Wall Street Trembles: Trump's Return Sparks Financial Tech Revolution

Finance

2025-04-29 08:00:48

The emerging Trump 2.0 landscape is sparking fascinating transformations in the financial ecosystem, blurring traditional boundaries between cryptocurrency firms and traditional banking institutions. As the digital finance frontier continues to evolve, we're witnessing an unprecedented convergence where crypto companies are exploring banking licenses, while established banks are simultaneously venturing into digital asset creation. This dynamic shift represents more than just a trend—it's a strategic realignment that signals a profound reimagining of financial services. Cryptocurrency firms, once viewed as disruptive outsiders, are now seeking legitimacy through formal banking channels. Simultaneously, traditional banks are recognizing the potential of digital assets, eager to remain competitive in an increasingly digital-first financial world. The result is a fascinating hybrid landscape where innovation meets regulation, and where the lines between digital currencies and traditional banking are becoming increasingly blurred. As these sectors continue to intersect, we can expect more creative approaches to financial services that leverage the strengths of both crypto and conventional banking models. MORE...

Global Banking Titans Weigh Massive $1.7B Investment in Argentina's Energy Frontier

Finance

2025-04-29 07:43:14

In a strategic financial move, Argentina's national oil company YPF SA is leading a powerful consortium of energy firms in advanced negotiations to secure a substantial $1.7 billion loan. The financing is earmarked for the pivotal Vaca Muerta oil and gas project, which is widely considered a game-changing development for Argentina's energy sector. The consortium, comprised of YPF and its international partners, is currently in talks with five prominent global banking institutions to finalize the loan terms. This significant financial arrangement is expected to accelerate development of the Vaca Muerta formation, one of the world's largest unconventional hydrocarbon reserves. By securing this substantial funding, the consortium aims to unlock the immense potential of the Vaca Muerta region, which promises to transform Argentina's energy landscape and potentially boost the country's economic prospects. The project represents a critical investment in infrastructure and resource extraction that could position Argentina as a major player in the global energy market. MORE...

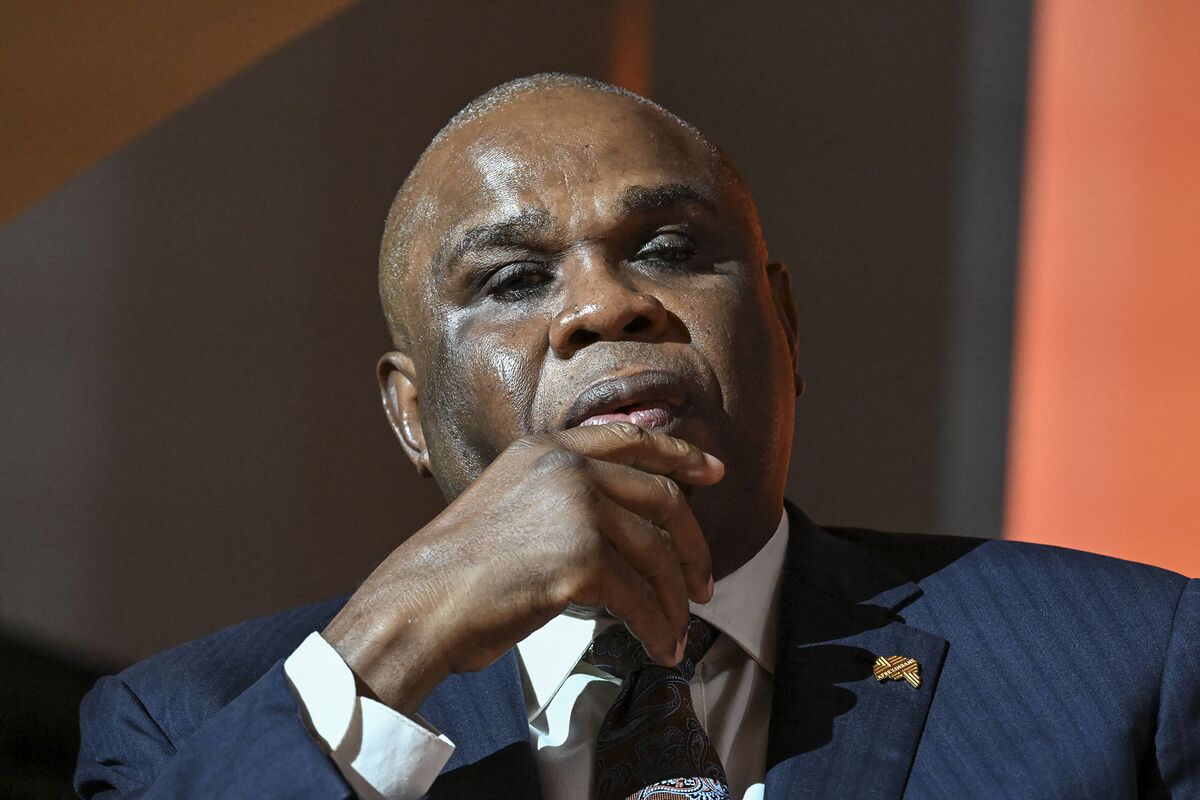

Oil Trade Boom: Afreximbank Unleashes $14 Billion Lifeline for African Energy Sector

Finance

2025-04-29 07:32:06

The African Export-Import Bank (Afreximbank) has unveiled an ambitious petroleum product financing initiative designed to revolutionize fuel trade across the African continent. This groundbreaking program aims to support and facilitate the trade of up to $14 billion in locally produced petroleum products, marking a significant milestone in Africa's energy sector development. By providing strategic financial support, Afreximbank is positioning itself as a key enabler of intra-African trade and energy infrastructure. The innovative financing program will help bridge critical funding gaps, promote regional energy independence, and stimulate economic growth across multiple African nations. This bold move underscores the bank's commitment to strengthening Africa's economic resilience and creating sustainable pathways for petroleum product distribution. The initiative is expected to not only boost trade volumes but also enhance the continent's capacity to meet its own energy needs more effectively. MORE...

HSBC Weathers Profit Storm: Q1 Earnings Slip 25% But Outperform Wall Street Expectations

Finance

2025-04-29 04:10:12

HSBC Weathers Profit Decline, Surpasses Market Expectations Global banking giant HSBC revealed its first-quarter financial performance on Tuesday, reporting a 25% drop in profits. Despite the decline, the bank managed to outperform market predictions, thanks to strategic business restructuring that involved divesting its banking operations in Canada and Argentina. The one-time charges associated with these strategic disposals impacted the bank's overall earnings, yet HSBC demonstrated resilience in a challenging economic landscape. Investors and analysts were pleasantly surprised by the bank's ability to navigate these complex transitions while maintaining a relatively stable financial position. This latest financial report underscores HSBC's ongoing commitment to streamlining its global operations and optimizing its strategic footprint across international markets. The bank's proactive approach to portfolio management continues to be a key factor in its long-term growth strategy. MORE...

Breaking: Finance House P.J.S.C Leads Potential Surge in Middle Eastern Penny Stock Landscape

Finance

2025-04-29 04:04:47

Emerging Opportunities: Middle Eastern Penny Stocks Poised for Growth As Gulf financial markets continue to show promising gains, savvy investors are turning their attention to the region's dynamic economic landscape. While large-cap stocks often dominate investment conversations, astute market participants recognize the hidden potential lurking within penny stocks. The Middle Eastern financial ecosystem presents a unique opportunity for investors willing to look beyond conventional investment strategies. These smaller, often underappreciated companies can deliver remarkable returns when supported by robust financial foundations and strategic market positioning. Our analysis focuses on three compelling penny stocks from the Middle East that demonstrate exceptional financial resilience and growth potential. These emerging market gems offer investors an intriguing pathway to diversify their portfolios and tap into the region's economic dynamism. By carefully examining financial indicators, market trends, and company fundamentals, investors can uncover valuable opportunities that might otherwise remain overlooked. The key lies in conducting thorough research and maintaining a strategic, long-term perspective when exploring these promising penny stock investments. As regional markets continue to evolve and mature, these smaller companies represent not just investment opportunities, but potential windows into the innovative and transformative economic landscape of the Middle East. MORE...

Breaking: Woolworths Employee's Financial Hustle Exposes Harsh Savings Reality for Australians

Finance

2025-04-29 04:03:19

Struggling to Make Ends Meet: A Tale of Determination In a candid revelation, a local worker shared the challenging reality of his daily grind, juggling three demanding jobs—including a position at Woolworths—just to keep up with mounting living expenses. His story is a powerful testament to the resilience and hard work of individuals navigating today's economic landscape. Balancing multiple roles has become more than just a choice; for many, it's a necessity. This individual's commitment to financial stability speaks volumes about the dedication and perseverance required to support oneself in challenging times. From stocking shelves at Woolworths to managing additional employment, he exemplifies the spirit of those working tirelessly to build a sustainable future. His experience sheds light on the broader economic challenges facing workers today, highlighting the importance of adaptability and multiple income streams in an increasingly complex job market. MORE...

Bajaj Finance's Record Profits Mask Potential Market Headwinds

Finance

2025-04-29 03:21:04

Bajaj Finance is poised to continue its impressive financial performance, potentially marking its 13th consecutive quarter of record-breaking profits. However, market analysts are tempering expectations, suggesting that the company's stock may have already reached its peak for the year. Despite the remarkable streak of financial success, investors and market watchers are cautiously evaluating the company's future trajectory. The sharp gains already witnessed in Bajaj Finance's stock price this year have led experts to adopt a more measured outlook, pointing to uncertain market conditions and potential challenges ahead. While the company has demonstrated remarkable resilience and growth, the current market landscape presents a complex environment for further significant stock appreciation. Analysts are closely monitoring the financial institution's ability to maintain its stellar performance amid evolving economic dynamics. Investors are advised to carefully assess the current market positioning and potential future growth prospects of Bajaj Finance, recognizing both its impressive track record and the potential limitations in its near-term stock performance. MORE...

Fiscal Forecast: City Budget Braces for Stagnant Revenue Ahead

Finance

2025-04-29 02:13:00

Denver's financial landscape is set for a steady course in 2026, with city finance officials presenting a pragmatic revenue outlook to the City Council's Budget and Finance Committee. The preliminary planning session focused on establishing clear financial guidance and maintaining fiscal stability. City leaders are taking a measured approach to budgeting, anticipating flat revenue streams that reflect a cautious yet strategic financial management strategy. This approach signals a commitment to fiscal responsibility and careful economic planning in the face of potential economic uncertainties. During the committee meeting, finance experts outlined their initial framework, emphasizing the importance of maintaining financial equilibrium while preparing for potential economic challenges. The goal is to create a robust financial plan that provides stability and flexibility for the city's future economic needs. While the flat revenue projection might seem conservative, it demonstrates Denver's proactive approach to municipal financial planning. City officials are prioritizing sustainable budgeting that protects essential services and maintains the city's financial health. As discussions continue, stakeholders will closely examine the proposed financial strategy, ensuring it meets the diverse needs of Denver's residents and supports the city's long-term economic goals. MORE...

Money Matters: Monterey's Financial Roadmap Takes Shape as Committee Unveils Fiscal Blueprint

Finance

2025-04-28 23:00:00

In a recent budget planning session, the Monterey Finance Committee has proposed a revised municipal budget for the upcoming fiscal year. The recommendation includes a notable adjustment to garbage collection fees, signaling potential changes in the town's waste management services. While the committee's draft budget suggests an increase in waste disposal charges, other municipal service rates remain unchanged. Local residents and business owners can expect to see the proposed fee modifications in the upcoming budget discussions. The proposed fee adjustment aims to address rising operational costs and maintain the quality of municipal waste collection services. Town officials are expected to hold public hearings in the coming weeks to gather community input on the proposed budget changes. Residents are encouraged to attend upcoming town meetings to learn more about the proposed fee increases and provide their feedback on the municipal budget planning process. MORE...

Risky Business: Ohio's Taxpayer-Funded Browns Stadium Plan Raises Red Flags

Finance

2025-04-28 22:34:04

Ohio's budget officials have raised significant concerns about the potential financial strain this ambitious project could impose on the state's taxpayers. The proposed initiative threatens to create a substantial economic burden that could impact the financial well-being of Ohio residents. Budget experts are carefully evaluating the long-term fiscal implications, warning that the project's costs could place an unprecedented financial challenge on the state's already stretched resources. The mounting apprehension centers on the potential economic impact, with budget analysts meticulously examining how the project might translate into increased tax obligations for everyday Ohioans. Their primary concern is protecting taxpayers from what they perceive as an potentially unsustainable financial commitment that could strain state and local budgets for years to come. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421