Market Mayhem Alert: Triple Witching Day Approaches - Investors Brace for Potential Chaos

Finance

2025-03-19 17:00:00

Market Mayhem: Understanding the Triple Witching Phenomenon Investors, buckle up! This Friday marks the first triple witching event of 2025, a quarterly financial spectacle that sends ripples through the stock market. But what exactly is this intriguing market occurrence? Triple witching is a unique moment when three key financial derivatives simultaneously expire: stock options, index futures, and index futures options. This high-stakes financial convergence happens just four times each year, creating potential volatility and excitement for traders and investors. Experts Madison Mills from Catalysts and Jessica Inskip, director of investor research at StockBrokers.com, are diving deep into this fascinating market event. They'll help unpack the complexities and potential market implications of this quarterly phenomenon. For those looking to stay ahead of market trends and gain expert insights, be sure to catch more in-depth analysis from the Catalysts team. Whether you're a seasoned investor or a curious market observer, understanding triple witching can provide valuable perspective on market dynamics. Stay tuned and stay informed as we navigate this quarterly financial rollercoaster! MORE...

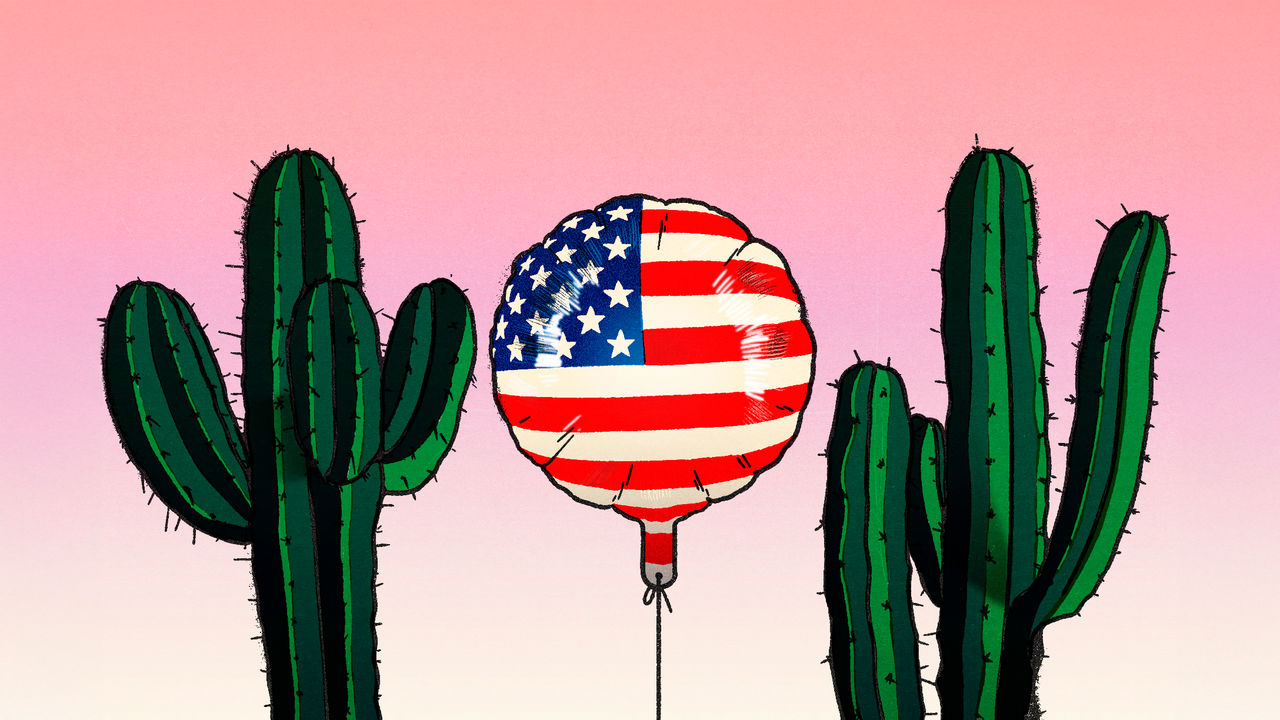

Wall Street Trembles: Trump's High-Stakes Market Gamble Raises Alarms

Finance

2025-03-19 16:53:24

The American investment landscape stands on precarious ground, with investors facing potentially significant financial risks that could send ripples through the entire economic ecosystem. Recent market indicators suggest an unprecedented level of vulnerability, positioning both individual portfolios and broader economic structures at a critical juncture. Mounting economic pressures have created a perfect storm of uncertainty, where investors are increasingly exposed to potential market downturns. The delicate balance of investment strategies, coupled with volatile market conditions, means that even a modest sell-off could trigger substantial financial repercussions. Experts warn that the current investment climate is characterized by heightened risk, with many portfolios heavily concentrated in sectors that could quickly unravel under economic stress. This concentration creates a domino effect where individual investor exposure could rapidly translate into wider economic instability. The interconnected nature of modern financial markets means that a significant sell-off would not just impact Wall Street, but could potentially cascade through various economic sectors, challenging the resilience of the entire financial system. Investors and economic policymakers are closely monitoring these potential risks, understanding that prevention and strategic adaptation are crucial in navigating these turbulent financial waters. MORE...

Green Finance Revolution: CRE Innovator Joins Forces with USGBC to Transform Sustainable Development

Finance

2025-03-19 16:19:03

CIRRUS Low Carbon C-PACE Financing: Incentivizing Sustainable Development Developers now have an exciting opportunity to reduce both their carbon footprint and financing costs through CIRRUS Low Carbon C-PACE financing. This innovative program offers substantial rate reductions as a direct reward for developers committed to minimizing environmental impact. By strategically implementing carbon reduction strategies, developers can unlock more favorable financing terms, creating a win-win scenario that promotes sustainable building practices while delivering financial benefits. The program incentivizes green construction and renovation, encouraging industry-wide transformation towards more environmentally responsible development. With CIRRUS Low Carbon C-PACE, developers are empowered to make meaningful environmental choices without compromising economic performance. The financing model demonstrates that sustainability and financial prudence can go hand in hand, setting a new standard for responsible real estate development. MORE...

Urban Reinvention: Keystone Bags $42M to Revolutionize Office Spaces into Homes

Finance

2025-03-19 16:19:00

Keystone Transforms Historic Office Space into Luxurious Urban Living Destination In a bold move that showcases innovative urban redevelopment, Keystone has secured a substantial $42 million in financing from Arbor Realty Trust to breathe new life into a prominent commercial property. The ambitious project at 500 West Germantown Pike will convert a 175,000-square-foot office building into Monarq, a cutting-edge 149-unit luxury apartment community. This groundbreaking transformation goes beyond mere construction, representing a strategic vision to reimagine urban living spaces. The Monarq development promises to deliver a wellness-focused living experience, featuring walkable design and modern amenities that cater to contemporary urban dwellers. By repurposing an existing office building, Keystone continues to demonstrate its leadership in adaptive reuse and sustainable development. The project not only revitalizes an underutilized commercial space but also provides a fresh, dynamic housing solution that meets the evolving needs of today's residents. The significant $42 million investment underscores the market's confidence in Keystone's innovative approach to residential development and urban renewal. MORE...

From Child Star to Cash Savvy: Jack Black's Early Financial Wisdom Revealed

Finance

2025-03-19 16:00:10

Brian Falduto, famously known for his iconic role as Fancy Pants in the beloved film 'School of Rock', has transformed his early acting success into a fascinating journey of personal and financial growth. In a candid podcast appearance on Living Not So Fabulously, Falduto joined hosts John and David Auten-Schneider to share insights into his career trajectory and the valuable financial lessons he's learned along the way. From child actor to country music artist, Falduto's story is a testament to adaptability and personal reinvention. During the podcast episode, he delved into how his early financial success as a young actor shaped his understanding of money and career development. Listeners can catch the full, in-depth conversation on their favorite podcast platforms or by visiting the Living Not So Fabulously website. Produced by Austin Rivera, the podcast offers an intimate look into the lives and experiences of creative professionals navigating their financial and personal landscapes. MORE...

Vcheck Clinches Top Honor: Revolutionizing Financial Security in FinTech Breakthrough's 2025 Awards

Finance

2025-03-19 16:00:00

Vcheck Triumphs at Fintech Breakthrough Awards, Revolutionizing Business Intelligence and Transaction Security In a groundbreaking recognition of technological innovation, Vcheck has been honored by the prestigious Fintech Breakthrough Awards for its cutting-edge approach to safeguarding financial transactions. The company's pioneering open-source and continuous business intelligence solutions are setting new industry standards for risk management and corporate due diligence. The award highlights Vcheck's commitment to transforming how businesses assess and mitigate financial risks in an increasingly complex global marketplace. By providing dynamic, real-time intelligence platforms, Vcheck empowers organizations to make more informed decisions and protect their financial ecosystems. Leveraging advanced technology and comprehensive data analytics, Vcheck has distinguished itself as a leader in delivering actionable insights that help companies navigate the intricate landscape of modern financial transactions. Their innovative solutions represent a significant leap forward in proactive risk assessment and corporate intelligence. This recognition from the Fintech Breakthrough Awards underscores Vcheck's role as a trailblazer in financial technology, demonstrating their ability to develop sophisticated tools that enhance transparency, security, and strategic decision-making for businesses across various sectors. MORE...

Digital Money Rebels: How Stablecoins Are Quietly Dismantling Traditional Banking

Finance

2025-03-19 15:51:16

The Financial Revolution: How Stablecoins and Advanced Platforms Are Transforming Global Digital Assets In the rapidly evolving landscape of digital finance, stablecoins and cutting-edge institutional platforms are pioneering a new era of financial innovation. These groundbreaking technologies are breaking down traditional barriers, offering unprecedented opportunities for secure, efficient, and seamless digital asset management on a global scale. Stablecoins represent a game-changing approach to cryptocurrency, providing the stability of traditional currencies while leveraging the flexibility and transparency of blockchain technology. By maintaining a consistent value tied to reliable assets like the US dollar, these digital currencies offer investors and businesses a reliable bridge between traditional and digital financial ecosystems. Institutional-grade platforms are further amplifying this transformation, delivering robust infrastructure that enables sophisticated investors, financial institutions, and corporations to navigate the digital asset landscape with confidence. These platforms provide advanced security protocols, comprehensive compliance tools, and scalable solutions that meet the most demanding professional standards. The convergence of stablecoins and institutional-grade platforms is not just a technological advancement—it's a fundamental reimagining of how financial transactions can be conducted. From cross-border payments to complex investment strategies, these innovations are creating a more accessible, transparent, and efficient global financial network. As the digital asset ecosystem continues to mature, stablecoins and advanced platforms are poised to play a pivotal role in shaping the future of finance, offering unprecedented opportunities for innovation, growth, and financial inclusion worldwide. MORE...

Breaking: LGB Capital Markets Boosts Simply Asset Finance with £100m Medium-Term Note Expansion

Finance

2025-03-19 15:25:02

In a strategic financial move, LGB first unveiled its innovative £20 million Medium Term Note (MTN) programme in March 2020, designed to provide crucial junior capital that would fuel the company's ambitious loan book expansion. This forward-thinking initiative demonstrated LGB's commitment to sustainable growth and financial flexibility, positioning the firm to capitalize on emerging market opportunities. The MTN programme represented a sophisticated approach to capital management, allowing LGB to strategically support its lending operations while maintaining a robust and adaptable financial structure. By introducing this junior capital instrument, the company signaled its confidence in its growth strategy and its ability to navigate the complex financial landscape. With this carefully crafted programme, LGB set the stage for potential future growth, creating a flexible financial mechanism that could quickly respond to market demands and support the company's ongoing expansion objectives. MORE...

Financial Watchdogs Prevail: East Longmeadow Council Doubles Down on Fiscal Transparency

Finance

2025-03-19 15:16:55

Budget Deliberations Heat Up: East Longmeadow Town Council Weighs Financial Oversight Options As East Longmeadow prepares to finalize its fiscal year 2026 budget, the Town Council finds itself at a critical crossroads. Members are currently wrestling with a pivotal decision: whether to maintain the traditional approach to financial oversight or chart a new course by potentially sidelining the Financial Oversight Committee. The ongoing discussions reflect the council's commitment to ensuring transparent and responsible fiscal management. Council members are carefully evaluating the potential implications of their decision, recognizing that the choice could significantly impact the town's financial planning and accountability. While details remain fluid, the debate underscores the complex considerations that go into municipal budgeting. Stakeholders are watching closely as the council deliberates on this important governance matter, eager to understand how the final decision might shape East Longmeadow's financial strategy in the coming fiscal year. MORE...

Trade War Tactics: Inside Trump's Potential Tariff Playbook

Finance

2025-03-19 15:04:01

As the April tariff deadline approaches, trade analysts are diving deep into economic data to predict President Trump's potential strategic moves. By meticulously examining trade statistics and economic indicators, experts are piecing together insights into which sectors and countries might face the most significant tariff impacts. The upcoming round of tariffs promises to be a critical moment in the ongoing trade tensions, with potential far-reaching consequences for global commerce. Economists are closely tracking import-export patterns, trade imbalances, and geopolitical dynamics to anticipate the administration's potential targets. While specific details remain speculative, the data suggests that countries with substantial trade surpluses and strategic economic sectors could be at the forefront of Trump's tariff strategy. The analysis reveals a complex landscape of international trade relationships that could be dramatically reshaped by these impending tariffs. Businesses and policymakers are watching closely, understanding that these tariffs could have significant ripple effects across multiple industries and international markets. The intricate economic chess game continues, with each data point potentially signaling the next strategic move in global trade relations. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421