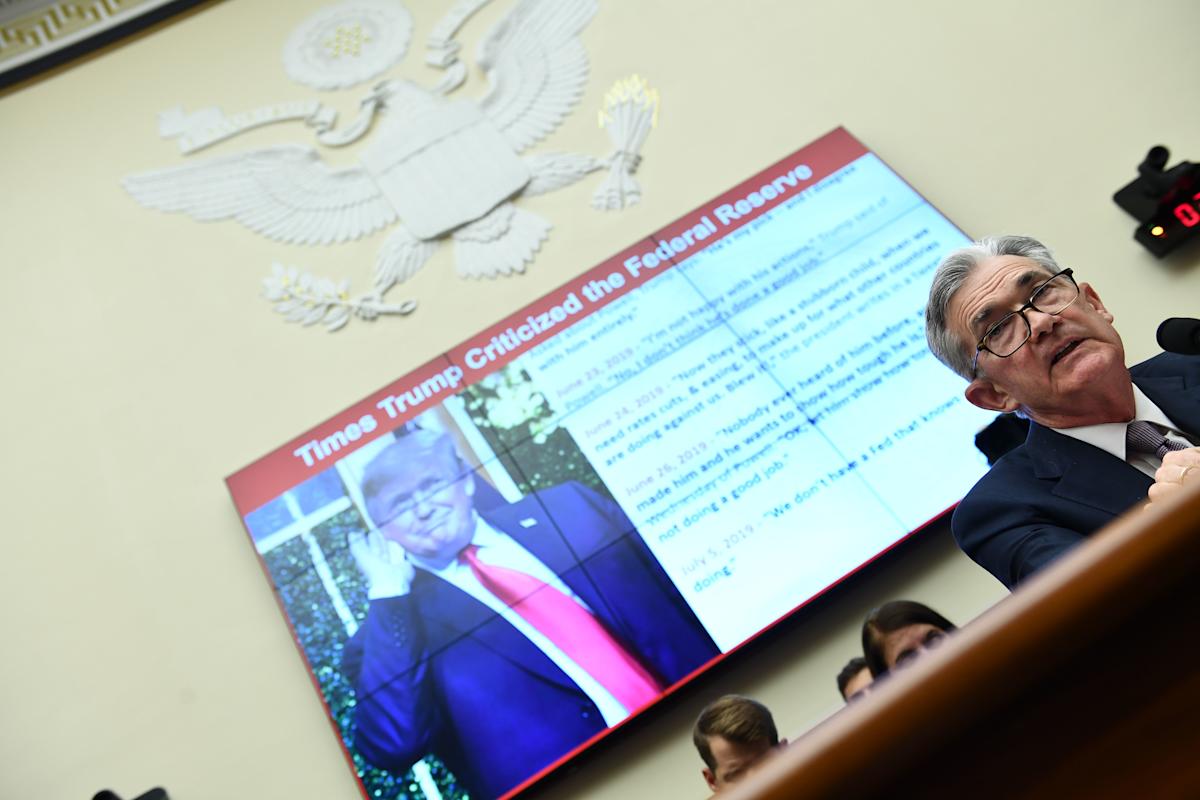

Powell vs. Trump: The Political Putt-Down That Defined a Rivalry

Finance

2025-04-22 13:49:09

The tension between President Trump and Federal Reserve Chairman Jerome Powell is heating up once again, echoing their contentious confrontation from 2019 - but this time, the stakes and potential outcomes look markedly different. As the economic landscape shifts and political pressures mount, the renewed friction between the White House and the Fed promises to be a high-stakes showdown with potentially far-reaching consequences. While their previous clash was characterized by public criticism and heated exchanges, the current dynamic suggests a more complex and nuanced confrontation. Unlike the 2019 encounter, where Trump openly lambasted Powell's monetary policy decisions, the current scenario is colored by a more intricate political and economic backdrop. The potential resolution of this standoff appears less predictable, with both sides navigating increasingly complex financial and political terrain. The recurring battle highlights the ongoing tension between presidential expectations and the Federal Reserve's commitment to maintaining economic stability through independent monetary policy. As the situation continues to evolve, observers are watching closely to see how this latest chapter in their complicated relationship will unfold. MORE...

Economic Triumph: Greece Celebrates Surplus with €1B Citizen Boost

Finance

2025-04-22 13:44:33

In a bold move to support struggling citizens and boost economic growth, Greece's Prime Minister has unveiled a substantial financial package worth 1 billion euros. The comprehensive plan aims to provide critical relief to lower-income households while simultaneously injecting momentum into the country's public investment program. This strategic economic intervention demonstrates the government's commitment to addressing the financial challenges faced by vulnerable populations. By allocating significant resources directly to those most in need, the Prime Minister is sending a powerful message of economic solidarity and support during challenging times. The 1 billion euro package represents a targeted approach to economic recovery, balancing immediate household support with long-term infrastructure and development investments. This dual-focused strategy is expected to provide immediate financial breathing room for struggling families while simultaneously creating opportunities for broader economic revitalization. MORE...

Wall Street Rebounds: Stocks Stage Comeback After Market Turbulence

Finance

2025-04-22 13:31:34

Wall Street staged a modest comeback on Wednesday, attempting to regain ground after a turbulent trading session that saw significant market volatility. The day was particularly notable for the escalating tension between President Trump and Federal Reserve Chair Jerome Powell, with the president renewing his public criticism of the central bank's leadership. Investors watched closely as stocks began to recover from earlier steep declines, signaling a potential stabilization of market sentiment. The trading day reflected the ongoing uncertainty surrounding monetary policy and the complex relationship between the White House and the Federal Reserve. The market's resilience emerged despite the sharp verbal exchanges and continued pressure from the presidential office on the Fed's decision-making. Traders and analysts remained cautious, monitoring the potential implications of the ongoing political and economic discourse. As the trading session progressed, the initial market losses gradually receded, offering a glimmer of hope for investors seeking to navigate the current volatile economic landscape. MORE...

Despite Trade Tensions, Poland Affirms Unwavering Faith in U.S. Partnership

Finance

2025-04-22 13:29:01

In a strategic push for economic collaboration, Poland's finance minister emphasized the critical importance of expanding trade relations between the European Union and the United States. Highlighting potential opportunities, the minister suggested that defense could be a promising sector for deepening bilateral cooperation and economic ties. The call for enhanced trade comes at a time when both regions are seeking to strengthen their economic partnerships and explore new avenues for mutual growth. By focusing on sectors like defense, the EU and U.S. could not only boost economic interactions but also reinforce their strategic alliance. The minister's remarks underscore the ongoing efforts to create more robust and dynamic economic connections between these two significant global markets, signaling a proactive approach to international trade and diplomatic relations. MORE...

Renewable Energy Powerhouse Apricus Generation Bolsters Leadership with Finance Titans

Finance

2025-04-22 13:06:00

Apricus Generation Emerges as a Pioneering Force in Renewable Energy Development Apricus Generation, a dynamic holding company, is making significant strides in transforming the renewable energy landscape through strategic solar and battery development initiatives. The company has positioned itself as a key player in the national distributed energy market, focusing on innovative solutions that drive sustainable power generation. With a forward-thinking approach, Apricus Generation is committed to expanding its portfolio of solar and battery projects across the United States. The company's strategic vision centers on creating robust, decentralized energy infrastructure that supports the growing demand for clean, reliable power sources. By leveraging cutting-edge technologies and a comprehensive development strategy, Apricus Generation is poised to make a substantial impact on the renewable energy sector. Their commitment to sustainable infrastructure promises to accelerate the transition to more environmentally friendly power generation methods. As the renewable energy market continues to evolve, Apricus Generation stands at the forefront of innovation, driving meaningful change in how communities and businesses approach energy production and consumption. MORE...

Home Sweet Opportunity: Finance of America Reveals Equity Lifeline for Mature Homeowners

Finance

2025-04-22 13:00:00

PLANO, Texas - Finance of America Reverse LLC, a pioneering force in home equity-based financing solutions, is revolutionizing retirement planning with its bold new brand platform, A Better Way with FOA. The company, a key subsidiary of Finance of America Companies Inc. (NYSE: FOA), is set to make waves with a comprehensive national advertising campaign that promises to transform how Americans think about retirement financing. Launching today, the innovative campaign features compelling television spots and dynamic digital advertisements that will reach audiences across the United States. This groundbreaking initiative represents more than just a marketing effort; it's a strategic move to redefine financial empowerment for retirees and near-retirees. By introducing A Better Way with FOA, the company aims to provide more flexible, transparent, and personalized home equity solutions that help seniors maximize their financial potential during retirement. The campaign underscores Finance of America's commitment to delivering cutting-edge financial products that adapt to the evolving needs of modern retirees. With this bold new direction, Finance of America Reverse LLC is not just advertising a service, but championing a movement towards more intelligent, dignified retirement planning. MORE...

Rising Stars: Phoenix Management Pros Honored by ABF Journal in Specialty Finance Spotlight

Finance

2025-04-22 12:07:00

J.S. Held is thrilled to announce that two exceptional professionals from Phoenix Management, its specialized division, have been honored by ABF Journal. The prestigious middle-market specialty finance publication has recognized these experts as trailblazers who are shaping the future of the specialty finance industry. These outstanding individuals have been highlighted for their innovative approaches, strategic insights, and significant contributions that are driving transformative change in the financial landscape. Their recognition underscores J.S. Held's commitment to nurturing top-tier talent and maintaining leadership in specialized financial consulting. MORE...

Home Makeover Magic: ChargeAfter and Foundation Finance Team Up to Revolutionize Renovation Financing

Finance

2025-04-22 12:00:00

ChargeAfter, a leading embedded lending platform revolutionizing point-of-sale financing, has announced a strategic partnership with Foundation Finance to dramatically expand consumer financing options. This groundbreaking collaboration aims to provide merchants and consumers with more flexible and accessible financial solutions at the point of purchase. By combining ChargeAfter's innovative lending technology with Foundation Finance's robust financial network, the partnership promises to streamline the financing experience for both retailers and customers. The partnership represents a significant milestone in the evolving landscape of digital lending, offering seamless, multi-lender financing options that can be integrated directly into the purchasing process. Merchants will now have the ability to provide customers with more personalized and diverse financing choices, potentially increasing sales and customer satisfaction. Through this strategic alliance, ChargeAfter continues to demonstrate its commitment to transforming the traditional financing model, making credit more accessible and user-friendly in today's digital marketplace. MORE...

Finance Frontier: Netgain's Bold Summit Unveils Tomorrow's Accounting Revolution

Finance

2025-04-22 12:00:00

Netgain Launches Groundbreaking Accounting Summit to Revolutionize Financial Technology

Netgain, a pioneering force in modern accounting automation, is set to transform the financial landscape with its highly anticipated Netgain Accounting Summit. This dynamic, one-day immersive event promises to be a game-changing experience for accounting professionals seeking to stay ahead in an increasingly digital world.

The summit represents a unique opportunity for industry leaders, financial experts, and technology innovators to converge and explore cutting-edge accounting solutions. Designed to provide unparalleled insights and networking opportunities, the event will showcase the latest advancements in accounting automation and technological innovation.

Attendees can expect a comprehensive program featuring expert speakers, interactive workshops, and hands-on demonstrations that will illuminate the future of financial technology. From breakthrough automation techniques to strategic digital transformation strategies, the Netgain Accounting Summit is poised to be the must-attend event for forward-thinking accounting professionals.

By bringing together the brightest minds in the industry, Netgain aims to drive innovation, foster collaboration, and empower accounting professionals to leverage technology for unprecedented efficiency and growth.

MORE...Breaking: City Finance Panel Greenlights Critical Infrastructure Funding for Broadway Water Main Overhaul

Finance

2025-04-22 11:52:00

In a groundbreaking move, our community is set to transform Broadway through an unprecedented investment strategy. The project represents more than just infrastructure improvement; it's a testament to our collective vision and commitment to progress. By allocating funds directly without complex repayment structures or burdensome interest rates, we're demonstrating a bold and compassionate approach to urban development. This isn't just about fixing a street—it's about creating a vibrant, welcoming corridor that will inspire and uplift residents and visitors alike. The proposed renovation promises to be a game-changer. Residents are expected to be thrilled when they witness the dramatic transformation, with the street becoming a showcase of modern design and community pride. Imagine a Broadway that flows seamlessly, inviting pedestrians, cyclists, and drivers to experience a renewed sense of connection and possibility. Our luck and foresight have converged to make this ambitious project a reality. By simplifying the financial approach and focusing on immediate, tangible improvements, we're setting a new standard for community-driven urban renewal. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421