Multifamily Housing Market on Edge: Trump's Finance Reforms Spark Potential Meltdown

Finance

2025-02-21 17:36:57

The Trump administration's proposed housing policies are casting a long shadow over the multifamily housing market, potentially undermining the critical support provided by the Department of Housing and Urban Development (HUD) and Government-Sponsored Enterprises (GSEs). As the housing landscape faces unprecedented challenges, the proposed cuts threaten to destabilize a sector that has been a lifeline for millions of Americans seeking affordable housing. The potential reduction in support from key government agencies could create ripple effects throughout the real estate ecosystem, potentially limiting housing options for middle and low-income families. Experts, including myself at Whalen Global Advisors, are deeply concerned about the far-reaching implications of these policy changes. The proposed cuts could not only restrict housing development but also potentially trigger a broader economic disruption in the multifamily housing market. The delicate balance of housing affordability and market stability hangs in the balance, with these policy proposals risking significant unintended consequences. As policymakers continue to debate these critical issues, the potential impact on communities across the nation remains a pressing concern. The multifamily housing sector requires careful, strategic support – not sweeping cuts that could compromise its fundamental ability to provide safe, affordable housing for millions of Americans. MORE...

Dragon's Roar: Alibaba's Explosive Rally, Beijing's Consumption Lifeline Unveiled

Finance

2025-02-21 17:03:02

Asian markets concluded a stellar week on a high note, with Hong Kong and Mainland China-listed growth stocks taking center stage, particularly in the wake of Alibaba's impressive financial results announced after the market close in Hong Kong. In a notable contrast, India stood out as an unexpected laggard, both for the day and the week. This performance has sparked intriguing speculation among investors: Could India be serving as a strategic funding source for a strategic pivot towards Chinese markets? The emerging narrative suggests a potential shift in investment dynamics, with traders potentially reallocating capital from Indian equities to capitalize on the promising momentum in Chinese stocks. The divergence in market performance highlights the complex and ever-changing landscape of Asian financial markets, where regional sentiment and company-specific developments can quickly reshape investment strategies. As investors continue to navigate these nuanced market conditions, the interplay between different Asian markets remains a fascinating area of focus. MORE...

AI Revolution: KPMG Reveals How Artificial Intelligence is Transforming Business Efficiency

Finance

2025-02-21 16:45:44

AI Transforms Financial Reporting: KPMG Reveals Breakthrough Adoption Rates In a groundbreaking December 2024 report, KPMG has unveiled the remarkable surge of artificial intelligence within corporate finance functions. The study highlights a significant milestone in technological integration, with AI becoming an increasingly critical tool for financial operations. The research reveals that a substantial 62% of U.S. companies are now leveraging AI to a moderate or substantial degree, signaling a transformative shift in financial management strategies. Even more impressive, 58% of organizations are actively piloting or implementing generative AI technologies, demonstrating a proactive approach to digital innovation. Particularly noteworthy is the finding that 52% of companies are specifically utilizing AI in financial reporting, streamlining complex processes and enhancing accuracy. This trend underscores the growing confidence in AI's capabilities to revolutionize traditional financial workflows. The data suggests a clear trajectory: artificial intelligence is no longer a futuristic concept but a present-day reality reshaping the financial landscape. As companies continue to embrace these advanced technologies, we can expect even more sophisticated and efficient financial operations in the years to come. MORE...

Fund Finance Frontier: Haynes Boone Recruits Heavy-Hitters to Sharpen Competitive Edge

Finance

2025-02-21 15:38:16

In a strategic move that signals significant growth, a prominent law firm has successfully recruited seven seasoned attorneys from Seward & Kissel, bringing deep expertise in securitization to their legal team. These high-caliber professionals, known for their specialized knowledge in complex financial transactions, are expected to enhance the firm's capabilities in structured finance and capital markets. The new additions come with an impressive track record of handling sophisticated securitization deals across various sectors, including asset-backed securities, commercial mortgage-backed securities, and other intricate financial instruments. Their collective experience is anticipated to strengthen the firm's competitive position and provide clients with sophisticated legal counsel in an increasingly complex financial landscape. By attracting these top-tier legal talents, the law firm demonstrates its commitment to expanding its expertise and offering comprehensive, cutting-edge legal solutions in the rapidly evolving world of financial services. The strategic hiring underscores the firm's ambition to be a leader in securitization and structured finance legal practice. MORE...

Hooters Braces for Financial Turbulence: Bankruptcy Looms on the Horizon

Finance

2025-02-21 14:55:50

Hooters, the popular restaurant chain known for its wings and distinctive uniform, is preparing to navigate a challenging financial landscape. The company is currently collaborating with its creditors to develop a strategic bankruptcy restructuring plan that could reshape its business operations in the coming months. Sources close to the negotiations have revealed that Hooters of America is actively working on a comprehensive plan to address its financial challenges through a carefully managed bankruptcy court process. This move suggests the restaurant brand is seeking to stabilize its financial position and potentially emerge stronger from the restructuring. While specific details of the restructuring remain confidential, the company appears committed to finding a path forward that preserves its core business and brand identity. The ongoing discussions with creditors indicate a proactive approach to managing the restaurant chain's financial complexities. Industry observers will be watching closely to see how Hooters navigates this critical period and what strategic changes might emerge from the bankruptcy restructuring process. MORE...

Musk's Monetary Mission: Billionaire Continues Crusade Against Federal Reserve

Finance

2025-02-21 14:40:48

In a bold statement that's sure to spark debate, tech mogul and billionaire Elon Musk has reignited his criticism of the Federal Reserve. Speaking at a conservative conference on Thursday, Musk declared his intention to push for a comprehensive audit of the central bank, signaling his ongoing skepticism about its financial practices. The outspoken entrepreneur, known for his provocative commentary on economic matters, once again challenged the Fed's operational transparency. By calling for a detailed examination of the institution's inner workings, Musk is positioning himself as a vocal advocate for greater financial accountability. This latest critique is consistent with Musk's previous statements, reflecting his long-standing belief that the Federal Reserve requires more rigorous oversight. His proposed audit aims to shed light on the central bank's decision-making processes and monetary policies, potentially exposing areas of concern to the public. As a high-profile business leader with significant influence in technology and finance, Musk's comments are likely to draw considerable attention and potentially spark broader discussions about the Federal Reserve's role in the U.S. economic landscape. MORE...

Wall Street's Hidden Gem: Why AJG Is Outpacing Finance Sector Expectations

Finance

2025-02-21 14:40:10

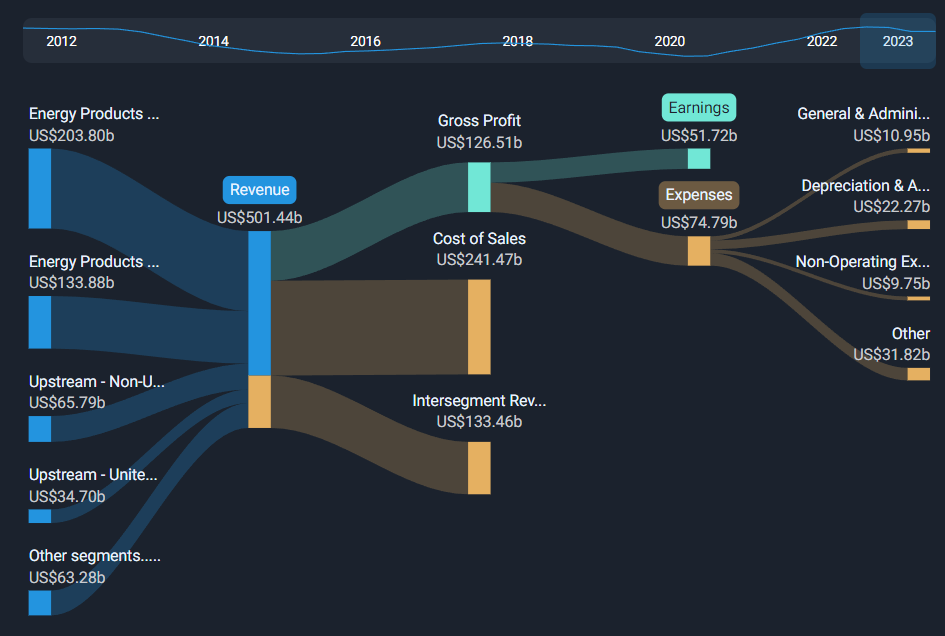

Arthur J. Gallagher and Citigroup: A Comparative Performance Analysis for 2023

Investors and market watchers are closely tracking the performance of two prominent financial sector players: Arthur J. Gallagher (AJG) and Citigroup (C). As the year progresses, both companies have demonstrated unique trajectories that offer intriguing insights into their market positioning and financial health.

Arthur J. Gallagher, a leading insurance brokerage and financial services firm, has been showing resilience in a dynamic market landscape. Meanwhile, Citigroup, a global banking giant, continues to navigate complex economic challenges with strategic adaptability.

Their performance relative to the broader financial sector provides a compelling narrative of corporate strategy, market responsiveness, and investor confidence. Analysts and shareholders are keenly observing how these companies differentiate themselves in an increasingly competitive financial environment.

As the year unfolds, the comparative analysis of AJG and Citigroup offers valuable perspectives on sector trends, investment potential, and corporate performance.

MORE...From Diapers to Dollars: A Rookie's Roadmap to Conquering Finance Recruitment

Finance

2025-02-21 14:30:19

There's a peculiar, almost mystical atmosphere that descends with the onset of sophomore year. The campus landscape subtly shifts, marked by an intangible energy that whispers of transformation. Friendships that once felt unbreakable during freshman year begin to evolve, stretching and reshaping like delicate spider webs catching the morning light. The tight-knit, codependent friend groups that defined your first year start to unravel, not from conflict, but from a natural progression of personal growth. Suddenly, individual paths become more pronounced. Some friends dive deeper into their majors, others explore new extracurricular passions, and some begin to drift towards different social circles that better reflect their emerging identities. This liminal space between familiarity and change is both unsettling and exhilarating. It's a silent reminder that college is not just about academic learning, but about personal metamorphosis. The wind of sophomore year carries with it the promise of self-discovery, challenging you to embrace the uncertainty and potential that lies ahead. MORE...

Beyond Private Equity: Carlyle's COO Reveals the Next Big Wave in Finance

Finance

2025-02-21 14:06:53

Carlyle Group Targets Asset-Based Finance for Future Growth

Carlyle Group Inc. is setting its sights on asset-based finance as a promising avenue for expansion, according to Chief Operating Officer Lindsay LoBue. The private equity firm sees significant potential in this financial strategy, which could drive the company's next phase of growth.

LoBue's insights suggest that the firm is strategically positioning itself to capitalize on emerging opportunities in the asset-based financing market. By focusing on this sector, Carlyle Group aims to diversify its investment portfolio and create new value for its stakeholders.

Asset-based finance involves lending against the value of specific assets, providing businesses with flexible financing options. This approach can be particularly attractive in uncertain economic environments, offering companies alternative methods to secure capital.

The move reflects Carlyle Group's adaptive approach to investment strategies, demonstrating the firm's commitment to identifying and pursuing innovative financial opportunities in a rapidly changing global market.

MORE...Green Finance Revolution: Investors Get a Say in EU's Sustainable Disclosure Overhaul

Finance

2025-02-21 13:49:40

Navigating the Future: SFDR's Bold Move Against Greenwashing

The sustainable finance landscape is undergoing a critical transformation as the Sustainable Finance Disclosure Regulation (SFDR) prepares to clamp down on misleading environmental claims. These upcoming updates represent a significant milestone in combating greenwashing and promoting genuine sustainability in financial products.

Financial institutions and investment managers are now facing increased scrutiny, with regulators demanding more transparent and substantive evidence of their environmental, social, and governance (ESG) commitments. The new SFDR guidelines will require more rigorous reporting, compelling companies to provide concrete data that substantiates their sustainability claims.

Key implications of these updates include:

- Enhanced disclosure requirements for sustainable investment products

- Stricter criteria for classifying financial products as environmentally friendly

- Mandatory detailed reporting on sustainability metrics and impact

By implementing these robust measures, the SFDR aims to restore investor confidence and create a more transparent, accountable sustainable finance ecosystem. Investors can expect clearer, more reliable information about the true environmental performance of their investments.

As the financial world adapts to these changes, proactive organizations that embrace genuine sustainability will be best positioned to thrive in this evolving regulatory landscape.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421