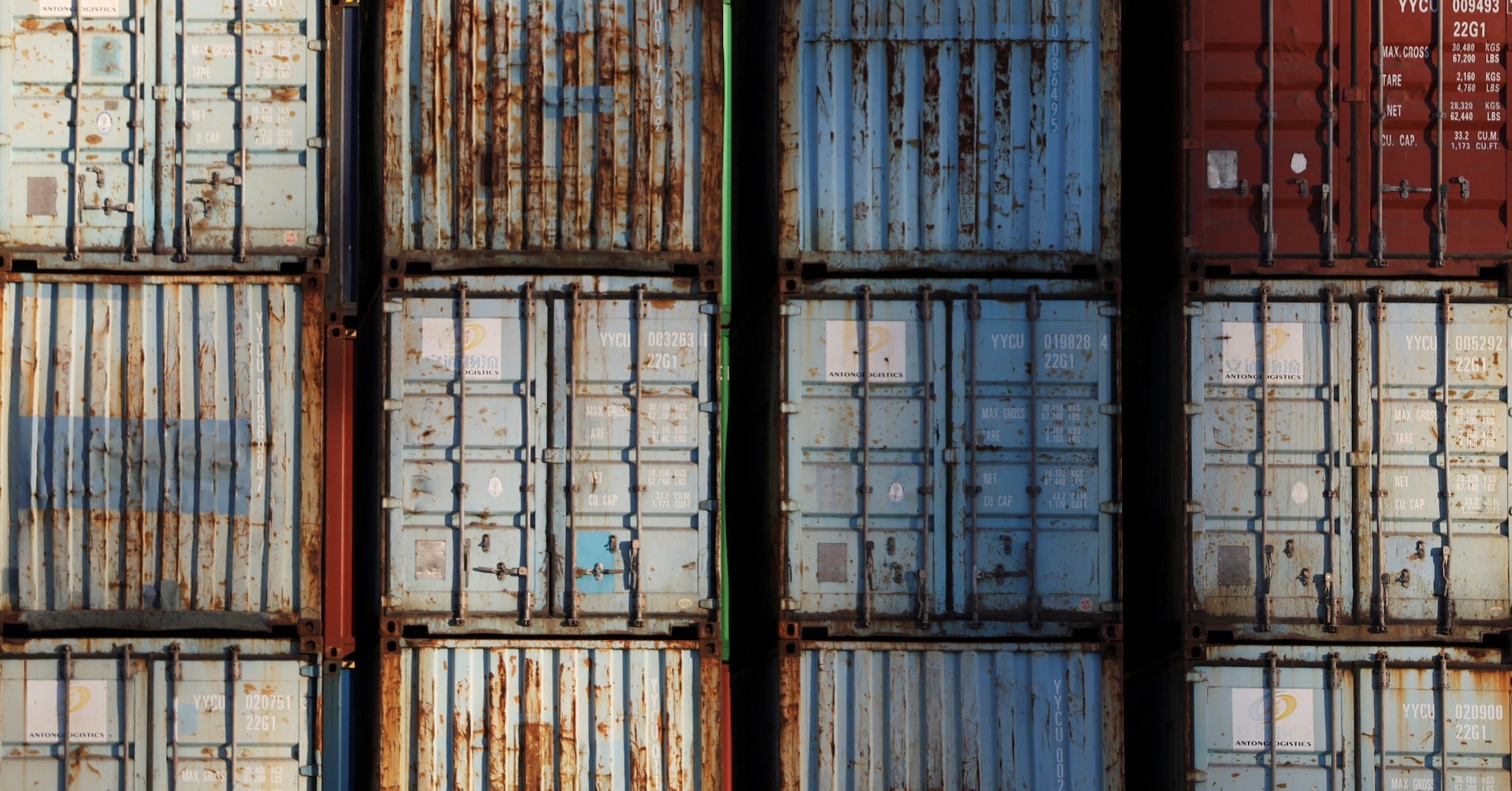

Trade War Escalates: China Slaps Massive 125% Tariff Hammer on US Goods

Finance

2025-04-11 08:11:55

In a significant escalation of trade tensions, China has dramatically increased tariffs on U.S. goods, announcing a steep 125% levy starting this Saturday. This marks a substantial jump from the previously proposed 84% tariff rate, as confirmed by the Chinese Ministry of Finance on Friday. The unexpected and aggressive tariff hike signals an intensifying economic standoff between the world's two largest economies. This move is likely to further strain the already delicate trade relations between the United States and China, potentially causing ripple effects across global markets. Businesses and trade analysts are closely watching the development, anticipating potential disruptions in international commerce and supply chains. The sharp increase in tariffs could lead to higher prices for consumers and create additional challenges for companies operating in both countries. As the trade war continues to evolve, market participants are bracing for potential retaliatory measures and the broader economic implications of this latest escalation. MORE...

Digital Revolution: How Brazil's Pix is Reshaping Financial Frontiers

Finance

2025-04-11 08:02:02

Beyond the rhythmic beats of samba, the passion of soccer, and the vibrant energy of carnival, Brazil is now capturing global attention for an entirely different reason. The country is experiencing a remarkable transformation, emerging as a powerhouse in an unexpected arena that's turning heads worldwide. Brazil's recent surge is not just another fleeting moment, but a significant shift that positions the nation at the forefront of a major global trend. This meteoric rise signals a new chapter in the country's narrative, showcasing its potential for innovation, adaptability, and strategic growth. As the world watches, Brazil is proving that its cultural richness is matched by its economic and technological ambition, redefining its international reputation and challenging traditional perceptions of emerging markets. MORE...

Defense Budgets Surge: European Finance Leaders Signal Major Military Investment Shift

Finance

2025-04-11 08:00:24

In a decisive move that signals a new era of strategic preparedness, European Union finance ministers have unanimously endorsed a significant increase in defense spending. This landmark decision comes after years of underinvestment and growing geopolitical tensions that have exposed the continent's military vulnerabilities. The ministers recognize that the current global landscape demands a robust and proactive approach to national security. By committing to substantial defense budget increases, European nations are sending a clear message about their commitment to collective defense and regional stability. This shift represents more than just a financial adjustment; it's a strategic realignment that acknowledges the complex security challenges facing Europe. From emerging technological threats to traditional military risks, the increased investment aims to modernize military capabilities and ensure the continent can effectively protect its interests. Experts argue that this long-overdue investment is crucial in an increasingly unpredictable world. By strengthening defense infrastructure and technological capabilities, European countries are positioning themselves to respond more effectively to potential security challenges and maintain geopolitical relevance. The decision reflects a growing consensus that defense spending is not merely an expense, but a critical investment in national and regional security. As global dynamics continue to evolve, Europe's proactive stance demonstrates a renewed commitment to strategic preparedness and collective defense. MORE...

Wall Street Trembles: JPMorgan's Earnings Reveal Tariff Shock Waves

Finance

2025-04-11 08:00:12

As JPMorgan Chase prepares to unveil its first-quarter financial results on Friday, investors are poised to look beyond the numbers, eagerly anticipating insights into how the ongoing trade tensions and President Trump's tariff strategies might reshape the bank's strategic landscape and impact its diverse customer base. The upcoming earnings report is more than just a financial snapshot; it's a potential crystal ball revealing how one of America's largest financial institutions navigates the complex economic currents created by escalating trade disputes. Analysts and shareholders alike will be listening intently for subtle hints about how these geopolitical dynamics could influence JPMorgan's future performance and strategic planning. With global markets experiencing unprecedented volatility, the bank's leadership is expected to provide nuanced commentary on how tariffs might affect corporate investment strategies, international trade flows, and overall economic sentiment. The insights shared could offer a critical perspective on the broader economic implications of current trade policies. MORE...

Global Markets on Edge: Germany's Finance Chief Signals Ongoing Economic Turbulence

Finance

2025-04-11 06:53:29

In a stark assessment of international trade dynamics, German Finance Minister Joerg Kukies has raised concerns about the potential ripple effects of President Donald Trump's latest trade policy maneuver. The temporary suspension of trade tariffs for numerous countries, spanning a 90-day period, threatens to inject further uncertainty into global markets and leave business leaders in a state of heightened anticipation. Kukies suggests that while the pause might appear to be a gesture of diplomatic flexibility, it could paradoxically create more economic tension. The uncertainty surrounding the potential reimposition of tariffs leaves companies and investors in a precarious position, unable to make confident long-term strategic decisions. The minister's comments underscore the complex and unpredictable nature of current international trade relations, where temporary measures can have far-reaching consequences for global economic stability. As businesses and markets continue to navigate this uncertain landscape, the impact of such policy decisions remains a critical point of concern for economic policymakers worldwide. MORE...

Breaking: Europe's Billion-Dollar Defense Gambit Unveiled

Finance

2025-04-11 05:03:04

Dive into the pulse of European politics and policy with Bloomberg's Brussels Edition—your essential daily guide to the pivotal developments shaping the European Union. Our carefully curated briefing cuts through the complexity, delivering insights that matter most from the epicenter of continental decision-making. Whether you're a policy wonk, business leader, or global observer, this is your front-row seat to the strategic conversations and critical movements unfolding in Brussels. Each day, we distill the most significant political, economic, and regulatory news, providing context and analysis that goes beyond the headlines. From breakthrough negotiations to emerging trends, our expert team brings you a comprehensive yet concise overview of what's driving the European agenda right now. Stay informed, stay ahead—welcome to the Brussels Edition. MORE...

Crude Crisis: Oil Giants Scramble to Stabilize Finances as Prices Nosedive

Finance

2025-04-11 05:02:49

Global oil-dependent governments are facing mounting financial challenges as crude prices plummet to their lowest levels since the COVID-19 pandemic. Facing significant revenue shortfalls, government officials are rapidly developing strategic policy responses, including exploring options like increased debt issuance and implementing aggressive spending cuts. The dramatic price collapse was triggered by a sharp 15% drop in Brent crude prices following escalating trade tensions between the United States and China. The ongoing economic standoff has intensified concerns about potential global recession and weakening energy demand, sending shockwaves through international oil markets. Historically, such oil price crashes have compelled resource-dependent nations to undertake painful and transformative economic reforms. Governments heavily reliant on petroleum export revenues are now being forced to reassess their economic strategies and diversify their financial foundations to ensure long-term stability. The current market volatility underscores the inherent risks of national economies overly dependent on fossil fuel exports, highlighting the urgent need for economic resilience and strategic financial planning in an increasingly unpredictable global economic landscape. MORE...

Green Tech Breakthrough: CARBIOS Reveals Financial Triumph in 2024 Annual Report

Finance

2025-04-11 04:45:00

CARBIOS Advances Strategic Roadmap with Financial Resilience and Key Milestones

In a promising update for 2025, CARBIOS has highlighted significant strategic developments, demonstrating robust financial management and continued progress in its innovative PET biorecycling technology.

Financial Snapshot

- Solid cash position of €109 million as of December 31, 2024

- Comprehensive cost-cutting plan reducing cash burn by 40%

Strategic Initiatives

The company is making substantial strides towards its goals, with key focus areas including:

- Resuming construction of the PET biorecycling plant in Longlaville

- Securing additional financing to support project completion

- Actively pursuing binding commercial contracts in the first half of 2025

Despite challenges, CARBIOS remains committed to maintaining its strategic capabilities while implementing a disciplined approach to resource management.

MORE...From Forest to Finance: How Alto Mayo Is Rewriting Climate Action

Finance

2025-04-11 00:00:00

Bridging the Gap: How Strategic Catalytic Funding Can Accelerate Climate Solutions In the urgent fight against climate change, innovative financing strategies can be the key to transforming ambitious goals into real-world progress. By strategically deploying catalytic funding in the early stages of climate projects and then gracefully stepping back to allow private capital to take the lead, we can unlock unprecedented potential for environmental transformation. This approach is not just about providing initial financial support; it's about creating a catalyst for sustainable innovation. By carefully nurturing promising climate initiatives through their most vulnerable developmental stages, we can help breakthrough technologies and solutions gain the momentum they need to attract mainstream investment. The power of this method lies in its ability to de-risk innovative projects, giving investors the confidence to step in and scale up promising climate solutions. It's a delicate dance of public and private sector collaboration that can turn bold climate ambitions into tangible, scalable results that have the potential to reshape our environmental future. MORE...

Japan's Finance Chief Signals Proactive Forex Dialogue with US Amid Market Tensions

Finance

2025-04-10 23:58:41

In a proactive stance towards economic stability, Japan's Finance Minister Katsunobu Kato announced on Friday that the country will maintain open communication with the United States regarding foreign exchange rates. The key focus of this dialogue is a mutual understanding that extreme currency fluctuations can potentially harm economic growth and financial markets. Kato emphasized the importance of collaborative dialogue to ensure currency markets remain stable and predictable, reflecting a commitment to preventing disruptive volatility that could negatively impact both nations' economic interests. This approach underscores Japan's diplomatic and economic strategy of maintaining transparent and cooperative international financial relations. The minister's statement signals Japan's willingness to work closely with the United States to monitor and potentially mitigate any significant currency movements that might create economic uncertainty. By prioritizing such communication, both countries aim to foster a more balanced and resilient global financial environment. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421