Green Energy Breakthrough: Cypress Creek Launches $150M Solar Venture with Ostrea Project

Finance

2025-05-06 11:04:02

Exciting progress is underway for the solar facility, which is poised to reach full commercial operation by the middle of 2026. The project is moving steadily forward, promising to deliver clean, renewable energy to the region and marking a significant milestone in sustainable power generation. Developers are confident in the timeline, with key infrastructure and technological components aligning to support the ambitious launch date. This solar installation represents a forward-thinking approach to meeting growing energy demands while reducing carbon footprint and supporting environmental sustainability. MORE...

Money Missteps: Financial Pro Reveals the Shocking Wealth Drain Most Millennials Never See Coming

Finance

2025-05-06 11:00:49

Financial Missteps: Why Young Professionals Are Losing Money on Low-Interest Savings Accounts In today's fast-paced financial landscape, young professionals are unknowingly sabotaging their financial growth by parking their hard-earned savings in low-interest bank accounts, according to Piere CEO Yuval Shuminer. This common mistake could be costing them thousands of dollars in potential earnings over time. Shuminer warns that traditional savings accounts offering minimal interest rates are essentially causing young professionals to lose money in real terms. With inflation continuously eroding purchasing power, these low-yield accounts are doing more harm than good to personal financial portfolios. Smart financial strategies demand that young professionals explore alternative investment options that can generate higher returns. From diversified investment portfolios to high-yield savings instruments, there are numerous ways to make money work harder and smarter. The key takeaway is simple: don't let your savings stagnate. Take proactive steps to maximize your financial potential by seeking out investment opportunities that offer more competitive returns and can help build long-term wealth. MORE...

Digital Upgrade Showdown: Charlottesville's Top Cop Pushes for High-Tech Crime Data Solution

Finance

2025-05-06 10:25:05

In a passionate appeal to the Charlottesville City Council, Police Chief Kochis unveiled an innovative data-driven initiative aimed at transforming community safety and policing strategies. The proposed one-year program seeks a strategic investment of $150,000 to comprehensively integrate and analyze departmental program data, promising a more nuanced and effective approach to law enforcement. Chief Kochis emphasized that the program would provide unprecedented insights into current policing methods, allowing for more targeted and responsive community interventions. By consolidating and examining data from various departmental programs, the initiative aims to identify trends, optimize resource allocation, and ultimately enhance public safety. The $150,000 funding request represents a forward-thinking investment in data-driven policing, reflecting the department's commitment to transparency, efficiency, and continuous improvement. If approved, the program could serve as a model for other municipalities seeking to modernize their law enforcement approaches through intelligent data integration and analysis. MORE...

HVAC Market Gets Boost: U.S. Bank's Avvance Merges with Pure Finance in Strategic Lending Leap

Finance

2025-05-06 10:23:06

Pure Finance Group is taking a strategic leap forward by adopting U.S. Bank's cutting-edge Avvance lending platform, signaling its ambitious expansion into the dynamic HVAC (Heating, Ventilation, and Air Conditioning) market. This innovative integration promises to streamline lending processes and enhance customer experience for contractors and consumers in the home improvement sector. The Avvance solution offers real-time credit decisioning capabilities, enabling Pure Finance Group to provide faster, more efficient financing options for HVAC equipment and installation services. By leveraging this advanced technology, the company aims to simplify the borrowing process and support both contractors and homeowners in making critical infrastructure investments. This strategic move underscores Pure Finance Group's commitment to digital transformation and its proactive approach to meeting evolving market demands. The integration of Avvance represents a significant milestone in the company's growth strategy, positioning them as a forward-thinking financial partner in the rapidly changing home services landscape. MORE...

Tragic Incident: Former German Finance Minister Involved in Fatal Dog Collision

Finance

2025-05-06 10:17:54

In a heartfelt expression of sympathy, German Finance Minister Christian Lindner addressed the tragic loss of a beloved canine companion. Breaking his silence on the matter, Lindner offered a sincere and compassionate apology, acknowledging the deep emotional pain that comes with losing a cherished pet. The minister's words reflect a genuine understanding of the profound bond between humans and their animal companions. By directly expressing his condolences, Lindner demonstrated sensitivity and empathy towards the grief experienced by those who have lost a furry family member. While the specific details surrounding the dog's passing remain unclear, Lindner's statement serves as a poignant reminder of the universal experience of pet loss and the emotional impact it can have on individuals and families. His simple yet profound statement, "I'm very sorry the dog died," resonates with anyone who has ever loved and lost a loyal four-legged friend, highlighting the emotional depth and compassion that can transcend political boundaries. MORE...

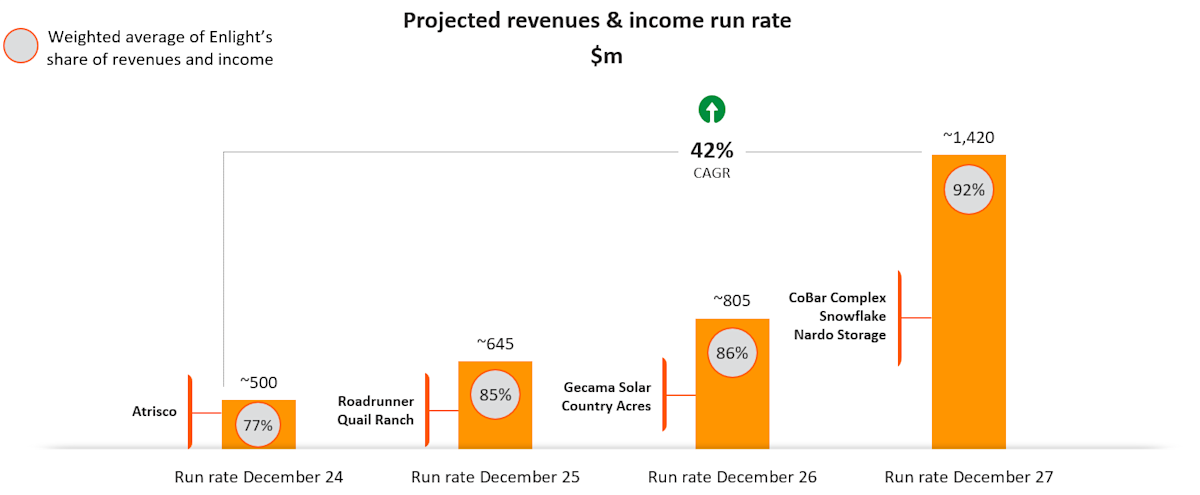

Green Energy Surge: Enlight Renewable Powers Through Q1 2025 with Impressive Financial Milestone

Finance

2025-05-06 10:05:00

Enlight Renewable Energy Announces First Quarter 2025 Financial Results

All financial figures are reported in U.S. dollars unless otherwise specified.

TEL AVIV, Israel - Enlight Renewable Energy Ltd. (NASDAQ: ENLT, TASE: ENLT) today unveiled its financial performance for the first quarter of 2025, which concluded on March 31, 2025.

Investors and stakeholders can access the company's earnings conference call and webcast registration links, available in both English and Hebrew, at the end of this earnings release.

The complete set of Enlight Renewable Energy's first quarter 2025 financial results is now available for review.

For more information, please refer to the detailed financial report and accompanying materials.

MORE...Global Titans Converge: Point Zero Forum 2025 Sparks Revolutionary Financial Dialogue

Finance

2025-05-06 09:32:00

Mark Your Calendars: Point Zero Forum 2025 Set to Illuminate Zurich's Convention Scene Get ready for an extraordinary gathering of innovators and thought leaders! The highly anticipated fourth edition of the Point Zero Forum (PZF) is preparing to take center stage in the heart of Zurich. From May 5th to 7th, 2025, the prestigious Circle Convention Centre will host this groundbreaking event, promising to deliver cutting-edge insights and transformative discussions across multiple industries. Attendees can look forward to three days of dynamic presentations, networking opportunities, and forward-thinking dialogues that are set to shape the future of global innovation. The Point Zero Forum continues to establish itself as a must-attend conference for professionals seeking to stay at the forefront of emerging trends and technological advancements. MORE...

Global Cash Crossroads: How Geopolitics is Reshaping the Future of Development Finance

Finance

2025-05-06 09:00:01

The recent IMF-World Bank Spring Meetings have cast a revealing light on the growing fractures within the global financial system, underscoring the urgent need for transformative reforms. As international economic leaders converged, the discussions highlighted the critical importance of reimagining our financial infrastructure to meet the complex challenges of sustainable development. The global economic landscape is evolving rapidly, and traditional approaches are no longer sufficient to address the intricate web of financial, social, and environmental challenges facing our world. Innovative solutions and bold strategic thinking have become imperative, offering a pathway to more resilient and inclusive economic frameworks. By embracing creative reform strategies, the international community can work towards bridging existing gaps, promoting economic equity, and supporting sustainable development goals. The Spring Meetings served as a powerful reminder that collaborative, forward-thinking approaches are essential in navigating the increasingly complex global economic terrain. As we move forward, the key lies in fostering adaptability, encouraging cross-border cooperation, and developing financial mechanisms that can respond effectively to the dynamic challenges of our interconnected world. MORE...

Jio Finance Gears Up for Landmark Rupee Bond Launch, Eyeing $118M Market Debut

Finance

2025-05-06 08:37:03

In a bold financial move, Jio Finance Ltd., the innovative shadow banking arm of billionaire Mukesh Ambani's business empire, is set to make its debut in the bond market. The company is preparing to raise an impressive 10 billion rupees (approximately $118 million) through its first-ever bond issuance in the domestic market. Sources close to the matter reveal that this strategic fundraising initiative underscores Jio Finance's ambitious expansion plans and growing confidence in India's financial landscape. As a subsidiary of Reliance Industries, led by Asia's wealthiest businessman, the company is poised to leverage its strong backing and market potential. The planned bond sale represents a significant milestone for Jio Finance, signaling its intent to establish a robust presence in the competitive financial services sector. Investors and market watchers are keenly observing this development, which could potentially reshape the dynamics of India's shadow banking industry. With Mukesh Ambani's proven track record of disruptive business strategies, this bond issuance is expected to attract considerable attention from both domestic and international investors seeking promising investment opportunities in India's rapidly evolving financial market. MORE...

Global Markets on Edge: Central Banks Set to Shake Up Financial Landscape

Finance

2025-05-06 08:01:54

The entertainment and trade worlds are closely watching Donald Trump's latest provocative statements about foreign-made films, as his unpredictable tariff policy continues to spark global attention. Trump's recent comments have once again highlighted his tendency to blend trade policy with cultural commentary, potentially signaling new challenges for international film producers and distributors. Industry experts are carefully analyzing the potential implications of Trump's remarks, which could have far-reaching consequences for Hollywood's global relationships and the international film market. The uncertainty surrounding his trade stance has become a hallmark of his approach to economic diplomacy, keeping stakeholders on constant alert for potential policy shifts. As with many of Trump's statements, the film industry is bracing for potential policy changes that could impact international film production, distribution, and import regulations. The ongoing speculation underscores the complex intersection of trade, entertainment, and political rhetoric in today's global landscape. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421