Semiconductor Showdown: Trump and TSMC's Massive $100B Bet on American Tech Supremacy

Finance

2025-03-03 20:03:04

In a landmark economic collaboration, President Donald Trump and Taiwan Semiconductor Manufacturing Company (TSMC) unveiled an ambitious plan that promises to revolutionize American semiconductor production. The tech giant has committed to investing a staggering $100 billion in US manufacturing capabilities in the near future, significantly expanding its existing investment in the United States. This substantial financial commitment will bring TSMC's total investment in American manufacturing to an impressive $165 billion, signaling a major boost to domestic technology infrastructure. The announcement underscores a strategic partnership between the US government and one of the world's leading semiconductor manufacturers, potentially reshaping the landscape of high-tech production on American soil. The massive investment highlights the growing importance of semiconductor manufacturing in the global technology ecosystem and represents a significant vote of confidence in the United States' economic potential. By expanding its manufacturing presence, TSMC is not only creating new job opportunities but also strengthening the country's technological capabilities and supply chain resilience. MORE...

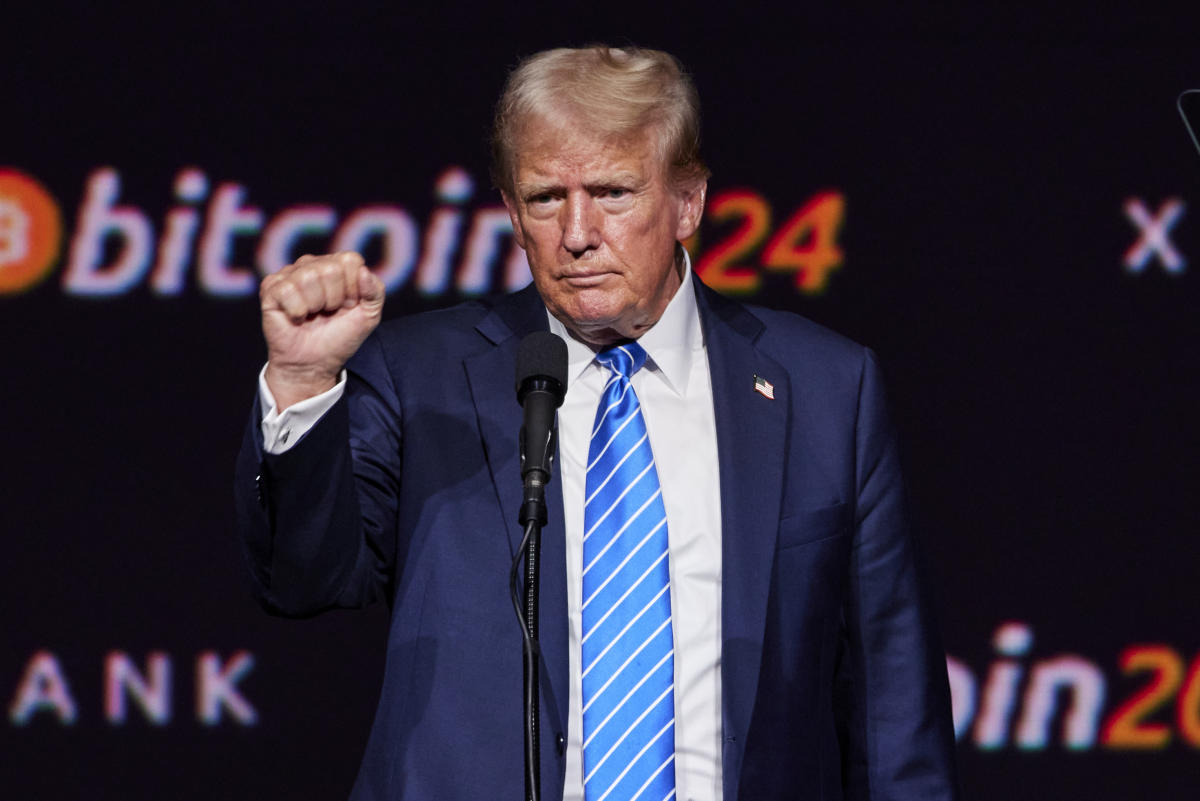

Crypto Markets Cool Off as Trump's Reserve Plan Fails to Spark Investor Excitement

Finance

2025-03-03 20:01:48

The cryptocurrency market experienced a sudden cooldown on Monday, with initial excitement quickly dissipating despite fresh promises from former President Donald Trump regarding a potential U.S. strategic cryptocurrency reserve. The day's trading saw digital assets losing momentum, reflecting the volatile nature of the crypto landscape. Trump's latest statements about establishing a national crypto reserve initially sparked investor interest, but the market's enthusiasm was short-lived. Traders and investors watched closely as the initial surge of optimism gradually waned, underscoring the complex dynamics that continue to shape the digital currency ecosystem. The fluctuating market conditions serve as a reminder of the ongoing uncertainty and rapid shifts characteristic of cryptocurrency investments. While strategic announcements can momentarily influence market sentiment, the underlying fundamentals and broader economic factors ultimately drive long-term performance. MORE...

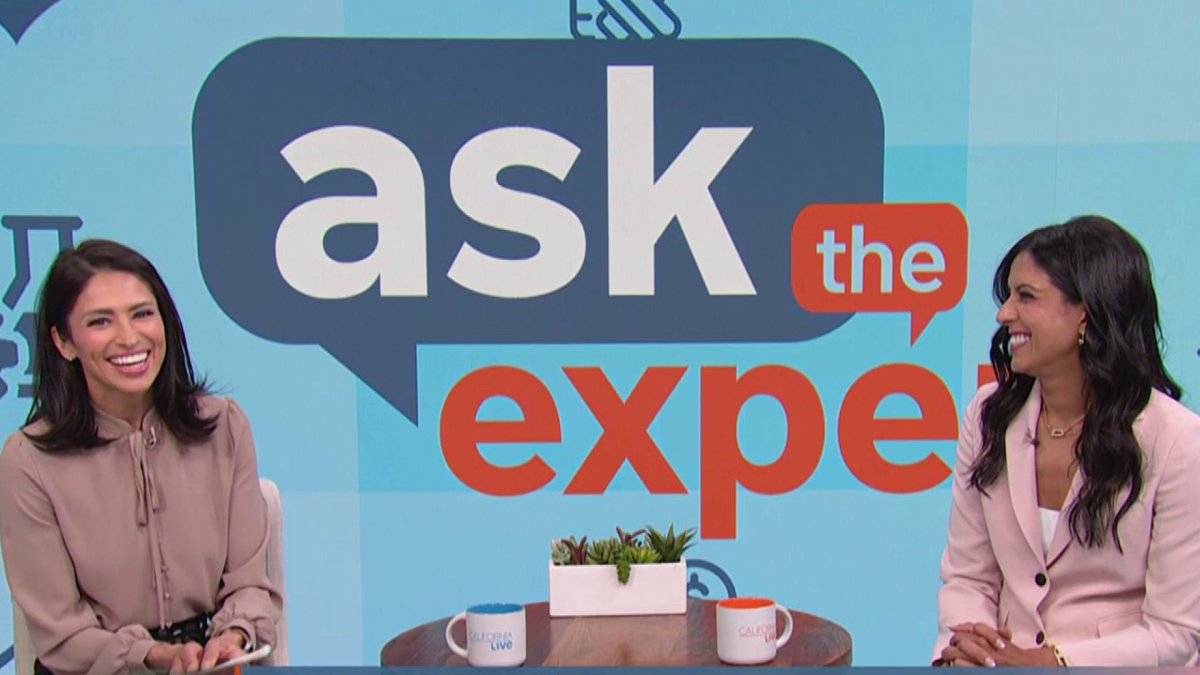

Money Matters Unveiled: Finance Gurus Tackle Your Burning Questions!

Finance

2025-03-03 19:56:04

Mastering Your Money: Expert Insights from Neha Kumar

In an exclusive sit-down with California Live's Jessica Vilchis, finance maven and Full Glass Wine Co. co-founder Neha Kumar opens up about the secrets to financial empowerment. With her wealth of industry knowledge, Kumar breaks down complex money matters into actionable advice that can help viewers transform their financial landscape.

From demystifying investment strategies to providing practical tips on savings and debt management, Kumar brings a refreshing and approachable perspective to personal finance. Her mission? To help individuals gain the confidence and control needed to take charge of their financial future.

Whether you're just starting your financial journey or looking to refine your money management skills, Kumar's expert insights offer a roadmap to achieving financial freedom. Join us as we dive deep into the world of smart money moves and learn how to make your cash work harder for you.

MORE...Trade War Escalates: Trump Announces Sweeping Agricultural Import Tariffs Set to Launch in April

Finance

2025-03-03 19:02:49

In a bold move signaling escalating trade tensions, President Donald Trump announced plans to implement tariffs on agricultural imports starting April 2nd. The declaration represents another strategic maneuver in the administration's ongoing approach to international trade policy. The president's latest proclamation suggests a continued commitment to protecting domestic agricultural markets by imposing trade barriers on external products. This decision follows a pattern of protectionist measures that have characterized the administration's economic strategy. While specific details about the scope and extent of these tariffs remain unclear, the announcement underscores the administration's willingness to use trade policy as a tool for economic negotiation and national economic protection. Market analysts and agricultural industry leaders are closely monitoring the potential implications of these proposed tariffs, anticipating potential ripple effects on international trade relationships and domestic agricultural markets. The move is likely to spark further debate about the effectiveness of tariff-based trade strategies and their long-term economic consequences for both domestic producers and international trading partners. MORE...

AI Powerhouse Anthropic Soars: $61.5 Billion Valuation Signals Tech Revolution

Finance

2025-03-03 18:39:11

In a groundbreaking financial milestone, Anthropic has secured an impressive $3.5 billion in its latest funding round, catapulting the AI powerhouse to a staggering $61.5 billion valuation. The startup, backed by tech giants Amazon and Google, continues to make waves in the artificial intelligence landscape with this substantial investment. This significant funding round underscores the growing confidence in Anthropic's innovative AI technologies and its potential to reshape the future of artificial intelligence. With support from major industry players like Amazon and Google, the company is well-positioned to accelerate its research, development, and strategic initiatives in the rapidly evolving AI sector. The substantial valuation reflects the immense potential and cutting-edge capabilities that Anthropic brings to the artificial intelligence market, signaling a bright and transformative future for the company and the broader AI ecosystem. MORE...

Wall Street's Dip: Smart Money Sees Green in Market Pullback

Finance

2025-03-03 18:30:00

Market Volatility Sparks Strategic Investment Shifts

In the ever-changing landscape of financial markets, investors are recalibrating their portfolios in response to recent market fluctuations. Wells Fargo Investment Institute's global investment strategist Veronica Willis offers compelling insights into the current investment environment.

"The recent pullback in equities presents a golden opportunity for investors to strategically add to their positions," Willis explains.

Sector Opportunities and Strategic Positioning

Willis highlights several promising sectors that are catching investors' attention:

- Financials: Demonstrating strong performance

- Industrials: Showing significant potential

- Energy: Maintaining robust momentum

- Communication Services: Presenting attractive investment prospects

Inflation and Federal Reserve Outlook

Addressing the critical factors of inflation and potential interest rate changes, Willis provides a nuanced perspective: "If inflation remains elevated, we anticipate the Federal Reserve might be more cautious about rate cuts. Our current projection suggests a single rate cut this year, though the likelihood of an extended pause is increasing."

For investors navigating these complex market dynamics, staying informed and adaptable remains key to successful investment strategies.

MORE...Retail Titans Brace for Impact: Target and Best Buy's Q4 Earnings Amid Tax Shake-Up

Finance

2025-03-03 17:55:13

Market Insights: Navigating Investments and Tax Season Strategies

In the latest episode of Yahoo Finance's Wealth, market experts dive deep into current financial trends and opportunities. Wells Fargo Investment Institute's global investment strategist Veronica Willis provides valuable insights into the ongoing market pullback, suggesting that this could be a strategic moment for investors to reassess and rebalance their portfolios.

Market Pullback: A Potential Investment Opportunity

Willis highlights that the current market fluctuations in major indices like the Dow Jones Industrial Average (^DJI), NASDAQ (^IXIC), and S&P 500 (^GSPC) might present a unique chance for savvy investors to optimize their investment strategies.

Tax Season Spotlight

H&R Block's Vice President of The Tax Institute, Andy Phillips, joins the discussion to shed light on critical tax filing changes that Americans need to be aware of this tax season. His expert advice aims to help taxpayers navigate the complexities of this year's filing requirements.

Top Trending Stocks

The Yahoo Finance platform is currently tracking several notable stocks, including:

- Target (TGT)

- Best Buy (BBY)

- Intel (INTC)

- Chipotle Mexican Grill (CMG)

For more in-depth market analysis and expert insights, be sure to check out more episodes of Yahoo Finance's Wealth.

MORE...Wall Street's Crystal Ball: Goldman Sachs Predicts Potential Tremors in S&P 500's Bullish Run

Finance

2025-03-03 17:38:36

The recent S&P 500 rally is facing potential headwinds as Goldman Sachs warns of a looming economic slowdown. Investors are now carefully reassessing their market strategies amid growing uncertainty about future economic growth. Goldman Sachs analysts have raised red flags about the sustainability of the current market momentum. Their latest research suggests that the robust stock market performance may be built on increasingly fragile economic foundations. The investment bank predicts a significant deceleration in economic expansion, which could challenge the optimistic sentiment driving recent market gains. The warning comes at a critical time when markets have been riding a wave of enthusiasm, buoyed by hopes of potential Federal Reserve interest rate cuts and signs of cooling inflation. However, the Goldman Sachs forecast introduces a note of caution that could prompt investors to recalibrate their expectations. Key concerns include slowing corporate earnings growth, potential challenges in consumer spending, and the lingering effects of previous monetary tightening. The S&P 500, which has shown remarkable resilience in recent months, may now face a critical test of its underlying strength. Investors are advised to remain vigilant and diversify their portfolios, as the market landscape appears increasingly complex. While the current rally has been impressive, the Goldman Sachs outlook suggests that maintaining this momentum could prove challenging in the coming months. MORE...

FOCUS-27 Strategy Gains Momentum: How Our 2024 Performance Defied Expectations

Finance

2025-03-03 17:35:00

Sanofi Navigates Challenging Market with Operational Resilience in 2024

Paris, March 3rd, 2025 - Despite a turbulent economic landscape, Sanofi demonstrates remarkable adaptability in its full-year 2024 financial results, showcasing strategic strength and financial prudence.

Key Financial Highlights

- Net sales declined 10.0% to €911.9 million, reflecting market challenges

- Core EBITDA reached €50.4 million, with a margin of 5.5%

- Production suspension at Brindisi partially impacted overall performance

Strategic Insights

The company's performance was influenced by lower volumes and production disruptions, yet maintained encouraging commercial momentum. The 370 basis point margin reduction primarily stems from unfavorable fixed cost impacts.

Financial Overview

EBITDA stood at €(43.6) million, with significant investments of €87.1 million aimed at long-term strategic positioning and operational enhancement.

Sanofi remains committed to navigating market complexities with resilience and forward-thinking strategies.

MORE...Semiconductor Showdown: Trump Meets TSMC CEO, Signals Major Investment in Tech Frontier

Finance

2025-03-03 17:16:46

In a significant boost to U.S. semiconductor manufacturing, President Donald Trump is set to unveil a groundbreaking investment by Taiwan Semiconductor Manufacturing Co. (TSMC), the world's leading chip manufacturer. Sources reveal that the company plans to inject a staggering $100 billion into American semiconductor production facilities. TSMC, a critical supplier for tech giants like Apple, Intel, and Nvidia, is expanding its commitment to U.S. manufacturing. This massive investment builds upon the company's previous pledge of over $65 billion, which included the construction of three advanced manufacturing plants in Arizona. The expansion was initially catalyzed by substantial government subsidies offered through the Biden administration's strategic economic initiatives. The announcement represents a major milestone in reshoring critical technology manufacturing and strengthening the United States' technological infrastructure. By dramatically increasing domestic chip production, TSMC is not only creating thousands of high-tech jobs but also reducing the nation's dependence on international semiconductor supply chains. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421