Fiscal Restraint Ahead: Turkey's Finance Chief Signals Tight Budget Control

Finance

2025-04-22 22:37:06

In a clear signal of fiscal prudence, Turkish Finance Minister Mehmet Simsek affirmed on Tuesday that the government remains committed to maintaining strict spending discipline, even in the face of potential economic growth challenges. Speaking with confidence, Simsek emphasized the country's resolve to keep fiscal controls tight, despite potential downside risks that could impact economic projections. The minister's statement underscores Turkey's strategic approach to economic management, demonstrating a steadfast commitment to financial stability during uncertain times. By prioritizing spending discipline, the government aims to navigate potential economic headwinds while preserving the nation's fiscal integrity. Simsek's remarks reflect a proactive stance, suggesting that Turkey is prepared to adapt its economic strategy to maintain fiscal responsibility, regardless of external economic pressures. This approach signals to investors and international markets that the country remains focused on sustainable economic growth and financial resilience. MORE...

Trade War Tensions Ease? Trump Signals Flexibility on China Tariffs

Finance

2025-04-22 22:01:35

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Trump Stands Firm: Fed Chair's Job Safe, Despite Past Tensions

Finance

2025-04-22 21:57:00

In a swift reversal of his earlier remarks, President Donald Trump reassured the financial markets on Tuesday by declaring he has no intention of removing Federal Reserve Chair Jerome Powell from his position. This statement comes just days after his previous comments suggesting potential termination sparked significant stock market volatility. Speaking directly to reporters, Trump emphatically stated, "I have no intention of firing him," effectively calming investor concerns. The president's latest comments represent a notable shift from his previous stance, during which he had openly expressed frustration with the Federal Reserve's decision to pause interest rate cuts. Trump's initial comments about potentially dismissing Powell had caused considerable unease on Wall Street, triggering a notable selloff that underscored the market's sensitivity to potential leadership changes at the central bank. By publicly reaffirming Powell's job security, the president appears to be attempting to restore confidence and stabilize financial markets. The about-face highlights the complex and sometimes unpredictable nature of presidential communication regarding monetary policy and financial leadership. MORE...

White House Signals Stability: Trump Stands Firm on Powell's Fed Leadership

Finance

2025-04-22 21:50:18

In a candid moment with reporters, President Trump sought to quell speculation about the future of Federal Reserve Chairman Jerome Powell, firmly stating that he has no plans to remove Powell from his position. Despite his vocal criticism of the Fed's current monetary policy, Trump emphasized that his desire for lower interest rates does not translate into a desire to replace the central bank's leadership. The president's remarks come amid ongoing tensions between the White House and the Federal Reserve, with Trump repeatedly expressing frustration over what he perceives as overly restrictive interest rate policies. While he continues to push for rate cuts to stimulate economic growth, Trump made it clear that his disagreements with Powell are professional, not personal. This latest statement provides some reassurance to financial markets, which have been sensitive to potential political interference in the Federal Reserve's operations. By publicly affirming Powell's job security, Trump appears to be balancing his economic critiques with a respect for the institutional independence of the central bank. MORE...

Tesla's Q1 Stumble: Musk Hints at Crypto Pivot as Stock Defies Expectations

Finance

2025-04-22 21:48:02

Tesla Delivers Mixed Financial Performance in First Quarter Earnings Report Electric vehicle giant Tesla unveiled its first quarter financial results on Tuesday, offering investors a nuanced snapshot of the company's current market position. The earnings report revealed both challenges and opportunities for the innovative automaker. Despite facing headwinds in a competitive electric vehicle market, Tesla demonstrated resilience with key financial metrics that provided insights into the company's strategic direction. The report highlighted the ongoing complexities of maintaining growth in an increasingly crowded automotive landscape. Key highlights from the earnings release included revenue figures, production volumes, and profitability indicators that will likely spark intense discussion among investors and industry analysts. Tesla's performance reflects the broader dynamics of the rapidly evolving electric vehicle sector, where innovation and market adaptation are crucial. The company continues to navigate global economic uncertainties while maintaining its commitment to technological advancement and sustainable transportation solutions. Investors and market watchers will be closely examining the details of this quarterly report to assess Tesla's strategic positioning and future potential. As the electric vehicle market continues to expand and transform, Tesla remains a pivotal player in shaping the future of automotive technology and sustainable transportation. MORE...

Wall Street Mood Darkens: Business Leaders Brace for Economic Storm Reminiscent of 2008

Finance

2025-04-22 21:14:46

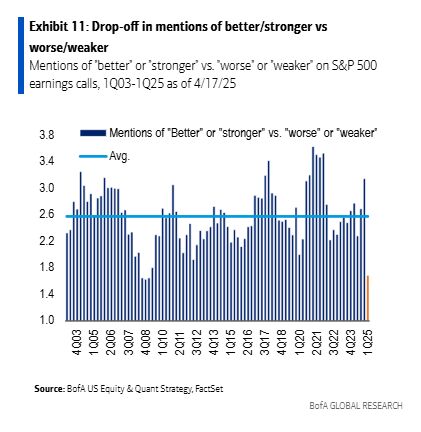

Corporate America's Economic Outlook Hits Lowest Point Since Financial Crisis In a stark warning for investors, company executives are painting an increasingly gloomy picture of the economic landscape, signaling potential turbulence ahead. The current sentiment among business leaders echoes the dark days of the 2008 financial crisis, with corporate earnings calls revealing unprecedented levels of pessimism. The mounting concerns stem largely from the ongoing trade tensions and economic uncertainty created by policy challenges. Executives are voicing deep apprehensions about the potential market impact, suggesting that the ripple effects of current economic policies could be far-reaching and significant. Investors are now closely watching these corporate signals, trying to gauge the potential depth and duration of the economic challenges. The widespread negativity across corporate boardrooms serves as a critical barometer, hinting at potential market volatility and economic headwinds in the near future. This unprecedented level of corporate pessimism isn't just a minor fluctuation—it represents a significant warning sign that could presage broader economic challenges. As companies adjust their strategies and expectations, the market may be on the brink of a substantial shift in economic dynamics. Analysts and investors are advised to pay close attention to these corporate sentiment indicators, as they often provide early insights into potential economic trends and market movements. MORE...

Capital One Rides Wave of Interest Income, Profits Surge in Q1

Finance

2025-04-22 21:12:58

In the midst of growing economic uncertainty, consumers are tightening their belts and scaling back discretionary spending. However, Capital One stands out as a resilient player in the financial landscape, largely thanks to its robust credit card business. The company's strategic focus on credit cards has proven to be a powerful shield against broader market challenges. What sets Capital One apart is the significantly higher interest rates on credit card debt compared to traditional loans like mortgages. This financial advantage means that credit cards now constitute nearly half of Capital One's entire loan portfolio, providing a stable and lucrative revenue stream. While many businesses are feeling the pinch of economic volatility, Capital One's diversified approach and credit card-centric model offer a compelling buffer against market fluctuations. The high-yield nature of credit card lending has positioned the company to weather economic headwinds more effectively than many of its competitors. MORE...

Market Pulse: Equifax Defies Odds with Stellar Earnings Amid S&P 500 Rollercoaster

Finance

2025-04-22 21:11:58

Wall Street Surges as Investors Digest Corporate Earnings and Trade Developments The S&P 500 delivered a robust performance on Tuesday, April 22, climbing an impressive 2.5% as market participants closely tracked the latest developments in trade negotiations and corporate earnings reports. Investors displayed growing optimism, with the index showing strong momentum amid a complex economic landscape. The significant market advance reflected a mix of positive corporate financial results and potential signs of progress in international trade discussions. Traders and analysts alike were keenly observing the intricate interplay of economic indicators and corporate performance that drove the day's market sentiment. As companies continued to report their quarterly results, the market responded with enthusiasm, signaling a potential shift in investor confidence and economic outlook. The S&P 500's substantial gain underscored the market's resilience and the ongoing potential for growth in the current financial environment. MORE...

Behind the Numbers: How Finance Managers Are Reshaping Corporate Strategy in 2024

Finance

2025-04-22 21:09:39

Exciting Career Opportunity: Finance Manager at Novato Sanitary District!

Position Highlights

- Salary Range: $160,104 – $194,604 Annually

- Work Schedule: Flexible 9/80 Schedule (Alternating Fridays off)

- Benefits: Comprehensive and Outstanding Package

About the Role

The Novato Sanitary District is seeking a dynamic and strategic Finance Manager to lead our financial operations. This is an exceptional opportunity for a highly skilled professional with a passion for municipal financial management.

Key Responsibilities

As our Finance Manager, you'll be responsible for:

- Directing and managing comprehensive financial activities

- Overseeing accounting, financial planning, and reporting

- Managing debt issuance and investment portfolio

- Administering budgeting and payroll processes

- Implementing and monitoring internal financial controls

Ideal Candidate Profile

We're looking for a collaborative municipal leader who demonstrates:

- Exceptional analytical and problem-solving skills

- Strong verbal and written communication abilities

- Proven experience managing complex financial systems

- Ability to work independently with meticulous attention to detail

Application Information

First Application Review: Thursday, May 8, 2025

For comprehensive job details and to apply, visit our official job listing.

Apply NowEarnings Insight: Willis Lease Finance Reveals Q1 2025 Financial Snapshot

Finance

2025-04-22 21:04:00

Willis Lease Finance Corporation Set to Unveil Q1 2025 Financial Performance

COCONUT CREEK, Fla. - Willis Lease Finance Corporation (NASDAQ: WLFC) is preparing to share its first-quarter financial results for 2025, with a comprehensive conference call scheduled for Tuesday, May 6, 2025.

The company's executive leadership team will host a detailed financial review at 10:00 a.m. Eastern Daylight Time, offering investors and analysts an in-depth look at the organization's quarterly performance.

Interested participants can join the conference call by dialing the dedicated toll-free number: (800) 289-0459 for US and Canadian callers.

This upcoming financial disclosure provides stakeholders with valuable insights into Willis Lease Finance Corporation's strategic progress and financial health for the first quarter of 2025.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421