Legal Powerhouse Spencer Fane Bolsters Finance Team with Armstrong Teasdale's Debt Expertise

Finance

2025-03-21 19:35:00

Spencer Fane LLP has bolstered its legal team with a significant lateral hire, bringing on board a distinguished finance expert from Armstrong Teasdale LLP. The new partner, formerly the chair of Armstrong Teasdale's debt finance practice, will be joining the firm's St. Louis office and expanding its capabilities in financial and corporate services. This strategic addition underscores Spencer Fane's commitment to strengthening its legal expertise and providing comprehensive financial legal solutions to clients. The experienced attorney brings a wealth of knowledge and a proven track record in debt finance, which is expected to enhance the firm's service offerings and competitive edge in the market. By recruiting such a high-caliber legal professional, Spencer Fane demonstrates its ongoing investment in top-tier talent and its dedication to maintaining a robust, dynamic legal practice across multiple practice areas. MORE...

Fiscal Roadmap Revealed: Bedford's Finance Team Unveils Critical Budget Insights for 2024 Town Meeting

Finance

2025-03-21 19:29:52

Bedford residents, mark your calendars! The annual Town Meeting is set to take place on Monday, March 24, beginning at 6:30 p.m. at Bedford High School. The Finance Committee has carefully prepared its recommendations for the evening's articles, promising an informative and important community gathering. As a crucial opportunity for local democratic participation, this Town Meeting will provide residents with insights into the town's financial planning and key municipal decisions. The Finance Committee has diligently reviewed and developed recommendations that will be presented to attendees, offering a comprehensive overview of Bedford's fiscal priorities and proposed initiatives. Community members are encouraged to attend and engage with the important discussions that will shape Bedford's future. Whether you're a long-time resident or new to the town, this meeting represents a valuable chance to understand local governance and contribute to community decision-making. Don't miss this opportunity to stay informed and involved in Bedford's municipal processes. Come prepared, bring your questions, and be part of the democratic dialogue that drives our local community forward. MORE...

Navigating Financial Storms: Proven Strategies to Grow Your Wealth When Markets Wobble

Finance

2025-03-21 19:15:00

As the largest intergenerational wealth transfer in history unfolds, projected to move a staggering $124 trillion across generations by 2048, financial experts are offering critical insights into building and preserving wealth in today's unpredictable economic landscape. In an exclusive interview, Empify CEO Ashley Fox joins Brad Smith on Wealth to unpack strategic approaches for navigating market volatility and creating sustainable financial growth. With unprecedented economic shifts challenging traditional investment models, Fox provides actionable guidance for investors seeking to secure their financial future. The conversation delves into innovative wealth-building strategies that can help individuals and families not just survive, but thrive, amid complex market dynamics. From understanding generational wealth transfer trends to implementing resilient investment techniques, this expert discussion offers a comprehensive roadmap for financial success. For those eager to gain deeper market insights and expert analysis, the full interview promises to be an invaluable resource in understanding how to effectively manage and grow wealth in an ever-changing economic environment. MORE...

Unlock Travel Rewards: Your Ultimate Credit Card Cheat Sheet

Finance

2025-03-21 19:15:00

Mastering Travel Credit Cards: Expert Insights from The Points Guy

In an exclusive interview, Clint Henderson, managing editor of The Points Guy, joins Wealth Host Brad Smith to demystify the world of travel credit cards. Their in-depth conversation provides travelers with invaluable strategies for selecting the perfect credit card and maximizing its potential benefits.

Henderson breaks down the complex landscape of travel rewards, offering practical advice on how to:

- Identify the most suitable travel credit card for your unique lifestyle

- Understand the nuanced rewards programs

- Optimize credit card perks and sign-up bonuses

- Strategically accumulate and redeem travel points

For those looking to dive deeper into expert financial insights and cutting-edge market analysis, viewers are encouraged to explore more content on Wealth, where top industry professionals share their knowledge.

Whether you're a frequent traveler or an occasional vacationer, this expert guidance promises to transform how you approach travel credit cards and rewards.

MORE...Profit in Chaos: The Corporate Playbook for Navigating Global Tensions

Finance

2025-03-21 19:12:56

Navigating Uncertainty: How Global Businesses Thrive Amid Geopolitical Challenges

In an era of unprecedented global volatility, forward-thinking companies are transforming geopolitical turbulence from a potential threat into a strategic opportunity. The complex landscape of international tensions, trade disruptions, and economic shifts has become a fertile ground for innovative business strategies.

Turning Challenges into Competitive Advantages

Smart organizations are no longer merely reacting to geopolitical disruptions—they're proactively developing resilient business models that can adapt and even capitalize on global uncertainties. By maintaining flexible supply chains, diversifying market presence, and developing robust risk management frameworks, companies are turning potential vulnerabilities into strategic strengths.

Strategic Adaptation in a Shifting Global Landscape

Leading multinational corporations are implementing sophisticated approaches to navigate geopolitical complexities. This includes:

- Comprehensive geopolitical risk assessment

- Agile supply chain restructuring

- Localized investment strategies

- Advanced scenario planning

Technology and Intelligence: The New Competitive Edge

Cutting-edge technologies like artificial intelligence and advanced data analytics are empowering businesses to predict and respond to geopolitical shifts with unprecedented precision. Companies investing in real-time global intelligence are gaining significant competitive advantages, transforming uncertainty into strategic foresight.

Conclusion: Resilience in Complexity

As the global business landscape continues to evolve rapidly, organizations that view geopolitical challenges as opportunities for innovation and strategic repositioning will emerge as the true winners in an increasingly interconnected world.

MORE...Oil Giants Surge: How Energy Stocks Are Defying Market Turbulence in 2023

Finance

2025-03-21 18:06:12

As market dynamics shift, investors are strategically pivoting towards the energy sector, driven by two key market signals: persistent inflationary pressures and ongoing tariff uncertainties. The current economic landscape is compelling savvy investors to seek out sectors with potential resilience and growth, with energy emerging as a particularly attractive investment destination. Sticky inflation, which continues to linger despite monetary policy efforts, is creating a ripple effect across financial markets. This persistent economic challenge is pushing investors to recalibrate their portfolios, seeking sectors that can potentially outperform in a complex economic environment. The energy sector, known for its ability to adapt and generate robust returns, is increasingly viewed as a strategic hedge against economic volatility. Simultaneously, the ongoing uncertainty surrounding international trade tariffs is adding another layer of complexity to investment decisions. As geopolitical tensions and trade negotiations continue to evolve, the energy sector stands out as a relatively stable and potentially lucrative option for investors looking to mitigate risk while maintaining growth potential. By reallocating capital into energy stocks and related investments, market participants are signaling their confidence in the sector's capacity to navigate challenging economic conditions and deliver meaningful returns. MORE...

Hidden Gems: 3 TSX Penny Stocks Poised for Potential Breakout

Finance

2025-03-21 18:05:15

As the Canadian investment landscape evolves in 2025, market dynamics are revealing intriguing opportunities for savvy investors. Despite softened growth projections in Canada and the United States, the financial ecosystem is witnessing a strategic shift towards diversification and nuanced investment approaches. Penny stocks, once dismissed as speculative investments, are now emerging as potential hidden gems for discerning investors. These shares representing smaller or emerging companies are no longer viewed through a narrow lens but are being carefully evaluated for their underlying financial strength and growth potential. Successful navigation of this market requires a sophisticated approach: identifying penny stocks with robust financial foundations, promising growth trajectories, and the resilience to weather economic uncertainties. By conducting meticulous research and maintaining a balanced perspective, investors can uncover opportunities that offer both stability and meaningful upside potential. The key lies in transforming traditional perceptions and embracing a more strategic, analytical investment mindset that looks beyond surface-level market noise and focuses on fundamental value and long-term potential. MORE...

Financial Pulse: BOK's Q1 2025 Earnings Reveal Surprising Market Insights

Finance

2025-03-21 18:00:00

BOK Financial Corporation Set to Unveil Q1 2025 Financial Performance Investors and financial analysts, mark your calendars! BOK Financial Corporation (NASDAQ:BOKF) is preparing to share its first quarter 2025 financial insights in an upcoming conference call scheduled for Tuesday, April 22, 2025, at 12:00 PM Central Time. The highly anticipated call promises to provide a comprehensive overview of the company's financial performance, offering stakeholders a detailed look into BOK Financial's strategic achievements and economic positioning for the first quarter of 2025. Participants can expect an in-depth analysis of the company's key financial metrics, potential growth strategies, and market outlook. Financial professionals, investors, and media representatives are invited to join this important financial update, which will offer valuable insights into BOK Financial's current business landscape and future prospects. Stay tuned for a transparent and comprehensive review of the company's quarterly performance. MORE...

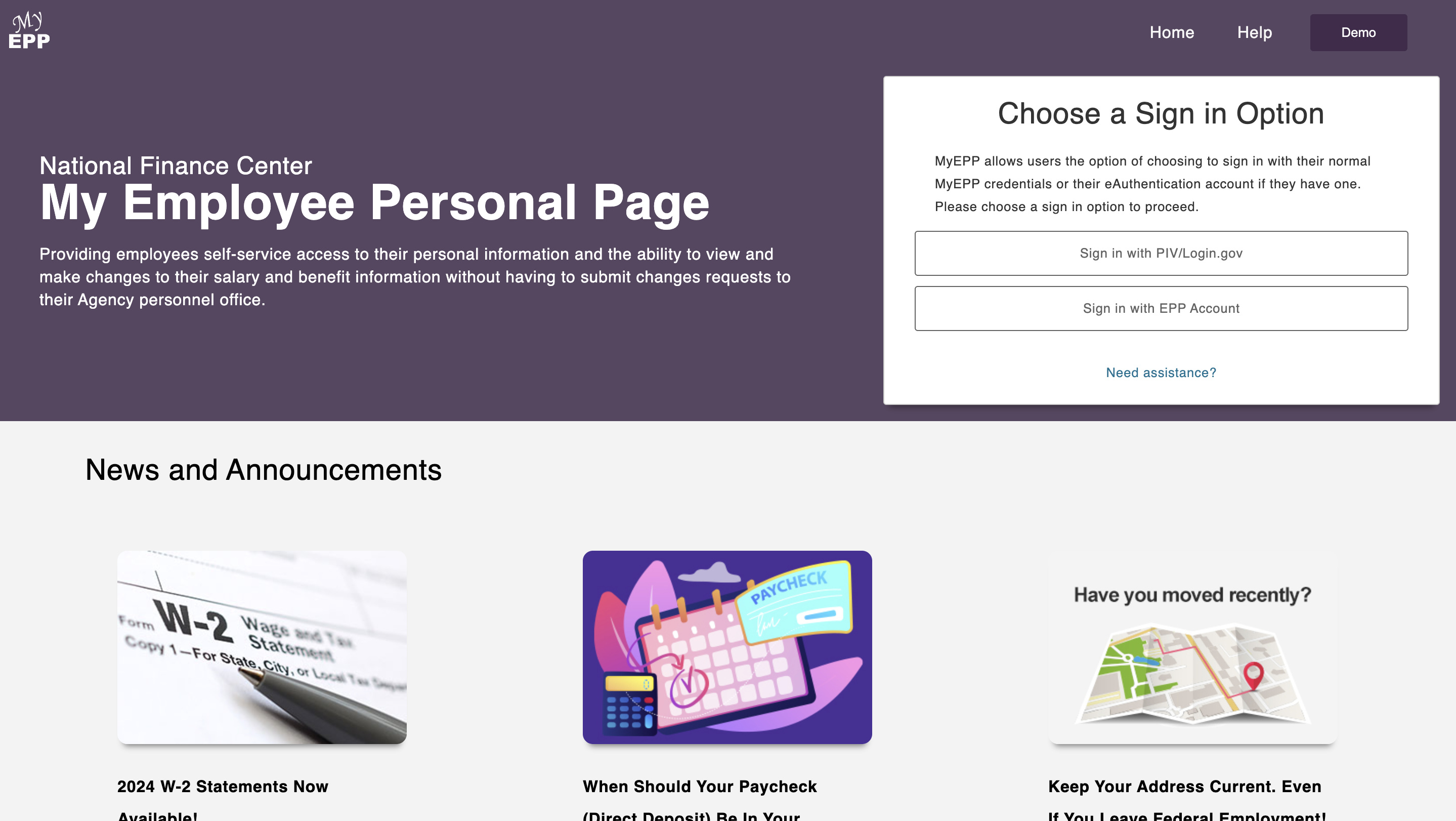

Phishing Scheme Exposes Massive Federal Employee Data Breach at National Finance Center

Finance

2025-03-21 17:11:01

A sophisticated phishing scheme is targeting federal employees by exploiting their search for National Finance Center services online. Cybercriminals are crafting a deceptive trap designed to trick unsuspecting government workers into revealing critical personal and professional information. The scam operates by creating search engine results that closely mimic legitimate National Finance Center web pages. When federal workers attempt to access official services, they are instead directed to fraudulent websites carefully constructed to look authentic. These malicious sites are engineered to prompt users to enter sensitive login credentials, personal identification details, and other confidential information. Cybersecurity experts warn that such targeted phishing attempts pose a significant risk to government infrastructure and individual employee data. Federal workers are advised to exercise extreme caution, verify website URLs carefully, and only access official government services through verified, direct links from official government domains. By staying vigilant and implementing robust digital safety practices, federal employees can protect themselves from these increasingly sophisticated online threats that seek to exploit their trust and access to sensitive systems. MORE...

AI's Hidden Gem: Why AT&T Could Be the Unexpected Tech Powerhouse Investors Are Overlooking

Finance

2025-03-21 16:30:00

In a recent interview with Yahoo Finance, Kimberly Forrest, founder and chief investment officer of Bokeh Capital Partners, highlighted AT&T as a standout stock pick with significant potential in the evolving technological landscape. Forrest passionately explained her bullish stance on the telecommunications giant, describing AT&T as a critical infrastructure provider for the internet. "They're essentially the backbone of digital connectivity," she noted, emphasizing the company's strategic position in an increasingly connected world. With the rapid advancement of artificial intelligence technologies, Forrest sees AT&T as uniquely positioned to benefit from the massive data transmission requirements. The company's robust network infrastructure makes it a key player in supporting the growing demands of AI and digital communication. Her insights underscore AT&T's potential as more than just a traditional telecom company, but as a vital conduit for the digital transformation sweeping across industries. For investors seeking exposure to the infrastructure powering tomorrow's technological innovations, Forrest suggests AT&T could be an attractive opportunity. For more expert market analysis and insights, be sure to explore additional coverage from Yahoo Finance's Catalysts series. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421