Green Finance Retreat: RBC Scales Back Sustainability Goals Amid Regulatory Crackdown

Finance

2025-04-29 22:49:51

A leading bank is facing potential regulatory penalties due to concerns over its climate reporting methodology. The financial institution warns that its current measurement practices may not fully comply with emerging climate-reporting legislation, putting the organization at risk of significant regulatory consequences. Executives are now scrambling to review and potentially overhaul their environmental reporting systems to ensure they meet the stringent new standards. The challenge highlights the growing complexity of climate-related financial disclosures and the increasing pressure on financial institutions to provide transparent and accurate environmental impact assessments. As regulatory bodies tighten their grip on climate reporting requirements, banks are finding themselves in a critical position of needing to adapt quickly or face potential financial and reputational repercussions. This situation underscores the critical importance of robust and compliant environmental reporting in today's increasingly sustainability-focused financial landscape. MORE...

Starbucks Stumbles: CEO Brian Niccol Confronts Earnings Setback in Candid Admission

Finance

2025-04-29 22:48:33

Starbucks Navigates Challenging Terrain: US Sales Dip While Chinese Market Shows Signs of Recovery The coffee giant's latest financial report reveals a nuanced picture of its global performance, with domestic same-store sales continuing to experience a downward trend, while its Chinese market begins to show promising stabilization. Despite the challenges in the United States, Starbucks remains optimistic about its strategic positioning and potential for future growth. The company's earnings report highlights the ongoing shifts in consumer behavior and the complex dynamics of the global coffee market. While US sales have been struggling, the gradual recovery in China represents a potential bright spot for the international coffee chain. Investors and industry analysts are closely watching how Starbucks will navigate these market fluctuations and implement strategies to reinvigorate its domestic performance. As Starbucks continues to adapt to changing consumer preferences and economic landscapes, the company remains committed to its core mission of delivering high-quality coffee experiences across its global network of stores. MORE...

Behind the Scenes: How Top Hospitals Navigate the Tightrope of Finance, Innovation, and Patient Care

Finance

2025-04-29 22:38:27

In a candid recent panel discussion, healthcare executives unveiled the delicate art of navigating innovation while maintaining financial stability. Hospital leaders shared compelling insights into their strategic approaches, demonstrating how cutting-edge healthcare can coexist with fiscal responsibility. The panel highlighted several key strategies for striking this critical balance. Executives emphasized the importance of critically reassessing vendor contracts, seeking opportunities to optimize spending without sacrificing quality. They also stressed the value of maximizing existing technological capabilities, encouraging hospitals to fully leverage current infrastructure before investing in expensive new systems. Perhaps most notably, the leaders discussed innovative patient support methods that don't compromise financial margins. By thinking creatively and strategically, these healthcare professionals are proving that patient care and financial sustainability are not mutually exclusive goals. Their collaborative approach offers a blueprint for hospitals seeking to thrive in an increasingly complex healthcare landscape, where innovation and economic prudence must walk hand in hand. MORE...

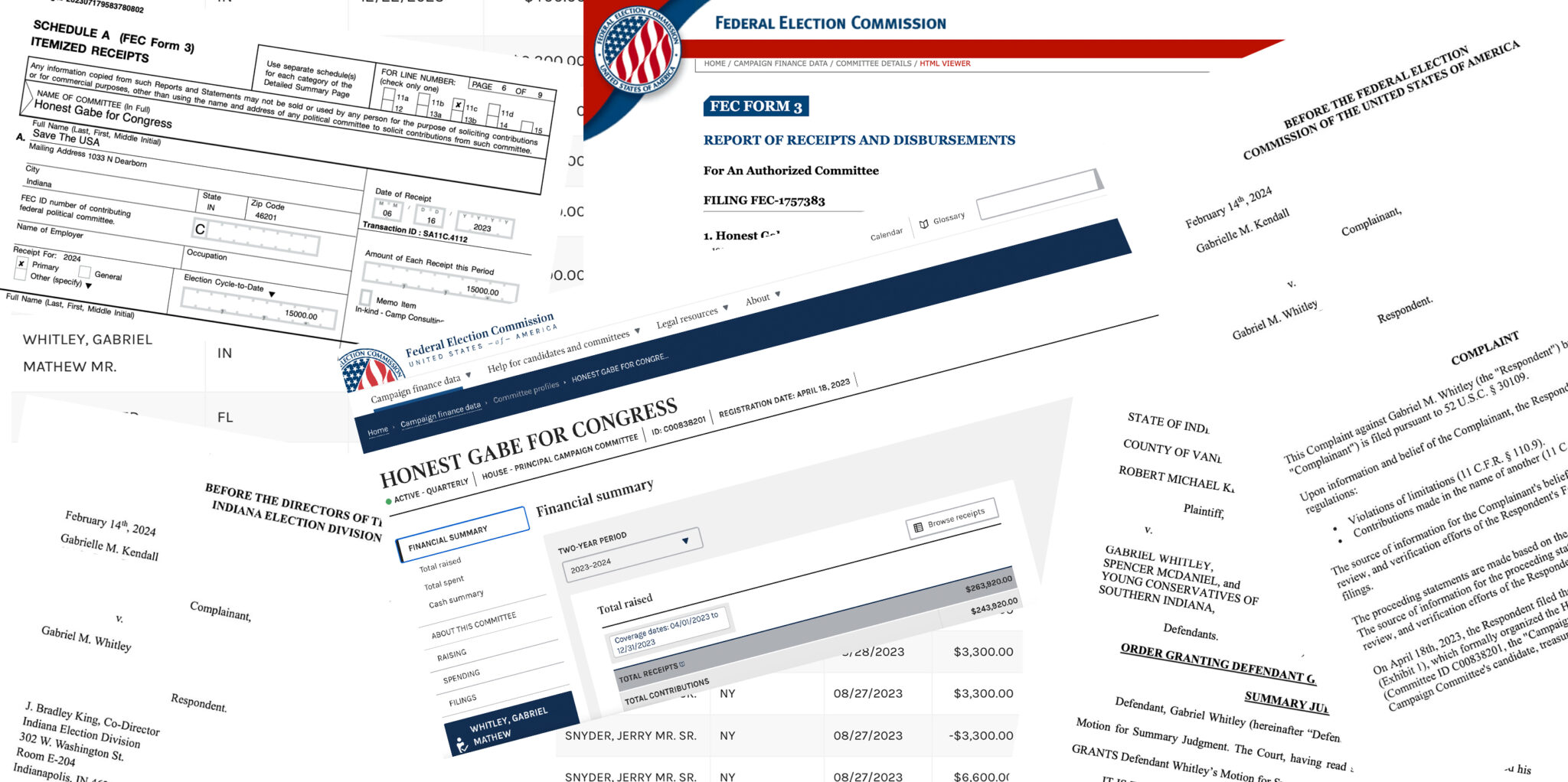

Campaign Cash Conspiracy: Ex-Indiana Candidate Faces Federal Prison for Financial Fraud

Finance

2025-04-29 22:36:03

In a stark legal consequence, a former Indiana Congressional candidate has been handed a three-month federal prison sentence for deliberately manipulating campaign finance documentation. The ruling underscores the serious legal ramifications of financial misconduct in political campaigns, sending a clear message about the importance of transparency and ethical reporting in electoral processes. The sentencing highlights the judicial system's commitment to maintaining integrity in political fundraising and campaign financial disclosures. By imposing a federal prison term, authorities have demonstrated their zero-tolerance approach to deliberate financial misrepresentation in political campaigns. This case serves as a potent reminder that campaign finance laws are not mere bureaucratic formalities, but critical safeguards designed to protect the democratic process and ensure fair, accountable political representation. MORE...

Yangaroo's Financial Finale: Q4 Earnings Reveal Fiscal Year's Triumph

Finance

2025-04-29 21:52:00

Yangaroo Celebrates Milestone: Tenth Consecutive Quarter of Positive Financial Performance

Toronto, Ontario - In a remarkable display of financial resilience, YANGAROO Inc. (TSXV: YOO) (OTC Pink: YOOIF) has announced its impressive financial results for the fourth quarter and fiscal year ending December 31, 2024. The software innovator, renowned for its cutting-edge media asset workflow and distribution solutions, continues to demonstrate strong financial health and strategic growth.

The company has achieved a significant milestone by reporting its tenth consecutive quarter of positive Normalized EBITDA, underscoring its consistent operational excellence and strategic financial management. Investors and industry observers can find the complete financial details, including comprehensive Financial Statements and Management Discussion & Analysis, on the company's official website at www.yangaroo.com.

This latest financial report highlights YANGAROO's commitment to sustainable growth and its ability to navigate the dynamic technology landscape with precision and innovation.

MORE...Digital Finance Shakeup: Global Regulators' April Playbook Unveiled

Finance

2025-04-29 21:34:35

Digital Finance Revolution: Navigating the New Regulatory Landscape In an era of rapid technological transformation, the financial services sector is experiencing unprecedented change. Regulators and policymakers are stepping up to the challenge, developing innovative digital finance initiatives that aim to balance technological advancement with robust risk management. As cutting-edge technologies continue to disrupt traditional financial models, government agencies are working diligently to create comprehensive frameworks that protect consumers while fostering innovation. These emerging strategies seek to establish clear standards that can keep pace with the lightning-fast evolution of digital financial technologies. The goal is not to stifle innovation, but to create a secure and transparent ecosystem where digital financial services can thrive. By proactively addressing potential risks and developing forward-thinking guidelines, regulators are helping to build trust in the increasingly digital world of finance. From blockchain and cryptocurrency to artificial intelligence-driven financial services, the landscape is changing rapidly. Policymakers are committed to developing adaptive strategies that can protect investors, ensure market stability, and embrace the transformative potential of digital financial technologies. MORE...

Green Finance Goes Global: Regulatory Shifts Reshaping Investment Landscape in April

Finance

2025-04-29 21:28:19

Green Finance: Navigating the Evolving Regulatory Landscape The financial sector is undergoing a transformative journey as regulators and governments intensify their push towards a sustainable future. Banks, investment firms, and financial institutions are increasingly finding themselves at the crossroads of economic strategy and environmental responsibility. New regulations are emerging as powerful tools to accelerate the green transition, challenging traditional financial models and encouraging innovative approaches to sustainable investing. These evolving expectations are not just compliance requirements, but strategic opportunities for financial institutions to redefine their role in combating climate change. From carbon disclosure mandates to green investment incentives, the financial world is being reshaped by a growing commitment to environmental stewardship. Institutions that proactively adapt to these changes are positioning themselves as leaders in a rapidly evolving economic ecosystem. As governments worldwide strengthen their climate commitments, the financial sector must continue to innovate, develop green financial products, and integrate sustainability into their core business strategies. The path forward requires creativity, commitment, and a fundamental reimagining of financial success in the context of global environmental challenges. MORE...

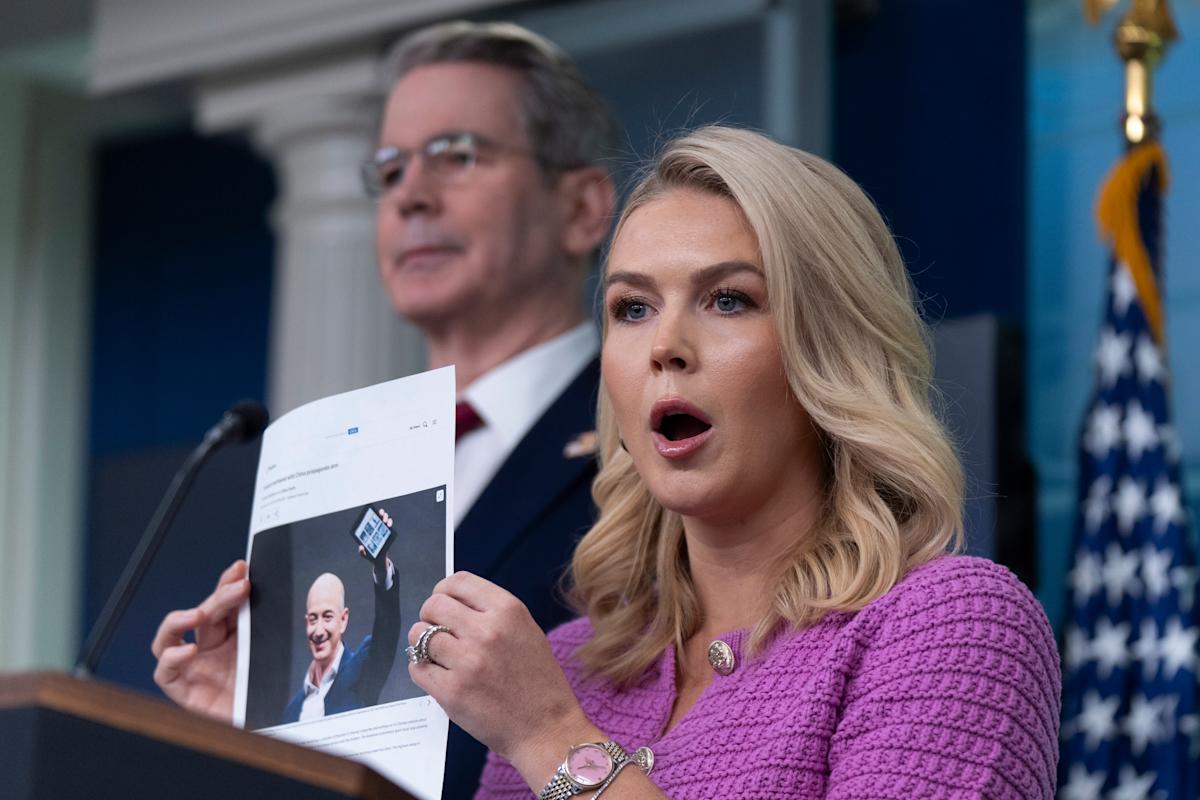

Bezos Breakthrough: Trump Backs Down After Amazon Tariff Showdown

Finance

2025-04-29 20:43:24

In a heated exchange, the White House is pushing back against Amazon's claims about tariff impacts on product pricing. The tech giant has reportedly been preparing to demonstrate how trade tariffs could potentially affect the prices of goods sold through its popular e-commerce platform. The administration is challenging Amazon's narrative, suggesting that the company's pricing strategy might be more complex than a simple pass-through of tariff costs. This confrontation highlights the ongoing tension between the government and one of the world's largest online retailers. As trade policies continue to evolve, the dispute underscores the broader economic implications of international trade regulations and their potential impact on consumer prices. The White House appears determined to counter Amazon's perspective and provide its own interpretation of how tariffs influence pricing in the digital marketplace. The developing story reveals the intricate dynamics between government policy and corporate pricing strategies, offering a glimpse into the complex world of e-commerce and international trade. MORE...

GM Financial Surges: Loan Originations Soar by Double Digits in Breakthrough Quarter

Finance

2025-04-29 20:35:30

GM Financial Drives Strong Growth in First Quarter Originations In a robust start to the year, GM Financial reported impressive financial performance, closely mirroring General Motors' sales momentum. The company's originations surged to $14.5 billion in the first quarter, marking a substantial 15.1% year-over-year increase. Breaking down the numbers, lease originations experienced a notable 15.7% year-over-year jump, reaching $5 billion. Similarly, retail loan originations climbed 14.8% year-over-year, hitting $9.6 billion. This growth aligns with broader trends observed across the banking sector, reflecting a positive economic landscape for automotive financing. The strong performance underscores GM Financial's strategic positioning and ability to capitalize on the growing demand for vehicle financing. As the automotive market continues to evolve, the company appears well-positioned to maintain its upward trajectory. MORE...

Dividend Delight: NexPoint Real Estate Finance Boosts Investor Confidence

Finance

2025-04-29 20:30:00

NexPoint Real Estate Finance Declares Quarterly Dividend, Signaling Continued Financial Strength NexPoint Real Estate Finance, Inc. (NYSE: NREF) has announced a strategic quarterly dividend distribution, reinforcing the company's commitment to delivering consistent value to its shareholders. The board of directors has carefully evaluated the company's financial performance and market position before making this decisive dividend declaration. This latest dividend payment underscores NexPoint's robust financial health and its ongoing dedication to providing attractive returns to investors. By maintaining a steady dividend strategy, the company demonstrates its confidence in its current business model and future growth potential. Investors and financial analysts will likely view this dividend declaration as a positive signal of the company's stable financial foundation and strategic management approach. The announcement reflects NexPoint's consistent performance in the competitive real estate finance sector. Shareholders can expect further details about the dividend, including the exact amount, record date, and payment date, to be communicated through official company channels in the coming days. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421