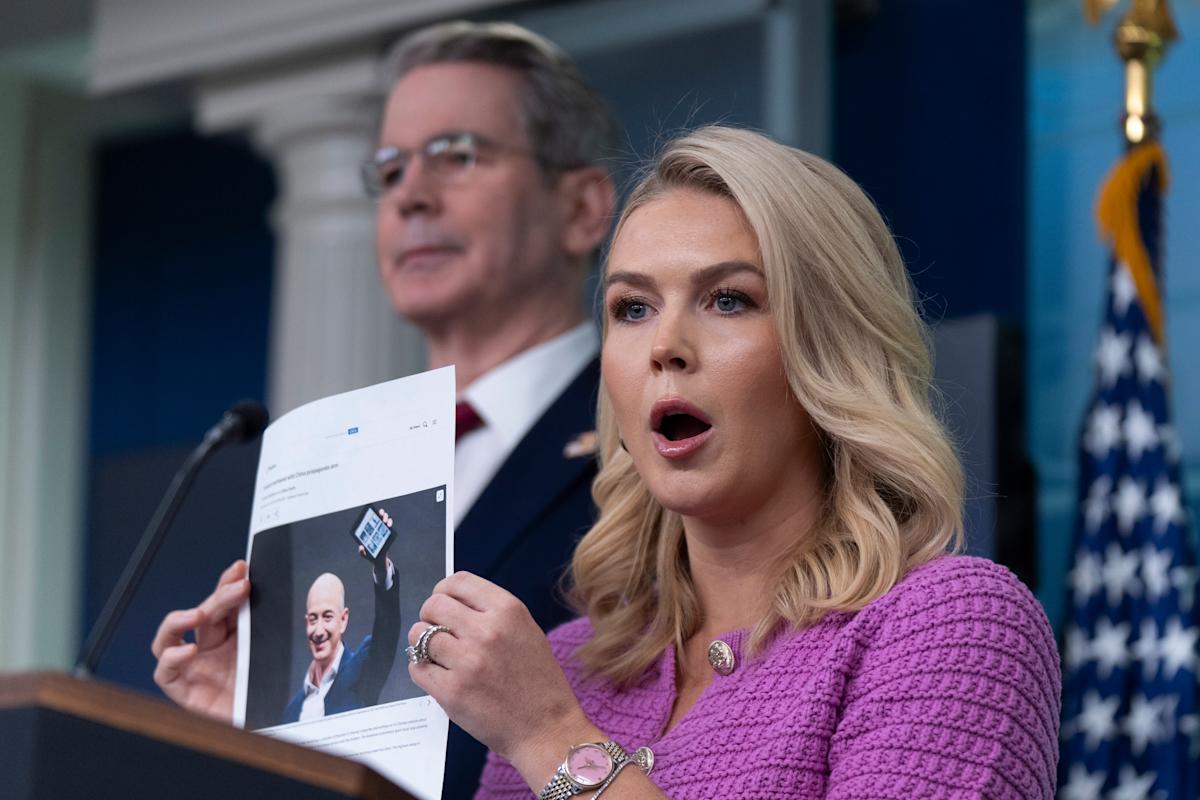

Trade Tensions Flare: White House Slams Amazon's 'Politically Charged' Tariff Strategy

Finance

2025-04-29 14:35:28

In a heated exchange, the White House is pushing back against Amazon's claims about tariff impacts on product pricing. The tech giant has reportedly been preparing to demonstrate how trade tariffs could potentially affect the prices of goods sold through its popular e-commerce platform. The administration is challenging Amazon's narrative, suggesting that the company's pricing strategy might be more complex than a simple pass-through of tariff costs. This confrontation highlights the ongoing tension between the government and one of the world's largest online retailers. As trade policies continue to evolve, the dispute underscores the broader economic implications of international trade regulations and their potential impact on consumer prices. The White House appears determined to counter Amazon's perspective and provide its own interpretation of how tariffs influence pricing in the digital marketplace. The developing story reveals the intricate dynamics between government policy and corporate pricing strategies, offering a glimpse into the complex world of e-commerce and international trade. MORE...

Crypto Crackdown: UK Unveils Sweeping Financial Regulation Roadmap

Finance

2025-04-29 14:13:59

In a significant move to bring clarity and structure to the rapidly evolving digital finance landscape, British Finance Minister Rachel Reeves unveiled plans on Tuesday to introduce comprehensive draft legislation for cryptocurrency regulation. The announcement signals the UK government's commitment to creating a robust framework for crypto assets, positioning the country at the forefront of digital financial innovation. Reeves revealed that the government will present a detailed financial services strategy on July 15th, which is expected to provide a comprehensive roadmap for managing and overseeing cryptocurrency markets. This strategic approach aims to balance innovation with investor protection, addressing growing concerns about the volatility and potential risks associated with digital assets. The proposed legislation represents a crucial step towards establishing clear guidelines and regulatory oversight in the crypto sector. By creating a more transparent and secure environment, the UK hopes to attract responsible crypto businesses while safeguarding investors from potential financial uncertainties. Financial experts and industry stakeholders are eagerly anticipating the full details of the strategy, which could potentially set a precedent for how other countries approach cryptocurrency regulation in the future. MORE...

Budget Showdown: Finance Committee Heads to Wausau for Public Budget Hearing

Finance

2025-04-29 13:11:07

Residents of Wausau and surrounding areas will have a chance to voice their opinions on the state's upcoming budget this Tuesday, as the Joint Finance Committee prepares to host a crucial public hearing. The session will provide an opportunity for community members to learn about and discuss the governor's proposed two-year budget plan, offering a direct line of communication with key decision-makers. The hearing, set to take place in Wausau, represents an important step in the state's budgetary process, allowing citizens to provide input and insights on financial priorities that could impact their local communities. Interested residents are encouraged to attend and participate in this democratic dialogue about the state's fiscal future. MORE...

Financing Secrets Unveiled: Brian Devling's Expert Guide to Mastering Acquisition Deals

Finance

2025-04-29 13:00:00

Spencer Fane's Brian Devling Illuminates Legal Insights in Banker Publication In a recent edition of The Show-Me Banker, the official publication of the Missouri Bankers Association, Spencer Fane attorney Brian Devling took center stage with an insightful Legal Eagle Spotlight. Devling's expert contribution offers a compelling look into critical legal perspectives affecting the banking industry, providing valuable guidance for professionals navigating complex regulatory landscapes. As a distinguished legal professional at Spencer Fane, Devling brings a wealth of knowledge and strategic understanding to the forefront of banking law. His spotlight article demonstrates the firm's commitment to delivering cutting-edge legal analysis and practical insights that empower financial institutions to make informed decisions. The publication highlights Devling's expertise and underscores Spencer Fane's reputation as a leading law firm with deep understanding of the banking sector's unique challenges and opportunities. MORE...

CFPB Budget Slashed: Are Consumers About to Lose Their Financial Shield?

Finance

2025-04-29 12:53:08

A High-Stakes Showdown: Trump's Challenge to Consumer Financial Protection The Trump administration is waging a strategic battle to dramatically reshape the Consumer Financial Protection Bureau (CFPB), potentially transforming how financial regulations protect everyday Americans. At the heart of this confrontation is a fundamental question: How much can the administration scale back the agency's power without leaving consumers vulnerable to predatory financial practices? The ongoing legal and political struggle could have far-reaching implications for millions of Americans who rely on the CFPB's protective oversight. Consumer advocates warn that any significant reduction in the bureau's authority could open the door for banks, credit card companies, and other financial institutions to return to risky practices that dominated the pre-2008 financial landscape. Meanwhile, the administration argues that the CFPB's current structure represents an overreach of government regulation. The potential impacts for consumers are substantial. Reduced CFPB oversight could mean: • Less protection against unfair lending practices • Fewer safeguards for credit card and loan agreements • Increased risk of hidden fees and aggressive financial marketing • Diminished ability to file complaints against financial institutions As this high-stakes battle continues, consumers are watching closely, understanding that the outcome could significantly affect their financial security and rights. MORE...

Budget Showdown: Joint Finance Committee Holds Crucial Wausau Hearing

Finance

2025-04-29 12:43:41Budget Spotlight Turns to Wausau: Final Public Hearing Set for Joint Finance Committee The Wisconsin Joint Finance Committee is preparing for its concluding budget hearing today in Wausau, marking the final opportunity for citizens to voice their perspectives on the state's fiscal blueprint. Scheduled from 10 a.m. to 5 p.m. at Northcentral Technical College, this hearing represents the last of four public forums designed to gather community input on the proposed state budget. Residents, community leaders, and stakeholders are invited to share their insights, concerns, and recommendations directly with committee members. The all-day session provides a critical platform for Wisconsin citizens to participate in the state's budgetary decision-making process, ensuring local voices are heard before final budget negotiations. This culminating hearing offers a significant chance for public engagement, allowing community members to provide testimony that could potentially shape the state's financial priorities and spending strategies in the coming fiscal year. MORE...

Wall Street Holds Its Breath: Earnings Surge and Trade Hopes Spark Market Suspense

Finance

2025-04-29 12:01:00

Wall Street Braces for Earnings Avalanche and Economic Insights Investors are navigating a complex landscape of corporate earnings and economic indicators this week, with particular attention focused on potential relief from auto tariffs. The financial markets are buzzing with anticipation as companies unveil their latest financial performance, while traders and analysts carefully parse through economic data that could signal broader market trends. The current market atmosphere is charged with a mix of excitement and caution. Investors are keenly watching how various sectors are weathering economic challenges, with special interest in potential shifts in trade policy that could impact key industries like automotive manufacturing. The possibility of auto tariff relief has added an extra layer of intrigue to the week's financial narrative. As earnings reports continue to roll in, market participants are looking for signs of resilience and growth amid ongoing economic uncertainties. The interplay between corporate performance, economic indicators, and potential policy changes creates a dynamic and unpredictable investment environment that keeps Wall Street on its toes. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421